Canadian Energy Centre

Proposed emissions cap threatens critical Canada-U.S. energy trade

From the Canadian Energy Centre

The vast majority of Canadian oil exports to the United States are processed in Midwest states. Above, the Cushing Terminal near Cushing, Oklahoma is Enbridge’s largest tank farm and the most significant trading hub for North American crude.

Canada and the United States share something that doesn’t exist anywhere else. A vast, interconnected energy network that today produces more oil and gas than any other region – including the Middle East, according to analysis by S&P Global.

It’s a blanket of energy security researchers called “a powerful card to play” in increasingly unstable times.

But, according to two leaders in governance and energy policy, that relationship is at risk.

Analysis has shown that the federal proposal to cap emissions in Canada’s oil and gas sector would result in reduced production. That likely means less energy available to Canada’s largest customer, the United States.

Jamie Tronnes, executive director of the Center for North American Prosperity and Security, is a former Canadian political staffer born in northern Alberta now living in Washington, D.C.

Heather Exner-Pirot is a prominent energy policy analyst and senior fellow with the Ottawa-based Macdonald-Laurier Institute.

Here’s what they shared with CEC.

CEC: The U.S. is one of the world’s largest oil and gas producers. Why does it need imports from Canada?

HEP: It’s because all oil is not the same. The United States developed its refinery industry before the shale revolution, when they were importing heavier crudes. Canada has that heavier crude. They are now exporting some of their sweet light oil and importing Canadian crude because that’s what their refinery mix requires.

What’s interesting is that we have never exported more Canadian crude to the United States than we are right now. Even as they have become the world’s largest oil producer, they’ve never needed Canadian oil more than today.

They also import a ton of natural gas from us. They have become the world’s biggest gas producer and the world’s biggest gas exporter, but part of that, and having their LNG capacity being able to so quickly surpass Qatar and Australia, is because some of the production is being backfilled by Canada.

CEC: Will the incoming new administration (either Democrat or Republican) impact the Canada-U.S. energy relationship?

JT: I don’t see a big change happening in such a way as it did when the Biden administration came in with the axing of the Keystone XL pipeline. Now that Russia has invaded Ukraine, the global energy market has changed radically.

On the Republican side, Trump often repeats the phrase “drill, baby drill.” The issue is that the U.S. is already drilling about as much as demand allows.

I don’t think a Harris government would move quickly to limit oil and gas production without having a strategic alternative in place. It simply would make her look very weak, and she has explicitly said that she would not ban fracking.

In the post-COVID world, I believe that the Democrat side of the aisle is coming to the view that it was a geopolitical mistake in terms of securing North American energy dominance to cut the Keystone XL pipeline.

The reality is that being able to export refined Canadian feedstock is key to keeping the U.S. as an energy superpower.

The U.S. government continues to offer and subsidize tax credits for investment in carbon capture technology. Even though Trump has said that he would end all of those carbon capture credits and subsidies, it still would not stop the U.S. from importing Canadian oil and gas.

That’s only going to grow as things like AI continue to create more demand for energy. A huge amount of the United States electrical energy grid is powered still by natural gas, and that’s going to take decades to change.

CEC: Would a reduction in Canadian production from the federal government’s proposed oil and gas emissions cap impact the United States?

HEP: Yes, and we should be raising the alarm bells. The federal government has said it is a cap on emissions, not a cap on production, but all the analysis that Alberta and the oil and gas sector have done is that it will create somewhere between 1 million and 2 million barrels of production being shut in.

Well, 95 per cent of our exports are to the United States. If we are shutting in 1 million barrels or 2 million barrels, that all comes out of their end just when their shale oil is expected to plateau and decline.

A cap would also tap down natural gas production and LNG capacity. If you’re Japan or South Korea and you’re looking to secure 20 years of supply, the cap creates a lot of uncertainty with that Canadian supply. There’s zero uncertainty with Qatar’s supply. If you’re Japanese, these are not pleasant conversations. This is not giving you confidence. And if you don’t have confidence in LNG, you’re going to burn coal.

In a perfect world, Canada would supply LNG to Asia, the United States would supply it to Europe, and we’d be a pretty energy-independent Western alliance.

I wish we would be honest that we need a different way to reduce emissions that does not take away from production, because that capacity is a big part of what we offer our allies right now.

JT: It threatens the security of North America in a big way because the energy dominance of the United States is tied to Canada. Especially with what’s going on in Russia and other countries, it behooves us as Canadians and me as an American to remember that security is not freely granted.

