Alberta

Provincial Budget 2025: Meeting the challenge

To help Albertans with the high cost of living, Budget 2025 delivers on the promised tax cut that will save Albertans hundreds of dollars starting this year. The new eight per cent personal income tax bracket for income up to $60,000 is starting two years ahead of schedule and will save Albertan families up to $1,500 in 2025.

To meet the needs of a population that has grown rapidly in the last few years, Budget 2025 also makes the highest-ever investment in health care and education while moving forward with the Alberta government’s commitment to build schools and classroom spaces faster. The budget continues to support vulnerable Albertans and keep communities and provincial borders safe while supporting the economy, communities and sectors outside the oil and gas industry.

“Budget 2025 is a budget of tough but measured choices that meet the needs of Albertans and maintains our Alberta advantage. It cuts taxes, steadfastly supports public services and solidifies our economic foundation so it can withstand future headwinds.”

Budget 2025 takes a cautious approach in its economic outlook, reflecting the high risk of a Canada-U.S. trade conflict and the potential significant impact on the Alberta economy. The outlook assumes a moderate trade conflict where Canada will face an average 15 per cent tariffs on all goods, while energy products will face a 10 per cent tariff. Alberta will continue to work with federal, provincial and territorial partners to find solutions. Even in light of tariffs, the province expects moderate but continued growth in oil production and investment to keep the province’s economic engine humming. Alberta’s responsible crude oil exports are expected to continue to meet critical U.S energy needs, and the Trans Mountain Pipeline expansion will provide more export capacity for producers.

Investment will continue in existing major projects that are driving activity in industrial building construction, including Dow’s Path2Zero project, Air Products’ new hydrogen facility and Imperial Oil’s Strathcona Refinery renewable diesel expansion project.

Alberta’s housing market is expected to stand out as a bright spot in the economy as homebuilders work to meet the needs of a growing population A slower population growth will help the labour market gradually rebalance over the next few years.

While the province is facing significant economic uncertainty and revenue volatility, the government remains committed to making prudent spending decisions to keep operating expense growth below population growth plus inflation and to sustainably deliver important programs and services to Albertans and Alberta businesses.

Budget 2025 invests:

- $9.9 billion in operating expenses for education, an increase of 4.5 per cent from 2024-25, to help with enrolment pressures, hire more teachers and other educational staff, and support complex classrooms and students.

- $2.6 billion over three years for educational (K-12) infrastructure, an increase of $505 million or 23.9 per cent from Budget 2024. This funding will support the construction of more than 200,000 new and modernized student spaces over the next seven years (almost 90,000 within the next four years).

- $28 billion in operating expense, an increase of $1.4 billion or 5.4 per cent, across the refocused health care system including:

- $22.1 billion to health care to improve access to quality health services close to home, prioritize patients, build capacity at hospitals and rural facilities, expand surgeries and compensate and retain health professionals.

- $1.7 billion for implementing the compassionate intervention framework and Recovery Alberta Services.

- $3.8 billion to focus on making the full continuum of care available to all Albertans, from assisted living, home care and community care, to housing and social supports with wraparound social services.

- $1.3 billion for operating expense for Public Safety and Emergency Services, an increase of 3.7 per cent from 2024-25, to support Alberta Sheriffs, Correctional Services and emergency management in the work to keep Alberta communities safe and secure the southern border.

- $1.6 billion, or a six per cent increase from last year, for Children and Family Services to strengthen the programs vulnerable children and families rely on.

- $6.2 billion, or an 8.8 per cent increase from 2024-25, to support core social programs, including a short-term bump to support more people affected by potential U.S. tariffs and rising grants for housing programs.

- Overall, Budget 2025’s Capital Plan includes $26.1 billion over three years, an increase of 4.4 per cent or $1.1 billion more than Budget 2024, to meet the challenge of growth and build and enhance schools, hospitals, roads and bridges in the province. The plan is projected to support an average of 26,500 direct and 12,000 indirect jobs annually through 2027-28.

The province is also continuing to focus on building the Heritage Fund to $250 billion by 2050. The fund was valued at $25 billion in the third fiscal quarter of 2024-25 and is expected to grow to about $27 billion by the end of the fiscal year. A renewed Heritage Fund that earns money year over year will secure a resilient and prosperous Alberta for generations to come and lessen the province’s reliance on natural resource revenues. An independent board of directors and a new Heritage Fund Opportunities Corporation will unlock access to new opportunities and partnerships with global sovereign wealth funds.

