Economy

Prime minister and premier combine to reduce living standards in B.C.

From the Fraser Institute

By Jake Fuss

In B.C., the Eby government is following the prime minister’s lead. After nearly two decades of spending restraint (1999/00 to 2016/17), the province has experienced an explosion in government spending. Program spending will increase from $46.1 billion in 2016-17 to a projected $85.3 billion this year, a nominal increase of more than 85 per cent.

Recently, Prime Minister Justin Trudeau and Premier David Eby had a tête-à-tête and vowed to always “work together on important issues.” While they belong to two different political parties, their visions rely on a larger role for government, which includes more spending, regulation, borrowing and higher taxes. Unsurprisingly, this economic strategy hasn’t worked and has instead led to stagnant living standards in British Columbia and across Canada.

Under the NDP, British Columbians have seen their incomes completely stagnate. B.C.’s per-person GDP, a broad measure of living standards, is expected to be lower this year than in 2018, and decline by an average annual rate of 0.9 per cent from 2022 to 2024—the third biggest drop among the provinces during this period.

This represents a marked departure from the economic results under the previous government. From 2001 to 2017, per-person GDP grew (on average) by 1.4 per cent. And the average British Columbian’s income increased by 27 per cent over these 16 years.

The decline in living standards is also occurring nationally. Canada’s per-person GDP was lower at the end of 2023 than it was in 2014.

Why?

Since first elected in 2015, Prime Minister Trudeau has greatly expanded the federal government’s role in the Canadian economy. Federal program spending (total spending excluding debt interest costs) will increase from $256.2 billion in the final full year of the Harper government to a projected $483.6 billion in 2024-25, an increase of nearly 90 per cent over a decade. The government has financed this spending surge through tax increases and borrowing.

Specifically, the Trudeau government in 2016 raised the top personal income tax rate (which applies to many entrepreneurs and businessowners) and also opaquely increased taxes on middle-income Canadians by eliminating several tax credits (as a result, 86 per cent of middle-income families now pay higher taxes). Federal debt has spiked considerably to finance the government’s insatiable appetite for spending, reaching nearly $2.1 trillion this year, almost double the level in 2014-15.

In B.C., the Eby government is following the prime minister’s lead. After nearly two decades of spending restraint (1999/00 to 2016/17), the province has experienced an explosion in government spending. Program spending will increase from $46.1 billion in 2016-17 to a projected $85.3 billion this year, a nominal increase of more than 85 per cent.

With Premier Eby’s plan to ramp up spending further in the next few years and incur substantial deficits, B.C.’s net government debt is projected to reach a whopping $128.8 billion by 2026/27—a 227 per cent increase since 2016-17.

The B.C. NDP has also raised one tax after another to feed its appetite for spending. The government hiked personal income tax rates from 14.7 per cent to 16.8 per cent on income between roughly $181,000 and $253,000, and introduced a new top tax rate of 20.5 per cent for top-income earners. And raised the business tax rate from 11.0 to 12.0 per cent in 2018, deterring badly needed investment in the province.

Prime Minister Trudeau and Premier Eby are pursuing the same policies and achieving the same miserable economic results. Simply put, the Trudeau-Eby zero economic growth alliance has reduced the living standards of British Columbians and Canadians.

Author:

Alberta

Pierre Poilievre – Per Capita, Hardisty, Alberta Is the Most Important Little Town In Canada

From Pierre Poilievre

Business

Why it’s time to repeal the oil tanker ban on B.C.’s north coast

The Port of Prince Rupert on the north coast of British Columbia. Photo courtesy Prince Rupert Port Authority

From the Canadian Energy Centre

By Will Gibson

Moratorium does little to improve marine safety while sending the wrong message to energy investors

In 2019, Martha Hall Findlay, then-CEO of the Canada West Foundation, penned a strongly worded op-ed in the Globe and Mail calling the federal ban of oil tankers on B.C.’s northern coast “un-Canadian.”

Six years later, her opinion hasn’t changed.

“It was bad legislation and the government should get rid of it,” said Hall Findlay, now director of the University of Calgary’s School of Public Policy.

The moratorium, known as Bill C-48, banned vessels carrying more than 12,500 tonnes of oil from accessing northern B.C. ports.

Targeting products from one sector in one area does little to achieve the goal of overall improved marine transport safety, she said.

“There are risks associated with any kind of transportation with any goods, and not all of them are with oil tankers. All that singling out one part of one coast did was prevent more oil and gas from being produced that could be shipped off that coast,” she said.

Hall Findlay is a former Liberal MP who served as Suncor Energy’s chief sustainability officer before taking on her role at the University of Calgary.

She sees an opportunity to remove the tanker moratorium in light of changing attitudes about resource development across Canada and a new federal government that has publicly committed to delivering nation-building energy projects.

“There’s a greater recognition in large portions of the public across the country, not just Alberta and Saskatchewan, that Canada is too dependent on the United States as the only customer for our energy products,” she said.

“There are better alternatives to C-48, such as setting aside what are called Particularly Sensitive Sea Areas, which have been established in areas such as the Great Barrier Reef and the Galapagos Islands.”

