Business

PayPal Admits Freezing Account Over Covid Mandate Criticism

PayPal’s internal documents reveal a politically charged decision-making process behind Covid-era account closures.

|

It seemed pretty obvious as it was happening – but now there appears to be proof that PayPal was punishing users for their Covid-era speech that didn’t align with official narratives.

One of the critics of pandemic mandates that got “debanked” is UsForThem founder Molly Kingsley, who has been told by PayPal that her account got frozen because it was used to receive donations, and that was found to be outside the payment giant’s “acceptable use” rules. The parent campaign group and Kingsley were vocal critics of obligatory Covid vaccination of children, forcing them to wear face masks, as well as school closures. And now PayPal has spelled it out. The Telegraph reported the account was terminated because of “content published by UsForThem relating to mandatory Covid-19 vaccinations and school closures.” PayPal had to reinstate the account less than a month after it was shut down in September 2022 because UK’s financial regulator FCA intervened. This was not the only account targeted, that belonged to groups and individuals opposed to Covid restrictions, but when they got shut down, PayPal chose not to officially explain why. Among those affected was Toby Young, a free speech advocate who’s Daily Skeptic blog was critical of Covid mandates, as well as lawyers gathered in the Law or Fiction group who shared similar views, and said that depriving them of access to their money on PayPal was a China-style “blatant assault on free speech.” The information PayPal has come out with now regarding UsForThem and Kingsley was revealed in (legal) pre-action phase documents, which also show that the company spent four months leading up to the September 2022 account freeze putting together “a dossier of information about Kingsley.” That dossier included quotes from her book, The Children’s Inquiry. Around the same time, the UK’s Counter Disinformation Unit – known for trying to suppress speech about lockdowns that was skeptical of the official line – was carrying out surveillance of Kingsley’s social media activity. PayPal is now refusing to comment on what it calls “individual customer accounts” but the company claims its approach is objective and not politics-driven. However, Kingsley believes that PayPal “appears to have admitted what we had suspected all along: that it was engaged in politically motivated debankings of those of us who criticized the government’s response to Covid, and the lockdown narrative in particular.” “For more than two years, PayPal has resisted my efforts to uncover what happened,” the campaigner added. |

If you’re tired of censorship and surveillance, subscribe to Reclaim The Net.

|

You subscribe to Reclaim The Net because you value free speech and privacy. Each issue we publish is a commitment to defend these critical rights, providing insights and actionable information to protect and promote liberty in the digital age.

Despite our wide readership, less than 0.2% of our readers contribute financially. With your support, we can do more than just continue; we can amplify voices that are often suppressed and spread the word about the urgent issues of censorship and surveillance. Consider making a modest donation — just $5, or whatever amount you can afford. Your contribution will empower us to reach more people, educate them about these pressing issues, and engage them in our collective cause. Thank you for considering a contribution. Each donation not only supports our operations but also strengthens our efforts to challenge injustices and advocate for those who cannot speak out.

Thank you.

|

2025 Federal Election

Next federal government should end corporate welfare for forced EV transition

From the Fraser Institute

By Tegan Hill and Jake Fuss

Corporate welfare simply shifts jobs and investment away from other firms and industries—which are more productive, as they don’t require government funding to be economically viable—to the governments’ preferred industries and firms, circumventing the preferences of consumers and investors. And since politicians spend other people’s money, they have little incentive to be careful investors.

General Motors recently announced the temporary closure of its electric vehicle (EV) manufacturing plant in Ontario, laying off 500 people because its new EV isn’t selling. The plant will shut down for six months despite hundreds of millions in government subsides financed by taxpayers. This is just one more example of corporate welfare—when governments subsidize favoured industries and companies—and it’s time for the provinces and the next federal government to eliminate it.

Between the federal government and Ontario government, GM received about $500 million to help fund its EV transition. But this is just one example of corporate welfare in the auto sector. Stellantis and Volkswagen will receive about $28 billion in government subsidies while Honda is promised $5 billion.

More broadly, from 2007 to 2019, the last pre-COVID year of data, the federal government spent an estimated $84.6 billion (adjusted for inflation) on corporate welfare while provincial and local governments spent another $302.9 billion. And crucially, these numbers exclude other forms of government support such as loan guarantees, direct investments and regulatory privileges, so the actual cost of corporate welfare during this period was much higher.

Of course, politicians claim that corporate welfare benefits workers. Yet according to a significant body of research, corporate welfare fails to generate widespread economic benefit. Think of it this way—if the businesses that received subsidies were viable to begin with, they wouldn’t need government support. So unprofitable companies are kept in business through governments’ support, which can prevent resources, including investment and workers, from moving to profitable companies, hurting overall economic growth.

Put differently, rather than fuelling economic growth, corporate welfare simply shifts jobs and investment away from other firms and industries—which are more productive, as they don’t require government funding to be economically viable—to the governments’ preferred industries and firms, circumventing the preferences of consumers and investors. And since politicians spend other people’s money, they have little incentive to be careful investors.

Governments also must impose higher tax rates on everyone else to pay for corporate welfare. In turn, higher tax rates discourage entrepreneurship and business investment—again, which fuels economic growth. And the higher the tax rates, the more economic activity they discourage.

