Opinion

The American Experiment Has Gone Down In Flames

From the Daily Caller News Foundation

From the Daily Caller News Foundation

What are we to do about it?

In the late eighteenth century, a group of unusually enlightened men gathered to plot rebellion against the most powerful military power of the day. Their grievances were many, set down in the Declaration of Independence. This storied document was many things, but above all it was a cry of rebellion against tyranny: against the arbitrary, capricious and unwelcome rule of the English over the colonies. It was a cry for liberty.

Against all odds, their rebellion succeeded and, a few years later, they met once again to devise a form of government that would be strong enough to see to those things that only government can do, such as military defense and the enablement of trade between the states. They were, however, leery of the dangers of tyranny, and so they crafted a unique form of government: a federal republic, with power dispersed among the several states, and numerous checks and balances to prevent abuse.

It was a noble experiment, and it served us well for centuries, but it is essential that we understand that this experiment has now failed in its primary purpose: to secure our liberties and to forestall tyrannical rule.

The evidence of this failure is indisputable to anyone with eyes to see. Unelected bureaucrats can impose their will on the citizenry in a way that so far exceeds the arbitrary and capricious rule of the English as to stagger the imagination.

They are imposing upon us regulations to all but outlaw vehicles powered by fossil fuels. They have decreed that a woman can become a man, and a man can become a woman, with utter disregard for biological reality.

They have colluded with the internet oligarchs to censor dissent and to silence their political opponents. They are using the mechanisms of law enforcement to protect their friends and to persecute their enemies.

The intelligence services are spying on Americans, and the FBI looks more and more like the secret police with every passing day. I am afraid of my government; I fear the knock on the door in the middle of the night. The grievances listed in the Declaration of Independence look trifling by comparison.

If the Democrats get their way, it will get even worse. They have made it clear that they intend to undo the system of checks and balances that have kept tyrants at bay for centuries. They will eliminate the Senate filibuster.

They will pack the Supreme Court and turn it into something like the Soviet Politburo, an organ of political power unaccountable to the people with absolute authority over every aspect of life. They will continue to push for non-citizen voting rights, allowing millions of illegal immigrants to vote in key local and state elections.

And, perhaps worst of all, power will be further centralized in Washington under the Democrats, who will willingly crackdown on local and state governments that don’t adopt their left-wing vision. In short, a form of absolute tyranny will be established.

Our constitution was designed to prevent this from happening. It is time for us to recognize that our experiment in self-rule has failed, and that we must do something about it before it is too late.

How did we get here? It all starts with federal money. Money is, and always has been, a profoundly corrupting influence in government. This has been true throughout history, going back to the Romans and even before.

Money is power. Money is control. Money gives you the ability to reward your friends and punish your enemies. Federal money has become a lever used by the bureaucrats to impose their will on state and local government, emasculating the federal system.

The Biden administration is giving away trillions of dollars in public funds to support its allies and to buy votes with the money they’ve taken from us. But no matter how many trillions of dollars they fritter away, it’s never enough, and they are on the verge of spending the country into bankruptcy. The system they have constructed will inevitably collapse, and take us down with it.

What then shall we do? How can we reclaim our lost freedom and save ourselves from the coming tyranny?

To do this, we need to be as bold as our opposition. They have stated that the American system is to be burned to the ground and replaced with something new. I agree, in part. Yes, burn it to the ground — but replace it instead with something old: the Federal Republic the founders intended us to have. This will require a massive — and I mean massive — reduction in the size and the scope of the government, and a return to its stated purpose, as eloquently laid out in the Preamble to the Constitution of the United States:

“We the People of the United States, in Order to form a more perfect Union, establish Justice, insure domestic Tranquility, provide for the common defence, promote the general Welfare, and secure the Blessings of Liberty to ourselves and our Posterity, do ordain and establish this Constitution for the United States of America.”

This, and no more.

Craig W. Stanfill (@craigwstanfill) is a computer scientist, software entrepreneur, and the author of the AI Dystopia science fiction series.

The views and opinions expressed in this commentary are those of the author and do not reflect the official position of the Daily Caller News Foundation.

International

LOCKED AND LOADED: Trump threatens U.S. response if Iran slaughters protesters

President Trump warned Friday that the United States stands ready to act if Iran’s regime escalates its crackdown on protesters, saying America would “come to their rescue” should peaceful demonstrators be violently killed as unrest spreads across the country. Writing on Truth Social, Trump said, “If Iran shoots and violently kills peaceful protesters, which is their custom, the United States of America will come to their rescue,” adding bluntly, “We are locked and loaded and ready to go.” His comments came as clashes between protesters and security forces erupted in multiple Iranian cities, leaving at least six people dead — the first confirmed fatalities since the latest wave of unrest intensified.

The demonstrations began as economic protests, driven by soaring prices, inflation, and a collapsing currency after years of sanctions tied to Iran’s nuclear program, but have quickly taken on a political edge. Shopkeepers in Tehran reportedly shut their doors in protest over economic stagnation, with similar actions and street demonstrations spreading into at least 15 cities, largely concentrated in western Iran. Iranian state media acknowledged deadly clashes in Lordegan and Azna, while state television reported that a member of Iran’s security forces was killed during unrest in Kouhdasht.