We have to make sure that we are thinking more holistically when we think of things like emissions cap legislation that’s going to have knock-on effects and may even increase emissions. If you’re trying to replace that feedstock, it’s got to come from somewhere.

Business

Why it’s time to repeal the oil tanker ban on B.C.’s north coast

The Port of Prince Rupert on the north coast of British Columbia. Photo courtesy Prince Rupert Port Authority

From the Canadian Energy Centre

By Will Gibson

Moratorium does little to improve marine safety while sending the wrong message to energy investors

In 2019, Martha Hall Findlay, then-CEO of the Canada West Foundation, penned a strongly worded op-ed in the Globe and Mail calling the federal ban of oil tankers on B.C.’s northern coast “un-Canadian.”

Six years later, her opinion hasn’t changed.

“It was bad legislation and the government should get rid of it,” said Hall Findlay, now director of the University of Calgary’s School of Public Policy.

The moratorium, known as Bill C-48, banned vessels carrying more than 12,500 tonnes of oil from accessing northern B.C. ports.

Targeting products from one sector in one area does little to achieve the goal of overall improved marine transport safety, she said.

“There are risks associated with any kind of transportation with any goods, and not all of them are with oil tankers. All that singling out one part of one coast did was prevent more oil and gas from being produced that could be shipped off that coast,” she said.

Hall Findlay is a former Liberal MP who served as Suncor Energy’s chief sustainability officer before taking on her role at the University of Calgary.

She sees an opportunity to remove the tanker moratorium in light of changing attitudes about resource development across Canada and a new federal government that has publicly committed to delivering nation-building energy projects.

“There’s a greater recognition in large portions of the public across the country, not just Alberta and Saskatchewan, that Canada is too dependent on the United States as the only customer for our energy products,” she said.

“There are better alternatives to C-48, such as setting aside what are called Particularly Sensitive Sea Areas, which have been established in areas such as the Great Barrier Reef and the Galapagos Islands.”

The Business Council of British Columbia, which represents more than 200 companies, post-secondary institutions and industry associations, echoes Hall Findlay’s call for the tanker ban to be repealed.

“Comparable shipments face no such restrictions on the East Coast,” said Denise Mullen, the council’s director of environment, sustainability and Indigenous relations.

“This unfair treatment reinforces Canada’s over-reliance on the U.S. market, where Canadian oil is sold at a discount, by restricting access to Asia-Pacific markets.

“This results in billions in lost government revenues and reduced private investment at a time when our economy can least afford it.”

The ban on tanker traffic specifically in northern B.C. doesn’t make sense given Canada already has strong marine safety regulations in place, Mullen said.

Notably, completion of the Trans Mountain Pipeline expansion in 2024 also doubled marine spill response capacity on Canada’s West Coast. A $170 million investment added new equipment, personnel and response bases in the Salish Sea.

“The [C-48] moratorium adds little real protection while sending a damaging message to global investors,” she said.

“This undermines the confidence needed for long-term investment in critical trade-enabling infrastructure.”

Indigenous Resource Network executive director John Desjarlais senses there’s an openness to revisiting the issue for Indigenous communities.

“Sentiment has changed and evolved in the past six years,” he said.

“There are still concerns and trust that needs to be built. But there’s also a recognition that in addition to environmental impacts, [there are] consequences of not doing it in terms of an economic impact as well as the cascading socio-economic impacts.”

The ban effectively killed the proposed $16-billion Eagle Spirit project, an Indigenous-led pipeline that would have shipped oil from northern Alberta to a tidewater export terminal at Prince Rupert, B.C.

“When you have Indigenous participants who want to advance these projects, the moratorium needs to be revisited,” Desjarlais said.

He notes that in the six years since the tanker ban went into effect, there are growing partnerships between B.C. First Nations and the energy industry, including the Haisla Nation’s Cedar LNG project and the Nisga’a Nation’s Ksi Lisims LNG project.

This has deepened the trust that projects can mitigate risks while providing economic reconciliation and benefits to communities, Dejarlais said.

“Industry has come leaps and bounds in terms of working with First Nations,” he said.

“They are treating the rights of the communities they work with appropriately in terms of project risk and returns.”

Hall Findlay is cautiously optimistic that the tanker ban will be replaced by more appropriate legislation.

“I’m hoping that we see the revival of a federal government that brings pragmatism to governing the country,” she said.

“Repealing C-48 would be a sign of that happening.”

