Business

Salary costs in Prime Minister’s Office increase under Trudeau

From the Canadian Taxpayers Federation

By Ryan Thorpe

Like all areas of Ottawa’s ballooning bureaucracy, the cost and size of the Prime Minister’s Office has increased under the Trudeau government.

The inflation-adjusted cost of staffing the PMO has risen by 16 per cent under the watch of Prime Minister Justin Trudeau, according to access-to-information records obtained by the Canadian Taxpayers Federation.

Salary costs for the 103 staffers in the PMO came to $10.5 million in 2022-23. That figure does not represent overall compensation for PMO staff (including benefits), but rather base salary, according to the records.

Taxpayers are now on the hook for an additional $3.2 million in annual PMO salary costs over 2014-15, the last full year former prime minister Stephen Harper was in office.

“The cost of running the PMO has increased under Trudeau, but it’s a good bet most Canadians don’t think they’re getting any better performance from the prime minister,” said Franco Terrazzano, CTF Federal Director. “If Trudeau can’t find savings right under his nose, how can taxpayers trust him to cut the fat across government?”

The growth in PMO staff comes at a time when the Trudeau government has been ballooning the federal bureaucracy across the board.

Both the number and cost of the federal bureaucracy has exploded under Trudeau’s watch, according to other government records obtained by the CTF.

The number of federal bureaucrats increased by 42 per cent under Trudeau, with more than 108,000 new bureaucrats added to the government payroll.

Spending on federal bureaucrats hit a record high $67.4 billion in 2022-23, representing a 68 per cent increase since 2016.

The size of the federal c-suite has also expanded, with the number of executives increasing by 42 per cent under Trudeau.

The Trudeau government has handed out more than $1 billion in bonuses since 2015 and more than one million pay raises in the last four years.

Meanwhile, spending on consultants also reached a record high, with planned expenditures for 2023-24 sitting at $21.6 billion.

“Everywhere you look – the PMO, the federal c-suite, the bureaucracy – the cost and size of government is out of control,” Terrazzano said. “Trudeau must take air out of Ottawa’s ballooning bureaucracy and the place to start is his own office.”

PMO staff costs, government records obtained by the CTF

|

Fiscal year |

Number of PMO staff |

PMO salary costs |

|

2014-15 |

94 |

$7,258,436 |

|

2015-16 |

74 |

$6,353,188 |

|

2016-17 |

84 |

$7,462,686 |

|

2017-18 |

99 |

$8,155,068 |

|

2018-19 |

100 |

$8,479,353 |

|

2019-20 |

90 |

$8,536,672 |

|

2020-21 |

99 |

$9,840,834 |

|

2021-22 |

94 |

$9,383,328 |

|

2022-23 |

103 |

$10,536,649 |

|

Total |

|

$76,006,214 |

Business

Publicity Kills DEI: A Free Speech Solution to Woke Companies

For years, major corporations bragged about their wonderful Diversity, Equity, and Inclusion (DEI) programs. They’re good for business and morally correct, they said. So why are they now cutting those programs?

Robby Starbuck says these programs once got a lot of buy-in, because people wanted to be nice! But DEI came to mean much more than just being nice.

Starbuck says what it looked like in practice was “crazy trainings” and “overtly racist hiring practices.” Now lots of people agree with him.

Companies actually take notice when Starbuck tells his many followers about their DEI programs. Often the programs get dropped.

That’s the power of free speech.

After 40+ years of reporting, I now understand the importance of limited government and personal freedom.

——————————————

Libertarian journalist John Stossel created Stossel TV to explain liberty and free markets to young people.

Prior to Stossel TV he hosted a show on Fox Business and co-anchored ABC’s primetime newsmagazine show, 20/20. Stossel’s economic programs have been adapted into teaching kits by a non-profit organization, “Stossel in the Classroom.” High school teachers in American public schools now use the videos to help educate their students on economics and economic freedom. They are seen by more than 12 million students every year.

Stossel has received 19 Emmy Awards and has been honored five times for excellence in consumer reporting by the National Press Club. Other honors include the George Polk Award for Outstanding Local Reporting and the George Foster Peabody Award.

