Alberta

Province adds $335 million over three years to attract more investment from Hollywood

Action! for Alberta’s film and television industry

Alberta’s screen-based sector has momentum, and Alberta’s government is helping to make the province a magnet for the job-creating film and television industry.

In 2020, Alberta’s government launched the Film and Television Tax Credit, causing the province’s film and television industry to grow in size and reputation. Since then, Alberta has attracted 129 productions with a total production value of $1.7 billion. This growth has resulted in approximately 9,000 direct and indirect jobs for Albertans.

To keep this momentum going, Alberta’s government continues to make changes to the program and increase investment in it. One year after the tax credit was launched, the cap was raised, resulting in a doubling of the province’s film and television sector. Now, Alberta’s government is increasing its investment to a total of $335 million over three years to continue attracting the attention and investment dollars of Hollywood.

“Alberta is experiencing exponential growth in our film and television sector, and we are well on our way to becoming a top Canadian jurisdiction for producers from around the world. Since the introduction of the Film and Television Tax Credit, the film and television sector in Alberta has doubled. Productions reach every part of Alberta – big cities, small towns and rural locations – and use local resources, businesses, accommodations and contractors, supporting thousands of jobs.”

As the province’s film and television industry grows, so does the quality and number of Alberta-made productions. To help grow and promote local talent and productions, Alberta’s government is also doubling the funding to the Alberta Made Screen Industries Program. This funding will support local producers and attract productions from around the world to set up shop in Alberta.

“Alberta-made film and television productions showcase Alberta’s unique culture, breathtaking landscapes and stories to audiences across the globe. We are increasing our support to smaller productions because they provide a unique Alberta-made training ground for emerging talent and create local, highly skilled workers in the sector.”

The Film and Television Tax Credit and Alberta Made Screen Industries Program work together to showcase the beauty and diversity of Alberta, create jobs, diversify the economy and support hospitality, service and tourism in the province. These targeted incentives to the film and television industries are helping to ensure Alberta remains the economic engine of Canada for years to come and the next film and television hub.

“The tax credit is central to the success of the industry. This is a competitive industry globally, and here in Alberta we’re fortunate we had the cap removed. Now we can see productions with budgets from $100,000 to well over $100 million. Now that we have a robust production environment, there are more opportunities for people to have well-paying creative jobs.”

“The Alberta government has provided supports for the film and television industry that provide certainty. It gives us more flexibility in how we’re moving forward in our film and television work and the way that we’re running our businesses.”

“Seeing the increase to the Alberta Made Production Grant in the last budget has been fantastic. It will help grow the local industry, which means so much to local performers because that’s where they build their resumés. It allows them to be a working performer, and not take side jobs or a day job somewhere else, and really focus on their craft.”

Quick facts

- According to Statistics Canada data:

- Every $1 million of production activity in the screen-based production sector creates about 13 Alberta jobs.

- Every $1 million of government investment under the Film and Television Tax Credit program is expected to support about 85 Alberta jobs.

- The film and television industry is experiencing significant growth nationally and globally.

- Every year, Alberta graduates more than 3,000 creative industry professionals from its post-secondary institutions.

- The production workforce has grown 71 per cent from 2017, or by about 4,000 workers across all positions.

- Alberta’s Film and Television Tax Credit supports medium- and large-scale productions with costs over $499,999 through a refundable tax credit on eligible Alberta production and labour costs to corporations that produce films, television series and other eligible screen-based productions.

- The Alberta Made Production Grant supports productions with a budget of up to $499,999.

- The Alberta Made Screen Industries Program, through the Alberta Made Production Grant, supports smaller productions that do not qualify for the tax credit, covering 25 per cent of eligible Alberta production costs to a maximum of $125,000.

- Every $1 investment in the Alberta Made Production Grant program generates an additional $4 in economic return.

Alberta

Made in Alberta! Province makes it easier to support local products with Buy Local program

Show your Alberta side. Buy Local. |

When the going gets tough, Albertans stick together. That’s why Alberta’s government is launching a new campaign to benefit hard-working Albertans.

Global uncertainty is threatening the livelihoods of hard-working Alberta farmers, ranchers, processors and their families. The ‘Buy Local’ campaign, recently launched by Alberta’s government, encourages consumers to eat, drink and buy local to show our unified support for the province’s agriculture and food industry.

The government’s ‘Buy Local’ campaign encourages consumers to buy products from Alberta’s hard-working farmers, ranchers and food processors that produce safe, nutritious food for Albertans, Canadians and the world.

