Business

Three ‘hard truths’ about Canada’s trade

From the Fraser Institute

Author: Jock Finlayson

In Canada’s case, a small number of sectors reliably generate significant trade surpluses, which help finance large trade deficits incurred in other parts of our economy.

Canada is an “open” economy that depends on cross-border flows of trade, investment and data/knowledge to maintain high living standards. To pay our way in a very competitive world, Canadians must produce and sell goods and services to customers in other countries. These exports furnish the means to pay for the vast array of imports that contribute to the well-being of Canadian households and allow our businesses to operate efficiently and grow by accessing bigger markets.

In 2022, Canada exported $779 billion of goods to other countries, along with $161 billion of services, for a total of $940 billion. The services category includes a wide array of commercial services including professional, scientific, technical, digital and financial, as well as transportation services and international tourism (when non-Canadian visitors travel to spend money here).

About three-quarters of Canada’s exports are destined for a single market—the United States, whose economy has steadily expanded in size over time to reach some US$25 trillion of gross domestic product today. Canada also sources the bulk of our imports from the U.S.

The centrality of the American market to Canada’s economic prosperity is the first “hard truth” about Canada’s trade, a point explored in a recent paper by Steve Globerman. Despite periodic efforts to diversify Canada’s trade and commercial links over the last 50 years, Canada remains as closely tied to the American economy today as we were in the 1990s. There’s little reason to believe the Trudeau government’s recently unveiled “Indo-Pacific” strategy will change the situation. Proximity, a common language and business culture, and the impact of extensive and unusually deep business and personal ties all serve to reinforce the American-centric character of Canada’s trade. It follows that the U.S. should continue to figure prominently in the trade promotion and investment attraction activities of Canadian governments.

A second “hard truth” about Canada’s trade is the outsized place of natural resource-based products in the export mix. The first table below breaks down Canada’s goods and services exports in 2022 into the main groupings.

Added together, energy, non-metallic minerals and related products, metal ores, forest products and agri-food comprise almost half of the country’s total international exports of goods and services combined. Energy alone supplied 27 per cent of Canada’s merchandise exports (and 23 per cent of total exports) last year, generating a remarkable $212 billion in export-driven income for Canadian businesses, workers and governments.

Within the energy basket, oil and oil-based products dominate, providing about three-quarters of energy-based export revenues. Contrary to innumerable speeches and press releases issued by the current federal government, the energy share is likely to rise in the next several years, as LNG production from British Columbia comes on-line and Western Canadian oil exports increase following the completion of pipeline expansion projects.

The final “hard truth” is closely related to the second but carries a more nuanced message. Ultimately, every country will have a ledger showing the trade surpluses and trade deficits across its various industries. In Canada’s case, a small number of sectors reliably generate significant trade surpluses, which help finance large trade deficits incurred in other parts of our economy.

The second table provides a snapshot of Canada’s trade “balances”—the mix of deficits and surpluses by broad industry category.

The story is a fairly simple one; positive trade balances in the energy, mining, forestry and agri-food sectors offset chronic—and in some cases very sizable—trade deficits in consumer goods, chemicals and plastics, motor vehicles/parts, and industrial and electronic goods. We also run a smallish deficit in our overall services trade.

The trade data are informative. Among other things, they tell us where Canada has, in the language of economists, a “comparative advantage” in the global context. For a market-based economy, a pattern of positive trade balances is evidence that it very likely enjoys a comparative advantage in the industries which report consistent trade surpluses. Armed with such information, smart policymakers should strive to create and sustain an attractive business and investment climate for the industries that produce trade surpluses. Unfortunately, this is a lesson that today’s federal government in distant Ottawa has struggled to digest.

Business

B.C. Credit Downgrade Signals Deepening Fiscal Trouble

Dan Knight

Dan Knight

Spending is up, debt is exploding, and taxpayers are footing the bill—how David Eby’s reckless economics just pushed British Columbia one step closer to the brink.

So here’s something they’re not going to explain on CBC—British Columbia just got slapped with yet another credit downgrade. Actually, two. On April 2nd, both S&P Global and Moody’s—two of the most powerful financial watchdogs on the planet—downgraded B.C.’s credit rating. And not by accident. This wasn’t a glitch in the system or some market hiccup. This was a direct consequence of political recklessness.