Revenue

- Total revenue in 2025-26 is forecast at $74.1 billion, a decrease of $6.6 billion from the 2024-25 forecast of $80.7 billion. Total revenue is forecast to grow to $77.4 billion in 2026-27 and $80 billion by 2027-28, with broad-based revenue growth led primarily by income taxes.

- The decrease in 2025-26 comes mainly from a $4.4 billion drop in non-renewable resource revenue, driven by an anticipated decline in oil prices. This revenue source is forecast at $17.1 billion in 2025-26, compared to the $21.5 billion forecast for 2024-25.

- Revenue from personal income taxes is estimated to decrease to $15.5 billion in 2025-26, down from the $16.1 billion at the third quarter, due to the new eight per cent income tax bracket and negative impacts associated with potential tariffs. Personal income tax revenue is forecast to grow moderately in the following two years as more people continue to move to Alberta.

- Corporate income tax revenue is estimated at $6.8 billion in 2025-26, down $586 million from the third-quarter forecast for 2024-25, but rising over the next two years.

Expense

- Total expense in 2025-26 is forecast at $79.3 billion, an increase of $4.4 billion or 5.9 per cent from the 2024-25 third quarter forecast.

- Total expense is expected to be $79.8 billion in 2026-27 and $82 billion in 2027-28, or an increase of about 1.7 per cent per year.

- Operating expense is estimated at $64.3 billion, an increase of $2.2 billion or 3.6 per cent from the 2024-25 third quarter forecast.

- Operating expense grows to $64.8 billion in 2026-27 and $66.5 billion in 2027-28, an average increase of 1.7 per cent per year.

- A contingency of $4 billion will help to provide government with more flexibility to address unforeseen implications of increased economic uncertainty as well as compensation expense for collective bargaining currently underway.

Deficit

- A deficit of $5.2 billion is forecast for 2025-26.

- The deficit is forecast to drop to $2.4 billion and $2 billion for 2026-27 and 2027-28, respectively.

- The government’s fiscal framework includes allowable exceptions for when the government can run a deficit, including when there is a significant drop in revenue.

- This deficit is largely the result of falling non-renewable resource revenues and increases in costs necessary to provide world-class services to Albertans.

Debt

- Debt servicing costs are forecast to decrease by $231 million in 2025-26 from the 2024-25 forecast, to $3 billion, as funds pre-borrowed in 2024-25 will be used to repay sizeable debt maturities coming due in early 2025-26.

Economic Outlook

- In 2025, real gross domestic product is expected to decelerate to 1.8 per cent, then 1.7 per cent in 2026.

- Population growth is expected to moderate, growing at 2.5 per cent in the 2025 census year, down from the record 4.4 per cent growth in 2024. Growth will shift down to 1.4 per cent over the following two years, then 1.6 per cent in 2028.

Energy and economic assumptions, 2025-26

- West Texas Intermediate oil (USD/bbl) $68

- Western Canadian Select @ Hardisty (CND/bbl) $73.10

- Light-heavy differential (USD/bbl) $17.10

- ARP natural gas (CND/GJ) $2.50

- Conventional crude production (000s barrels/day) 519

- Raw bitumen production (000s barrels/day) 3,558

- Canadian dollar exchange rate (USD¢/CAD$) 69.60

- Interest rate (10-year Canada bonds, per cent) 3.10

Related information

2025 Federal Election

Next federal government should recognize Alberta’s important role in the federation

From the Fraser Institute

By Tegan Hill

With the tariff war continuing and the federal election underway, Canadians should understand what the last federal government seemingly did not—a strong Alberta makes for a stronger Canada.

And yet, current federal policies disproportionately and negatively impact the province. The list includes Bill C-69 (which imposes complex, uncertain and onerous review requirements on major energy projects), Bill C-48 (which bans large oil tankers off British Columbia’s northern coast and limits access to Asian markets), an arbitrary cap on oil and gas emissions, numerous other “net-zero” targets, and so on.

Meanwhile, Albertans contribute significantly more to federal revenues and national programs than they receive back in spending on transfers and programs including the Canada Pension Plan (CPP) because Alberta has relatively high rates of employment, higher average incomes and a younger population.

For instance, since 1976 Alberta’s employment rate (the number of employed people as a share of the population 15 years of age and over) has averaged 67.4 per cent compared to 59.7 per cent in the rest of Canada, and annual market income (including employment and investment income) has exceeded that in the other provinces by $10,918 (on average).

As a result, Alberta’s total net contribution to federal finances (total federal taxes and payments paid by Albertans minus federal money spent or transferred to Albertans) was $244.6 billion from 2007 to 2022—more than five times as much as the net contribution from British Columbians or Ontarians. That’s a massive outsized contribution given Alberta’s population, which is smaller than B.C. and much smaller than Ontario.

