Economy

Poor policies responsible for stagnant economy and deteriorating federal finances

From the Fraser Institute

By Jake Fuss and Jason Clemens

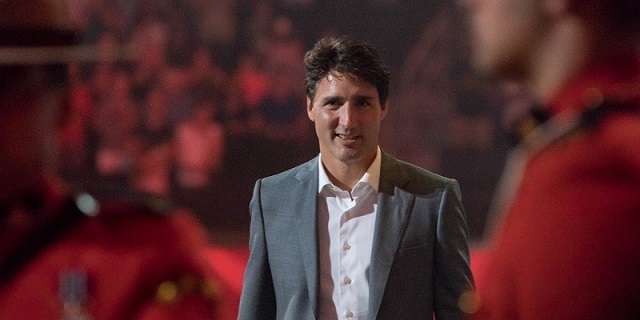

The Trudeau government was elected in 2015 based in part on a new approach to government policy, promising greater prosperity for Canadians through short-term deficit spending, lower taxes for most Canadians, and a more direct and active role for government in economic development. However, the result has been economic stagnation and a marked deterioration in the country’s finances. If Canada is to restore its economic and fiscal health, Ottawa must enact fundamental policy reform.

The Trudeau government has significantly increased spending from $256.2 billion in 2014-15 to a projected $449.8 billion in 2023-24 (excluding debt interest costs) to expand existing programs and create new programs.

In 2016, the government increased the top personal income tax rate on entrepreneurs, professionals and businessowners from 29 per cent to 33 per cent. Consequently, the combined top personal income tax rate (federal and provincial) now exceeds 50 per cent in eight provinces and the country’s average top combined rate in 2022 ranked fifth-highest among 38 OECD countries. This represents a serious competitive challenge for Canada to attract and retain entrepreneurs, investors and skilled professionals (e.g. doctors) we badly need.

And while the Trudeau government reduced the middle personal income tax rate, it also eliminated several tax credits. Due to the combination of these two policy changes, 86 per cent of middle-income families now pay higher personal income taxes.

The Trudeau government also borrowed to help finance new spending, triggering a string of budget deficits. As a result, federal gross debt has ballooned to $1.9 trillion (2022-23) and will reach a projected $2.4 trillion by 2027-28, fueling a marked growth in interest costs, which now consume substantial levels of revenue unavailable for government services or tax reduction.

Simply put, the Trudeau government has produced large increases in government spending, taxes and borrowing, which have not translated into a more robust and vibrant economy.

For example, from 2013 to 2022, growth in per-person GDP, the broadest measure of living standards, was the weakest on record since the 1930s. Prospects for the future, given current policies, are not encouraging. According to the OECD, Canada will record the lowest rate of per-person GDP growth among 32 advanced economies during the periods 2020 to 2030 and 2030 to 2060. Countries such as Estonia, South Korea and New Zealand are expected to vault past Canada and achieve higher living standards by 2060.

Canada’s economic growth crisis is due in part to the decline in business investment, which is critical to increasing living standards because it equips workers with tools and technologies to produce more and provide higher-quality goods and services. The Trudeau government has dampened investment by increasing regulatory barriers, particularly in the energy and mining sectors, and running deficits, which imply tax increases in the future.

Business investment (inflation-adjusted, excluding residential construction) has declined by 1.8 per cent annually, on average, since 2014. Between 2014 and 2021, business investment per worker (inflation-adjusted, excluding residential construction) decreased by $3,676 in Canada compared to growth of $3,418 in the United States.

There’s reason for optimism, however, since many of Canada’s challenges are of Ottawa’s own making. The Chrétien Liberals in the 1990s faced many of the same challenges we do today. By shifting the focus to more prudent government spending, balanced budgets, debt reduction and competitive tax rates, the Chrétien Liberals—followed in large measure by the Harper Tories—paved the way for two decades of prosperity. To help foster greater prosperity for Canadians today and tomorrow, the federal government should learn from the Chrétien Liberals and Harper Tories and enact fundamental policy reform.

Authors:

Business

Carney budget doubles down on Trudeau-era policies

From the Fraser Institute

By Kenneth P. Green and Elmira Aliakbari

The Carney government tabled its first budget, which includes major new spending initiatives to promote a so-called “green economy,” and maintains greenhouse gas (GHG)-emission extinction as a central operating principle of Canadian governance.