“It’s time to let these hard-working Albertans know we have their back. Now, more than ever, we need to shop local and buy made-in-Alberta products. The next time you are grocery shopping or go out for dinner or a drink with your friends or family, support local to demonstrate your Alberta pride. We are pleased tariffs don’t impact the ag industry right now and will keep advocating for our ag industry.”

Alberta’s government supports consumer choice. We are providing tools to help folks easily identify Alberta- and Canadian-made foods and products. Choosing local products keeps Albertans’ hard-earned dollars in our province. Whether it is farm-fresh vegetables, potatoes, honey, craft beer, frozen food or our world-renowned beef, Alberta has an abundance of fresh foods produced right on our doorstep.

Quick facts

- This summer, Albertans can support local at more than 150 farmers’ markets across the province and meet the folks who make, bake and grow our food.

- In March 2023, the Alberta government launched the ‘Made in Alberta’ voluntary food and beverage labelling program to support local agriculture and food sectors.

- Through direct connections with processors, the program has created the momentum to continue expanding consumer awareness about the ‘Made in Alberta’ label to help shoppers quickly identify foods and beverages produced in our province.

- Made in Alberta product catalogue website

Related information

Alberta

Province to expand services provided by Alberta Sheriffs: New policing option for municipalities

Expanding municipal police service options |

Proposed amendments would help ensure Alberta’s evolving public safety needs are met while also giving municipalities more options for local policing.

As first announced with the introduction of the Public Safety Statutes Amendment Act, 2024, Alberta’s government is considering creating a new independent agency police service to assume the police-like duties currently performed by Alberta Sheriffs. If passed, Bill 49 would lay additional groundwork for the new police service.

Proposed amendments to the Police Act recognize the unique challenges faced by different communities and seek to empower local governments to adopt strategies that effectively respond to their specific safety concerns, enhancing overall public safety across the province.

If passed, Bill 49 would specify that the new agency would be a Crown corporation with an independent board of directors to oversee its day-to-day operations. The new agency would be operationally independent from the government, consistent with all police services in Alberta. Unlike the Alberta Sheriffs, officers in the new police service would be directly employed by the police service rather than by the government.

“With this bill, we are taking the necessary steps to address the unique public safety concerns in communities across Alberta. As we work towards creating an independent agency police service, we are providing an essential component of Alberta’s police framework for years to come. Our aim is for the new agency is to ensure that Albertans are safe in their communities and receive the best possible service when they need it most.”

Additional amendments would allow municipalities to select the new agency as their local police service once it becomes fully operational and the necessary standards, capacity and frameworks are in place. Alberta’s government is committed to ensuring the new agency works collaboratively with all police services to meet the province’s evolving public safety needs and improve law enforcement response times, particularly in rural communities. While the RCMP would remain the official provincial police service, municipalities would have a new option for their local policing needs.

Once established, the agency would strengthen Alberta’s existing policing model and complement the province’s current police services, which include the RCMP, Indigenous police services and municipal police. It would help fill gaps and ensure law enforcement resources are deployed efficiently across the province.

Related information

-

Daily Caller2 days ago

Daily Caller2 days agoTrump Executive Orders ensure ‘Beautiful Clean’ Affordable Coal will continue to bolster US energy grid

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoBREAKING from THE BUREAU: Pro-Beijing Group That Pushed Erin O’Toole’s Exit Warns Chinese Canadians to “Vote Carefully”