Let’s talk numbers. S&P cut B.C.’s rating from ‘AA-’ to ‘A+’. Moody’s dropped it from ‘aa1’ to ‘aa2’. That’s the fourth downgrade in four years. Four. This is a province that used to hold AAA status—the financial gold standard. That means British Columbia was once considered one of the most fiscally stable jurisdictions not just in Canada, but globally. Not anymore.

Even more alarming? S&P didn’t just hit their long-term rating—they downgraded the short-term rating too, from ‘A-1+’ to ‘A-1’. Why? Because even in the short term, B.C. is starting to look like a risk. A liquidity risk. That means the money might not be there when it’s needed. That’s a red flag for anyone with a calculator and a memory longer than five minutes.

This is not some vague bureaucratic move. This is a direct indictment of the NDP’s economic policies in British Columbia. This is what happens when you treat taxpayers like an ATM machine and the economy like a social experiment. And now, international financial institutions are officially saying what a lot of people have been screaming for years: B.C. is in serious fiscal trouble.

Causes: Spending, Deficits, and Revenue Pressure

The core driver behind the downgrades is the ballooning of operating and capital deficits, coupled with aggressive government spending. According to B.C.’s 2025 budget, unveiled by Finance Minister Brenda Bailey on March 4, the provincial deficit is projected to hit $10.9 billion in 2025–26—up from $9.1 billion the previous year. Moody’s projects an even higher shortfall of $14.3 billion, raising red flags about B.C.’s ability to fund programs without unsustainable borrowing.

S&P cited the impact of reduced immigration levels and ongoing trade uncertainty as key headwinds, limiting economic growth and shrinking the province’s revenue base. Moody’s pointed to persistent budgetary gaps and limited progress on deficit reduction, highlighting the growing gap between revenue and expenditure.

Additionally, spending growth has significantly outpaced both population and inflation. Data from the Fraser Institute shows that between 2019/20 and 2024/25, program spending increased by 51.6%, whereas only 29.2% was needed to keep pace with demographic and price trends. This excess has pushed real per-capita expenditures to historic highs, without a corresponding rise in revenue.

Opposition Blames NDP Mismanagement for Downgrade

But what does that actually mean for real people—not bureaucrats, not lobbyists—but the mom on a fixed income buying groceries? So I reached out to John Rustad, leader of the Official Opposition in B.C., to ask exactly that.

“Two downgrades! Absolute disaster,” he told me. “Under David Eby, we’ve gone from a AAA status to a single A with a negative outlook. This government’s reckless spending and irresponsible management will have a devastating effect—not just today, but for generations to come.”

He’s not exaggerating. According to Rustad, by the end of this fiscal period, B.C.’s debt will have nearly tripled since the NDP took power. Let that sink in—tripled. And no, this isn’t just some abstract macroeconomic trend. This hits you. Directly.

Rustad laid it out. These downgrades mean higher borrowing costs for the province. That’s code for more taxpayer money getting funneled into interest payments instead of hospitals, schools, or—God forbid—tax relief.

“By the end of this fiscal plan, even before the downgrade and before the loss of billions in carbon tax revenue, interest payments were projected to hit $7 billion annually,” Rustad said. “That’s about 30% of personal income tax revenue—just to pay the interest.”

That’s money you send to Victoria every month—just lighting it on fire.

And with the downgrade? Expect to pay another $1 billion more in interest. That’s around $200 per person, per year. Not for roads. Not for services. Just to keep the debt monster fed.

Meanwhile, Premier David Eby—well, he’s had months to plan for replacing the carbon tax, and guess what? Still no plan. Rustad told me he expected Eby to raise industrial taxes to make up the difference, but even that hasn’t happened yet. For now, the hole is just growing—a $2 billion loss in carbon tax revenue on top of an $11 billion deficit.

So What Does This Mean for the Average Mom?

In response to a direct question about what this credit downgrade means for a mother living on a fixed income, Opposition Leader John Rustad laid out the long-term consequences in no uncertain terms:

“The average person will not notice this immediately. But what it does mean is higher borrowing costs, So with the massive deficit and debt, more money will need to be spent on interest payments. By the end of this fiscal, before loss of billions in carbon tax revenue and before the debt downgrades, interest payments would increase to about $7 billion by the end of the fiscal plan. To put that in perspective, that would be the equivalent of 30% or more of personal income taxes just to pay interest.”

