Business

Sale of beer with alcohol banned at World Cup stadiums

DOHA, Qatar (AP) — The sale of all beer with alcohol at the eight World Cup stadiums was banned Friday, only two days before the soccer tournament is set to start.

Non-alcoholic beer will still be sold at the 64 matches in the country.

“Following discussions between host country authorities and FIFA, a decision has been made to focus the sale of alcoholic beverages on the FIFA Fan Festival, other fan destinations and licensed venues, removing sales points of beer from … stadium perimeters,” FIFA said in a statement.

Champagne, wine, whiskey and other alcohol is still expected to be served in the luxury hospitality areas of the stadiums. Outside of those places, beer is normally the only alcohol sold to regular ticket holders.

Ab InBev, the parent company of World Cup beer sponsor Budweiser, did not immediately respond to a request for comment.

AB InBev pays tens of millions of dollars at each World Cup for exclusive rights to sell beer and has already shipped the majority of its stock from Britain to Qatar in expectation of selling its product to millions of fans. The company’s partnership with FIFA started at the 1986 tournament and they are in negotiations for renewing their deal for the next World Cup in North America.

While a sudden decision like this may seem extreme in the West, Qatar is an autocracy governed by a hereditary emir, who has absolute say over all governmental decisions.

Qatar, an energy-rich Gulf Arab country, follows an ultraconservative form of Islam known as Wahhabism like neighboring Saudi Arabia. However, alcohol sales have been permitted in hotel bars for years.

Qatar’s government and its Supreme Committee for Delivery and Legacy did not immediately respond to request for comment.

Already, the tournament has seen Qatar change the date of the opening match only weeks before the World Cup began.

When Qatar launched its bid to host the World Cup, the country agreed to FIFA’s requirements of selling alcohol in stadiums, and again when signing contracts after winning the vote in 2010.

At the 2014 World Cup in Brazil, the host country was forced to change a law to allow alcohol sales in stadiums.

Ronan Evain, the executive director of the fan group Football Supporters Europe, called the decision to ban beer sales at the stadiums in Qatar “extremely worrying.”

“For many fans, whether they don’t drink alcohol or are used to dry stadium policies at home, this is a detail. It won’t change their tournament,” Evain wrote on Twitter. “But with 48 (hours) to go, we’ve clearly entered a dangerous territory — where ‘assurances’ don’t matter anymore.”

AB InBev’s deal with FIFA was renewed in 2011 — after Qatar was picked as host — in a two-tournament package through 2022. However, the Belgium-based brewer has faced uncertainty in recent months on the exact details of where it can serve and sell beer in Qatar.

An agreement was announced in September for beer with alcohol to be sold within the stadium perimeters before and after games. Only alcohol-free Bud Zero would be sold in the stadium concourses for fans to drink in their seats in branded cups.

Last weekend, AB InBev was left surprised by a new policy insisted on by Qatari organizers to move beer stalls to less visible locations within the perimeter.

Budweiser was also to be sold in the evenings only at the official FIFA fan zone in downtown Al Bidda Park, where up to 40,000 fans can gather to watch games on giant screens. The price was confirmed as $14 for a beer.

The company will be based at an upscale hotel in the West Bay area of Doha with its own branded nightclub for the tournament.

At the W Hotel in Doha, workers continued putting together a Budweiser-themed bar planned at the site. Its familiar AB logo was plastered on columns and walls at the hotel, with one reading: “The World Is Yours To Take.”

___

AP World Cup coverage: https://apnews.com/hub/world-cup and https://twitter.com/AP_Sports

Graham Dunbar, The Associated Press

Business

Carney’s carbon madness

Dan McTeague

Dan McTeague

Well, we are in quite the pickle.

In nine plus years as prime minister, Justin Trudeau has waged a multi-front war on the consumption and production of hydrocarbon energy, and, with that, on our economy, our quality of life, and our cost of living.

