David Clinton

The Hidden and Tragic Costs of Housing and Immigration Policies

We’ve discussed the housing crisis before. That would include the destabilizing combination of housing availability – in particular a weak supply of new construction – and the immigration-driven population growth.

Parsing all the data can be fun, but we shouldn’t forget the human costs of the crisis. There’s the significant financial strain caused by rising ownership and rental costs, the stress so many experience when desperately searching for somewhere decent to live, and the pressure on businesses struggling to pay workers enough to survive in madly expensive cities.

If Canada doesn’t have the resources to house Canadians, should there be fewer of us?

Well we’ve also discussed the real problems caused by low fertility rates. As they’ve already discovered in low-immigration countries like Japan and South Korea, there’s the issue of who will care for the growing numbers of childless elderly. And who – as working-age populations sharply decline – will sign up for the jobs that are necessary to keep things running.

How much are the insights you discover in The Audit worth to you?

Consider becoming a paid subscriber.

The odds are that we’re only a decade or so behind Japan. Remember how a population’s replacement-level fertility rate is around 2.1 percent? Here’s how Canadian “fertility rates per female” have dropped since 1991:

Put differently, Canada’s crude birth rate per 1,000 population dropped from 14.4 in 1991, to 8.8 in 2023.

As a nation, we face very difficult constraints.

But there’s another cost to our problems that’s both powerful and personal, and it exists at a place that overlaps both crises. A recent analysis by the Parliamentary Budget Officer (PBO) frames it in terms of suppressed household formation.

Household formation happens when two more more people choose to share a home. As I’ve written previously, there are enormous economic benefits to such arrangements, and the more permanent and stable the better. There’s also plenty of evidence that children raised within stable families have statistically improved economic, educational, and social outcomes.

But if households can’t form, there won’t be a lot of children.

In fact, the PBO projects that population and housing availability numbers point to the suppression of nearly a half a million households in 2030. And that’s incorporating the government’s optimistic assumptions about their new Immigration Levels Plan (ILP) to reduce targets for both permanent and temporary residents. It also assumes that all 2.8 million non-permanent residents will leave the country when their visas expire. Things will be much worse if either of those assumptions doesn’t work out according to plan.

Think about a half a million suppressed households. That number represents the dreams and life’s goals of at least a million people. Hundreds of thousands of 30-somethings still living in their parents basements. Hundreds of thousands of stable, successful, and socially integrated families that will never exist.

And all that will be largely (although not exclusively) the result of dumb-as-dirt political decisions.

Who says policy doesn’t matter?

How much are the insights you discover in The Audit worth to you?

Consider becoming a paid subscriber.

For the full experience, upgrade your subscription.

David Clinton

You’re Actually Voting for THEM? But why?

By David Clinton

By David Clinton

Putting the “dialog” back in dialog

I hate it when public figures suggest that serious issues require a “dialog” or a “conversation”. That’s because real dialog and real conversation involve bi-directional communication, which is something very few public figures seem ready to undertake. Still, it would be nice is there was some practical mechanism through which a conversation could happen.

It should be obvious – and I’m sure you’ll agree – that no intelligent individual will be voting in the coming federal election for any party besides the one I’ve chosen. And yet I’ve got a nagging sense that, inexplicably, many of you have other plans. Which, since only intelligent people read The Audit, leads me directly to an epistemological conflict.

I have my doubts about the prospects for meaningful leadership debates. Even if such events are being planned, they’ll probably produce more shouting and slogans than a useful comparison of policy positions.

And I have remarkably little patience for opinion polls. Even if they turn out to have been accurate, they tell us absolutely nothing about what Canadians actually want. Poll numbers may be valuable to party campaign planners, but there’s very little there for me.

If I can’t even visualize the thinking taking place in other camps, I’m missing a big part of Canada’s biggest story. And I really don’t like being left out.

