Business

Taxpayers on the hook for millions in renovations at Trudeau’s mansions

“While there were multimillion-dollar renos being done to Trudeau’s mansion, housing prices have doubled for most ordinary working Canadians”

Taxpayers have been hit with a hefty, multimillion-dollar price tag to renovate Prime Minister Justin Trudeau’s mansion on the grounds of Rideau Hall in recent years.

Renovations at Rideau Cottage, the mansion where Trudeau has lived since being elected in 2015, cost taxpayers more than $5 million between 2016-17 and 2023-24, according to access-to-information records obtained by the Canadian Taxpayers Federation.

“While there were multimillion-dollar renos being done to Trudeau’s mansion, housing prices have doubled for most ordinary working Canadians,” said Kris Sims, CTF Alberta Director. “Trudeau needs to explain why this cost taxpayers so much.”

Last year, renovations at Rideau Cottage cost taxpayers $1.3 million.

That’s enough money to cover the annual grocery bills of 81 Canadian families, according to Canada’s Food Price Report.

Taxpayers have been on the hook for an average of $630,000 in annual renovation costs at Rideau Cottage since Trudeau moved into the two-storey, 22-room mansion.

Renovations have included improvements to the tennis court and “powder room,” thousands spent on painting, various RCMP security upgrades, new appliances, wall and roof repairs, paving and landscaping services and tree stump removal.

Taxpayers have also been billed for 10 piano tunings, according to the records.

“Does the prime minister’s powder room have a gold toilet? How can these upgrades cost this much?” Sims said. “Taxpayers don’t expect Trudeau to sleep in a tent, but racking-up reno bills costing Canadians more than half a million dollars per year is excessive.”

In addition to the $5 million in renovations at Rideau Cottage, taxpayers have also been on the hook for millions in renovations at Harrington Lake, the prime minister’s lakeside cottage estate.

In 2022, the CTF reported the National Capital Commission, which manages Canada’s six official residences, was spending $11 million on renovations at Harrington Lake.

Included in those costs was the construction of a backup cottage on the property for $2.5 million, and a kitchen renovation that cost more than $700,000.

The federal government spent an additional $6 million on renovations at Harrington Lake between 2016-17 and 2019-20, according to a 2021 NCC report.

Taxpayers were also on the hook for $1 million in renovations at 24 Sussex during the same period, despite the fact the property has sat vacant since 2015.

Despite long-standing claims that Canada’s official residences are subject to “chronic underfunding,” the CTF previously reported the NCC spent $135 million renovating the properties between 2006 and 2022.

“Canadians need to know why the NCC, a glorified parks and rec department that plants flowers in Ottawa, manages to blow millions and millions of dollars on these swanky buildings without much to show for it,” Sims said. “Why are there now three official residences for our one prime minister, and why did taxpayers pay for an entirely new mansion up at Harrington Lake? Who is living in that new house and why did it cost so much?”

Business

Will Paramount turn the tide of legacy media and entertainment?

From the Daily Caller News Foundation

The recent leadership changes at Paramount Skydance suggest that the company may finally be ready to correct course after years of ideological drift, cultural activism posing as programming, and a pattern of self-inflicted financial and reputational damage.

Nowhere was this problem more visible than at CBS News, which for years operated as one of the most partisan and combative news organizations. Let’s be honest, CBS was the worst of an already left biased industry that stopped at nothing to censor conservatives. The network seemed committed to the idea that its viewers needed to be guided, corrected, or morally shaped by its editorial decisions.

This culminated in the CBS and 60 Minutes segment with Kamala Harris that was so heavily manipulated and so structurally misleading that it triggered widespread backlash and ultimately forced Paramount to settle a $16 million dispute with Donald Trump. That was not merely a legal or contractual problem. It was an institutional failure that demonstrated the degree to which political advocacy had overtaken journalistic integrity.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

For many longtime viewers across the political spectrum, that episode represented a clear breaking point. It became impossible to argue that CBS News was simply leaning left. It was operating with a mission orientation that prioritized shaping narratives rather than reporting truth. As a result, trust collapsed. Many of us who once had long-term professional, commercial, or intellectual ties to Paramount and CBS walked away.