Alberta

The permanent CO2 storage site at the end of the Alberta Carbon Trunk Line is just getting started

Wells at the Clive carbon capture, utilization and storage project near Red Deer, Alta. Photo courtesy Enhance Energy

From the Canadian Energy Centre

Inside Clive, a model for reducing emissions while adding value in Alberta

It’s a bright spring day on a stretch of rolling farmland just northeast of Red Deer. It’s quiet, but for the wind rushing through the grass and the soft crunch of gravel underfoot.

The unassuming wellheads spaced widely across the landscape give little hint of the significance of what is happening underground.

In just five years, this site has locked away more than 6.5 million tonnes of CO₂ — equivalent to the annual emissions of about 1.5 million cars — stored nearly four CN Towers deep beneath the surface.

The CO₂ injection has not only reduced emissions but also breathed life into an oilfield that was heading for abandonment, generating jobs, economic activity and government revenue that would have otherwise been lost.

This is Clive, the endpoint of one of Canada’s largest carbon capture, utilization and storage (CCUS) projects. And it’s just getting started.

Rooted in Alberta’s first oil boom

Clive’s history ties to Alberta’s first oil boom, with the field discovered in 1952 along the same geological trend as the legendary 1947 Leduc No. 1 gusher near Edmonton.

“The Clive field was discovered in the 1950s as really a follow-up to Leduc No. 1. This is, call it, Leduc No. 4,” said Chris Kupchenko, president of Enhance Energy, which now operates the Clive field.

Over the last 70 years Clive has produced about 70 million barrels of the site’s 130 million barrels of original oil in place, leaving enough energy behind to fuel six million gasoline-powered vehicles for one year.

“By the late 1990s and early 2000s, production had gone almost to zero,” said Candice Paton, Enhance’s vice-president of corporate affairs.

“There was resource left in the reservoir, but it would have been uneconomic to recover it.”

Gearing up for CO2

Calgary-based Enhance bought Clive in 2013 and kept it running despite high operating costs because of a major CO2 opportunity the company was developing on the horizon.

In 2008, Enhance and North West Redwater Partnership had launched development of the Alberta Carbon Trunk Line (ACTL), one of the world’s largest CO2 transportation systems.

Wolf Midstream joined the project in 2018 as the pipeline’s owner and operator.

Completed in 2020, the groundbreaking $1.2 billion project — supported by the governments of Canada and Alberta — connects carbon captured at industrial sites near Edmonton to the Clive facility.

“With CO2 we’re able to revitalize some of these fields, continue to produce some of the resource that was left behind and permanently store CO2 emissions,” Paton said.

An oversized pipeline on purpose

Each year, about 1.6 million tonnes of CO2 captured at the NWR Sturgeon Refinery and Nutrien Redwater fertilizer facility near Fort Saskatchewan travels down the trunk line to Clive.

In a unique twist, that is only about 10 per cent of the pipeline’s available space. The project partners intentionally built it with room to grow.

“We have a lot of excess capacity. The vision behind the pipe was, let’s remove barriers for the future,” Kupchenko said.

The Alberta government-supported goal was to expand CCS in the province, said James Fann, CEO of the Regina-based International CCS Knowledge Centre.

“They did it on purpose. The size of the infrastructure project creates the opportunity for other emitters to build capture projects along the way,” he said.

CO2 captured at the Sturgeon Refinery near Edmonton is transported by the Alberta Carbon Trunk Line to the Clive project. Photo courtesy North West Redwater Partnership

Extending the value of aging assets

Building more CCUS projects like Clive that incorporate enhanced oil recovery (EOR) is a model for extending the economic value of aging oil and gas fields in Alberta, Kupchenko said.

“EOR can be thought of as redeveloping real estate,” he said.

“Take an inner-city lot with a 700-square-foot house on it. The bad thing is there’s a 100-year-old house that has to be torn down. But the great thing is there’s a road to it. There’s power to it, there’s a sewer connection, there’s water, there’s all the things.

“That’s what this is. We’re redeveloping a field that was discovered 70 years ago and has at least 30 more years of life.”

The 180 existing wellbores are also all assets, Kupchenko said.

“They may not all be producing oil or injecting CO2, but every one of them is used. They are our eyes into the reservoir.”

CO2 injection well at the Clive carbon capture, utilization and storage project. Photo for the Canadian Energy Centre

Alberta’s ‘beautiful’ CCUS geology

The existing wells are an important part of measurement, monitoring and verification (MMV) at Clive.

The Alberta Energy Regulator requires CCUS projects to implement a comprehensive MMV program to assess storage performance and demonstrate the long-term safety and security of CO₂.