Tehran’s leadership responded sharply to Trump’s warning. Ali Larijani, head of Iran’s top security body, reportedly cautioned that U.S. involvement would “destabilize the entire region” and urged Trump to be “mindful of their soldiers’ safety.” Ali Shamkhani, an adviser to Supreme Leader Ali Khamenei, called Iran’s internal security a “red line,” warning that any American intervention would be met with a response. Even as Iranian officials attempt to strike a public tone of concern, the threat of force is unmistakable. President Masoud Pezeshkian described the protests over economic hardship as understandable and said Thursday that his government would “end up in hell” if it failed to fix the economy. At the same time, prosecutors and judiciary officials vowed zero tolerance. Lorestan prosecutor Ali Hasavand warned that participation in “illegal gatherings” or actions disturbing public order would be treated as crimes and punished “with the greatest firmness,” accusing “hostile individuals” of sowing chaos.

The unrest comes as Iran’s regional position appears weakened following setbacks to its allies in Gaza, Lebanon, and Syria, adding to pressure on the regime at home. While the current demonstrations remain smaller than the massive 2022 protests sparked by the death of Mahsa Amini — which left hundreds dead — the echoes are unmistakable. Similar nationwide unrest in 2019 over fuel prices eventually evolved into open calls to overthrow Iran’s clerical rulers. Trump’s message, characteristically direct, places Tehran on notice: if the regime chooses mass bloodshed again, he says the United States will not look away.

International

Maduro says he’s “ready” to talk

Venezuelan strongman Nicolás Maduro is striking a suddenly conciliatory tone toward Washington after a reported CIA drone strike targeted a cartel-linked docking area inside his country, claiming Caracas is now “ready” to negotiate with the United States on drug trafficking — and even dangling access to Venezuela’s oil sector as leverage.

In a sit-down interview recorded on New Year’s Eve with Spanish journalist Ignacio Ramonet and aired Thursday on state television, Maduro said the U.S. government has long known Venezuela is open to talks, insisting that if Washington wants a note-for-note agreement to combat narcotics flows, “we’re ready.”

He went further, suggesting that American energy firms could return in force, saying Venezuela is open to U.S. oil investment “whenever they want it, wherever they want it and however they want it,” explicitly referencing past dealings with Chevron.

Venezuelan President Maduro:

If the United States wants to seriously talk about an agreement to combat drug trafficking, we are ready. pic.twitter.com/3cWMyDxuC8

— Open Source Intel (@Osint613) January 2, 2026

The remarks come amid an aggressive U.S. pressure campaign that has seen at least 35 American strikes on suspected drug-smuggling vessels across the Caribbean and eastern Pacific since early September, operations U.S. officials say have killed more than 115 suspected traffickers.

Those actions are widely viewed as part of a broader effort to choke off cartel pipelines tied to the Maduro regime and destabilize a government Washington has long accused of functioning as a narco-state.

Last week’s strike — the first publicly acknowledged U.S. operation on Venezuelan soil since the maritime campaign began — was revealed by President Trump himself in a Dec. 26 radio interview, marking a sharp escalation.

Maduro refused to address the strike directly during the interview, saying only that he could “talk about it in a few days,” a silence that stood in contrast to his sudden eagerness to negotiate.

U.S. officials have been far less ambiguous. Secretary of State Marco Rubio said in December that the current relationship with Caracas is “intolerable,” accusing the regime of actively partnering with terrorist organizations and criminal networks that threaten U.S. national interests.

Maduro, who is under U.S. indictment on charges including drug trafficking, money laundering, and corruption, is now signaling flexibility just as American pressure tightens — a familiar pattern for a regime that has often talked cooperation when cornered, only to revert once the heat eases.

Whether Washington sees this latest outreach as a genuine shift or another tactical feint remains an open question, but the timing suggests the message was less about diplomacy than survival.

-

International2 days ago

International2 days agoTrump confirms first American land strike against Venezuelan narco networks

-

Business2 days ago

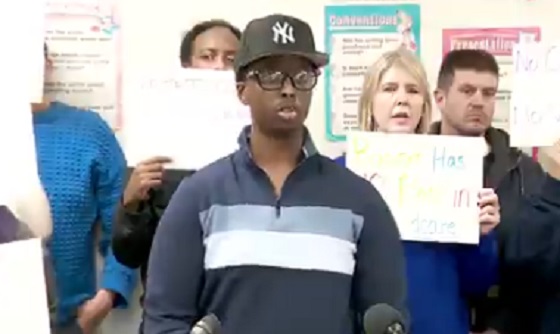

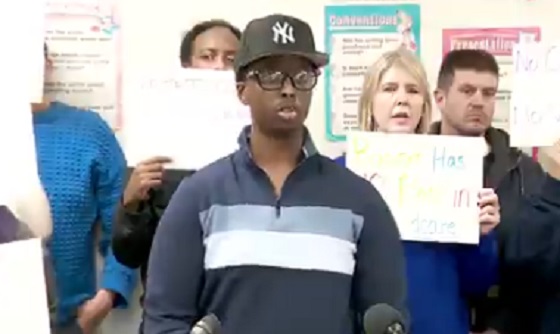

Business2 days agoHow convenient: Minnesota day care reports break-in, records gone

-

International20 hours ago

International20 hours agoMaduro says he’s “ready” to talk

-

Business2 days ago

Business2 days agoThe great policy challenge for governments in Canada in 2026

-

Bruce Dowbiggin21 hours ago

Bruce Dowbiggin21 hours agoThe Rise Of The System Engineer: Has Canada Got A Prayer in 2026?

-

International20 hours ago

International20 hours agoLOCKED AND LOADED: Trump threatens U.S. response if Iran slaughters protesters