Trudeau zealously pursued and implemented anti-energy policies, most infamously the consumer Carbon Tax, but let’s not forget his so-called ”Clean Fuel” regulations; his Industrial Carbon Tax; his proposed emissions caps; his Electric Vehicle subsidies and mandates; Bill C-59, which bans businesses from touting the environmental positives of their work if it doesn’t meet a government-approved standard; and various other pieces of legislation which make the construction of new pipelines nearly impossible and significantly reduces our ability to sell our oil and gas overseas.

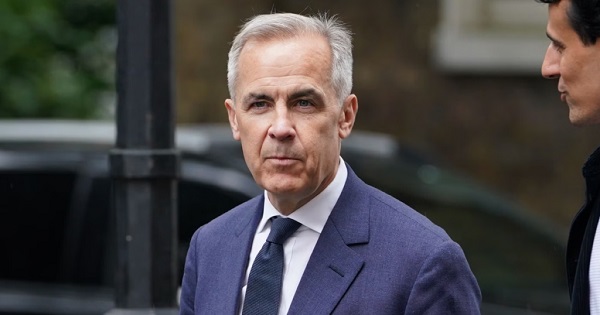

Every one of these policies can be traced back to the pernicious Net Zero ideology which informs them, and in which Trudeau and his bosom buddies — Gerald Butts, Steven Guilbeault, Mark Carney, etc — remain true believers.

And yet, despite those policies contributing to his party’s collapsing poll numbers and Trudeau’s unceremonious ouster, the Liberals are on the verge of naming as his replacement Mark Carney, one of the very Trudeau consiglieri who got us into this mess in the first place!

Now, Carney is currently doing everything in his power to downplay and dance around those aspects of his career which voters might find objectionable. He’s making quite a habit of it, in fact. And on the energy file, he’s being especially misleading, walking back his long-time support of the Carbon Tax — he’s said it has “served a purpose up until now” — and claiming that he intends to repeal it, while finding other ways to “make polluters pay.”

This is nonsense. In fact, Carney is a Carbon Tax superfan, and, if you listen to him closely, his actual critique of the Trudeau tax isn’t that it has made it more expensive to heat our homes, gas up our cars, and pay for our groceries (which it has.) It’s that it is too visible to voters. His vow to “make polluters pay” means, in fact, that he intends to “beef up” Trudeau’s less discussed Industrial Carbon Tax, targeting businesses, which will ultimately pass the cost down to consumers.

He’s even discussed enacting a Carbon tariff, which would apply to trade with countries which don’t adopt the onerous Net Zero policies which he wants to force on Canada.

That’s just who Mark Carney is.

And, unfortunately, Donald Trump’s tariff threats have provoked a “rally round the flag” sentiment, enabling the Liberals to close the polling gap with the Conservatives, with some polls currently showing them neck-and-neck. Which is to say, there is a possibility that, whenever we get around to having an election, anti-American animus could keep the Liberals in power, and propel Carney to the top job in our government.

This is, in a word, madness.

Let us not forget that it was the Liberals’ policies — especially their assault on our “golden goose,” the natural resource sector — which left us in such a precarious fiscal state that Trudeau felt the need to fly to Mar-a-Lago and tell the newly elected president that a tariff would “kill” our economy. That’s what provoked Trump’s “51st state” crack in the first place.

Access to U.S. markets will always be important for Canadian prosperity — they, by leaps and bounds, are our largest trading partner, after all — but without the Net Zero nonsense, we could have been an energy superpower, providing an alternative source of oil and natural gas for those countries leary about relying for energy on less-environmentally conscious, human-rights-abusing petrostates. We could have filled the void created by Russia, when they made themselves a pariah state in Europe by invading Ukraine.

In short, we might have been set up to negotiate with the Trump Administration from a position of strength. Instead, we’re proposing to double-down on Net Zero, pledging allegiance to a program which will make us less competitive and more likely to be steamrolled by major powers, including the U.S. but also (and less frequently mentioned) China.

