COVID-19

The Federal COVID-19 Economic Response Plan

2025 Federal Election

Conservatives promise to ban firing of Canadian federal workers based on COVID jab status

From LifeSiteNews

The Conservative platform also vows that the party will oppose mandatory digital ID systems and a central bank digital currency if elected.

Pierre Poilievre’s Conservative Party’s 2025 election platform includes a promise to “ban” the firing of any federal worker based “solely” on whether or not they chose to get the COVID shots.

On page 23 of the “Canada First – For A Change” plan, which was released on Tuesday, the promise to protect un-jabbed federal workers is mentioned under “Protect Personal Autonomy, Privacy, and Data Security.”

It promises that a Conservative government will “Ban the dismissal of federal workers based solely on COVID vaccine status.”

The Conservative Party also promises to “Oppose any move toward mandatory digital ID systems” as well as “Prohibit the Bank of Canada from developing or implementing a central bank digital currency.”

In October 2021, the Liberal government of former Prime Minister Justin Trudeau announced unprecedented COVID-19 jab mandates for all federal workers and those in the transportation sector. The government also announced that the unjabbed would no longer be able to travel by air, boat, or train, both domestically and internationally.

This policy resulted in thousands losing their jobs or being placed on leave for non-compliance. It also trapped “unvaccinated” Canadians in the country.

COVID jab mandates, which also came from provincial governments with the support of the federal government, split Canadian society. The shots have been linked to a multitude of negative and often severe side effects, such as death, including in children.

Many recent rulings have gone in favor of those who chose not to get the shots and were fired as a result, such as an arbitrator ruling that one of the nation’s leading hospitals in Ontario must compensate 82 healthcare workers terminated after refusing to get the jabs.

Beyond health concerns, many Canadians, especially Catholics, opposed the injections on moral grounds because of their link to fetal cell lines derived from the tissue of aborted babies.

COVID-19

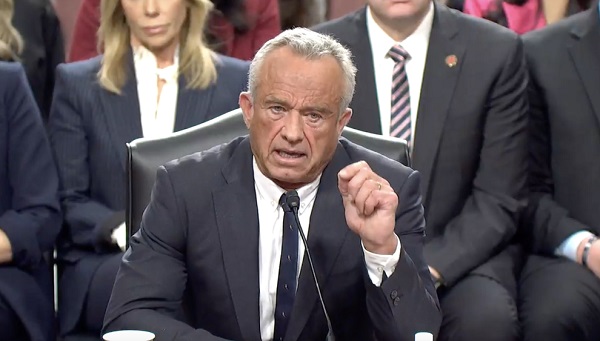

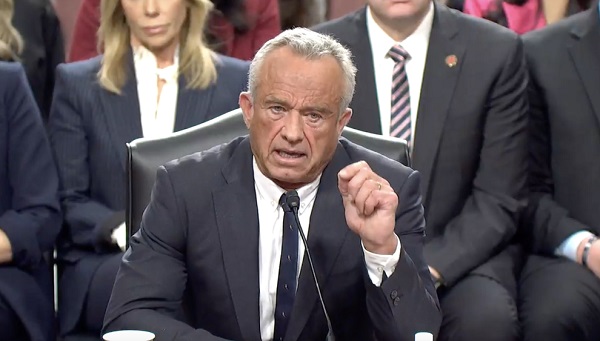

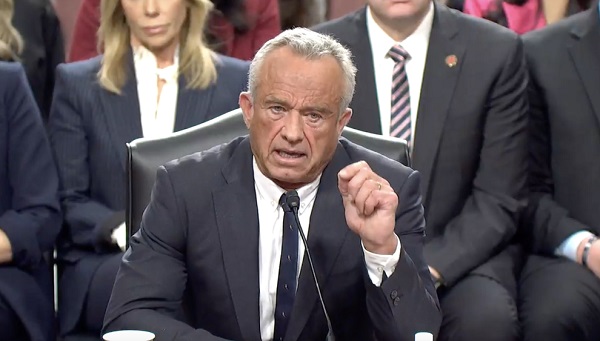

RFK Jr. Launches Long-Awaited Offensive Against COVID-19 mRNA Shots

Nicolas Hulscher, MPH

Nicolas Hulscher, MPH

As millions of Americans anxiously await action from the new HHS leadership against the COVID-19 mRNA injections—injected into over 9 million children this year—Robert F. Kennedy Jr. has finally gone publicly on the offensive:

Let’s go over each key point made by RFK Jr.:

The recommendation for children was always dubious. It was dubious because kids had almost no risk for COVID-19. Certain kids that had very profound morbidities may have a slight risk. Most kids don’t.

