Agriculture

Significant majority of Canadians want carbon tax scrapped on farms

From the Canadian Taxpayers Association

Author: Gage Haubrich

Canada is a big country filled with lots of opinions. It’s tough to talk about which hockey team you should cheer for without voices being raised, let alone getting into politics.

When a vast majority of Canadians think the same way on something, it’s a good idea for the government to stop and listen.

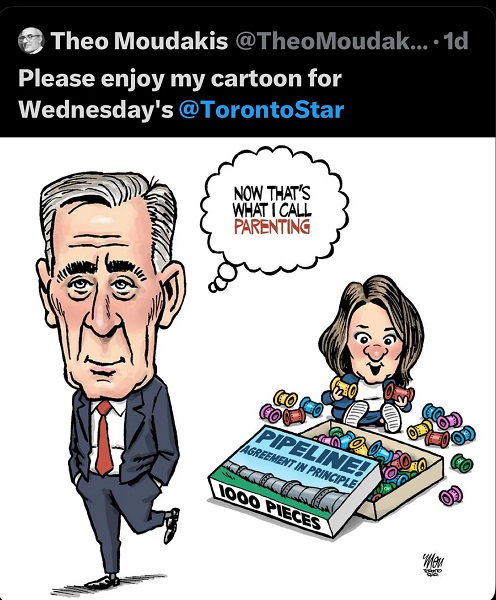

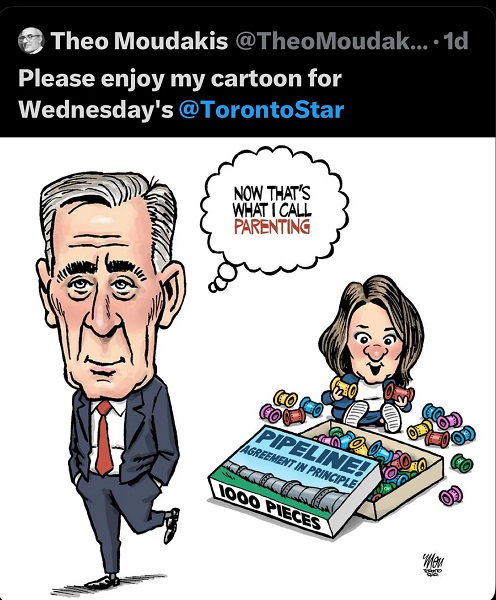

A new poll conducted by Leger shows that seven-in-10 Canadians want farmers to get an exemption on the carbon tax for natural gas and propane.

That means members of Parliament need to listen to Canadians and pass Bill C-234, a proposed piece of legislation that gives farmers this exact exemption.

Currently, the federal government already exempts the carbon tax from gasoline and diesel used on farms. And this bill simply extends that same carbon tax exemption to natural gas and propane.

The new national poll shows there is support for farmers across the country – Canadians want the carbon tax scrapped on farms.

Albertans leads the way with 76 per cent of them supporting giving a break to farmers, but other parts of the country aren’t far behind. British Columbians are 72 per cent in favour of the relief and even 68 per cent of people in Quebec and the Atlantic provinces support the exemption.

Canadians understand that just like the carbon tax costs them big money to fuel up their cars and heat their homes, it also costs farmers, but on a much larger scale. Without any relief, the carbon tax on natural gas and propane will cost farmers almost $1 billion by 2030, according to the Parliamentary Budget Officer.

That’s a lot of money that farmers are paying on their bills every month and it also hurts their competitiveness because farmers in the United States aren’t paying a carbon tax. Plus, if farmers aren’t paying millions of dollars every year in the carbon tax, it’s likely to help the rest of out with prices at the grocery store.

And passing bill C-234 is something farm groups have already been calling for. The Agriculture Carbon Alliance is a coalition of 15 farm associations is pushing the federal government to pass the bill and provide relief to farmers.

That’s because individual farmers are paying up to thousands of dollars every month in the carbon tax. The average livestock farmer can expect a $726 carbon tax bill every month, while crop farmers can look forward to a $2,024 bill according to the ACA.

Greenhouses are the worst off, with an average $17,173 carbon tax bill. In some cases, up to 40 per cent of a farmers energy cost is just carbon tax.

This new poll and the huge carbon tax bills for Canadian farmers should be a wake-up call for politicians in Ottawa to stop sitting on their hands and get farmers some relief, because this legislation has been through the wringer at this point.

Bill C-234 was originally introduced more than two years ago and it finally passed the House in March 2023, where it got unanimous support from the Conservatives, Bloc, NDP and Greens. Three Liberal MPs even voted for it.

But then it got to the Senate.

Unelected Senators amended the bill and got rid of much of the relief for farmers. They removed the exemptions for heating barns and decided that the relief should end after three years. The bill in its current form would still see farmers paying $910 million in the carbon tax by 2030, according to the PBO.

Now Bill C-234 is back in the House and MPs need to reject the amendments from the Senate and pass the bill in its original form.

It’s what Canadians want.

It’s time for Ottawa to start listening to Canadians and stop charging farmers carbon taxes that make all of our lives more expensive.

Agriculture

Health Canada indefinitely pauses plan to sell unlabeled cloned meat after massive public backlash

From LifeSiteNews

Health Canada has indefinitely paused its plan to allow unlabeled cloned meat in grocery stores after thousands of Canadians, prominent figures, and industry leaders condemned the move.

Health Canada is pausing its plan to put unlabeled cloned meat in Canadian grocery stores, following public outcry.

In a November 19 update on its website, Health Canada announced an indefinite suspension of the decision to remove labels from cloned meat products after thousands of Canadians condemned the plan online.