-

Business2 days ago

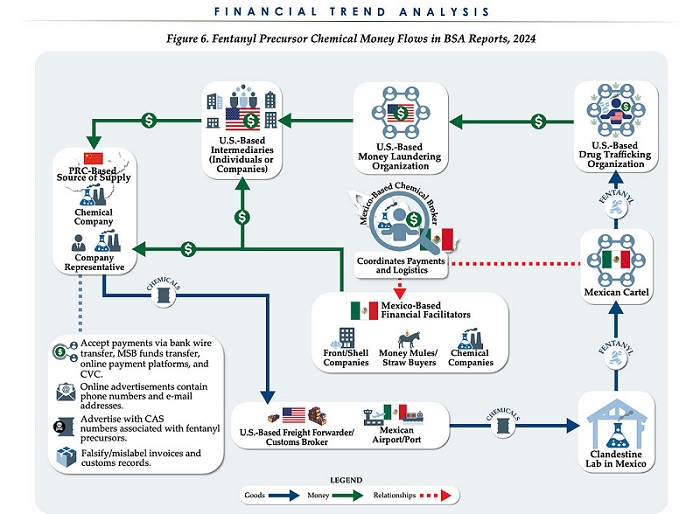

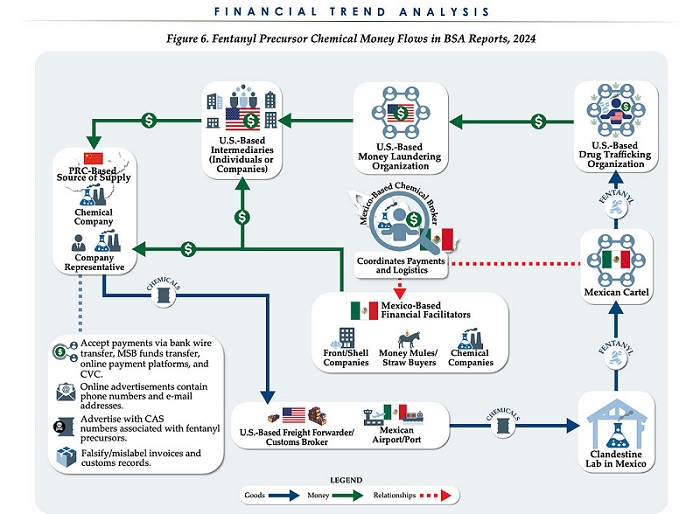

Business2 days agoChina, Mexico, Canada Flagged in $1.4 Billion Fentanyl Trade by U.S. Financial Watchdog

-

COVID-191 day ago

COVID-191 day agoTamara Lich and Chris Barber trial update: The Longest Mischief Trial of All Time continues..

-

Energy2 days ago

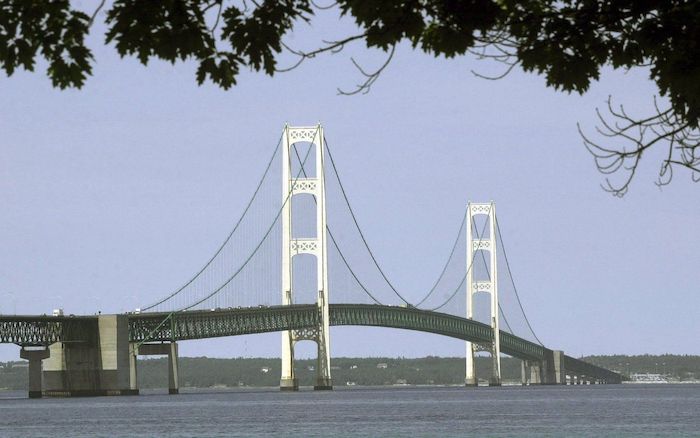

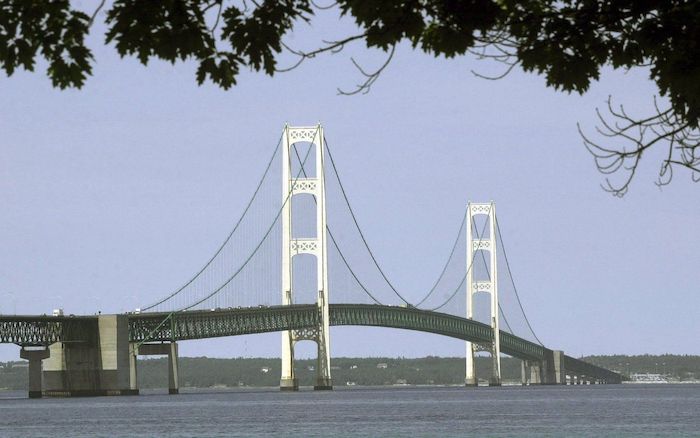

Energy2 days agoStraits of Mackinac Tunnel for Line 5 Pipeline to get “accelerated review”: US Army Corps of Engineers

-

2025 Federal Election17 hours ago

2025 Federal Election17 hours agoPRC-Linked Disinformation Claims Conservatives Threaten Chinese Diaspora Interests, Take Aim at PM Carney’s Debate Remark

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoAllegations of ethical misconduct by the Prime Minister and Government of Canada during the current federal election campaign

-

Daily Caller2 days ago

Daily Caller2 days agoDOJ Releases Dossier Of Deported Maryland Man’s Alleged MS-13 Gang Ties