Alberta

Red Deer Recovery Community will offer hope for residents from Central Alberta and around the world

Central Albertans won’t be the only ones paying close attention to the official opening of the Red Deer Recovery Community next month. According to Marshall Smith, Chief of Staff to Premier Danielle Smith, jurisdictions from across North America will be looking to the Red Deer Recovery Community for potential answers to their own issues. Red Deer Recovery Community will be the first of 11 the province is opening over the coming months.

Cities across North America and beyond have been battling an addictions crisis, and losing. As the number of homeless people and the number of fatal overdoses continues to rise, cities are looking for new solutions. After years of slipping further behind, Alberta has decided on a new approach to recovery and Marshall Smith has been leading the charge.

Smith is a recovering addict himself. A political organizer from BC, he once worked for former Premier Gordon Campbell. His own crisis started with alcohol, then moved to cocaine dependency before he eventually succumbed to methamphetamine use. The successful political operative found himself without work and living on the street for over four years. Eventually he benefited from a 35 day stay in a publicly funded recovery centre in BC.

Former Alberta Premier Jason Kenney brought Smith to Alberta to head up the UCP’s addictions and recovery file. His personal experiences and incredible comeback story are at the heart of Alberta’s new approach.

While the success of recovery programs vary, Marshall Smith and Dr. Christina Basedow of the Edgewood Health Network (operators of Red Deer Recovery Community) say with the right treatment and the right amount of time, they expect a very high rate of successful recoveries. Smith says the province won’t give up on patients, even if some have to go through more than once.

The Recovery Community is central to this new approach, but patients who will be able to stay for up to a year, will need somewhere to go when they leave. This week the province also announced the Bridge Healing Transitional Accommodation Program in Edmonton. This “second stage” housing will ensure former addicts have a place to stay upon leaving addiction treatment centres. This will be their home in the critical days following treatment when they need to reestablish their lives by finding work or educational opportunities.

Red Deer Mayor Ken Johnston feels the 75 bed Recovery Community will be transformation for Central Alberta. Mayor Johnston says all Central Albertans will play an important role in helping former addicts when they leave the Recovery Community.

Construction of the Red Deer Recovery Community is all but complete.

Thursday, municipal and provincial politicians toured the facility and were introduced to the operators of the new facility. Dr Christina Basedow, Western VP of Edgewood Health Network teamed up with Nicholas Milliken, Alberta’s Mental Health and Addiction Minister, to take questions about operations.

Red Deer South MLA Jason Stephan, Red Deer Mayor Ken Johnston, Dr. Christina Basedow, Minister Nicholas Milliken, Red Deer North MLA Adriana LaGrange

Premier Danielle Smith made the trip to Central Alberta to offer support for the project and see the facility first hand.

Red Deer Mayor Ken Johnston and Premier Danielle Smith listen to Chief of Staff Marshall Smith

Red Deer Mayor Ken Johnston and Premier Danielle Smith listen to Chief of Staff Marshall Smith

Marshall Smith explains aspects of the Recovery Community to Premier Danielle Smith, Red Deer Mayor Ken Johnston and Red Deer MLA’s Adriana LaGrange and Jason Stephan

Marshall Smith explains aspects of the Recovery Community to Premier Danielle Smith, Red Deer Mayor Ken Johnston and Red Deer MLA’s Adriana LaGrange and Jason Stephan

In the days leading up to an official opening expected in February, Edgewood Health Network is finalizing the admission process which will see the first batch of up to 75 people suffering addictions moving into single and double occupied rooms.

Typical double occupancy room at Red Deer Recovery Community

The new 75-bed facility, will begin accepting residents battling addictions in February. Those residents will stay for up to a full year accessing medications, programming and developing life skills.

In the meantime the province expects a recovery industry will be developing in Red Deer including second stage housing opportunities and counselling.

Alberta

Made in Alberta! Province makes it easier to support local products with Buy Local program

Show your Alberta side. Buy Local. |

When the going gets tough, Albertans stick together. That’s why Alberta’s government is launching a new campaign to benefit hard-working Albertans.

Global uncertainty is threatening the livelihoods of hard-working Alberta farmers, ranchers, processors and their families. The ‘Buy Local’ campaign, recently launched by Alberta’s government, encourages consumers to eat, drink and buy local to show our unified support for the province’s agriculture and food industry.

The government’s ‘Buy Local’ campaign encourages consumers to buy products from Alberta’s hard-working farmers, ranchers and food processors that produce safe, nutritious food for Albertans, Canadians and the world.

“It’s time to let these hard-working Albertans know we have their back. Now, more than ever, we need to shop local and buy made-in-Alberta products. The next time you are grocery shopping or go out for dinner or a drink with your friends or family, support local to demonstrate your Alberta pride. We are pleased tariffs don’t impact the ag industry right now and will keep advocating for our ag industry.”

Alberta’s government supports consumer choice. We are providing tools to help folks easily identify Alberta- and Canadian-made foods and products. Choosing local products keeps Albertans’ hard-earned dollars in our province. Whether it is farm-fresh vegetables, potatoes, honey, craft beer, frozen food or our world-renowned beef, Alberta has an abundance of fresh foods produced right on our doorstep.

Quick facts

- This summer, Albertans can support local at more than 150 farmers’ markets across the province and meet the folks who make, bake and grow our food.

- In March 2023, the Alberta government launched the ‘Made in Alberta’ voluntary food and beverage labelling program to support local agriculture and food sectors.

- Through direct connections with processors, the program has created the momentum to continue expanding consumer awareness about the ‘Made in Alberta’ label to help shoppers quickly identify foods and beverages produced in our province.