_ _ _ _ _ _ _ _

To get our new weekly video from Stossel TV, sign up here: https://www.johnstossel.com/#subscribe

_ _ _ _ _ _ _ _

Business

DOGE discovered $330M in Small Business loans awarded to children under 11

MxM News

MxM News

Quick Hit:

In a bombshell revelation at a White House cabinet meeting, Elon Musk announced that the Department of Government Efficiency (DOGE) had uncovered over $330 million in Small Business Administration (SBA) loans issued to children under the age of 11.

Key Details:

- Elon Musk stated that DOGE found $330 million in SBA loans given to individuals under the age of 11.

- The youngest recipient was reportedly just nine months old, receiving a $100,000 loan.

- SBA has now paused the direct loan process for individuals under 18 and over 120 years old.

Diving Deeper:

At a cabinet meeting held Monday at the White House, President Donald Trump and Elon Musk detailed a staggering example of federal waste uncovered by the newly-formed Department of Government Efficiency. Speaking directly to ongoing efforts to eliminate corruption and abuse in federal agencies, Musk explained that the SBA had awarded hundreds of millions in loans to children—some of whom were still in diapers.

“A case of fraud was with the Small Business Administration, where they were handing out loans — $330 million worth of loans to people under the age of 11,” Musk said. “I think the youngest, Kelly, was a nine-month year old who got a $100,000 loan. That’s a very precocious baby we’re talking about here.”

DOGE’s findings forced the SBA to abruptly change its loan procedures. In a post on X, the department revealed it would now require applicants to include their date of birth and was halting direct loans to those under 18 and above 120 years old. Musk commented sarcastically: “No more loans to babies or people too old to be alive.”

The discovery was just the latest in a series of contract cancellations and fraud crackdowns led by DOGE. According to Breitbart News, DOGE recently canceled 105 contracts totaling $935 million in potential taxpayer liabilities. The agency’s website currently lists over 6,600 terminated contracts, accounting for $20 billion in savings.

The president praised Musk and DOGE for rooting out government inefficiencies, noting his administration was focused on “cutting” people and programs that were not working or delivering results. “We’re not going to let people collect paychecks or taxpayer funds without doing their jobs,” Trump said.

Also during the cabinet session, USDA Secretary Brooke Rollins revealed her department had eliminated a $300,000 program aimed at teaching “food justice” to transgender and queer farmers in San Francisco. “I’m not even sure what that means,” Rollins said, “but apparently the last administration wanted to put our taxpayer dollars towards that.”

These revelations highlight what many conservatives have long suspected—that during prior administrations, including under President Joe Biden, massive amounts of federal funding were funneled into unserious, ideologically-driven projects and mismanaged government programs. Under the Trump administration’s second term, DOGE appears to be living up to its mission: trimming fat, exposing fraud, and putting American taxpayers first.

-

Alberta1 day ago

Alberta1 day agoFederal emissions plan will cost Albertans dearly

-

International21 hours ago

International21 hours agoEurope Can’t Survive Without America

-

Business2 days ago

Business2 days agoPossible Criminal Charges for US Institute for Peace Officials who barricade office in effort to thwart DOGE

-

Business13 hours ago

Business13 hours agoWhy a domestic economy upgrade trumps diversification

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCanadian construction worker goes viral for saying he refused to shake Mark Carney’s hand

-

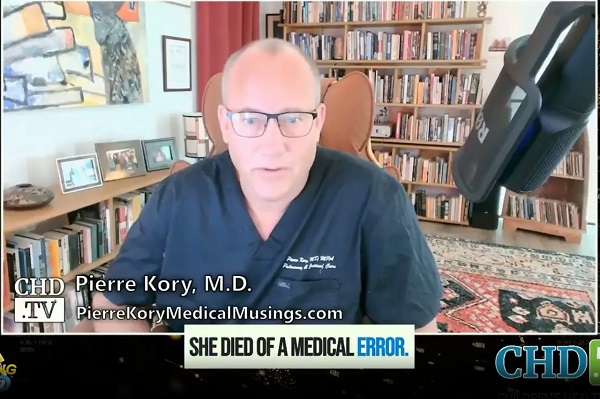

Health1 day ago

Health1 day agoDr. Pierre Kory Exposes the Truth About the Texas ‘Measles Death’ Hoax

-

Business6 hours ago

Business6 hours agoDOGE discovered $330M in Small Business loans awarded to children under 11

-

Business1 day ago

Business1 day ago28 energy leaders call for eliminating ALL energy subsidies—even ones they benefit from