In the largest review to date on myocarditis following SARS-CoV-2 infection vs. COVID-19 vaccination, Mead et al found that vaccine-induced myocarditis is not only significantly more common but also more severe—particularly in children and young males. Our findings make clear that the risks of the shots overwhelmingly outweigh any theoretical benefit:

The OpenSAFELY study included more than 1 million adolescents and children and found that myocarditis was documented ONLY in COVID-19 vaccinated groups and NOT after COVID-19 infection. There were NO COVID-19-related deaths in any group. A&E attendance and unplanned hospitalization were higher after first vaccination compared to unvaccinated groups:

So why are we giving this to tens of millions of kids when the vaccine itself does have profound risk? We’ve seen huge associations of myocarditis and pericarditis with strokes, with other injuries, with neurological injuries.

The two largest COVID-19 vaccine safety studies ever conducted, involving 99 million (Faksova et al) and 85 million people (Raheleh et al), confirm RFK Jr.’s concerns, documenting significantly increased risks of serious adverse events following vaccination, including:

- Myocarditis (+510% after second dose)

- Acute Disseminated Encephalomyelitis (+278% after first dose)

- Cerebral Venous Sinus Thrombosis (+223% after first dose)

- Guillain-Barré Syndrome (+149% after first dose)

- Heart Attack (+286% after second dose)

- Stroke (+240% after first dose)

- Coronary Artery Disease (+244% after second dose)

- Cardiac Arrhythmia (+199% after first dose)

And this was clear even in the clinical data that came out of Pfizer. There were actually more deaths. There were about 23% more deaths in the vaccine group than the placebo group. We need to ask questions and we need to consult with parents.

Actually, according to the Pfizer’s clinical trial data, there were 43% more deaths in the vaccine group compared to the placebo group when post-unblinding deaths are included:

We need to give people informed consent, and we shouldn’t be making recommendations that are not good for the population.

Public acknowledgment of the grave harms of COVID-19 vaccines signals that real action is right around the corner. However, we must hope that action is taken for ALL age groups, as no one is spared from their life-reducing effects:

Alessandria et al (n=290,727, age > 10 years): People vaccinated with 2 doses lost 37% of life expectancy compared to the unvaccinated population during follow-up.

Epidemiologist and Foundation Administrator, McCullough Foundation

Please consider following both the McCullough Foundation and my personal account on X (formerly Twitter) for further content.

-

2025 Federal Election2 days ago

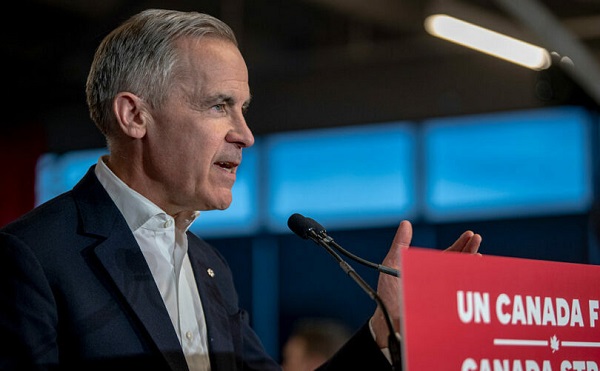

2025 Federal Election2 days agoMark Carney Wants You to Forget He Clearly Opposes the Development and Export of Canada’s Natural Resources

-

International1 day ago

International1 day agoPope Francis’ body on display at the Vatican until Friday

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCanada’s pipeline builders ready to get to work

-

Business2 days ago

Business2 days agoHudson’s Bay Bid Raises Red Flags Over Foreign Influence

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoFormer WEF insider accuses Mark Carney of using fear tactics to usher globalism into Canada

-

2025 Federal Election10 hours ago

2025 Federal Election10 hours agoCarney’s Hidden Climate Finance Agenda

-

COVID-191 day ago

COVID-191 day agoRFK Jr. Launches Long-Awaited Offensive Against COVID-19 mRNA Shots

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCanada’s press tries to turn the gender debate into a non-issue, pretend it’s not happening