Talk about cutting off your nose to spite your face! And all in the name of nationalism.

Here’s hoping we wise up and change course while there’s still time. Because, in the words of America’s greatest philosopher, Yogi Berra, “It’s getting late early.”

Dan McTeague is President of Canadians for Affordable Energy.

Support Dan’s Work to Keep Canadian Energy Affordable!

Canadians for Affordable Energy is run by Dan McTeague, former MP and founder of Gas Wizard. We stand up and fight for more affordable energy.

Business

Tariffs by Tuesday: Trump Says There Is ‘No Room Left’ For Any Negotiations On Postponing Tariffs On Mexico, Canada

From the Daily Caller News Foundation

By Nicole Silverio

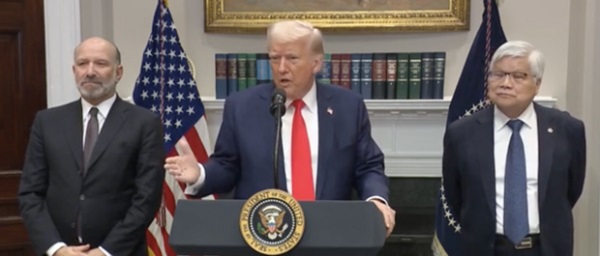

President Donald Trump said Monday that there is “no room left” for any negotiations on postponing tariffs on Mexico, Canada or China in response to their handling of the immigration and fentanyl crisis.

Trump initially planned to impose 25% tariffs on Mexico and Canada and a 10% tariff on China over its role in allowing illegal immigration and fentanyl to pour into the U.S. in record numbers. After postponing these tariffs for a month after Mexico and Canada caved to his requests, the president said he has fully made up his mind to officially impose these tariffs this upcoming Tuesday.

“No room left for Mexico or for Canada. No, the tariffs [are] all set, they go into effect tomorrow,” Trump said. “And just so you understand, vast amounts of fentanyl have poured into our country from Mexico and as you know, also from China where it goes to Mexico and goes to Canada and China also had an additional 10 [percent], so it’s 10 + 10, and it comes in from Canada and it comes in from Mexico and that’s a very important thing to say.”

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here. Thank you!

WATCH:

Trump postponed the tariffs on Feb. 3 after Mexican President Claudia Sheinbaum and Canadian Prime Minister Justin Trudeau caved to his requests by increasing their efforts to tackle illegal immigration and fentanyl. Sheinbaum deployed 10,000 National Guard soldiers to the U.S.-Mexico border while Trudeau invested $1.3 billion to crackdown on illegal migration and appointed a “Fentanyl Czar” to oversee a $200 million effort against the drug.

The president announced in a Feb. 27 Truth Social post that he planned to double the tariffs on China to 20% and move forward with the tariffs on Mexico and Canada over the “very high and unacceptable levels” of drugs pouring into the U.S.

“We cannot allow this scourge to continue to harm the USA, and therefore, until it stops, or is seriously limited, the proposed TARIFFS scheduled to go into effect on MARCH FOURTH will, indeed, go into effect, as scheduled,” Trump said. “China will likewise be charged an additional 10% Tariff on that date. The April Second Reciprocal Tariff date will remain in full force and effect. Thank you for your attention to this matter. GOD BLESS AMERICA!”

These three countries are being slapped with tariffs as the U.S. suffers a fentanyl epidemic, with over 21,000 pounds of the deadly drug being seized at the southern border in the fiscal year 2024, according to Customs and Border Protection (CBP). Border agents have seized over 5,400 pounds in the 2025 fiscal year thus far.

At the U.S.-Canadian border, officials encountered over 11,000 pounds of drugs in the 2024 fiscal year and over 3,200 pounds have so far been seized in the 2025 fiscal year, according to CBP data. Over 60,000 pounds and 55,000 pounds of drugs were seized in the 2022 and 2023 fiscal years.