So I decided to ask you for your thoughts. I’d love for each of you to take a super-simple, one question survey. I’m not really interested in how you’re planning to vote, but why. I’m asked for open-ended explanations that justify your choice. Will your vote be a protest against something you don’t like or an expression of your confidence in one particular party? Is it just one issue that’s pushing you to the polling station or a whole set?

I’d do this as a Substack survey, but the Substack platform associates way too much of your private information with the results. I really, really want this one to be truly anonymous.

And when I say this is a “super simple” survey, I mean it. To make sure that absolutely no personal data accompanies your answers (and to save me having to work harder), the survey page is a charming throwback to PHP code in all its 1996 glory.

So please do take the survey: theaudit.ca/voting.

If there are enough responses, I plan to share my analysis of patterns and trends through The Audit.

Business

We’re paying the bills, why shouldn’t we have a say?

By David Clinton

By David Clinton

Shaping Government Spending Choices to Reflect Taxpayer Preferences

Technically, the word “democracy” means “rule of the people”. But we all know that the ability to throw the bums out every few years is a poor substitute for “rule”. And as I’ve already demonstrated, the last set of bums you sent to Ottawa are 19 times more likely than not to simply vote along party lines. So who they are as individuals barely even matters.

This story isn’t new, and it hasn’t even got a decent villain. But it is about a universal weakness inherent in all modern, nation-scale democracies. After all, complex societies governed by hundreds of thousands of public servants who are responsible for spending trillions of dollars can’t realistically account for millions of individual voices. How could you even meaningfully process so many opinions?

Hang on. It’s 2025. These days, meaningfully processing lots of data is what we do. And the challenge of reliably collecting and administrating those opinions is trivial. I’m not suggesting we descend into some hellish form of governance by opinion poll. But I do wonder why we haven’t tried something that’s far more focused, measured, and verifiable: directed revenue spending.

Self-directed income tax payments? Crazy, no? Except that we’ve been doing it in Ontario for at least 60 years. We (sometimes) get to choose which of five school boards – English public, French public, English separate (Catholic), French separate (Catholic), or Protestant separate (Penetanguishene only) – will receive the education portion of our property tax.

Here’s how it could work. A set amount – perhaps 20 percent of the total federal tax you owe – would be considered discretionary. The T1 tax form could include the names of, say, ten spending programs next to numeric boxes. You would enter the percentage of the total discretionary portion of your income tax that you’d like directed to each program with the total of all ten boxes adding up to 100.

The specific programs made available might change from one year to the next. Some might appear only once every few years. That way, the departments responsible for executing the programs wouldn’t have to deal with unpredictable funding. But what’s more important, governments would have ongoing insights into what their constituents actually wanted them to be doing. If they disagreed, a government could up their game and do a better job explaining their preferences. Or it could just give up and follow the will of their taxpayers.

Since there would only be a limited number of pre-set options available, you wouldn’t have to worry about crackpot suggestions (“Nuke Amurika!”) or even reasoned and well-meaning protest campaigns (“Nuke Ottawa!”) taking over. And since everyone who files a tax form has to participate, you won’t have to worry about a small number of squeaky wheels dominating the public discourse.

Why would any governing party go along with such a plan? Well, they almost certainly won’t if that’s any comfort. Nevertheless, in theory at least, they could gain significant political legitimacy were their program preferences to receive overwhelming public support. And if politicians and civil servants truly believed they toil in the service of the people of Canada, they should be curious about what the people of Canada actually want.

What could go wrong?

Well the complexity involved with adding a new layer of constraints to spending planning can’t be lightly dismissed. And there’s always the risk that activists could learn to game the system by shaping mass movements through manipulative online messaging. The fact that wealthy taxpayers will have a disproportionate impact on spending also shouldn’t be ignored. Although, having said that, I’m not convinced that the voices of high-end taxpayers are less valuable than those of the paid lobbyists and PMO influencers who currently get all the attention.

