National

Thoughts on the emergence of Pierre Poilievre from political writer Paul Wells

Posted with permission from author Paul Wells

![]()

What Poilievre is up to

We’re in an odd world where most of the journalistic coverage of Pierre Poilievre is critical, but he might yet become Prime Minister. The week’s big Abacus poll suggests this may simply be because more and more people are done with Justin Trudeau. But we’re still missing a theory of Pierre Poilievre. Since Shannon Proudfoot’s profile of him for a prominent food magazine last year (note: Shannon didn’t write or like the headline), there’ve actually been fewer attempts to figure the guy out as he gets closer to an election.

Here’s one thing to chew on. In early 2022, two weeks after Poilievre announced his candidacy for the Conservative leadership, this essay appeared in The Hub, a good online journal of mostly conservative-leaning opinion. It was by Ben Woodfinden, “a doctoral candidate and political theorist at McGill University.” Woodfinden has since got hired as Poilievre’s communications director, which suggests that if there’s anyone who thought Woodfinden had Poilievre figured out, it’s Poilievre.

What did he write? Woodfinden’s essay noted that Poilievre had already been talking about “gatekeepers” who make the rules that stifle initiative and progress for ordinary people. He encouraged Poilievre to keep going. The “gatekeeper” talk could appeal to a few different corners of today’s conservative movement — small-government conservatives, populists and new Canadians who feel frustrated in their attempts to get ahead. Woodfinden writes:

“The elites in this message are essentially political elites whose actions hold back the so-called ‘little guy’—ordinary Canadians who just want to own a home and make a living. There is undoubtedly something of a populist moment in the Canadian right at the moment, and this is a particular framing that can resonate with the Tory base whilst not giving in to the darker and more sinister populist temptation.

And:

“Put all this together, and Poilievre may have the makings of a perfect storm message. It scratches the itch of different parts of the conservative coalition, and it has the potential makings of a winning electoral coalition that could propel the Poilievre-led Conservatives to government. Whilst appealing to both small government and populist types in the conservative movement, it also potentially offers a populist message that appeals to people who feel left behind or screwed over in Canada today, with ire aimed at a clique of gatekeepers who frustrate the goals and aspirations of ordinary Canadians.”

I’ll let you read the rest if you like. Woodfinden’s essay is here. Not having written it I offer no warranty for it. But I’ve always found it worthwhile to consider what politicians think they’re doing, rather than just what their worst critics think they’re doing. Maybe this piece will be illuminating.

Paul Wells is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Paul Wells

Politics and culture as though they mattered.

2025 Federal Election

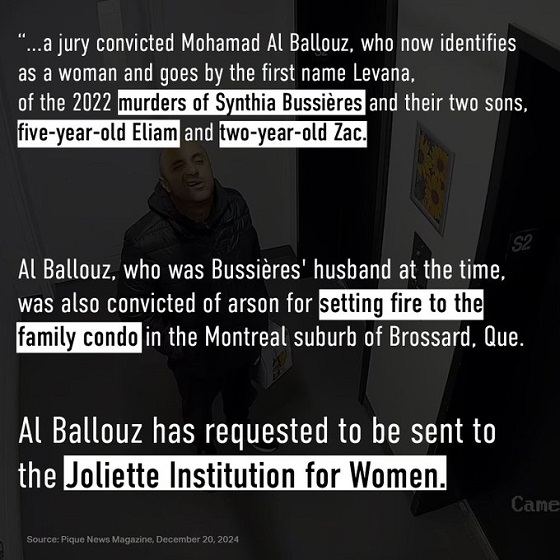

‘Sadistic’ Canadian murderer claiming to be woman denied transfer to female prison

From LifeSiteNews

The logical decision to house the male murderer with men flies in the face of the Liberal Party’s official stance, which is to incarcerate prisoners according to their ‘self-identified’ gender.

A Canadian man who butchered his family and now claims to be a woman will not be allowed to transfer to a female prison.

On April 8, Correctional Services Canada (CSC) announced that Mohamad Al Ballouz, who brutally murdered his wife and two children, will be sent to a men’s prison, despite claiming to be a woman, according to CTV News.

