Business

Report Reveals Push to Weaponize AI for Censorship

New US report highlights federal attempts to regulate AI for censorship, proposing free speech-focused legislation to protect open innovation.

|

For a while now, emerging AI has been treated by the Biden-Harris administration, but also the EU, the UK, Canada, the UN, etc., as a scourge that powers dangerous forms of “disinformation” – and should be dealt with accordingly.

According to those governments/entities, the only “positive use” for AI as far as social media and online discourse go, would be to power more effective censorship (“moderation”). A new report from the US House Judiciary Committee and its Select Subcommittee on the Weaponization of the Federal Government puts the emphasis on the push to use this technology for censorship as the explanation for the often disproportionate alarm over its role in “disinformation.” We obtained a copy of the report for you here. If you’re tired of censorship and surveillance, subscribe to Reclaim The Net.

The interim report’s name spells out its authors’ views on this quite clearly: the document is called, “Censorship’s Next Frontier: The Federal Government’s Attempt to Control Artificial Intelligence to Suppress Free Speech.” The report’s main premise is well-known – that AI is now being funded, developed, and used by the government and third parties to add speed and scale to their censorship, and that the outgoing administration has been putting pressure on AI developers to build censorship into their models. What’s new are the proposed steps to remedy this situation and make sure that future federal governments are not using AI for censorship. To this end, the Committee wants to see new legislation passed in Congress, AI development that respects the First Amendment and is open, decentralized, and “pro-freedom.” The report recommends legislation along four principles, focused on preserving American’s right to free speech. The first is that the government cannot be involved when decisions are made in private algorithms or datasets regarding “misinformation” or “bias.” The government should also be prohibited from funding censorship-related research or collaboration with foreign entities on AI regulation that leads to censorship. Lastly, “Avoid needless AI regulation that gives the government coercive leverage,” the document recommends. The Committee notes the current state of affairs where the Biden-Harris administration made a number of direct moves to regulate the space to its political satisfaction via executive orders, but also by pushing its policy through by giving out grants via the National Science Foundation, once again, aimed at building AI tools that “combat misinformation.” But – “If allowed to develop in a free and open manner, AI could dramatically expand Americans’ capacity to create knowledge and express themselves,” the report states. |

|

|

|

You subscribe to Reclaim The Net because you value free speech and privacy. Each issue we publish is a commitment to defend these critical rights, providing insights and actionable information to protect and promote liberty in the digital age.

Despite our wide readership, less than 0.2% of our readers contribute financially. With your support, we can do more than just continue; we can amplify voices that are often suppressed and spread the word about the urgent issues of censorship and surveillance. Consider making a modest donation — just $5, or whatever amount you can afford. Your contribution will empower us to reach more people, educate them about these pressing issues, and engage them in our collective cause. Thank you for considering a contribution. Each donation not only supports our operations but also strengthens our efforts to challenge injustices and advocate for those who cannot speak out.

Thank you.

|

Business

Is Government Inflation Reporting Accurate?

David Clinton

David Clinton

Who ya gonna believe: official CPI figures or your lyin’ eyes?

Great news! We’ve brought inflation back under control and stuff is now only costing you 2.4 percent more than it did last year!

That’s more or less the message we’ve been hearing from governments over the past couple of years. And in fact, the official Statistics Canada consumer price index (CPI) numbers do show us that the “all-items” index in 2024 was only 2.4 percent higher than in 2023. Fantastic.

So why doesn’t it feel fantastic?

Well statistics are funny that way. When you’ve got lots of numbers, there are all kinds of ways to dress ‘em up before presenting them as an index (or chart). And there really is no one combination of adjustments and corrections that’s definitively “right”. So I’m sure Statistics Canada isn’t trying to misrepresent things.

But I’m also curious to test whether the CPI is truly representative of Canadians’ real financial experiences. My first attempt to create my own alternative “consumer price index”, involved Statistics Canada’s “Detailed household final consumption expenditure”. That table contains actual dollar figures for nation-wide spending on a wide range of consumer items. To represent the costs Canadian’s face when shopping for basics, I selected these nine categories:

- Food and non-alcoholic beverages

- Clothing and footwear

- Housing, water, electricity, gas and other fuels

- Major household appliances

- Pharmaceutical products and other medical products (except cannabis)

- Transport

- Communications

- University education

- Property insurance

I then took the fourth quarter (Q4) numbers for each of those categories for all the years between 2013 and 2024 and divided them by the total population of the country for each year. That gave me an accurate picture of per capita spending on core cost-of-living items.

Overall, living and breathing through Q4 2013 would have cost the average Canadian $4,356.38 (or $17,425.52 for a full year). Spending for those same categories in Q4 2024, however, cost us $6,266.48 – a 43.85 percent increase.