David Ellison’s acquisition of Paramount marks the most consequential change to the studio’s identity in a generation. Ellison is not anchored to the old Hollywood ecosystem where cultural signaling and activist messaging were considered more important than story, audience appeal, or shareholder value.

His professional history in film and strategic business management suggests an approach grounded in commercial performance, audience trust, and brand rebuilding rather than ideological identity. That shift matters because Paramount has spent years creating content and news coverage that seemed designed to provoke or instruct viewers rather than entertain or inform them. It was an approach that drained goodwill, eroded market share, and drove entire segments of the viewing public elsewhere.

The appointment of Bari Weiss as the new chief editor of CBS News is so significant. Weiss has built her reputation on rejecting ideological conformity imposed from either side. She has consistently spoken out against antisemitism and the moral disorientation that emerges when institutions prioritize political messaging over honesty.

Her brand centers on the belief that journalism should clarify rather than obscure. During President Trump’s recent 60 Minutes interview, he praised Weiss as a “great person” and credited her with helping restore integrity and editorial seriousness inside CBS. That moment signaled something important. Paramount is no longer simply rearranging executives. It is rethinking identity.

The appointment of Makan Delrahim as Chief Legal Officer was an early indicator. Delrahim’s background at the Department of Justice, where he led antitrust enforcement, signals seriousness about governance, compliance, and restoring institutional discipline.

But the deeper and more meaningful shift is occurring at the ownership and editorial levels, where the most politically charged parts of Paramount’s portfolio may finally be shedding the habits that alienated millions of viewers.The transformation will not be immediate. Institutions develop habits, internal cultures, and incentive structures that resist correction. There will be internal opposition, particularly from staff and producers who benefited from the ideological culture that defined CBS News in recent years.

There will be critics in Hollywood who see any shift toward balance as a threat to their influence. And there will be outside voices who will insist that any move away from their preferred political posture is regression.

But genuine reform never begins with instant consensus. It begins with leadership willing to be clear about the mission.

Paramount has the opportunity to reclaim what once made it extraordinary. Not as a symbol. Not as a message distribution vehicle. But as a studio that understands that good storytelling and credible reporting are not partisan aims. They are universal aims. Entertainment succeeds when it connects with audiences rather than instructing them. Journalism succeeds when it pursues truth rather than victory.

In an era when audiences have more viewing choices than at any time in history, trust is an economic asset. Viewers are sophisticated. They recognize when they are being lectured rather than engaged. They know when editorial goals are political rather than informational. And they are willing to reward any institution that treats them with respect.

There is now reason to believe Paramount understands this. The leadership is changing. The tone is changing. The incentives are being reassessed.

It is not the final outcome. But it is a real beginning. As the great Winston Churchill once said; “Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning”.

For the first time in a long time, the door to cultural realignment in legacy media is open. And Paramount is standing at the threshold and has the capability to become a market leader once again. If Paramount acts, the industry will follow.

Bill Flaig and Tom Carter are the Co-Founders of The American Conservatives Values ETF, Ticker Symbol ACVF traded on the New York Stock Exchange. Ticker Symbol ACVF

Learn more at www.InvestConservative.com

Business

Parliamentary Budget Officer begs Carney to cut back on spending

PBO slices through Carney’s creative accounting

The Canadian Taxpayers Federation is calling on Prime Minister Mark Carney to cut spending following today’s bombshell Parliamentary Budget Officer report that criticizes the government’s definition of capital spending and promise to balance the operating budget.

“The reality is that Carney is continuing on a course of unaffordable borrowing and the PBO report shows government messaging about ‘balancing the operating budget’ is not credible,” said Franco Terrazzano, CTF Federal Director. “Carney is using creative accounting to hide the spiralling debt.”

