Business

Trudeau’s Delusion Meets Trump’s Tariffs: 25% Hit on Canada and Mexico Could Cripple Economies Overnight!

In a fiery Truth Social post on November 25th, Donald Trump made his position crystal clear: the days of open borders, unchecked drug smuggling, and illegal immigration are over. The president-elect, set to take office in January, declared that one of his first actions as commander-in-chief will be to slap a 25% tariff on all goods from Mexico and Canada until both nations “use their absolute right and power” to stop the flow of drugs and illegal immigrants into the United States.

The Trump Doctrine Returns

This announcement serves as a bold reminder of Trump’s “America First” strategy, which dominated his first presidency. According to Trump, the current state of the U.S.-Mexico border is a “national emergency,” with caravans from Mexico allegedly bringing record levels of drugs like fentanyl and waves of illegal migrants. Canada isn’t off the hook either, as Trump accuses Justin Trudeau’s government of maintaining what he calls “ridiculous open borders” that have contributed to the crisis.

“Both Mexico and Canada have the absolute right and power to easily solve this long-simmering problem,” Trump stated. “Until such time that they do, it is time for them to pay a very big price!”

Economic Weapons Locked and Loaded

The proposed tariffs are no small matter. A 25% import tax on goods from Canada and Mexico could cripple their export-driven economies, both of which are heavily reliant on U.S. trade:

- Mexico: Over 80% of its exports head to the U.S. A 25% tariff would devastate industries like auto manufacturing, agriculture, and electronics.

- Canada: With 75% of exports destined for the U.S., Canadian businesses are bracing for significant disruptions to key sectors, including energy and auto parts.

Experts warn that these tariffs would also raise prices for American consumers. But Trump’s post signals he’s unfazed by potential backlash. “It’s time for these countries to pay a very big price,” he declared, echoing his tough-on-trade rhetoric from the 2016 campaign trail.

The Bureau – Canada’s Role in the Fentanyl Epidemic

According to The Bureau, U.S. investigators have uncovered a direct connection between Canadian cities—particularly Toronto and Vancouver—and transnational fentanyl money-laundering networks. These networks, allegedly run by Triads with ties to Beijing, are laundering cash for Mexican cartels smuggling fentanyl precursors from China.

David Asher, a former Trump administration official and DEA consultant, didn’t mince words in his interview with The Bureau. He stated that U.S. intelligence points to Canada as the “command and control” hub for these networks, which have fueled the devastating fentanyl crisis.

“When we seized their phones, we’d see Canada light up like a Christmas tree,” Asher said, highlighting how Toronto and British Columbia play central roles in these operations.

Canada’s Tariff Crisis: The Numbers Don’t Lie

Let’s dig into the cold, hard facts, courtesy of the Canadian Chamber of Commerce, and they’re downright devastating. Trump’s proposed tariffs aren’t just a political statement—they’re an economic wrecking ball aimed squarely at Canada’s most vulnerable industries. For Justin Trudeau’s government and hapless premiers like David Eby, these numbers are a brutal wake-up call.

The Trade Dependency Trap

Canada’s economic lifeblood is deeply tied to the United States, with 41% of Ontario’s GDP and a staggering two-thirds of New Brunswick’s GDP linked to cross-border trade. And it’s not just Canada feeling the squeeze—states like Michigan (14% GDP dependency) and Illinois (10.2%) rely heavily on Canadian trade.

The kicker? Nearly 63% of Canadian exports to the U.S. are intermediate inputs, meaning they’re critical components for American manufacturing. Canada isn’t just exporting products; it’s exporting the gears that keep U.S. industries turning.

Energy and Autos: The Collateral Damage

Consider this: in the first half of 2024 alone, Canada exported $85 billion in energy and $40 billion in auto parts to the U.S. A 25% tariff would obliterate these sectors, dragging down both economies in the process. And while Trudeau and his team posture about “standing united,” it’s clear their lack of preparation will only deepen the pain for Canadians.

Tariff Fallout: A National Recession Looms

The numbers paint a grim picture: a 25% tariff would deliver a 2.6% GDP decline annually for Canada, costing the average Canadian $2,000 CAD per year in lost income. Add in retaliatory tariffs, and this spirals into a full-blown recession, with cascading impacts on productivity, supply chains, and jobs.