Katherine Romanak, a subsurface CCUS specialist at the University of Texas at Austin, said that her nearly 20 years of global research indicate the process is safe.

“There’s never been a leak of CO2 from a storage site,” she said.

Alberta’s geology is particularly suitable for CCUS, with permanent storage potential estimated at more than 100 billion tonnes.

“The geology is beautiful,” Romanak said.

“It’s the thickest reservoir rocks you’ve ever seen. It’s really good injectivity, porosity and permeability, and the confining layers are crazy thick.”

CO2-EOR gaining prominence

The extra capacity on the ACTL pipeline offers a key opportunity to capitalize on storage potential while addressing aging oil and gas fields, according to the Alberta government’s Mature Asset Strategy, released earlier this year.

The report says expanding CCUS to EOR could attract investment, cut emissions and encourage producers to reinvest in existing properties — instead of abandoning them.

However, this opportunity is limited by federal policy.

Ottawa’s CCUS Investment Tax Credit, which became available in June 2024, does not apply to EOR projects.

“Often people will equate EOR with a project that doesn’t store CO2 permanently,” Kupchenko said.

“We like to always make sure that people understand that every ton of CO2 that enters this project is permanently sequestered. And we take great effort into storing that CO2.”

The International Energy Forum — representing energy ministers from nearly 70 countries including Canada, the U.S., China, India, Norway, and Saudi Arabia — says CO₂-based EOR is gaining prominence as a carbon sequestration tool.

The technology can “transform a traditional oil recovery method into a key pillar of energy security and climate strategy,” according to a June 2025 IEF report.

Tapping into more opportunity

In Central Alberta, Enhance Energy is advancing a new permanent CO2 storage project called Origins that is designed to revitalize additional aging oil and gas fields while reducing emissions, using the ACTL pipeline.

“Origins is a hub that’s going to enable larger scale EOR development,” Kupchenko said.

“There’s at least 10 times more oil in place in this area.”

Meanwhile, Wolf Midstream is extending the pipeline further into the Edmonton region to transport more CO2 captured from additional industrial facilities.

-

Business1 day ago

Business1 day agoRFK Jr. says Hep B vaccine is linked to 1,135% higher autism rate

-

Crime2 days ago

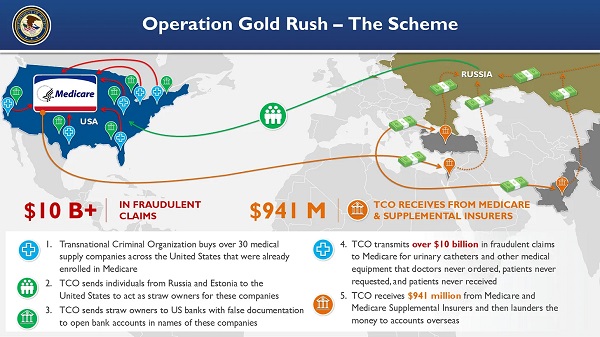

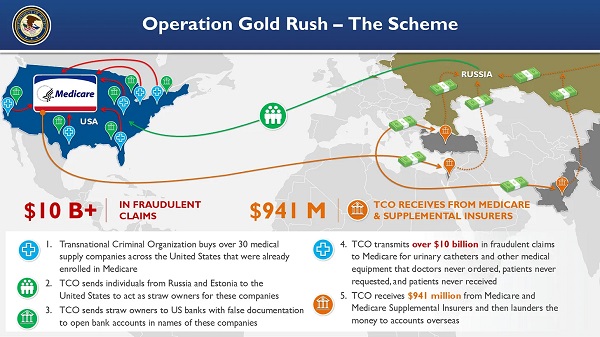

Crime2 days agoNational Health Care Fraud Takedown Results in 324 Defendants Charged in Connection with Over $14.6 Billion in Alleged Fraud

-

Business14 hours ago

Business14 hours agoWhy it’s time to repeal the oil tanker ban on B.C.’s north coast

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoGlobal media alliance colluded with foreign nations to crush free speech in America: House report

-

Alberta9 hours ago

Alberta9 hours agoAlberta Provincial Police – New chief of Independent Agency Police Service

-

Health2 days ago

Health2 days agoRFK Jr. Unloads Disturbing Vaccine Secrets on Tucker—And Surprises Everyone on Trump

-

Alberta14 hours ago

Alberta14 hours agoPierre Poilievre – Per Capita, Hardisty, Alberta Is the Most Important Little Town In Canada

-

Business1 day ago

Business1 day agoElon Musk slams Trump’s ‘Big Beautiful Bill,’ calls for new political party