“When there are overriding health and safety concerns, the request is denied and alternatives are put in place to meet the offender’s gender‑related needs at the institution where they are incarcerated,” the CSC statement reads.

Following an assessment of Al Ballouz request, CSC confirmed that he “will be incarcerated in a men’s institution.”

On December 16, Al Ballouz, a 38-year-old from Quebec, was found guilty second-degree murder of his wife Synthia Bussières, first-degree murder of five-year-old Eliam and two-year-old Zac, and one count of attempted arson.

Crown prosecutor Éric Nadeau revealed that the murder took place in September 2022 when Al Ballouz slaughtered his family at their Brossard apartment. He stabbed his wife 23 times before suffocated his children and trying to set the apartment on fire. He then ingested windshield washer fluid, which is believed to have been a suicide attempt.

During the trial, Quebec Superior Justice Eric Downs described Al Ballouz, as having a “sadistic character” and being “deeply narcissistic.” He was sentenced to life imprisonment with no chance of parole for 25 years.

Throughout the trial, Al Ballouz, a biological male, claimed to be a woman and demanded that he be referred to as “Levana,” a change which was made after he was charged for his crimes. Notably, the Canadian Broadcasting Report’s (CBC’s) report of the case refers to the convicted murder as “she” and uses his fake name.

Following his sentencing, the murderer requested to be sent to the Joliette Institution for Women; however, Downs responded that is a decision for Correctional Service Canada.

Currently under the Liberal Party, the policy is to place prisoners according to their “self-identified” gender, not according to biology. As a result, male rapists and murderers can be sent to prison with females.

However, Al Ballouz’s case caused an uproar on social media as many pointed out that putting the murderer in a women’s prison would pose a danger to female inmates.

Conservative Party leader Pierre Poilievre has condemned the Liberal policy and promised that he would end this practice if elected.

“Surreal: A man who killed his wife and two kids now claims he is a woman to go to a female prison,” he wrote in a December 22 post on X.

“I can’t believe I have to say this: but when I’m PM, there will be no male prisoners in female jails,” Poilievre continued. “Period.”

2025 Federal Election

What Trump Says About Modern U.S. And What Carney Is Hiding About Canada

“Reporters once asked legendary boxer Rocky Graziano why he hugged his opponent after the guy had pounded him senseless for 15 rounds. “He stopped punching me, didn’t he?” That sums up the reaction of Boomer voters hugging Mark Carney after ten years of having Liberals pound them. They can rationalize any amount of suffering.”

The two looming figures in the current “hurry up before they find out who Mark Carney is” election are Carney, the transnational banker/ climate zealot/ not-Trudeau Liberal, and Donald Trump. Yes, Pierre Poilievre is running against Carney, but Carney and the Gerry Butts braintrust are running against the U.S. president.

And not just POTUS 45/47. They’re running against the SNL cartoon figure embraced by Canada’s mainstream media outlets. Depending on the day the Toronto Star/ CBC/ Ottawa Citizen iteration of Trump is “stupid”, “racist”, “sex fiend” and, for this campaign, the boogeyman who will swallow Canada whole. While these scribblers and talking heads themselves are going broke, they imagine Trump as an economic moron collapsing the western economy.

All the clever Conservative ads, all the Carney flubs, all the revelations of election rigging by Chinese operatives— none of it matters to Canada’s Boomers huddled against the blustering winds of Trump. They call it Team Canada but it might just as well be Team Surrender to people who are willing to keep the Liberals’ Gong Show going for another four years.

As they say, you’re welcome to your own opinion, you’re just not welcome to your own facts. And the facts are that Trump and Carney are representative of their separate nations in 2025. Before we address the parachute PM Carney let us suggest that CDNs weaned on Stephen Colbert and John Oliver have little idea why Trump is the most impactful American politician of the century so far.

But don’t take our word for it. Here’s Democratic comedian Dave Chappelle explaining why so many remain loyal to the former Democrat and reality TV star in the face of impeachments, criminal charges and yes, bullets. Chappelle, who lives outside the Hollywood bubble in Ohio, said, “I’m not joking right now, he’s an honest liar. That first (2016) debate, I’ve never seen anything like it. I’ve never seen a white male billionaire screaming at the top of his lungs, ‘This whole system is rigged.’