- Auto/Transport Exports: Down 10 percentage points.

- Basic Metals Exports: Down 9 percentage points.

- Chemicals and Paper Products: Exports drop by 8% and 7%, respectively.

- Overall Sector Decline: A staggering 22 percentage points for critical industries.

Meanwhile, cross-border investment—once a pillar of Canada-U.S. relations—is under threat. Canadian investments in the U.S. total $1.1 trillion, but a tariff war risks destabilizing these flows and gutting the broader economic relationship.

Last Weeks Spin Piece from the Canadian Press

As we look at the fallout from Trump’s 25% tariff announcement, let’s take a moment to laugh at this spin piece from the Canadian Press that came out just last week. The article tried to paint a picture of Canada’s Foreign Affairs Minister Mélanie Joly claiming that Donald Trump’s return to the White House has somehow boosted Canada’s influence on the world stage. Yes, you heard that right—Canada, the same country with open borders, an overreliance on U.S. trade, and a prime minister whose leadership is about as effective as a broken clock, is supposedly advising the world on how to handle Trump.

Joly boldly declared from the Asia-Pacific Economic Cooperation summit in Lima, “No country understands the United States better than Canada.” According to her, nations are lining up to learn from Canada’s experience with Trump, as though Trudeau and his team have some masterclass on navigating Trump’s policies. Fast forward to today, with Trump poised to slam Canada with tariffs that could destroy their economy, and the absurdity of this claim is glaring.

This narrative that Canada is a calm, steady hand amid Trump’s return is nothing more than a fantasy. While Joly and Trudeau were hobnobbing at summits, Trump was gearing up to deliver real consequences. His 25% tariff on Canadian imports isn’t hypothetical—it’s a financial wrecking ball aimed at an economy that relies on U.S. trade for survival. Energy exports, autos, and agriculture—the pillars of Canada’s economy—will take a direct hit. But instead of preparing for this, Joly was busy spinning a tale of Canada’s supposed “influence.”

And let’s not forget what Joly was selling in that article. “Canada’s influence is actually increasing because of the impacts that the world is now facing with the new administration.” Increasing? On what planet? Trump’s tariffs make it clear that Canada isn’t leading anything; it’s scrambling to react.

The article also floated the idea that Trudeau was in a “privileged position” because of his past dealings with Trump. Let’s recall how that went, shall we? Trudeau was caught mocking Trump on a hot mic during a G7 summit, embarrassing himself and the country in front of world leaders. His government barely held onto a renegotiated NAFTA—now the USMCA—that Trump rewrote to suit America’s interests. If this is the kind of experience Trudeau brings to the table, it’s no wonder Canada is in trouble.

Meanwhile, the Canadian Press tries to prop up Trudeau as some staunch defender of “rules-based trade,” as though those rules mean anything when Trump has the leverage to rewrite them. Joly spoke about sending “clear messages” to Beijing, yet Trump’s tariff threats expose just how little Canada has done to address the very issues Trump is targeting. Let’s not forget The Bureau’s report on Canada’s role in fentanyl money laundering, with Toronto and Vancouver lighting up as command centers for Triads laundering cash from Mexican cartels. Canada’s failures are part of the problem Trump is confronting.

And here’s the kicker: as of today, neither Trudeau nor Joly has made a peep about Trump’s tariff announcement. No tweets, no press statements, no leadership—just silence. So much for being the world’s go-to expert on Trump. Canada’s leaders are AWOL while Trump tightens the economic screws.

While our beloved PM is silent, Jagmeet Singh, ever the opportunist, couldn’t resist wading into the chaos with his usual brand of hollow theatrics. “Stand up and fight like hell,” he bellowed at Justin Trudeau on Twitter, as though anyone has ever mistaken Singh for a warrior of any kind. Let’s be honest—Singh’s idea of “fighting like hell” probably involves drafting another toothless motion in Parliament or throwing shade on social media while offering zero solutions. This is the same guy who props up Trudeau’s government with his NDP-Liberal supply-and-confidence deal, enabling the very weakness he’s now trying to criticize. Spare us the tough talk, Jagmeet. Bootlicking Trudeau one day and grandstanding the next doesn’t exactly scream credibility.

