From the Fraser Institute By Jake Fuss and Grady Munro According to a new poll from RBC, nearly half (48 per cent) of Canadians can’t maintain their standard...

From the Fraser Institute By Alex Whalen and Jake Fuss On the eve of a possible trade war with the United States, Canadian policymakers have a...

From the Fraser Institute By Jake Fuss and Grady Munro Defence Minister Bill Blair recently claimed the federal government could “absolutely” achieve the North Atlantic Treaty Organization (NATO)...

From the Fraser Institute By Jake Fuss and Grady Munro Premier Doug Ford, who will trigger an election this week, recently said he plans to “spend...

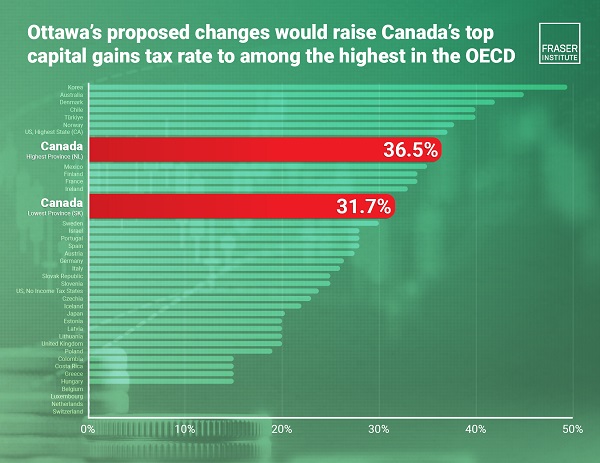

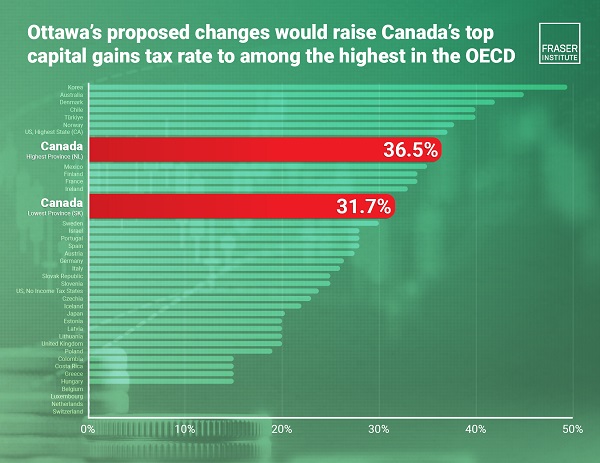

From the Fraser Institute By Jake Fuss and Grady Munro Ottawa’s proposed increase to the effective capital gains tax rate will result in Canada having among...

From the Fraser Institute By Jake Fuss and Grady Munro On Monday outside Rideau Cottage in Ottawa, after Prime Minister Justin Trudeau told Canadians he plans...

From the Fraser Institute By Jake Fuss and Grady Munro On Monday, after weeks of turmoil and speculation, Prime Minister Justin Trudeau told Canadians he’ll resign...

From the Fraser Institute By Ben Eisen and Jake Fuss Over the next weeks and months, there will be much discussion about Justin Trudeau’s legacy as...

From the Fraser Institute By Jason Clemens and Jake Fuss One of the authors of this op-ed resides in a municipality, which recently launched an online survey to...

From the Fraser Institute By Jake Fuss and Grady Munro Following the sudden departure of Chrystia Freeland as finance minister, the Trudeau government released its 2024 fall fiscal update on...