“The Government of Canada has received significant input from both consumers and industry about the implications of this potential policy update,” the publication read. “The Department has therefore indefinitely paused the policy update to provide time for further discussions and consideration,” it continued, adding, “Until the policy is updated, foods made from cloned cattle and swine will remain subject to the novel food assessment.”

In late October, Health Canada quietly approved removing labels from foods derived from somatic cell nuclear transfer (SCNT) clones and their offspring. As a result, Canadians buying meat from the grocery store would have had no way of knowing if the product was cloned meat.

Many researchers have documented high rates of cloning failure, large offspring syndrome (LOS), placental abnormalities, early death, and organ defects in cloned animals. The animals are also administered heavy doses of antibiotics due to infections and immune issues.

Typically, the offspring of cloned animals, rather than the cloned animals themselves, are processed for human consumption. As a result, researchers allege that the health defects and high drug use does not affect the final product.

However, there are no comprehensive human studies on the effects of eating cloned meat, meaning that the side-effects for humans are unknown.

News of the plan spread quickly on social media, with thousands of Canadians condemning the plan and promising to switch to local meat providers.

“By authorizing the sale of meat from cloned animals without mandatory labeling or a formal public announcement, Health Canada risks repeating a familiar and costly failure in risk communication. Deeply disappointing,” food policy expert and professor at Dalhousie University Sylvain Charlebois wrote on X.

"By authorizing the sale of meat from cloned animals without mandatory labeling or a formal public announcement, Health Canada risks repeating a familiar and costly failure in risk communication. Deeply disappointing."

More on this week's Food Professor Podcast! https://t.co/UZTIcQzUN3

— The Food Professor (@FoodProfessor) October 30, 2025

Likewise, Conservative MP Leslyn Lewis warned, “Health Canada recently decided that meat from cloned animals and their offspring no longer needs a special review or any form of disclosure.”

“That means, soon you could buy beef or pork and have no idea how it was bred,” she continued. “Other countries debate this openly: the EU has considered strict labelling, and even the U.S. has admitted that cloned-offspring meat is circulating.”

“But here in Canada, the public wasn’t even told. This is about informed choice,” Lewis declared. “If government and industry don’t have to tell us when meat comes from cloned animals, then Canadians need to ask a simple, honest question: What else are we not being told?”

Health Canada recently decided that meat from cloned animals and their offspring no longer needs a special review or any form of disclosure. That means, soon you could buy beef or pork and have no idea how it was bred.

Other countries debate this openly: the EU has considered… pic.twitter.com/zCnqJOpvf3

— Dr. Leslyn Lewis (@LeslynLewis) November 14, 2025

Likewise, duBreton, a leading North American supplier of organic pork based out of Quebec, denounced the move, saying, “Canadians expect clarity, transparency, and meaningful consultation on issues that directly touch their food supply. As producers, we consider it our responsibility and believe our governing food authorities should too.”

According to a survey conducted by duBreton, 74 percent of Canadians believe that “cloned meat and genetic editing practices have no place in farm and food systems.”

Agriculture

Federal cabinet calls for Canadian bank used primarily by white farmers to be more diverse

From LifeSiteNews

A finance department review suggested women, youth, Indigenous, LGBTQ, Black and racialized entrepreneurs are underserved by Farm Credit Canada.

The Cabinet of Prime Minister Mark Carney said in a note that a Canadian Crown bank mostly used by farmers is too “white” and not diverse enough in its lending to “traditionally underrepresented groups” such as LGBT minorities.

Farm Credit Canada Regina, in Saskatchewan, is used by thousands of farmers, yet federal cabinet overseers claim its loan portfolio needs greater diversity.

The finance department note, which aims to make amendments to the Farm Credit Canada Act, claims that agriculture is “predominantly older white men.”

Proposed changes to the Act mean the government will mandate “regular legislative reviews to ensure alignment with the needs of the agriculture and agri-food sector.”

“Farm operators are predominantly older white men and farm families tend to have higher average incomes compared to all Canadians,” the note reads.

“Traditionally underrepresented groups such as women, youth, Indigenous, LGBTQ, and Black and racialized entrepreneurs may particularly benefit from regular legislative reviews to better enable Farm Credit Canada to align its activities with their specific needs.”

The text includes no legal amendment, and the finance department did not say why it was brought forward or who asked for the changes.

Canadian census data shows that there are only 590,710 farmers and their families, a number that keeps going down. The average farmer is a 55-year-old male and predominantly Christian, either Catholic or from the United Church.

Data shows that 6.9 percent of farmers are immigrants, with about 3.7 percent being “from racialized groups.”

National census data from 2021 indicates that about four percent of Canadians say they are LGBT; however, those who are farmers is not stated.

Historically, most farmers in Canada are multi-generational descendants of Christian/Catholic Europeans who came to Canada in the mid to late 1800s, mainly from the United Kingdom, Ireland, Ukraine, Russia, Italy, Poland, the Netherlands, Germany, and France.

-

Daily Caller15 hours ago

Daily Caller15 hours agoTech Mogul Gives $6 Billion To 25 Million Kids To Boost Trump Investment Accounts

-

Business16 hours ago

Business16 hours agoRecent price declines don’t solve Toronto’s housing affordability crisis

-

Alberta2 days ago

Alberta2 days agoNew era of police accountability

-

National2 days ago

National2 days agoMedia bound to pay the price for selling their freedom to (selectively) offend

-

C2C Journal2 days ago

C2C Journal2 days agoLearning the Truth about “Children’s Graves” and Residential Schools is More Important than Ever

-

National14 hours ago

National14 hours agoCanada Needs an Alternative to Carney’s One Man Show

-

armed forces1 day ago

armed forces1 day agoGlobal Military Industrial Complex Has Never Had It So Good, New Report Finds

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoSometimes An Ingrate Nation Pt. 2: The Great One Makes His Choice