Business

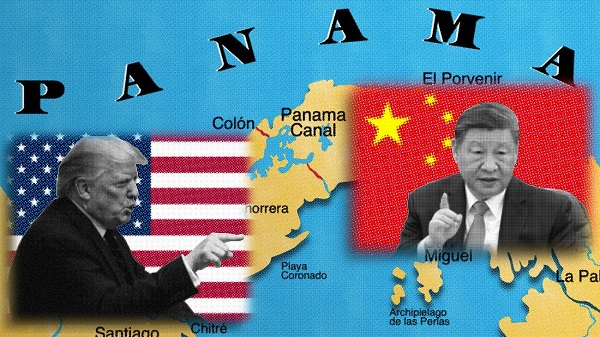

Trump demands free passage for American ships through Panama, Suez

MxM News

MxM News

Quick Hit:

President Donald Trump is pushing for U.S. ships to transit the Panama and Suez canals without paying tolls, arguing the waterways would not exist without America.

Key Details:

-

In a Saturday Truth Social post, Trump said, “American Ships, both Military and Commercial, should be allowed to travel, free of charge, through the Panama and Suez Canals! Those Canals would not exist without the United States of America.”

-

Trump directed Secretary of State Marco Rubio to “immediately take care of, and memorialize” the issue, signaling a potential new diplomatic initiative with Panama and Egypt.

-

The Panama Canal generated about $3.3 billion in toll revenue in fiscal 2023, while the Suez Canal posted a record $9.4 billion. U.S. vessels account for roughly 70% of Panama Canal traffic, according to government figures.

Diving Deeper:

President Donald Trump is pressing for American ships to receive free passage through two of the world’s most critical shipping lanes—the Panama and Suez canals—a move he argues would recognize the United States’ historic role in making both waterways possible. In a post shared Saturday on Truth Social, Trump wrote, “American Ships, both Military and Commercial, should be allowed to travel, free of charge, through the Panama and Suez Canals! Those Canals would not exist without the United States of America.”

— Rapid Response 47 (@RapidResponse47) April 26, 2025

Trump added that he has instructed Secretary of State Marco Rubio to “immediately take care of, and memorialize” the situation. His comments, first reported by FactSet, come as U.S. companies face rising shipping costs, with tolls for major vessels ranging from $200,000 to over $500,000 per Panama Canal crossing, based on canal authority schedules.

The Suez Canal, operated by Egypt, reportedly saw record revenues of $9.4 billion in 2023, largely driven by American and European shipping amid ongoing Red Sea instability. After a surge in attacks by Houthi militants on commercial ships earlier this year, Trump authorized a sustained military campaign targeting missile and drone sites in northern Yemen. The Pentagon said the strikes were part of an effort to “permanently restore freedom of navigation” for global shipping near the Suez Canal.

Trump has framed the military operations as part of a broader strategy to counter Iranian-backed destabilization efforts across the Middle East.

Meanwhile, in Central America, Trump’s administration is working to counter Chinese influence near the Panama Canal. On April 9th, Defense Secretary Pete Hegseth announced an expanded partnership with Panama to bolster canal security, including a memorandum of understanding allowing U.S. warships and support vessels to move “first and free” through the canal. “The Panama Canal is key terrain that must be secured by Panama, with America, and not China,” Hegseth emphasized during a press conference in Panama City.

American commercial shipping has long depended on the canal, which reduces the shipping route between the U.S. East Coast and Asia by nearly 8,000 miles. About 40% of all U.S. container traffic uses the Panama Canal annually, according to the U.S. Maritime Administration.

The United States originally constructed and controlled the Panama Canal following a monumental effort championed by President Theodore Roosevelt in the early 20th century. After backing Panama’s independence from Colombia in 1903, the U.S. secured the rights to build and operate the canal, which opened in 1914. Although U.S. control ended in 1999 under the Torrijos-Carter Treaties, the canal remains vital to U.S. trade.

