Business

Trudeau launches assault on property rights to answer housing shortage

From the MacDonald Laurier Institute

By Aaron Wudrick and Jon Hartley

Liberals crack down on short-term rental owners in fiscal update — while ignoring the need for mass-scale construction of private builds

In Tuesday’s fiscal update, the Trudeau government found itself trying to bury the lede in a bad news story of bigger deficits, higher debt payments and a weakened economy.

Following a slew of opinion polls that show the Liberals trailing the opposition Conservatives by a widening margin, the update also exuded a palpable sense of urgency as the government scrambles to address a critical issue on which they were caught completely off guard: housing.

Housing has emerged, in recent months, as arguably the single biggest political concern in Canada. It impacts middle- and lower-income Canadians most severely and is a significant part of why the Liberals have been bleeding support amongst these key constituencies, which disproportionately include younger Canadians.

In response to their slide in the polls, the Liberals have belatedly started to act on the file — by removing the GST on new rental builds and dedicating $4 billion to a housing accelerator program that aims to incentivize municipalities to remove prohibitive zoning barriers. The fiscal update boasted that this fund has already signed agreements with nine cities to build 21,000 homes over the next three years, which sounds impressive until you consider that Canada needs approximately 3.5 million new homes by 2030 to fix the affordability crisis.

While any new housing supply will be welcome, the measures amount to knee-jerk reactions by a government that tries to solve problems by hastily showering them with money. While the Housing Accelerator Fund correctly focuses on scrapping restrictive zoning, the real goal should be to incentivize the construction of privately built housing on a mass scale, rather than simply subsidize additional public housing. The real cause of Canada’s housing shortage is not market failure but a series of policy failures on multiple fronts and levels.

Perhaps most alarming is the government’s assault on short-term rental housing by reducing tax deductions available to property owners, framed as a crusade against greedy landlords profiting from tourists while everyday Canadians scramble to keep a roof over their heads. The implicit assumption seems to be that, by making short-term rentals less attractive, these units will be magically transformed into long-term rental accommodations (which is wishful thinking, to say the least). In so doing, the government overlooks the diverse array of reasons Canadians choose to rent out properties on a short-term basis.

Flexibility — as facilitated by platforms like Airbnb — is essential for those who do not wish to commit to full-time landlord responsibilities. Additionally, Canadians may have family members who intermittently require housing, such as aging parents or university students. Long-term tenancy, burdened with compliance issues and eviction challenges, is unappealing to many property owners. If the government instead chose to make the work of a landlord more attractive, it wouldn’t need to make short-term rentals less appealing.

Even more troubling is the broader trend of the government encroaching on Canadians’ property rights, ostensibly to compensate for its own housing policy failures. Dictating how citizens use their own property raises serious concerns about the government overstepping its bounds. In a country with well-established property rights, it is inappropriate and misguided for the government to meddle in the choices of families seeking to make ends meet by renting out their properties.

On a practical level, the government’s chosen channels to tackle housing — relying on more government subsidies, undermining the short-term rental market, discouraging institutional investors from buying single-family homes and foreign buyer taxes or bans — will ultimately be too small to meaningfully grow the total stock of housing but will cause a number of harmful unintended consequences.

The bottom line is this: to make any kind of impact on housing affordability at scale, especially for individuals living below the median income, Canada needs a much larger housing supply — and the amount of capital investment this requires can only come from private developers.

All in all, the fiscal update shows the slapdash nature of the Trudeau government’s frantic attempts to address housing concerns, as well as its unfortunate inclination to resort to heavy-handed interventions, particularly in the realm of short-term rentals. The government’s indifference to infringing on private property rights underscores the need for a more supply-oriented approach to housing policy — one that works with, rather than against, the rights of property owners.

Aaron Wudrick is the domestic policy director at the Macdonald-Laurier Institute.

Jon Hartley is a senior fellow at the Macdonald-Laurier Institute and a research fellow at the Foundation for Research on Equal Opportunity.