He continued:

“The debt downgrades mean the province will have to pay more in interest—likely 1/4 to 1/2% more. On $220+ billion, that could mean $1 billion more in interest. That could be about $200 per man, woman and child annually in more interest by 2027.”

And with no plan to rein in spending, Rustad issued a stark warning:

“The compounding problem is: will this mean service cuts, more taxes, or yet more debt to be paid by our children?”

Final Thoughts

So here’s a question no one on CBC is going to ask: What actually happens when a progressive government can’t manage a budget? I’ll tell you. You get poorer. That’s what happens. You, the person who gets up every day and works a real job, pays the price while the people in charge keep living large off your labour.

Let’s walk through it. First, you pay provincial income tax—a tax just for working. Imagine that. You go out, earn a living, and the government takes a cut just because you dared to be productive. Then there’s the PST—you buy something, anything, and you get taxed again. Why? Because you had the audacity to participate in the economy.

And then there’s the carbon tax, the holy grail of progressive grifts. This wasn’t about saving the planet—it was about propping up the very same government that couldn’t manage a piggy bank, let alone a provincial budget. That tax was floating David Eby’s spending addiction. Now it’s gone, and surprise—there’s no plan to replace it. Just more debt, more interest, and more economic chaos.

But wait—here’s the part that really insults your intelligence. After taxing you into the ground, they turn around and say, “Don’t worry, we’ll give you a rebate.” A rebate? You mean you’re going to give me back a tiny fraction of the money you stole from me and act like you’re doing me a favour? Please. That’s not generosity—it’s gaslighting. It’s economic abuse wrapped in a government cheque.

And that’s why I keep saying it: fiscal responsibility matters. Because I’d rather have that money in my wallet, feeding my kids, paying my bills, building my future—than watching David Eby burn it on pet projects, political theatre, and bloated bureaucracy.

But here’s the thing—there is hope. It’s not all doom and despair. In the last election, something incredible happened. The BC Conservatives, a party written off by the elites and ignored by the media, pulled off a political miracle. They surged from obscurity to contention—why? Because regular people are waking up. Because the voters who pay the bills, raise the kids, and still believe in common sense are done being treated like ATMs for a government that doesn’t even pretend to respect them.

And maybe—just maybe—after a little more pain, after a little more David Eby-style financial recklessness, the voters of this province will finally realize why fiscal responsibility matters. Not because it sounds good in a press release, but because without it, your future vanishes. Your freedom shrinks. And the people in charge? They just keep spending.

So next time, when the ballots are counted and the smoke clears, maybe British Columbia will finally remember who this province belongs to—not to bureaucrats, not to activists, not to the political class in Victoria—but to you.

And that day can’t come soon enough.

Business

California planning to double film tax credits amid industry decline

From The Center Square

By

California legislators have unveiled a bill to follow through with the governor’s plan of more than doubling the state’s film and TV production tax credits to $750 million.

The state’s own analysis warns it’s likely the refundable production credits generate only 20 to 50 cents of state revenue for every dollar the state spends, and the increase could stoke a “race to the bottom” among the 38 states that now have such programs.

Industry insiders say the state’s high production costs are to blame for much of the exodus, and experts say the cost of housing is responsible for a significant share of the higher costs.

The bill creates a special carve-out for shooting in Los Angeles, where productions would be able to claim refundable credits for 35% of the cost of production.

California Gov. Gavin Newsom announced his proposal last year and highlighted his goal of expanding the program at an industry event last week.

“California is the entertainment capital of the world – and we’re committed to ensuring we stay that way,” said Newsom. “Fashion and film go hand in hand, helping to express characters, capture eras in time and reflect cultural movements.”

With most states now offering production credits, economic analysis suggests these programs now produce state revenue well below the cost of the credits themselves.

“A recent study from the Los Angeles County Economic Development Corporation found that each $1 of Program 2.0 credit results in $1.07 in new state and local government revenue. This finding, however, is significantly overstated due to the study’s use of implausible assumptions,” wrote the state’s analysts in a 2023 report. “Most importantly, the study assumes that no productions receiving tax credits would have filmed here in the absence of the credit.”