GM’s EV plant shut down once again proves that when governments try to engineer the economy with corporate welfare, workers will ultimately lose. It’s time for the provinces and the next federal government—whoever it may be—to finally put an end to this costly and ineffective policy approach.

Business

Hudson’s Bay Bid Raises Red Flags Over Foreign Influence

From the Frontier Centre for Public Policy

A billionaire’s retail ambition might also serve Beijing’s global influence strategy. Canada must look beyond the storefront

When B.C. billionaire Weihong Liu publicly declared interest in acquiring Hudson’s Bay stores, it wasn’t just a retail story—it was a signal flare in an era where foreign investment increasingly doubles as geopolitical strategy.

The Hudson’s Bay Company, founded in 1670, remains an enduring symbol of Canadian heritage. While its commercial relevance has waned in recent years, its brand is deeply etched into the national identity. That’s precisely why any potential acquisition, particularly by an investor with strong ties to the People’s Republic of China (PRC), deserves thoughtful, measured scrutiny.

Liu, a prominent figure in Vancouver’s Chinese-Canadian business community, announced her interest in acquiring several Hudson’s Bay stores on Chinese social media platform Xiaohongshu (RedNote), expressing a desire to “make the Bay great again.” Though revitalizing a Canadian retail icon may seem commendable, the timing and context of this bid suggest a broader strategic positioning—one that aligns with the People’s Republic of China’s increasingly nuanced approach to economic diplomacy, especially in countries like Canada that sit at the crossroads of American and Chinese spheres of influence.

This fits a familiar pattern. In recent years, we’ve seen examples of Chinese corporate involvement in Canadian cultural and commercial institutions, such as Huawei’s past sponsorship of Hockey Night in Canada. Even as national security concerns were raised by allies and intelligence agencies, Huawei’s logo remained a visible presence during one of the country’s most cherished broadcasts. These engagements, though often framed as commercially justified, serve another purpose: to normalize Chinese brand and state-linked presence within the fabric of Canadian identity and daily life.

What we may be witnessing is part of a broader PRC strategy to deepen economic and cultural ties with Canada at a time when U.S.-China relations remain strained. As American tariffs on Canadian goods—particularly in aluminum, lumber and dairy—have tested cross-border loyalties, Beijing has positioned itself as an alternative economic partner. Investments into cultural and heritage-linked assets like Hudson’s Bay could be seen as a symbolic extension of this effort to draw Canada further into its orbit of influence, subtly decoupling the country from the gravitational pull of its traditional allies.

From my perspective, as a professional with experience in threat finance, economic subversion and political leveraging, this does not necessarily imply nefarious intent in each case. However, it does demand a conscious awareness of how soft power is exercised through commercial influence, particularly by state-aligned actors. As I continue my research in international business law, I see how investment vehicles, trade deals and brand acquisitions can function as instruments of foreign policy—tools for shaping narratives, building alliances and shifting influence over time.

Canada must neither overreact nor overlook these developments. Open markets and cultural exchange are vital to our prosperity and pluralism. But so too is the responsibility to preserve our sovereignty—not only in the physical sense, but in the cultural and institutional dimensions that shape our national identity.

Strategic investment review processes, cultural asset protections and greater transparency around foreign corporate ownership can help strike this balance. We should be cautious not to allow historically Canadian institutions to become conduits, however unintentionally, for geopolitical leverage.

In a world where power is increasingly exercised through influence rather than force, safeguarding our heritage means understanding who is buying—and why.

Scott McGregor is the managing partner and CEO of Close Hold Intelligence Consulting.

-

2025 Federal Election23 hours ago

2025 Federal Election23 hours agoBREAKING: THE FEDERAL BRIEF THAT SHOULD SINK CARNEY

-

2025 Federal Election24 hours ago

2025 Federal Election24 hours agoCHINESE ELECTION THREAT WARNING: Conservative Candidate Joe Tay Paused Public Campaign

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoOttawa Confirms China interfering with 2025 federal election: Beijing Seeks to Block Joe Tay’s Election

-

2025 Federal Election1 day ago

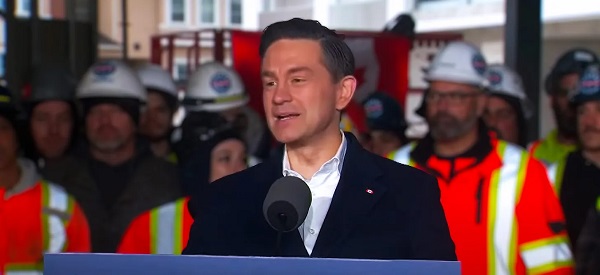

2025 Federal Election1 day agoReal Homes vs. Modular Shoeboxes: The Housing Battle Between Poilievre and Carney

-

Business13 hours ago

Business13 hours agoHudson’s Bay Bid Raises Red Flags Over Foreign Influence

-

2025 Federal Election9 hours ago

2025 Federal Election9 hours agoMark Carney Wants You to Forget He Clearly Opposes the Development and Export of Canada’s Natural Resources

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoHow Canada’s Mainstream Media Lost the Public Trust

-

2025 Federal Election10 hours ago

2025 Federal Election10 hours agoCanada’s pipeline builders ready to get to work