2025 Federal Election

Next federal government should end corporate welfare for forced EV transition

From the Fraser Institute

By Tegan Hill and Jake Fuss

Corporate welfare simply shifts jobs and investment away from other firms and industries—which are more productive, as they don’t require government funding to be economically viable—to the governments’ preferred industries and firms, circumventing the preferences of consumers and investors. And since politicians spend other people’s money, they have little incentive to be careful investors.

General Motors recently announced the temporary closure of its electric vehicle (EV) manufacturing plant in Ontario, laying off 500 people because its new EV isn’t selling. The plant will shut down for six months despite hundreds of millions in government subsides financed by taxpayers. This is just one more example of corporate welfare—when governments subsidize favoured industries and companies—and it’s time for the provinces and the next federal government to eliminate it.

Between the federal government and Ontario government, GM received about $500 million to help fund its EV transition. But this is just one example of corporate welfare in the auto sector. Stellantis and Volkswagen will receive about $28 billion in government subsidies while Honda is promised $5 billion.

More broadly, from 2007 to 2019, the last pre-COVID year of data, the federal government spent an estimated $84.6 billion (adjusted for inflation) on corporate welfare while provincial and local governments spent another $302.9 billion. And crucially, these numbers exclude other forms of government support such as loan guarantees, direct investments and regulatory privileges, so the actual cost of corporate welfare during this period was much higher.

Of course, politicians claim that corporate welfare benefits workers. Yet according to a significant body of research, corporate welfare fails to generate widespread economic benefit. Think of it this way—if the businesses that received subsidies were viable to begin with, they wouldn’t need government support. So unprofitable companies are kept in business through governments’ support, which can prevent resources, including investment and workers, from moving to profitable companies, hurting overall economic growth.

Put differently, rather than fuelling economic growth, corporate welfare simply shifts jobs and investment away from other firms and industries—which are more productive, as they don’t require government funding to be economically viable—to the governments’ preferred industries and firms, circumventing the preferences of consumers and investors. And since politicians spend other people’s money, they have little incentive to be careful investors.

Governments also must impose higher tax rates on everyone else to pay for corporate welfare. In turn, higher tax rates discourage entrepreneurship and business investment—again, which fuels economic growth. And the higher the tax rates, the more economic activity they discourage.

GM’s EV plant shut down once again proves that when governments try to engineer the economy with corporate welfare, workers will ultimately lose. It’s time for the provinces and the next federal government—whoever it may be—to finally put an end to this costly and ineffective policy approach.

Business

Hudson’s Bay Bid Raises Red Flags Over Foreign Influence

From the Frontier Centre for Public Policy

A billionaire’s retail ambition might also serve Beijing’s global influence strategy. Canada must look beyond the storefront

When B.C. billionaire Weihong Liu publicly declared interest in acquiring Hudson’s Bay stores, it wasn’t just a retail story—it was a signal flare in an era where foreign investment increasingly doubles as geopolitical strategy.

The Hudson’s Bay Company, founded in 1670, remains an enduring symbol of Canadian heritage. While its commercial relevance has waned in recent years, its brand is deeply etched into the national identity. That’s precisely why any potential acquisition, particularly by an investor with strong ties to the People’s Republic of China (PRC), deserves thoughtful, measured scrutiny.

Liu, a prominent figure in Vancouver’s Chinese-Canadian business community, announced her interest in acquiring several Hudson’s Bay stores on Chinese social media platform Xiaohongshu (RedNote), expressing a desire to “make the Bay great again.” Though revitalizing a Canadian retail icon may seem commendable, the timing and context of this bid suggest a broader strategic positioning—one that aligns with the People’s Republic of China’s increasingly nuanced approach to economic diplomacy, especially in countries like Canada that sit at the crossroads of American and Chinese spheres of influence.

This fits a familiar pattern. In recent years, we’ve seen examples of Chinese corporate involvement in Canadian cultural and commercial institutions, such as Huawei’s past sponsorship of Hockey Night in Canada. Even as national security concerns were raised by allies and intelligence agencies, Huawei’s logo remained a visible presence during one of the country’s most cherished broadcasts. These engagements, though often framed as commercially justified, serve another purpose: to normalize Chinese brand and state-linked presence within the fabric of Canadian identity and daily life.