Those are serious considerations. I’m decidedly less concerned about some other possible objections:

- The risk that taxpayers might demonstrate a preference for short term fixes or glamour projects over important long term wonkish needs (like debt servicing) rings hollow. Couldn’t those words just as easily describe the way many government departments already behave?

- Couldn’t taxpayer choices be influenced by dangerous misinformation campaigns? Allowing for the fact the words “misinformation campaign” make me nervous, that’s certainly possible. But I’m aware of no research demonstrating that, as a class, politicians and civil servants are somehow less susceptible to such influences.

- Won’t such a program allow governments to deflect responsibility for their actions? Hah! I spit in your face in rueful disdain! When was the last time any government official actually took responsibility (or even lost a job) over stupid decisions?

- Won’t restricting access to a large segment of funds make it harder to respond to time-sensitive emergencies? There are already plenty of political and policy-based constraints on emergency spending choices. There’s no reason this program couldn’t be structured intelligently enough to prevent appropriate responses to a genuine emergency.

This idea has no more chance of being applied as some of the crazy zero-tax ideas from my previous post. But things certainly aren’t perfect right now, and throwing some fresh ideas into the mix can’t hurt.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoFixing Canada’s immigration system should be next government’s top priority

-

2025 Federal Election2 days ago

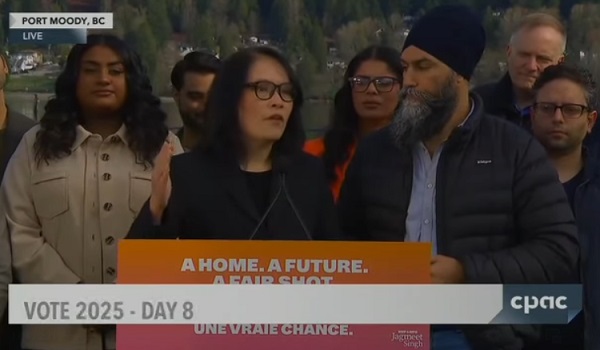

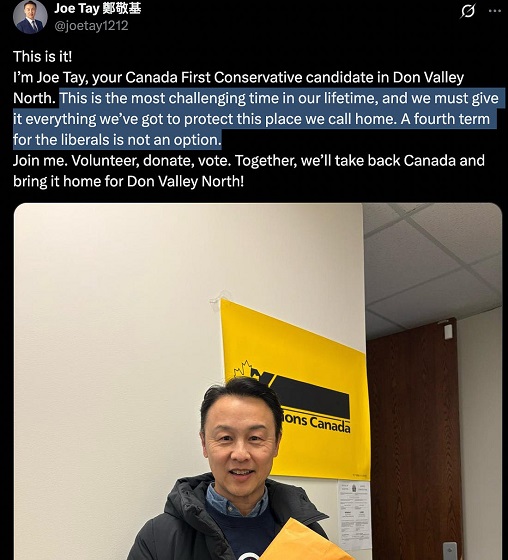

2025 Federal Election2 days agoChina Election Interference – Parties Received Security Briefing Days Ago as SITE Monitors Threats to Conservative Candidate Joe Tay

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoLondon-Based Human Rights Group Urges RCMP to Investigate Liberal MP for Possible Counselling of Kidnapping

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoJoe Tay Says He Contacted RCMP for Protection, Demands Carney Fire MP Over “Bounty” Remark

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoHong Kong-Canadian Groups Demand PM Carney Drop Liberal Candidate Over “Bounty” Remark Supporting CCP Repression

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoBeijing’s Echo Chamber in Parliament: Part 2 – Still No Action from Carney

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoRCMP Confirms It Is ‘Looking Into’ Alleged Foreign Threat Following Liberal Candidate Paul Chiang Comments

-

2025 Federal Election18 hours ago

2025 Federal Election18 hours agoPM Carney’s Candidate Paul Chiang Steps Down After RCMP Confirms Probe Into “Bounty” Comments