The budget leaves untouched most of the legislative dampers on Canada’s fossil fuel sector (oil, gas, coal) of the last 10 years, while pouring still more money into theoretically “green” projects such as additional (and speculative new types) of nuclear power, electrical transmission to service “green” energy production, continued tax credits for alternative fuels such as hydrogen, and more. Adding insult to injury, the budget discusses “enhancing” (read: likely increasing) the carbon tax on industrial emitters across Canada, and tightening controls over provinces to ensure they meet new federal tax targets.

Over the past decade, Ottawa introduced numerous regulations to restrict oil and gas development and again accelerate the growth of the green sector. Key initiatives include Ottawa’s arbitrary cap on GHG emissions for the oil and gas sector, which will restrict production; stricter regulations for methane emissions in the oil and gas industry, which will also likely restrict production; “clean electricity” regulations that aim to decarbonize Canada’s electricity generation; Bill C-69 (which introduced subjective ill-defined criteria into the evaluation of energy projects); and Bill C-48, known as the oil tanker ban on the west coast, which limits Canadian exports to Asian and other non-U.S. markets.

At the same time, governments launched a wide range of spending initiatives, tax credits and regulations to promote the green economy, which basically includes industries and technologies that aim to reduce pollution and use cleaner energy sources. Between 2014/15 and 2024/25, federal spending on green initiatives (such as subsidizing renewable power, providing incentives for electric vehicles and charging infrastructure, funding for building retrofits, and support for alternative fuels such as hydrogen, etc.) went from $0.6 billion to $23 billion—a 38-fold increase. Altogether, since 2014, Ottawa and provincial governments in the country’s four largest provinces (Ontario, British Columbia, Quebec and Alberta) have spent and foregone revenues of at least $158 billion to promote the green sector.

Yet, despite the government’s massive spending and heavy regulation to constrain the fossil fuel industry and promote the green sector, the outcomes have been extremely disappointing. In 2014, the green sector accounted for 3.1 per cent of Canada’s economic output, and by 2023, that share had only slightly grown to 3.6 per cent. Put simply, despite massive spending, the sector’s contribution to Canada’s economy has barely changed. In addition, between 2014 and 2023, despite billions in government spending to promote the green sector, only 68,000 new jobs were added in this sector, many of them in already established fields such as waste management and hydroelectric power. The sector’s contribution to national employment remains small, representing only 2 per cent of total jobs in the country.

Not surprisingly, this combination of massive government spending and heavy-handed regulation have contributed to Canada’s economic stagnation in recent years. As documented by our colleagues, Canadian living standards—measured by per-person GDP—were lower in the second quarter of 2025 than six years earlier, suggesting we are poorer today than we were six years ago.

But for Prime Minister Carney, apparently, past failures do not temper future plans, as the budget either reaffirms or expands upon the failed plans of the past decade. No lessons appear to have even been considered, much less learned from past failures.

There had been some hope that Carney’s first budget would include some reflection of how badly the natural resource and energy policies of the Trudeau government have hurt Canada’s economy.

But other than some language obfuscation—“investment” vs. “spending,” “competitiveness” of GHG controls (not economy), and the “green” energy economy vs. the “conventional” energy economy—this is a Trudeau-continuance business-as-usual agenda on steroids. Yes, they will allow some slight deceptive rollbacks to proceed (such as rolling the consumer carbon tax into the industrial carbon tax rather than eliminating it), and may allow still more carbon taxes to render at least one onerous Trudeau-era regulation (the oil and gas cap) to be rendered moot, but that’s stunningly weak tea on policy reform.

The first Carney budget could and likely will, if passed, continue the economic stagnation plaguing Canada. That does not bode well for the future prosperity of Canadians.

Daily Caller

UN Chief Rages Against Dying Of Climate Alarm Light

From the Daily Caller News Foundation

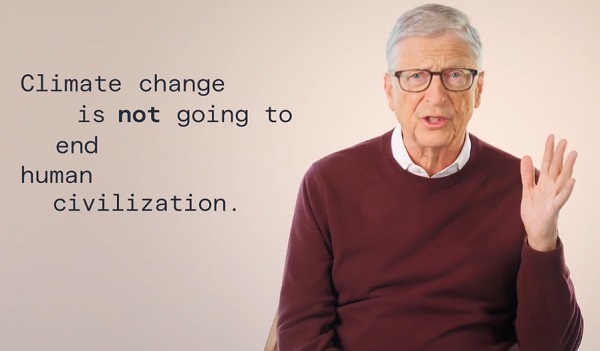

The light of the global climate alarm movement has faded throughout 2025, as even narrative-pushing luminaries like Bill Gates have begun admitting. But that doesn’t mean the bitter clingers to the net-zero by 2050 dogma will go away quietly. No one serves more ably as the poster child of this resistance to reality than U.N. chief Antonio Guterres, who is preparing to host the UN’s annual climate conference, COP30, in Brazil on Nov. 10.