U.S. border officials also encountered over 8.5 million migrants at the southern border during the four fiscal years of former President Joe Biden’s administration. Border crossings at the northern border skyrocketed with over 198,000 encounters and nearly 19,000 arrests occurring in the 2024 fiscal year.

-

Business2 days ago

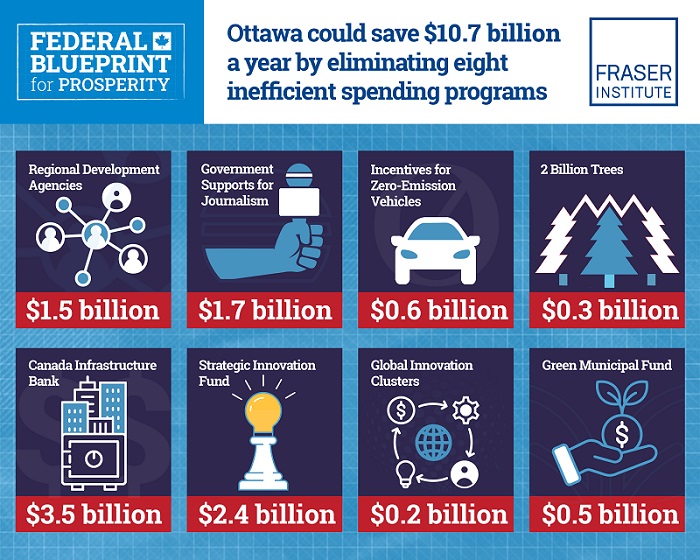

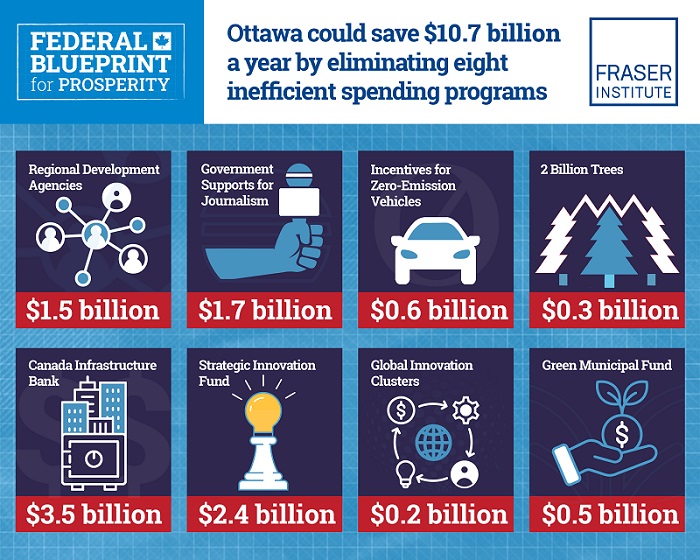

Business2 days agoFederal government could save $10.7 billion this fiscal year by eliminating eight ineffective spending programs

-

Courageous Discourse1 day ago

Courageous Discourse1 day agoZelensky Met with Dems Before He Met President Trump

-

Energy2 days ago

Energy2 days agoTrial underway in energy company’s lawsuit against Greenpeace

-

conflict17 hours ago

conflict17 hours agoIs Ukraine War a Money-Sucking Charade?

-

Alberta11 hours ago

Alberta11 hours agoFormer Chief Judge of Manitoba Proincial Court will lead AHS third-party investigation into AHS procurement process

-

Business2 days ago

Business2 days agoMusk vs. the bureaucracy vs. Congress: Who has the power to cut spending?

-

Canadian Energy Centre2 days ago

Canadian Energy Centre2 days ago‘Big vulnerability’: How Ontario and Quebec became reliant on U.S. oil and gas

-

International1 day ago

International1 day agoDataRepublican Exposes the Shadow Government’s Darkest Secrets