- Made in Alberta product catalogue website

Related information

Alberta

Province to expand services provided by Alberta Sheriffs: New policing option for municipalities

Expanding municipal police service options |

Proposed amendments would help ensure Alberta’s evolving public safety needs are met while also giving municipalities more options for local policing.

As first announced with the introduction of the Public Safety Statutes Amendment Act, 2024, Alberta’s government is considering creating a new independent agency police service to assume the police-like duties currently performed by Alberta Sheriffs. If passed, Bill 49 would lay additional groundwork for the new police service.

Proposed amendments to the Police Act recognize the unique challenges faced by different communities and seek to empower local governments to adopt strategies that effectively respond to their specific safety concerns, enhancing overall public safety across the province.

If passed, Bill 49 would specify that the new agency would be a Crown corporation with an independent board of directors to oversee its day-to-day operations. The new agency would be operationally independent from the government, consistent with all police services in Alberta. Unlike the Alberta Sheriffs, officers in the new police service would be directly employed by the police service rather than by the government.

“With this bill, we are taking the necessary steps to address the unique public safety concerns in communities across Alberta. As we work towards creating an independent agency police service, we are providing an essential component of Alberta’s police framework for years to come. Our aim is for the new agency is to ensure that Albertans are safe in their communities and receive the best possible service when they need it most.”

Additional amendments would allow municipalities to select the new agency as their local police service once it becomes fully operational and the necessary standards, capacity and frameworks are in place. Alberta’s government is committed to ensuring the new agency works collaboratively with all police services to meet the province’s evolving public safety needs and improve law enforcement response times, particularly in rural communities. While the RCMP would remain the official provincial police service, municipalities would have a new option for their local policing needs.

Once established, the agency would strengthen Alberta’s existing policing model and complement the province’s current police services, which include the RCMP, Indigenous police services and municipal police. It would help fill gaps and ensure law enforcement resources are deployed efficiently across the province.

Related information

-

2025 Federal Election17 hours ago

2025 Federal Election17 hours agoMEI-Ipsos poll: 56 per cent of Canadians support increasing access to non-governmental healthcare providers

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoEuthanasia is out of control in Canada, but nobody is talking about it on the campaign trail

-

2025 Federal Election1 day ago

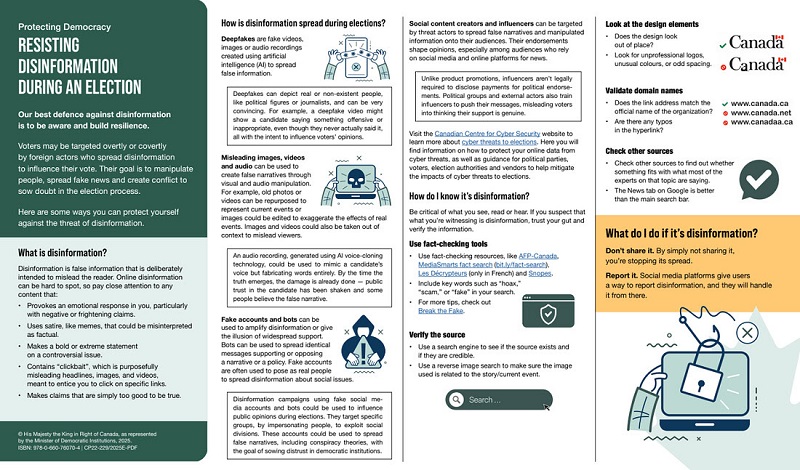

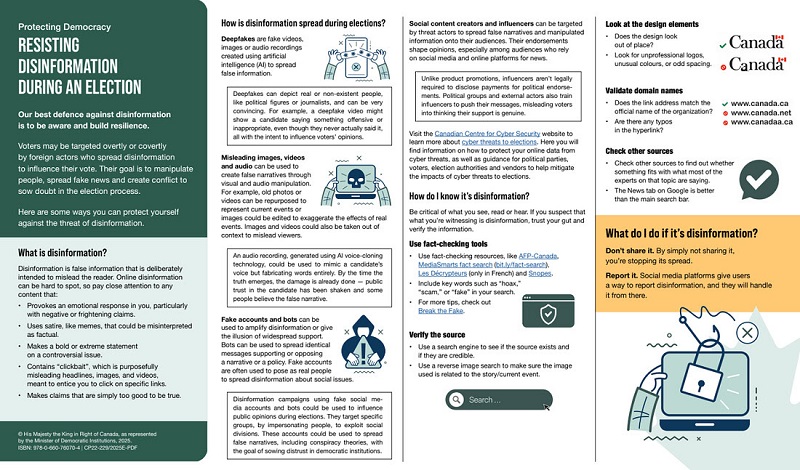

2025 Federal Election1 day agoAI-Driven Election Interference from China, Russia, and Iran Expected, Canadian Security Officials Warn

-

2025 Federal Election9 hours ago

2025 Federal Election9 hours agoRCMP Whistleblowers Accuse Members of Mark Carney’s Inner Circle of Security Breaches and Surveillance

-

Health17 hours ago

Health17 hours agoTrump admin directs NIH to study ‘regret and detransition’ after chemical, surgical gender transitioning

-

illegal immigration1 day ago

illegal immigration1 day agoDespite court rulings, the Trump Administration shows no interest in helping Abrego Garcia return to the U.S.

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoConservative MP Leslyn Lewis warns Canadian voters of Liberal plan to penalize religious charities

-

Bjorn Lomborg1 day ago

Bjorn Lomborg1 day agoGlobal Warming Policies Hurt the Poor