And as for Trudeau and Mélanie Joly? Their performance over the last week has been nothing short of delusional. While Trump was setting the stage to unleash a 25% tariff that could dismantle Canada’s economy, Trudeau was busy posturing at international summits and snapping photos with global elites. Joly, for her part, claimed that Trump’s return to power somehow boosted Canada’s global influence—because apparently being a punching bag now counts as diplomacy.

This isn’t global influence; it’s global irrelevance. The Trudeau government spent the last week basking in delusion while Trump was preparing to drop the hammer. And now the clock has run out. Stay tuned—because while Trudeau dithers and Singh flails, the reckoning is here.

Final Thoughts

Trump campaigned on a clear and powerful message: tariffs are a weapon to protect American workers and restore national sovereignty. And, folks, he wasn’t wrong. Sure, input costs might rise. Sure, a few elites will clutch their pearls as their profits shrink. But this isn’t about them. This is about something bigger. It’s about standing up for the forgotten workers in Michigan, Ohio, and Wisconsin who’ve watched their livelihoods vanish thanks to decades of globalist betrayal. Trump’s message is loud and clear: no more one-sided trade deals, no more globalist bull. America comes first.

And what about Canada? What has Justin Trudeau done? He’s alienated an entire nation while dividing our own country with his disastrous, virtue-signaling policies. Trudeau doesn’t just dislike the West—he actively works against it. The West pays the bills in this country, folks. Alberta’s oil sands, Saskatchewan’s agriculture, and British Columbia’s resources prop up this nation’s economy. And how does Trudeau repay them? By demonizing their industries, their workers, and their very way of life to appease his climate cult.

While Trudeau struts on the world stage preaching green fantasies, the West bears the cost. It’s their jobs, their industries, and their communities that are hollowed out to fund his carbon tax schemes. Now, with Trump’s tariffs about to slam Canada’s economy, the true cost of Trudeau’s failures is finally coming home to roost.

How can Canada face this crisis when our so-called leader is more concerned with photo ops, platitudes, and meaningless “climate leadership” than standing up for our country? Trudeau has alienated our most important trading partner, antagonized the West, and is now leaving us unprepared for a showdown with Trump’s America.

Let’s look at the facts. Canada is at odds with China, embroiled in a cold war with India, and now staring down Trump’s tariffs. Every move Trudeau makes puts us further into isolation, weaker and more vulnerable. So here’s the question: can we really afford another year of this man at the helm?

The Trudeau government has run out of excuses, out of allies, and now, out of time. This isn’t just about whether Canada can survive Trump’s tariffs. It’s about whether we can survive another year of Justin Trudeau’s leadership. The reckoning is here, and Canada deserves better.

Subscribe to The Opposition with Dan Knight .

For the full experience, upgrade your subscription.

Business

Mark Carney’s Fiscal Fantasy Will Bankrupt Canada

By Gwyn Morgan

Mark Carney was supposed to be the adult in the room. After nearly a decade of runaway spending under Justin Trudeau, the former central banker was presented to Canadians as a steady hand – someone who could responsibly manage the economy and restore fiscal discipline.

Instead, Carney has taken Trudeau’s recklessness and dialled it up. His government’s recently released spending plan shows an increase of 8.5 percent this fiscal year to $437.8 billion. Add in “non-budgetary spending” such as EI payouts, plus at least $49 billion just to service the burgeoning national debt and total spending in Carney’s first year in office will hit $554.5 billion.

Even if tax revenues were to remain level with last year – and they almost certainly won’t given the tariff wars ravaging Canadian industry – we are hurtling toward a deficit that could easily exceed 3 percent of GDP, and thus dwarf our meagre annual economic growth. It will only get worse. The Parliamentary Budget Officer estimates debt interest alone will consume $70 billion annually by 2029. Fitch Ratings recently warned of Canada’s “rapid and steep fiscal deterioration”, noting that if the Liberal program is implemented total federal, provincial and local debt would rise to 90 percent of GDP.

