National

Trudeau gov’t considered using term ‘heat-flation’ to link rising costs with ‘climate change’

From LifeSiteNews

Recently revealed documents show that members of Prime Minister Justin Trudeau’s cabinet were looking to associate rising inflation in Canada with “climate change” by using the term “heat-flation,” but abandoned the idea after negative feedback from polls.

The documents show that Trudeau’s own Privy Council Office in an April 24 report said it had commissioned its own “in-house” research on the “concepts of ‘climate-flation’ and ‘heat-flation’” to see Canadians take on the terms.

Predictably, the bid to try and convince Canadians that the rising costs of living was the result of so-called “climate change” did not go over well with those polled as nobody had even heard of the term “heat-flation.”

The information regarding the poll was gleaned from a report titled Continuous Qualitative Data Collection Of Canadians’ Views, as noted by Blacklock’s Reporter, and asked if Canadians had heard of these “terms before” with “none indicated they had.”

“Describing what they believed these terms referred to, many expected they were likely connected to the issue of climate change and rising economic costs of its effect as well as efforts to mitigate its impacts going forward,” noted the report.

“To clarify, participants were informed ‘heat-flation’ is when extreme heat caused by climate change makes food and other items more expensive, and that ‘climate-flation’ was a broader term that encompassed all of the ways in which climate change can cause prices to go up including but not limited to extreme heat.”

The report noted that while some of the people polled thought “climate change” might have had some effect on inflation, many other issues were seen as the cause.

The report noted that “All believed climate change was having at least some impact on the price of food” but not in the way the government narrative asserts.

The report found that some Canadians “felt that in addition to extreme heat and drought making it more difficult for farmers to protect their crops and livestock, extreme weather events could also cause damage to vital roadways and infrastructure making it more difficult to transport food products across the country. A few also expressed that in addition to impacting Canadian food production climate change could also make it more expensive to import food.”

Others, however, “expressed the opinion the federal government needed to reduce its spending, believing that growing deficits in recent years had contributed to rising inflation.”

Of note is that no Canadian government has balanced the budget since 2007, and many critics have pointed to this ever-increasing debt-load to the reason inflation has rocked the country.

When it came to the carbon tax, many expressed the view that the “carbon pricing system had served to further increase the rate of inflation.”

Whether its inflation, the carbon tax or other factors, it remains true that Canada’s poverty rate is on the rise.

As reported by LifeSiteNews, a July survey found that nearly half of Canadians are just $200 away from financial ruin as the costs of housing, food and other necessities has gone up massively since Trudeau took power in 2015.

Critics argue that instead of addressing these issues, the Trudeau government has instead used the “climate change” agenda to justify applying a punitive carbon tax on Canadians.

However, polls indicate that most Canadians are not as concerned with “climate change” as they are with other issues, and many do not buy into the alarmist government narrative. Many critics have also accused government officials of being hypocrites, as they punish Canadians via the carbon tax and other measures while themselves taking advantage of frequent flights at the expense of taxpayers.

Despite the rising unpopularity of such policies, the Trudeau government has continued to push a radical environmental agenda similar to those endorsed by globalist groups like the World Economic Forum and the United Nations.

Bruce Dowbiggin

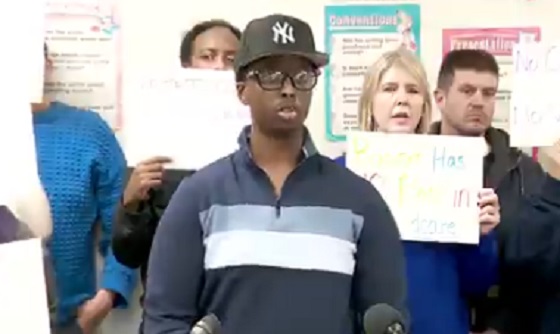

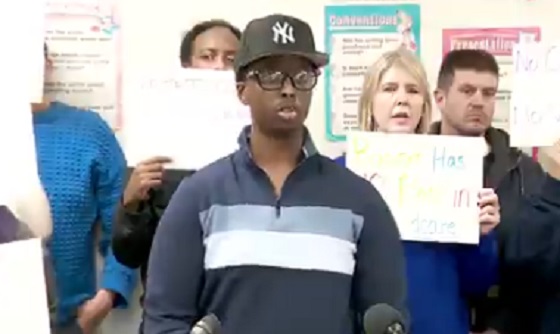

The Rise Of The System Engineer: Has Canada Got A Prayer in 2026?

“Of all tyrannies, a tyranny sincerely exercised for the good of its victims may be the most oppressive. It would be better to live under robber barons than under omnipotent moral busybodies.” C.S. Lewis

One of the aims of logical positivism has been Boomers’ quest to kill Western religion and the pursuit of faith in order to make room for the state. Symbols are banned. Churches are burned. Infidels are rewarded. Esoteric faith systems applauded. Yet, as 2026 dawns, it appears that, not only is traditional religion not dead, it might just be making a comeback with younger generations who’ve grown skeptical of their parents’ faux religion of self.