2025 Federal Election

Columnist warns Carney Liberals will consider a home equity tax on primary residences

From LifeSiteNews

The Liberals paid a group called Generation Squeeze, led by activist Paul Kershaw, to study how the government could tap into Canadians’ home equity — including their primary residences.

Winnipeg Sun Columnist Kevin Klein is sounding the alarm there is substantial evidence the Carney Liberal Party is considering implementing a home equity tax on Canadians’ primary residences as a potential huge source of funds to bring down the massive national debt their spending created.

Klein wrote in his April 23 column and stated in his accompanying video presentation:

The Canada Mortgage and Housing Corporation (CMHC) — a federal Crown corporation — has investigated the possibility of a home equity tax on more than one occasion, using taxpayer dollars to fund that research. This was not backroom speculation. It was real, documented work.

The Liberals paid a group called Generation Squeeze, led by activist Paul Kershaw, to study how the government could tap into Canadians’ home equity — including their primary residences.

Kershaw, by the way, believes homeowners are “lottery winners” who didn’t earn their wealth but lucked into it. That’s the ideology being advanced to the highest levels of government.

It didn’t stop there. These proposals were presented directly to federal cabinet ministers. That’s on record, and most of those same ministers are now part of Mark Carney’s team as he positions himself as the Liberals’ next leader.

Watch below Klein’s 7-minute, impassionate warning to Canadians about this looming major new tax should the Liberals win Monday’s election.

Klein further adds:

The total home equity held by Canadians is over $4.7 trillion. It’s the largest pool of private wealth in the country. For millions of Canadians — especially baby boomers — it’s the only retirement fund they have. They don’t have big pensions. They have a paid-off house and a hope that it will carry them through their later years. Yet, that’s what Ottawa has quietly been circling.

The Canadian Taxpayer’s Federation has researched this issue and published a report on the alarming amount of new taxation a homeowner equity tax could cost Canadians who sell their homes that have increased in value over the years they have lived in it. It is a shocker!

A Google search on the question, “what is a home equity tax?” returns the response:

A home equity tax, simply put, it’s a proposed levy on the increased value of your home, specifically, on your principal residence. The idea is for Government to raise money by taxing wealth accumulation from rising property values.

The Canadian Taxpayers Federation has provided a Home Equity Tax Calculator Backgrounder to help Canadians understand what the impact of three different types of Home Equity Tax Calculators would have on home owners. The required tax payment resulting from all three is a shocker.

Keep in mind that World Economic Forum policies intend to eventually eliminate all private home ownership and have the state own and control not only all residences, but also eliminate car ownership, and control when and where you may live and travel.

Carney, Trudeau and several other members of the Liberal government in key positions are heavily connected to the WEF.

Business

It Took Trump To Get Canada Serious About Free Trade With Itself

From the Frontier Centre for Public Policy

By Lee Harding

Trump’s protectionism has jolted Canada into finally beginning to tear down interprovincial trade barriers

The threat of Donald Trump’s tariffs and the potential collapse of North American free trade have prompted Canada to look inward. With international trade under pressure, the country is—at last—taking meaningful steps to improve trade within its borders.

Canada’s Constitution gives provinces control over many key economic levers. While Ottawa manages international trade, the provinces regulate licensing, certification and procurement rules. These fragmented regulations have long acted as internal trade barriers, forcing companies and professionals to navigate duplicate approval processes when operating across provincial lines.

These restrictions increase costs, delay projects and limit job opportunities for businesses and workers. For consumers, they mean higher prices and fewer choices. Economists estimate that these barriers hold back up to $200 billion of Canada’s economy annually, roughly eight per cent of the country’s GDP.

Ironically, it wasn’t until after Canada signed the North American Free Trade Agreement that it began to address domestic trade restrictions. In 1994, the first ministers signed the Agreement on Internal Trade (AIT), committing to equal treatment of bidders on provincial and municipal contracts. Subsequent regional agreements, such as Alberta and British Columbia’s Trade, Investment and Labour Mobility Agreement in 2007, and the New West Partnership that followed, expanded cooperation to include broader credential recognition and enforceable dispute resolution.