Albertans’ net contribution to the CPP is particularly significant. From 1981 to 2022, Alberta workers contributed 14.4 per cent (on average) of total CPP payments paid to retirees in Canada while retirees in the province received only 10.0 per cent of the payments. Albertans made a cumulative net contribution to the CPP (the difference between total CPP contributions made by Albertans and CPP benefits paid to retirees in Alberta) of $53.6 billion over the period—approximately six times greater than the net contribution of B.C., the only other net contributing province to the CPP. Indeed, only two of the nine provinces that participate in the CPP contribute more in payroll taxes to the program than their residents receive back in benefits.

So what would happen if Alberta withdrew from the CPP?

For starters, the basic CPP contribution rate of 9.9 per cent (typically deducted from our paycheques) for Canadians outside Alberta (excluding Quebec) would have to increase for the program to remain sustainable. For a new standalone plan in Alberta, the rate would likely be lower, with estimates ranging from 5.85 per cent to 8.2 per cent. In other words, based on these estimates, if Alberta withdrew from the CPP, Alberta workers could receive the same retirement benefits but at a lower cost (i.e. lower payroll tax) than other Canadians while the payroll tax would have to increase for the rest of the country while the benefits remained the same.

Finally, despite any claims to the contrary, according to Statistics Canada, Alberta’s demographic advantage, which fuels its outsized contribution to the CPP, will only widen in the years ahead. Alberta will likely maintain relatively high employment rates and continue to welcome workers from across Canada and around the world. And considering Alberta recorded the highest average inflation-adjusted economic growth in Canada since 1981, with Albertans’ inflation-adjusted market income exceeding the average of the other provinces every year since 1971, Albertans will likely continue to pay an outsized portion for the CPP. Of course, the idea for Alberta to withdraw from the CPP and create its own provincial plan isn’t new. In 2001, several notable public figures, including Stephen Harper, wrote the famous Alberta “firewall” letter suggesting the province should take control of its future after being marginalized by the federal government.

The next federal government—whoever that may be—should understand Alberta’s crucial role in the federation. For a stronger Canada, especially during uncertain times, Ottawa should support a strong Alberta including its energy industry.

Alberta

Province announces plans for nine new ‘urgent care centres’ – redirecting 200,000 hospital visits

Expanding urgent care across Alberta

If passed, Budget 2025 includes $17 million in planning funds to support the development of urgent care facilities across the province.

As Alberta’s population grows, so does the demand for health care. In response, the government is making significant investments to ensure every Albertan has access to high-quality care close to home. Currently, more than 35 per cent of emergency department visits are for non-life-threatening conditions that could be treated at urgent care centres. By expanding these centres, Alberta’s government is enhancing the health care system and improving access to timely care.

If passed, Budget 2025 includes $15 million to support plans for eight new urgent care centres and an additional $2 million in planning funds for an integrated primary and urgent care facility in Airdrie. These investments will help redirect up to 200,000 lower-acuity emergency department visits annually, freeing up capacity for life-threatening cases, reducing wait times and improving access to care for Albertans.

“More people are choosing to call Alberta home, which is why we are taking action to build capacity across the health care system. Urgent care centres help bridge the gap between primary care and emergency departments, providing timely care for non-life-threatening conditions.”

“Our team at Infrastructure is fully committed to leading the important task of planning these eight new urgent care facilities across the province. Investments into facilities like these help strengthen our communities by alleviating strains on emergency departments and enhance access to care. I am looking forward to the important work ahead.”

The locations for the eight new urgent care centres were selected based on current and projected increases in demand for lower-acuity care at emergency departments. The new facilities will be in west Edmonton, south Edmonton, Westview (Stony Plain/Spruce Grove), east Calgary, Lethbridge, Medicine Hat, Cold Lake and Fort McMurray.

“Too many Albertans, especially those living in rural communities, are travelling significant distances to receive care. Advancing plans for new urgent care centres will build capacity across the health care system.”

“Additional urgent care centres across Alberta will give Albertans more options for accessing the right level of care when it’s needed. This is a necessary and substantial investment that will eventually ease some of the pressures on our emergency departments.”

The remaining $2 million will support planning for One Health Airdrie’s integrated primary and urgent care facility. The operating model, approved last fall, will see One Health Airdrie as the primary care operator, while urgent care services will be publicly funded and operated by a provider selected through a competitive process.