How? In an age of victim status, traditional religion is suddenly a cuddly TikTok puppy. Hard to imagine that the force that spread imperialism and war across the globe for centuries being a victim. But yes. Only Christians and Jews are singled out for censure In Carney’s Canada The zeal to repeal God has backfired. Faith is off the canvas and punching back. (And we are NOT talking about the Woke pope.)

The purveyors of “old-time religion” will still find themselves facing a determined opponent well on the way to moral inversion. And a compliant population. As blogger Melanie in Saskatchewan points out, “Canadians were sold a calm, competent adult in the room. What they got was an unelected system engineer quietly converting moral claims into financial constraints. This is not leadership. It is non-consensual governance.

The freedoms that make dissent possible are being used to hollow out dissent. The protections meant to guard against abuse are being used to avoid scrutiny. And the law—stripped of its moral imagination—is asked to do what it cannot: resolve psychic conflict through paperwork.”

The sophistry of the superior class demands submission. C.S. Lewis warned of this inversion in God In The Dock. “To be “cured” against one’s will and cured of states which we may not regard as disease is to be put on a level of those who have not yet reached the age of reason or those who never will; to be classed with infants, imbeciles, and domestic animals.”

In Canada that compliant class has embraced Mark Carney as the great stabilizer. “Canadians keep asking the wrong question about Mark Carney,” says blogger Melanie in Saskatchewan. “They keep asking whether he is a good politician. That is like asking whether a locksmith is a good interior decorator.

Carney is not here to govern. He is here to re-engineer the operating system of the country while the Liberal Party provides the helpful stage props and applause track. And judging by how little scrutiny this government receives, the audience seems perfectly content to clap at whatever is placed in front of them, provided it comes with soothing words like “stability,” “resilience,” and “the experts agree”.

Adds Dr. Andrea Wagner, Canadians “hide behind procedure. Behind policy. Behind institutions. Behind NDAs. Behind committees, processes, protocols. Behind phrases like “we’re reviewing this internally” and “that’s beyond my authority.” They hide behind the pretense of empathy while quietly perpetuating injustice. They hide behind performative busy-ness: “I wish I had time,” “I’m swamped,” “I’ve been unwell.” There is enormous power in powerlessness—and Canadians wield it masterfully.”

The problem, says Melanie in Saskatchewan, is not that Mark Carney in full power is incompetent. The problem is that he is extremely competent at something Canadians never actually consented to. Technocrats redesign the machinery so that the outcome becomes inevitable. No messy debate. No inconvenient voters. No public reckoning. Just “the framework,” “the model,” “the standard,” and eventually the quiet conclusion that there is “no alternative.”

And this is precisely the world Mark Carney comes from. ”He did not rise through grassroots politics or party service. He rose through central banks, global finance institutions, and elite climate-finance bodies that speak fluent acronym and consider democracy an optional inconvenience. The man does not campaign. He architects.”

While the Conservative Party of Canada still polls evenly with the Liberals they are playing a different game, one they— with their traditional tactics— are not wired to win in a battle of systems with Carney. This cringeworthy “Keep It Up” endorsement of Carney by former CPC leader Erin O’Toole speaks to why they are further from power than ever.

The manufactured crisis over indigenous Rez school graves illustrates the method. “To call out intimidation or dehumanization is to risk being reframed as the aggressor. The person who names harm becomes the disturbance; the one who weaponizes grievance becomes the protected party. Justice no longer asks what happened, only who claims injury first. This is not accidental. It is the logical endpoint of a culture that has confused victimhood with virtue and pain with authority.

Suffering, once something to be alleviated, has become something to be curated. Identity now precedes evidence; accusation outruns inquiry. The system does not ask whether harm is real or proportional—only whether it can be procedurally contained. And containment, I am learning, is often preferred to truth.”

There are still some who believe there remains a way out of this. Here’s Paul Wells on Substack with a valid conclusion— which most sentient people reached by the end of Trudeau’s first term. “Canada has spent too long thinking of itself as a warehouse for the world instead of designing and building for itself. It’s time for a shared mindset of ambition quality and real investment in physical and human capital so Canadians become Canada’s designers and builders of livable cities rather than bystanders to our own future.”

But it’s hard to square that with the gap Carney’s already has. “The tragedy is that the Liberal Party is perfectly happy to hand (Carney) the country and then scold the public for noticing. If Canadians want a future where choices are still made by voters instead of algorithms and advisory panels, they are going to have to stop applauding this performance and start asking the one question that truly terrifies technocrats and their obedient political enablers.”

This system monolith taking over life is why the abrasive, defiant Donald Trump emerged. Vast segments of America employ him to defy the EU scolds with their censorship regimes. His defiance is categorical— which is why it frightens Canadians. The man from Mitch & Murray delivered a few truths to them and they soiled themselves. Paradise will never be the same!. Bad Trump! But an almost-octogenarian has little runway left himself. Who can continue the resistance to the Carney system engineers?