The Business Council of British Columbia, which represents more than 200 companies, post-secondary institutions and industry associations, echoes Hall Findlay’s call for the tanker ban to be repealed.

“Comparable shipments face no such restrictions on the East Coast,” said Denise Mullen, the council’s director of environment, sustainability and Indigenous relations.

“This unfair treatment reinforces Canada’s over-reliance on the U.S. market, where Canadian oil is sold at a discount, by restricting access to Asia-Pacific markets.

“This results in billions in lost government revenues and reduced private investment at a time when our economy can least afford it.”

The ban on tanker traffic specifically in northern B.C. doesn’t make sense given Canada already has strong marine safety regulations in place, Mullen said.

Notably, completion of the Trans Mountain Pipeline expansion in 2024 also doubled marine spill response capacity on Canada’s West Coast. A $170 million investment added new equipment, personnel and response bases in the Salish Sea.

“The [C-48] moratorium adds little real protection while sending a damaging message to global investors,” she said.

“This undermines the confidence needed for long-term investment in critical trade-enabling infrastructure.”

Indigenous Resource Network executive director John Desjarlais senses there’s an openness to revisiting the issue for Indigenous communities.

“Sentiment has changed and evolved in the past six years,” he said.

“There are still concerns and trust that needs to be built. But there’s also a recognition that in addition to environmental impacts, [there are] consequences of not doing it in terms of an economic impact as well as the cascading socio-economic impacts.”

The ban effectively killed the proposed $16-billion Eagle Spirit project, an Indigenous-led pipeline that would have shipped oil from northern Alberta to a tidewater export terminal at Prince Rupert, B.C.

“When you have Indigenous participants who want to advance these projects, the moratorium needs to be revisited,” Desjarlais said.

He notes that in the six years since the tanker ban went into effect, there are growing partnerships between B.C. First Nations and the energy industry, including the Haisla Nation’s Cedar LNG project and the Nisga’a Nation’s Ksi Lisims LNG project.

This has deepened the trust that projects can mitigate risks while providing economic reconciliation and benefits to communities, Dejarlais said.

“Industry has come leaps and bounds in terms of working with First Nations,” he said.

“They are treating the rights of the communities they work with appropriately in terms of project risk and returns.”

Hall Findlay is cautiously optimistic that the tanker ban will be replaced by more appropriate legislation.

“I’m hoping that we see the revival of a federal government that brings pragmatism to governing the country,” she said.

“Repealing C-48 would be a sign of that happening.”

-

Business1 day ago

Business1 day agoRFK Jr. says Hep B vaccine is linked to 1,135% higher autism rate

-

Crime2 days ago

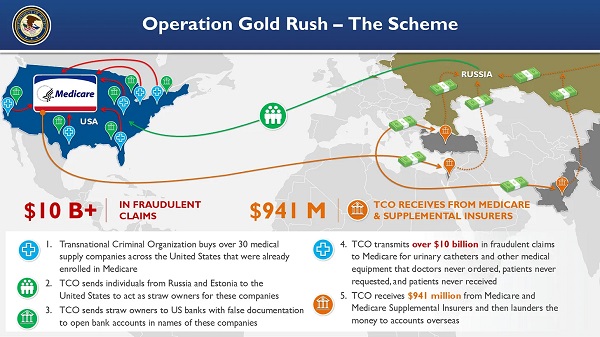

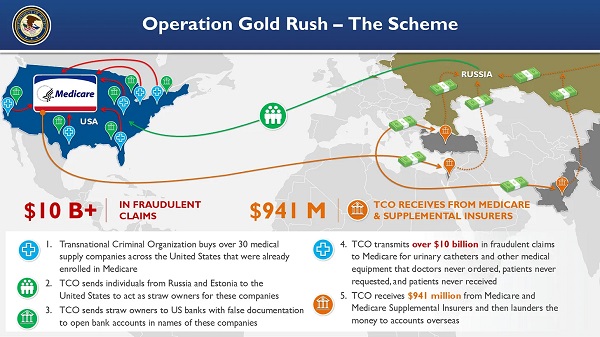

Crime2 days agoNational Health Care Fraud Takedown Results in 324 Defendants Charged in Connection with Over $14.6 Billion in Alleged Fraud

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoGlobal media alliance colluded with foreign nations to crush free speech in America: House report

-

Business12 hours ago

Business12 hours agoWhy it’s time to repeal the oil tanker ban on B.C.’s north coast

-

Health2 days ago

Health2 days agoRFK Jr. Unloads Disturbing Vaccine Secrets on Tucker—And Surprises Everyone on Trump

-

Alberta7 hours ago

Alberta7 hours agoAlberta Provincial Police – New chief of Independent Agency Police Service

-

Alberta12 hours ago

Alberta12 hours agoPierre Poilievre – Per Capita, Hardisty, Alberta Is the Most Important Little Town In Canada

-

Business1 day ago

Business1 day agoElon Musk slams Trump’s ‘Big Beautiful Bill,’ calls for new political party