By contrast, the official CPI over those years rose only 31.03 percent. That’s quite the difference. Here’s how the year-over-year changes in CPI inflation vs actual spending inflation compare:

As you can see, with the exception of 2020 (when COVID left us with nothing to buy), the official inflation number was consistently and significantly lower than actual spending. And, in the case of 2021, it was more than double.

Since 2023, the items with the largest price growth were university education (57.46 percent), major household appliances (52.67 percent), and housing, water, electricity, gas, and other fuels (50.79).

Having said all that, you could justifiably argue that the true cost of living hasn’t really gone up that much, but that at least part of the increase in spending is due to a growing taste for luxury items and high volume consumption. I can’t put a precise number on that influence, but I suspect it’s not trivial.

Since data on spending doesn’t seem to be the best measure of inflation, perhaps I could build my own basket of costs and compare those numbers to the official CPI. To do that, I collected average monthly costs for gasoline, home rentals, a selection of 14 core grocery items, and taxes paid by the average Canadian homeowner.¹ I calculated the tax burden (federal, provincial, property, and consumption) using the average of the estimates of two AI models.

How did the inflation represented by my custom basket compare with the official CPI? Well between 2017 and 2024, the Statistics Canada’s CPI grew by 23.39 percent. Over that same time, the monthly cost of my basket grew from $4,514.74 to $5,665.18; a difference of 25.48 percent. That’s not nearly as dramatic a difference as we saw when we measured spending, but it’s not negligible either.

The very fact that the government makes all this data freely available to us is evidence that they’re not out to hide the truth. But it can’t hurt to keep an active and independent eye on them, too.

Subscribe to The Audit.

For the full experience, upgrade your subscription.

2025 Federal Election

Carney’s Hidden Climate Finance Agenda

From Energy Now

By Tammy Nemeth and Ron Wallace

It is high time that Canadians discuss and understand Mark Carney’s avowed plan to re-align capital with global Net Zero goals.

Mark Carney’s economic vision for Canada, one that spans energy, housing and defence, rests on an unspoken, largely undisclosed, linchpin: Climate Finance – one that promises a Net Zero future for Canada but which masks a radical economic overhaul.

Regrettably, Carney’s potential approach to a Net Zero future remains largely unexamined in this election. As the former chair of the Glasgow Financial Alliance for Net Zero (GFANZ), Carney has proposed new policies, offices, agencies, and bureaus required to achieve these goals.. Pieced together from his presentations, discussions, testimonies and book, Carney’s approach to climate finance appears to have four pillars: mandatory climate disclosures, mandatory transition plans, centralized data sharing via the United Nations’ Net Zero Data Public Utility (NZDPU) and compliance with voluntary carbon markets (VCMs). There are serious issues for Canada’s economy if these principles were to form the core values for policies under a potential Liberal government.

About the first pillar Carney has been unequivocal: “Achieving net zero requires a whole economy transition.” This would require a restructuring energy and financial systems to shift away from fossil fuels to renewable energy with Carney insisting repeatedly in his book that “every financial [and business] decision takes climate change into account.” Climate finance, unlike broader sustainable finance with its Environmental, Social, and Governance (ESG) focus would channel capital into sectors aligned with a 2050 Net Zero trajectory. Carney states: “Companies, and those who invest in them…who are part of the solution, will be rewarded. Those lagging behind…will be punished.” In other words, capital would flow to compliant firms but be withheld from so-called “high emitters”.

How will investors, banks and insurers distinguish solution from problem? Mandatory climate disclosures, aligned with the International Sustainability Standards Board (ISSB), would compel firms to report emissions and outline their Net Zero strategies. Canada’s Sustainability Standards Board has adopted these methodologies, despite concerns they would disadvantage Canadian businesses. Here, Carney repeatedly emphasizes disclosures as the cornerstone to track emissions data required to shift capital away from “high emitters”. Without this, he claims, large institutional investors lack the data on supply chains to make informed decisions to shift capital to businesses that are Net Zero compliant.

The second pillar, Mandatory Transition Plans would require companies to map a 2050 Net Zero trajectory for emission reduction targets. Failure to meet those targets would invite pressure from investors, banks, or activists, who may pursue litigation for non-compliance. The UK’s Transition Plan Task Force, now part of ISSB, provides this standardized framework. Carney, while at GFANZ, advocated using transition plans for a “managed phase-out” of high-emitting assets like coal, oil and gas, not just through divestment but by financing emissions reductions. “As part of their transition planning, [GFANZ] members should establish and apply financing policies to phase out and align carbon-intensive sectors and activities, such as thermal coal, oil and gas and deforestation, not only through asset divestment but also through transition finance that reduces real world emissions. To assist with these efforts GFANZ will continue to develop and implement a framework for the Managed Phase-out of high-emitting assets.” Clearly, the purpose of this is to ensure companies either decarbonize or face capital withdrawal.