In the past organized religion was a refuge from the maelstrom of the secular storm. There was comfort in the message. Thus, the Liberals’ current need to destroy faith. So the epidemic of churches burned is ignored. The intrusive demonstrations of militant Islam are tolerated. (Carney says Muslim virtues are Canadian virtues.) History is re-written. Heroes debunked.

If Soviet Russia is any indication, the traditional faiths can survive and act as a bulwark against the technocrats— if they find their Pope John Paul II.. The Catholic and Orthodox faiths furnished a way out from behind the Iron Curtain. As organizations not co-opted by the state in the West religions can provide a moral backbone to expose and defeat the secular globalists.

Whether you are a believer or not they provide a pushback to restore the moral clarity C.S. described. It’s not too late as 2026 dawns. But if nothing is done in the West — if Canada accepts EU censorship and global ID— then writing this column in 2027 could well be defined as a criminal act.

“That which you most need will be found where you least want to look.” Carl Jung

Bruce Dowbiggin @dowbboy is the editor of Not The Public Broadcaster A two-time winner of the Gemini Award as Canada’s top television sports broadcaster, his 2025 book Deal With It: The Trades That Stunned The NHL And Changed Hockey is now available on Amazon. Inexact Science: The Six Most Compelling Draft Years In NHL History, his previous book with his son Evan, was voted the seventh-best professional hockey book of all time by bookauthority.org . His new poetry collection In Other Words is available via brucedowbigginbooks.ca and on Kindle books at https://www.amazon.ca/dp/1069802700

Business

The great policy challenge for governments in Canada in 2026

From the Fraser Institute

According to a recent study, living standards in Canada have declined over the past five years. And the country’s economic growth has been “ugly.” Crucially, all 10 provinces are experiencing this economic stagnation—there are no exceptions to Canada’s “ugly” growth record. In 2026, reversing this trend should be the top priority for the Carney government and provincial governments across the country.

Indeed, demographic and economic data across the country tell a remarkably similar story over the past five years. While there has been some overall economic growth in almost every province, in many cases provincial populations, fuelled by record-high levels of immigration, have grown almost as quickly. Although the total amount of economic production and income has increased from coast to coast, there are more people to divide that income between. Therefore, after we account for inflation and population growth, the data show Canadians are not better off than they were before.

Let’s dive into the numbers (adjusted for inflation) for each province. In British Columbia, the economy has grown by 13.7 per cent over the past five years but the population has grown by 11.0 per cent, which means the vast majority of the increase in the size of the economy is likely due to population growth—not improvements in productivity or living standards. In fact, per-person GDP, a key indicator of living standards, averaged only 0.5 per cent per year over the last five years, which is a miserable result by historic standards.

A similar story holds in other provinces. Prince Edward Island, Nova Scotia, Quebec and Saskatchewan all experienced some economic growth over the past five years but their populations grew at almost exactly the same rate. As a result, living standards have barely budged. In the remaining provinces (Newfoundland and Labrador, New Brunswick, Ontario, Manitoba and Alberta), population growth has outstripped economic growth, which means that even though the economy grew, living standards actually declined.

This coast-to-coast stagnation of living standards is unique in Canadian history. Historically, there’s usually variation in economic performance across the country—when one region struggles, better performance elsewhere helps drive national economic growth. For example, in the early 2010s while the Ontario and Quebec economies recovered slowly from the 2008/09 recession, Alberta and other resource-rich provinces experienced much stronger growth. Over the past five years, however, there has not been a “good news” story anywhere in the country when it comes to per-person economic growth and living standards.

In reality, Canada’s recent record-high levels of immigration and population growth have helped mask the country’s economic weakness. With more people to buy and sell goods and services, the overall economy is growing but living standards have barely budged. To craft policies to help raise living standards for Canadian families, policymakers in Ottawa and every provincial capital should remove regulatory barriers, reduce taxes and responsibly manage government finances. This is the great policy challenge for governments across the country in 2026 and beyond.

-

International1 day ago

International1 day agoTrump confirms first American land strike against Venezuelan narco networks

-

Business1 day ago

Business1 day agoHow convenient: Minnesota day care reports break-in, records gone

-

Opinion2 days ago

Opinion2 days agoGlobally, 2025 had one of the lowest annual death rates from extreme weather in history

-

Business1 day ago

Business1 day agoThe great policy challenge for governments in Canada in 2026

-

Bruce Dowbiggin4 hours ago

Bruce Dowbiggin4 hours agoThe Rise Of The System Engineer: Has Canada Got A Prayer in 2026?

-

International4 hours ago

International4 hours agoMaduro says he’s “ready” to talk

-

International4 hours ago

International4 hours agoLOCKED AND LOADED: Trump threatens U.S. response if Iran slaughters protesters