“Our new Airdrie facility, offering integrated primary and urgent care, will provide same-day access to approximately 30,000 primary care patients and increase urgent care capacity by around 200 per cent, benefiting the entire community and surrounding areas. We are very excited.”

Alberta’s government will continue to make smart, strategic investments in health facilities to support the delivery of publicly funded health programs and services to ensure Albertans have access to the care they need, when and where they need it.

Budget 2025 is meeting the challenge faced by Alberta with continued investments in education and health, lower taxes for families and a focus on the economy.

Quick facts

- The $2 million in planning funds for One Health Airdrie are part of a total $24-million investment to advance planning on several health capital initiatives across the province through Budget 2025.

- Alberta’s population is growing, and visits to emergency departments are projected to increase by 27 per cent by 2038.

- Last year, Alberta’s government provided $8.4 million for renovations to the existing Airdrie Community Health Centre.

Related information

-

Uncategorized2 days ago

Uncategorized2 days agoPoilievre on 2025 Election Interference – Carney sill hasn’t fired Liberal MP in Chinese election interference scandal

-

2025 Federal Election1 day ago

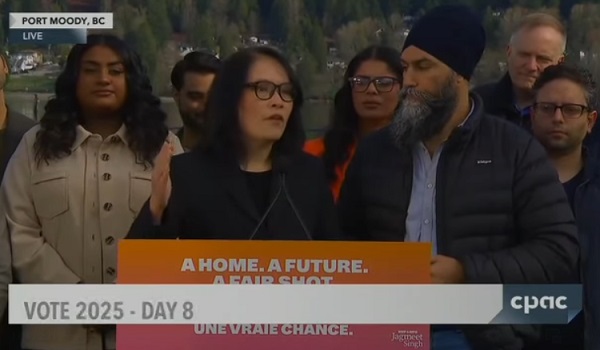

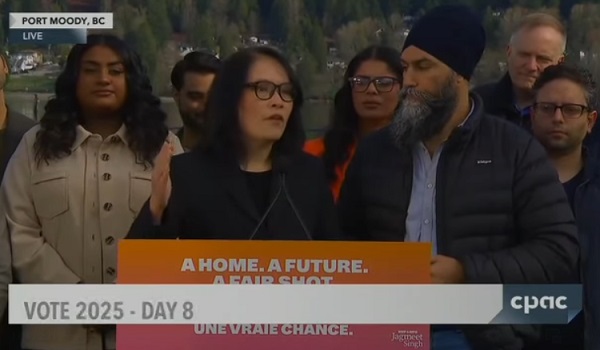

2025 Federal Election1 day agoChinese Election Interference – NDP reaction to bounty on Conservative candidate

-

2025 Federal Election1 day ago

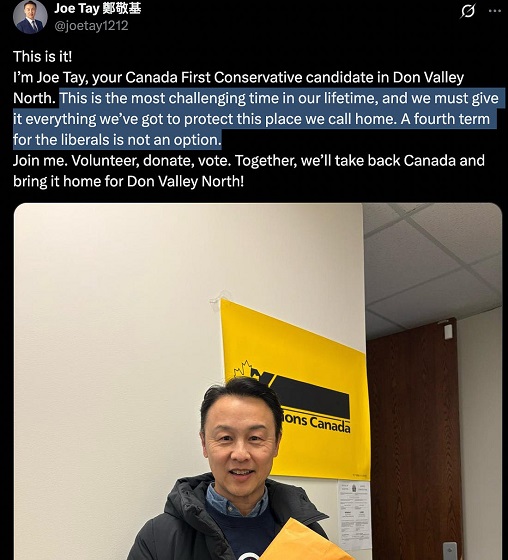

2025 Federal Election1 day agoChina Election Interference – Parties Received Security Briefing Days Ago as SITE Monitors Threats to Conservative Candidate Joe Tay

-

2025 Federal Election21 hours ago

2025 Federal Election21 hours agoLondon-Based Human Rights Group Urges RCMP to Investigate Liberal MP for Possible Counselling of Kidnapping

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoHong Kong-Canadian Groups Demand PM Carney Drop Liberal Candidate Over “Bounty” Remark Supporting CCP Repression

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoJoe Tay Says He Contacted RCMP for Protection, Demands Carney Fire MP Over “Bounty” Remark

-

2025 Federal Election24 hours ago

2025 Federal Election24 hours agoFixing Canada’s immigration system should be next government’s top priority

-

2025 Federal Election23 hours ago

2025 Federal Election23 hours agoBeijing’s Echo Chamber in Parliament: Part 2 – Still No Action from Carney