In a speech on Monday, Guterres echoed poet Dylan Thomas’s advice to aging men and women in his famed poem, “Do not go gentle into that good night:”

Do not go gentle into that good night,

Old age should burn and rave at close of day;

Rage, rage against the dying of the light.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

Though wise men at their end know dark is right,

Because their words had forked no lightning they

Do not go gentle into that good night.

Seeing that his own words have “forked no lightning,” Guterres raged, raged against the dying of the climate alarm light.

“Governments must arrive at the upcoming COP30 meeting in Brazil with concrete plans to slash their own emissions over the next decade while also delivering climate justice to those on the front lines of a crisis they did little to cause,” Guterres demanded, adding, “Just look at Jamaica.”

Yes, because, as everyone must assuredly know, the Earth has never produced major hurricanes in the past, so it must be the all-powerful climate change bogeyman that produced this major storm at the end of an unusually slow Atlantic hurricane season.

Actually, Guterres’ order to all national governments to arrive in Belem, Brazil outfitted with aspirational plans to meet the net-zero illusion, which everyone knows can and will never be met, helps explain why President Donald Trump will not be sending an official U.S. delegation. Trump has repeatedly made clear – most recently during his September speech before the U.N. General Assembly – that he views the entire climate change agenda as a huge scam. Why waste taxpayer money in pursuit of a fantasy when he’s had so much success pursuing a more productive agenda via direct negotiations with national leaders around the world?

“The Green New Scam would have killed America if President Trump had not been elected to implement his commonsense energy agenda…focused on utilizing the liquid gold under our feet to strengthen our grid stability and drive down costs for American families and businesses,” Taylor Rogers, a White House spokeswoman, said in a statement to the Guardian. “President Trump will not jeopardize our country’s economic and national security to pursue vague climate goals that are killing other countries,” she added.

The Guardian claims that Rogers’s use of the word “scam” refers to the Green New Deal policies pursued by Joe Biden. But that’s only part of it: The President views the entire net-zero project as a global scam designed to support a variety of wealth redistribution schemes and give momentum to the increasingly authoritarian forms of government we currently see cracking down in formerly free democracies like the U.K., Canada, Germany, France, Australia and other western developed nations.

Trump’s focused efforts on reversing vast swaths of Biden’s destructive agenda is undoing 16 years of command-and-control regulatory schemes implemented by the federal government. The resulting elimination of Inflation Reduction Act subsidies is already slowing the growth of the electric vehicles industry and impacting the rise of wind and solar generation as well.

But the impacts are international, too, as developing nations across the world shift direction to be able to do business with the world’s most powerful economy and developed nations in Europe and elsewhere grudgingly strive to remain competitive. Gates provided a clear wake-up call highlighting this global trend with his sudden departure from climate alarmist orthodoxy and its dogmatic narratives with his shift in rhetoric and planned investments laid out in last week’s long blog post.

Guterres, as the titular leader of the climate movement’s center of globalist messaging, sees his perch under assault and responded with a rhetorical effort to reassert his authority. We can expect the secretary general to keep raging as his influence wanes and he is replaced by someone whose own words might fork some lightning.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

-

Daily Caller2 days ago

Daily Caller2 days agoUS Eating Canada’s Lunch While Liberals Stall – Trump Admin Announces Record-Shattering Energy Report

-

espionage21 hours ago

espionage21 hours agoU.S. Charges Three More Chinese Scholars in Wuhan Bio-Smuggling Case, Citing Pattern of Foreign Exploitation in American Research Labs

-

Business1 day ago

Business1 day agoU.S. Supreme Court frosty on Trump’s tariff power as world watches

-

Energy2 days ago

Energy2 days agoEby should put up, shut up, or pay up

-

Justice1 day ago

Justice1 day agoCarney government lets Supreme Court decision stand despite outrage over child porn ruling

-

Business2 days ago

Business2 days agoThe Liberal budget is a massive FAILURE: Former Liberal Cabinet Member Dan McTeague

-

Daily Caller1 day ago

Daily Caller1 day agoUN Chief Rages Against Dying Of Climate Alarm Light

-

Business10 hours ago

Business10 hours agoHere’s what pundits and analysts get wrong about the Carney government’s first budget