Carney’s Budget 2025 splits the budget into operating and capital spending and promises to balance the operating budget by 2028-29.

However, today’s PBO budget report states that Carney’s definition of capital spending is “overly expansive.” Without using that “overly expansive” definition of capital spending, the government would run an $18 billion operating deficit in 2028-29, according to the PBO.

“Based on our definition, capital investments would total $217.3 billion over 2024-25 to 2029-30, which is approximately 30 per cent ($94 billion) lower compared to Budget 2025,” according to the PBO. “Moreover, based on our definition, the operating balance in Budget 2025 would remain in a deficit position over 2024-25 to 2029-30.”

The PBO states that the Carney government is using “a definition of capital investment that expands beyond the current treatment in the Public Accounts and international practice.” The report specifically points out that “by including corporate income tax expenditures, investment tax credits and operating (production) subsidies, the framework blends policy measures with capital formation.”

The federal government plans to borrow about $80 billion this year, according to Budget 2025. Carney has no plan stop borrowing money and balance the budget. Debt interest charges will cost taxpayers $55.6 billion this year, which is more than the federal government will send to the provinces in health transfers ($54.7 billion) or collect through the GST ($54.4 billion).

“Carney isn’t balancing anything when he borrows tens of billions of dollars every year,” Terrazzano said. “Instead of applying creative accounting to the budget numbers, Carney needs to cut spending and debt.”

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoRichmond Mayor Warns Property Owners That The Cowichan Case Puts Their Titles At Risk

-

Business2 days ago

Business2 days agoMark Carney Seeks to Replace Fiscal Watchdog with Loyal Lapdog

-

Business2 days ago

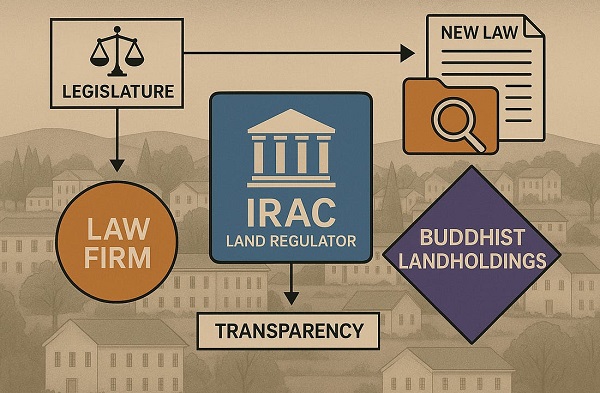

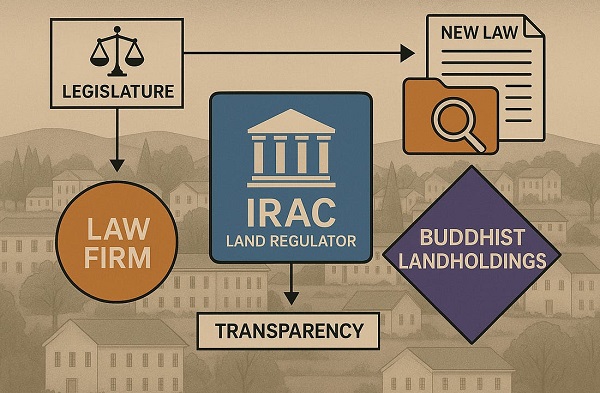

Business2 days agoP.E.I. Moves to Open IRAC Files, Forcing Land Regulator to Publish Reports After The Bureau’s Investigation

-

International1 day ago

International1 day agoIs America drifting toward civil war? Joe Rogan thinks so

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoEU’s “Democracy Shield” Centralizes Control Over Online Speech

-

COVID-192 days ago

COVID-192 days agoMajor new studies link COVID shots to kidney disease, respiratory problems

-

Energy2 days ago

Energy2 days agoCanada’s oilpatch shows strength amid global oil shakeup

-

Business2 days ago

Business2 days agoSluggish homebuilding will have far-reaching effects on Canada’s economy