In 2017, the Canadian Free Trade Agreement (CFTA) replaced the AIT to streamline trade among provinces and territories. While more ambitious in scope, the CFTA’s effectiveness has been limited by a patchwork of exemptions and slow implementation.

Now, however, Trump’s protectionism has reignited momentum to fix the problem. In recent months, provincial and territorial labour market ministers met with their federal counterpart to strengthen the CFTA. Their goal: to remove longstanding barriers and unlock the full potential of Canada’s internal market.

According to a March 5 CFTA press release, five governments have agreed to eliminate 40 exemptions they previously claimed for themselves. A June 1 deadline has been set to produce an action plan for nationwide mutual recognition of professional credentials. Ministers are also working on the mutual recognition of consumer goods, excluding food, so that if a product is approved for sale in one province, it can be sold anywhere in Canada without added red tape.

Ontario Premier Doug Ford has signalled that his province won’t wait for consensus. Ontario is dropping all its CFTA exemptions, allowing medical professionals to begin practising while awaiting registration with provincial regulators.

Ontario has partnered with Nova Scotia and New Brunswick to implement mutual recognition of goods, services and registered workers. These provinces have also enabled direct-to-consumer alcohol sales, letting individuals purchase alcohol directly from producers for personal consumption.

A joint CFTA statement says other provinces intend to follow suit, except Prince Edward Island and Newfoundland and Labrador.

These developments are long overdue. Confederation happened more than 150 years ago, and prohibition ended more than a century ago, yet Canadians still face barriers when trying to buy a bottle of wine from another province or find work across a provincial line.

Perhaps now, Canada will finally become the economic union it was always meant to be. Few would thank Donald Trump, but without his tariffs, this renewed urgency to break down internal trade barriers might never have emerged.

Lee Harding is a research fellow with the Frontier Centre for Public Policy.

-

2025 Federal Election17 hours ago

2025 Federal Election17 hours agoNine Dead After SUV Plows Into Vancouver Festival Crowd, Raising Election-Eve Concerns Over Public Safety

-

2025 Federal Election15 hours ago

2025 Federal Election15 hours agoMark Carney: Our Number-One Alberta Separatist

-

Opinion1 day ago

Opinion1 day agoCanadians Must Turn Out in Historic Numbers—Following Taiwan’s Example to Defeat PRC Election Interference

-

International2 days ago

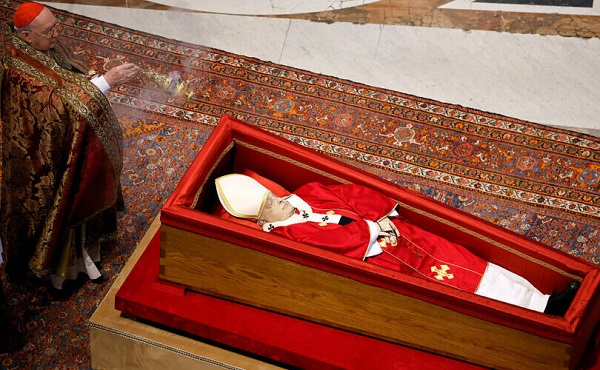

International2 days agoHistory in the making? Trump, Zelensky hold meeting about Ukraine war in Vatican ahead of Francis’ funeral

-

C2C Journal1 day ago

C2C Journal1 day ago“Freedom of Expression Should Win Every Time”: In Conversation with Freedom Convoy Trial Lawyer Lawrence Greenspon

-

International19 hours ago

International19 hours agoJeffrey Epstein accuser Virginia Giuffre reportedly dies by suicide

-

2025 Federal Election18 hours ago

2025 Federal Election18 hours agoColumnist warns Carney Liberals will consider a home equity tax on primary residences

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCarney’s budget is worse than Trudeau’s