“This is out of line with economic research discussed above which suggests tax credits influence location decisions of only a portion of recipients,” continued the state analysis. “Two studies that better reflect this research finding suggest that each $1 of film credit results in $0.20 to $0.50 of state revenues.”

“Parks and Recreation” stars Rob Lowe and Adam Scott recently shared on Lowe’s podcast how costs are so high their show likely would have been shot in Europe instead.

“It’s cheaper to bring 100 American people to Ireland than to walk across the lot at Fox past the sound stages and do it and do it there,” said Lowe.

“Do you think if we shot ‘Parks’ right now, we would be in Budapest?” asked Scott, who now stars in “Severance.”

“100%,” replied Lowe. “All those other places are offering 40% — forty percent — and then on top of that there’s other stuff that they do, and then that’s not even talking about the union stuff. That’s just tax economics of it all.”

“It’s criminal what California and LA have let happen. It’s criminal,” continued Lowe. “Everybody should be fired.”

According to the Public Policy Institute of California, housing is the single largest expense for California households.

“Across the income spectrum, 35–44% of household expenditures go to covering rent, mortgages, utilities and home maintenance,” wrote PPIC.

The cost of housing due to supply constraints now makes it nearly impossible for creatives to get their start in LA, said M. Nolan Gray, legislative director at housing regulatory reform organization California YIMBY.

“Hollywood depends on Los Angeles being the place where anybody can show up, take a big risk, and pursue their dreams, and that only works if you have a lot of affordable apartments,” said Gray to The Center Square. “We’ve built a Los Angeles where you have to be fabulously wealthy to have stable and decent housing, and as a result a lot of folks either are not coming, or those who are coming need to paid quite a bit higher to make it worth it, and it’s destroying one of California’s most important industries.”

“Anybody who arrived in Hollywood before the 2010s, their story is always, ‘Yeah, I showed up in LA, and I lived in a really, really dirt-cheap apartment with like $10 in my pocket.’ That just doesn’t exist anymore,” continued Gray. “Does the Walt Disney of 2025 not take the train from Kansas City to LA? Almost certainly not. If he goes anywhere, he goes to Atlanta.”

-

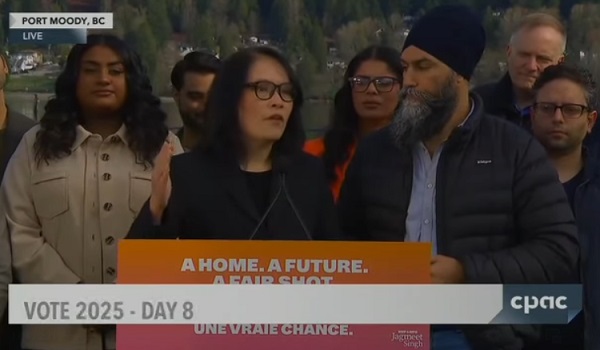

2025 Federal Election1 day ago

2025 Federal Election1 day agoMORE OF THE SAME: Mark Carney Admits He Will Not Repeal the Liberal’s Bill C-69 – The ‘No Pipelines’ Bill

-

2025 Federal Election23 hours ago

2025 Federal Election23 hours ago‘I’m Cautiously Optimistic’: Doug Ford Strongly Recommends Canada ‘Not To Retaliate’ Against Trump’s Tariffs

-

2025 Federal Election1 day ago

2025 Federal Election1 day ago‘Coordinated and Alarming’: Allegations of Chinese Voter Suppression in 2021 Race That Flipped Toronto Riding to Liberals and Paul Chiang

-

International2 days ago

International2 days agoTrump’s ‘Golden Dome’ defense shield must be built now, Lt. Gen. warns

-

Business23 hours ago

Business23 hours agoCanada may escape the worst as Trump declares America’s economic independence with Liberation Day tariffs

-

Business15 hours ago

Business15 hours agoCalifornia planning to double film tax credits amid industry decline

-

Alberta23 hours ago

Alberta23 hours agoBig win for Alberta and Canada: Statement from Premier Smith

-

Alberta1 day ago

Alberta1 day agoEnergy sector will fuel Alberta economy and Canada’s exports for many years to come