This was already a fiscal powder keg. But then Carney casually tossed in a lit match. At June’s NATO summit, he pledged to raise defence spending to 2 percent of GDP this fiscal year – to roughly $62 billion. Days later, he stunned even his own caucus by promising to match NATO’s new 5 percent target. If he and his Liberal colleagues follow through, Canada’s defence spending will balloon to the current annual equivalent of $155 billion per year. There is no plan to pay for this. It will all go on the national credit card.

This is not “responsible government.” It is economic madness.

And it’s happening amid broader economic decline. Business investment per worker – a key driver of productivity and living standards – has been shrinking since 2015. The C.D. Howe Institute warns that Canadian workers are increasingly “underequipped compared to their peers abroad,” making us less competitive and less prosperous.

The problem isn’t a lack of money; it’s a lack of discipline and vision. We’ve created a business climate that punishes investment: high taxes, sluggish regulatory processes, and politically motivated uncertainty. Carney has done nothing to reverse this. If anything, he’s making the situation worse.

Recall the 2008 global financial meltdown. Carney loves to highlight his role as Bank of Canada Governor during that time but the true credit for steering the country through the crisis belongs to then-prime minister Stephen Harper and his finance minister, Jim Flaherty. Facing the pressures of a minority Parliament, they made the tough decisions that safeguarded Canada’s fiscal foundation. Their disciplined governance is something Carney would do well to emulate.

Instead, he’s tearing down that legacy. His recent $4.3 billion aid pledge to Ukraine, made without parliamentary approval, exemplifies his careless approach. And his self-proclaimed image as the experienced technocrat who could go eyeball-to-eyeball against Trump is starting to crack. Instead of respecting Carney, Trump is almost toying with him, announcing in June, for example that the U.S. would pull out of the much-ballyhooed bilateral trade talks launched at the G7 Summit less than two weeks earlier.

Ordinary Canadians will foot the bill for Carney’s fiscal mess. The dollar has weakened. Young Canadians – already priced out of the housing market – will inherit a mountain of debt. This is not stewardship. It’s generational theft.

Some still believe Carney will pivot – that he will eventually govern sensibly. But nothing in his actions supports that hope. A leader serious about economic renewal would cancel wasteful Trudeau-era programs, streamline approvals for energy and resource projects, and offer incentives for capital investment. Instead, we’re getting more borrowing and ideological showmanship.

It’s no longer credible to say Carney is better than Trudeau. He’s worse. Trudeau at least pretended deficits were temporary. Carney has made them permanent – and more dangerous.

This is a betrayal of the fiscal stability Canadians were promised. If we care about our credit rating, our standard of living, or the future we are leaving our children, we must change course.

That begins by removing a government unwilling – or unable – to do the job.

Canada once set an economic example for others. Those days are gone. The warning signs – soaring debt, declining productivity, and diminished global standing – are everywhere. Carney’s defenders may still hope he can grow into the job. Canada cannot afford to wait and find out.

The original, full-length version of this article was recently published in C2C Journal.

Gwyn Morgan is a retired business leader who was a director of five global corporations.

Business

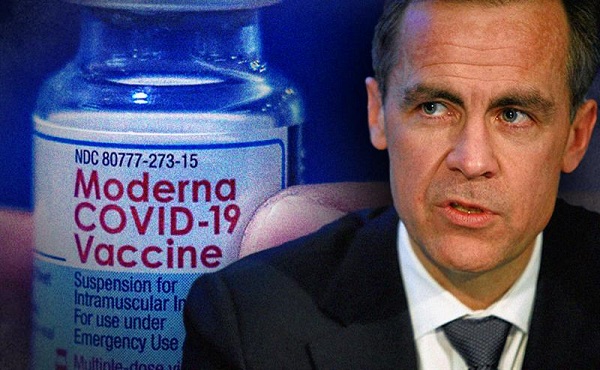

Carney Liberals quietly award Pfizer, Moderna nearly $400 million for new COVID shot contracts

From LifeSiteNews

Carney’s Liberal government signed nearly $400 million in contracts with Pfizer and Moderna for COVID shots, despite halted booster programs and ongoing delays in compensating Canadians for jab injuries.