“And the moderator said, ‘Well Mr. Trump if, in fact, the system is rigged as you suggest, what would be your evidence?’ He said, ‘I know the system is rigged because I use it.’ I said ‘Goddamn’.

“No one ever heard someone say something so true. And then Hillary Clinton tried to punch him on the taxes. She said, ‘This man doesn’t pay his taxes,’ he said, ‘That makes me smart.’ And then he said, ‘If you want me to pay my taxes, then change the tax code. But I know you won’t, because your friends and your donors enjoy the same tax breaks that I do.’…

“No one had ever seen anything like that. No one had ever seen somebody come from inside of that house outside and tell all the commoners we are doing everything that you think we are doing inside of that house. And a legend was born.”

In short, Trump is what we want politicians to be. Aspirational, yes. But willing to act. We can take it. Yes, his truth is wrapped in multiple layers of balderdash and folderol. There is a preening ego. Self serving. Vainglorious. Opportunistic. Bombastic.

But he recognized that no one— GOP included— wanted anything to do with closing borders, ending foreign wars, levelling the trade barriers. So while Canadians whined, he took them on, and for that he’s been given two terms in the White House. You can understand why people wanted him dead last summer. He’s bad for the business he exposed in that debate with Hillary.

So Canadian liberals might sneer and condescend, but Trump’s answering to a legitimate voice in an America that was deceived and abused during Covid. And had a senile man as POTUS being manipulated by unseen characters behind the scenes.

Which begs the question: What in the Canadian character is Mark Carney answering to as he is dropped into the seat formally occupied by Justin Trudeau? The most obvious answer is Trump’s 51st state musings as he seeks to re-order the world’s tariff system. But what about repudiating everything he and his party stood for the past decade? How does that fit into the Carney identity?

While Trump has a resounding mandate to pursue the issues he campaigned on, Carney has a manipulated Liberal leadership contest, no seat and Mike Myers. Plus a media that owes its living to his party’s bribing them.

It would be hard to imagine more own goals than Carney’s record since the Liberals rigged his nomination. The China denials, the offshore tax evasions, the three passports, the renunciation of his entire work history, the re-hiring the worst of Trudeau’s cabinet, the bad body language… yet every gaffe increases his numbers in the purchased polls and the bought media. It will be an amazing story when it’s written.

But it’s not being written that way now. Because Donald Trump has activated Canada’s passion for authority and the expert class. While the rest of the world has awakened to the government’s deliberate manipulation of fear and white-coat reverence during Covid, Canada’s Boomers are still in awe of people like Carney. They still think the vaccines work. That The Science was behind it all.

So prepare for another 15 rounds of being slugged in the head by people who don’t have your goals in mind. Don’t say you we weren’t warned.

Bruce Dowbiggin @dowbboy is the editor of Not The Public Broadcaster A two-time winner of the Gemini Award as Canada’s top television sports broadcaster. His new book Deal With It: The Trades That Stunned The NHL And Changed Hockey is now available on Amazon. Inexact Science: The Six Most Compelling Draft Years In NHL History, his previous book with his son Evan, was voted the seventh-best professional hockey book of all time by bookauthority.org. You can see all his books at brucedowbigginbooks.ca.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoRCMP memo warns of Chinese interference on Canadian university campuses to affect election

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoResearchers Link China’s Intelligence and Elite Influence Arms to B.C. Government, Liberal Party, and Trudeau-Appointed Senator

-

Business2 days ago

Business2 days agoTrump raises China tariffs to 125%, announces 90-day pause for countries who’ve reached out to negotiate

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoThe status quo in Canadian politics isn’t sustainable for national unity

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoPoilievre Announces Plan To Cut Taxes By $100,000 Per Home

-

Business2 days ago

Business2 days agoScott Bessent Says Trump’s Goal Was Always To Get Trading Partners To Table After Major Pause Announcement

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoTwo Canadian police unions endorse Pierre Poilievre for PM

-

2025 Federal Election22 hours ago

2025 Federal Election22 hours agoCarney needs to cancel gun ban and buyback