What we may be witnessing is part of a broader PRC strategy to deepen economic and cultural ties with Canada at a time when U.S.-China relations remain strained. As American tariffs on Canadian goods—particularly in aluminum, lumber and dairy—have tested cross-border loyalties, Beijing has positioned itself as an alternative economic partner. Investments into cultural and heritage-linked assets like Hudson’s Bay could be seen as a symbolic extension of this effort to draw Canada further into its orbit of influence, subtly decoupling the country from the gravitational pull of its traditional allies.

From my perspective, as a professional with experience in threat finance, economic subversion and political leveraging, this does not necessarily imply nefarious intent in each case. However, it does demand a conscious awareness of how soft power is exercised through commercial influence, particularly by state-aligned actors. As I continue my research in international business law, I see how investment vehicles, trade deals and brand acquisitions can function as instruments of foreign policy—tools for shaping narratives, building alliances and shifting influence over time.

Canada must neither overreact nor overlook these developments. Open markets and cultural exchange are vital to our prosperity and pluralism. But so too is the responsibility to preserve our sovereignty—not only in the physical sense, but in the cultural and institutional dimensions that shape our national identity.

Strategic investment review processes, cultural asset protections and greater transparency around foreign corporate ownership can help strike this balance. We should be cautious not to allow historically Canadian institutions to become conduits, however unintentionally, for geopolitical leverage.

In a world where power is increasingly exercised through influence rather than force, safeguarding our heritage means understanding who is buying—and why.

Scott McGregor is the managing partner and CEO of Close Hold Intelligence Consulting.

-

2025 Federal Election22 hours ago

2025 Federal Election22 hours agoBREAKING: THE FEDERAL BRIEF THAT SHOULD SINK CARNEY

-

2025 Federal Election22 hours ago

2025 Federal Election22 hours agoCHINESE ELECTION THREAT WARNING: Conservative Candidate Joe Tay Paused Public Campaign

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoOttawa Confirms China interfering with 2025 federal election: Beijing Seeks to Block Joe Tay’s Election

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoReal Homes vs. Modular Shoeboxes: The Housing Battle Between Poilievre and Carney

-

Business11 hours ago

Business11 hours agoHudson’s Bay Bid Raises Red Flags Over Foreign Influence

-

2025 Federal Election8 hours ago

2025 Federal Election8 hours agoMark Carney Wants You to Forget He Clearly Opposes the Development and Export of Canada’s Natural Resources

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoHow Canada’s Mainstream Media Lost the Public Trust

-

John Stossel1 day ago

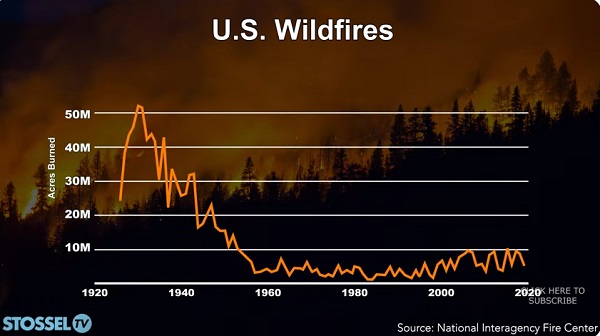

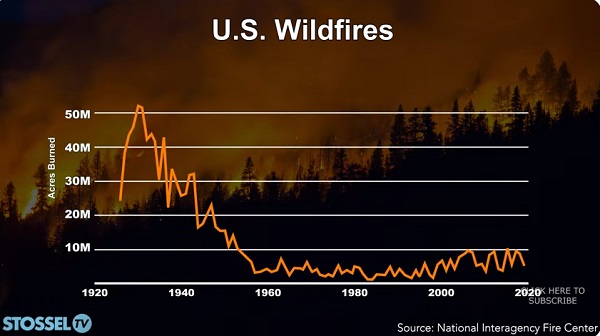

John Stossel1 day agoClimate Change Myths Part 2: Wildfires, Drought, Rising Sea Level, and Coral Reefs