The third pillar is the United Nations’ Net Zero Data Public Utility (NZDPU), a centralized platform for emissions and transition data. Carney insists these data be freely accessible, enabling investors, banks and insurers to judge companies’ progress to Net Zero. As Carney noted in 2021: “Private finance is judging…banks, pension funds and asset managers have to show where they are in the transition to Net Zero.” Hence, compliant firms would receive investment; laggards would face divestment.

Finally, voluntary carbon markets (VCMs) allow companies to offset emissions by purchasing credits from projects like reforestation. Carney, who launched the Taskforce on Scaling VCMs in 2020, has insisted on monitoring, verification and lifecycle tracking. At a 2024 Beijing conference, he suggested major jurisdictions could establish VCMs by COP 30 (planned for 2025 in Brazil) to create a global market. If Canada mandates VCMs, businesses especially small and medium enterprises (SMEs) would face much higher compliance costs with credits available only to those that demonstrate progress with transition plans.

These potential mandatory disclosures and transition plans would burden Canadian businesses with material costs and legal risks that constitute an economic gamble which few may recognize but all should weigh. Do Canadians truly want a government that has an undisclosed climate finance agenda that would be subservient to an opaque globalized Net Zero agenda?

Tammy Nemeth is a U.K.-based strategic energy analyst. Ron Wallace is an executive fellow of the Canadian Global Affairs Institute and the Canada West Foundation.

-

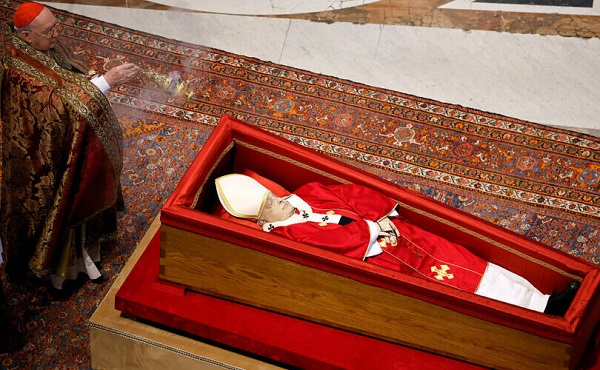

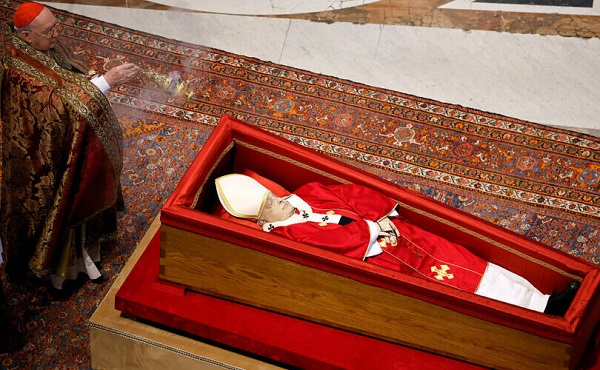

International2 days ago

International2 days agoPope Francis’ body on display at the Vatican until Friday

-

2025 Federal Election20 hours ago

2025 Federal Election20 hours agoCarney’s Hidden Climate Finance Agenda

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoFormer WEF insider accuses Mark Carney of using fear tactics to usher globalism into Canada

-

2025 Federal Election12 hours ago

2025 Federal Election12 hours agoThe Anhui Convergence: Chinese United Front Network Surfaces in Australian and Canadian Elections

-

2025 Federal Election10 hours ago

2025 Federal Election10 hours agoTrump Has Driven Canadians Crazy. This Is How Crazy.

-

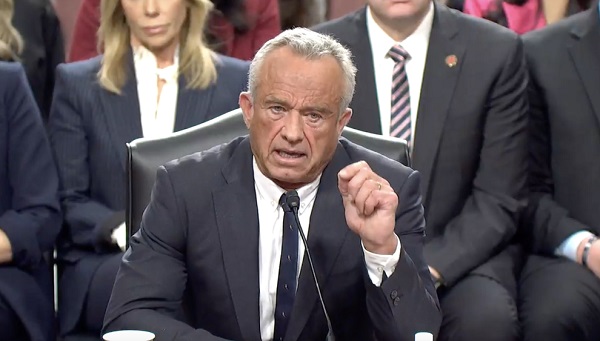

COVID-192 days ago

COVID-192 days agoRFK Jr. Launches Long-Awaited Offensive Against COVID-19 mRNA Shots

-

Business2 days ago

Business2 days agoTrump considers $5K bonus for moms to increase birthrate

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCanada’s press tries to turn the gender debate into a non-issue, pretend it’s not happening