Prime Minister Mark Carney has awarded Pfizer and Moderna nearly $400 million in new COVID shot contracts.

On June 30th, the Liberal government quietly signed nearly $400 million contracts with vaccine companies Pfizer and Moderna for COVID jabs, despite thousands of Canadians waiting to receive compensation for COVID shot injuries.

The contracts, published on the Government of Canada website, run from June 30, 2025, until March 31, 2026. Under the contracts, taxpayers must pay $199,907,418.00 to both companies for their COVID shots.

Notably, there have been no press releases regarding the contracts on the Government of Canada website nor from Carney’s official office.

Additionally, the contracts were signed after most Canadians provinces halted their COVID booster shot programs. At the same time, many Canadians are still waiting to receive compensation from COVID shot injuries.

Canada’s Vaccine Injury Support Program (VISP) was launched in December 2020 after the Canadian government gave vaccine makers a shield from liability regarding COVID-19 jab-related injuries.

There has been a total of 3,317 claims received, of which only 234 have received payments. In December, the Canadian Department of Health warned that COVID shot injury payouts will exceed the $75 million budget.

The December memo is the last public update that Canadians have received regarding the cost of the program. However, private investigations have revealed that much of the funding is going in the pockets of administrators, not injured Canadians.

A July report by Global News discovered that Oxaro Inc., the consulting company overseeing the VISP, has received $50.6 million. Of that fund, $33.7 million has been spent on administrative costs, compared to only $16.9 million going to vaccine injured Canadians.

Furthermore, the claims do not represent the total number of Canadians injured by the allegedly “safe and effective” COVID shots, as inside memos have revealed that the Public Health Agency of Canada (PHAC) officials neglected to report all adverse effects from COVID jabs and even went as far as telling staff not to report all events.

The PHAC’s downplaying of jab injuries is of little surprise to Canadians, as a 2023 secret memo revealed that the federal government purposefully hid adverse effect so as not to alarm Canadians.

The secret memo from former Prime Minister Justin Trudeau’s Privy Council Office noted that COVID jab injuries and even deaths “have the potential to shake public confidence.”

“Adverse effects following immunization, news reports and the government’s response to them have the potential to shake public confidence in the COVID-19 vaccination rollout,” read a part of the memo titled “Testing Behaviourally Informed Messaging in Response to Severe Adverse Events Following Immunization.”

Instead of alerting the public, the secret memo suggested developing “winning communication strategies” to ensure the public did not lose confidence in the experimental injections.

Since the start of the COVID crisis, official data shows that the virus has been listed as the cause of death for less than 20 children in Canada under age 15. This is out of six million children in the age group.

The COVID jabs approved in Canada have also been associated with severe side effects, such as blood clots, rashes, miscarriages, and even heart attacks in young, healthy men.

Additionally, a recent study done by researchers with Canada-based Correlation Research in the Public Interest showed that 17 countries have found a “definite causal link” between peaks in all-cause mortality and the fast rollouts of the COVID shots, as well as boosters.

Interestingly, while the Department of Health has spent $16 million on injury payouts, the Liberal government spent $54 million COVID propaganda promoting the shot to young Canadians.

The Public Health Agency of Canada especially targeted young Canadians ages 18-24 because they “may play down the seriousness of the situation.”

-

Business1 day ago

Business1 day agoCarney government should apply lessons from 1990s in spending review

-

Business2 days ago

Business2 days agoTrump to impose 30% tariff on EU, Mexico

-

Entertainment1 day ago

Entertainment1 day agoStudy finds 99% of late-night TV guests in 2025 have been liberal

-

illegal immigration2 days ago

illegal immigration2 days agoICE raids California pot farm, uncovers illegal aliens and child labor

-

Business7 hours ago

Business7 hours agoMark Carney’s Fiscal Fantasy Will Bankrupt Canada

-

Frontier Centre for Public Policy19 hours ago

Frontier Centre for Public Policy19 hours agoCanada’s New Border Bill Spies On You, Not The Bad Guys

-

Energy2 days ago

Energy2 days agoLNG Export Marks Beginning Of Canadian Energy Independence

-

Uncategorized19 hours ago

Uncategorized19 hours agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda