Energy

Ottawa’s emissions cap—all pain, no gain

From the Fraser Institute

By: Julio Mejía, Elmira Aliakbari and Tegan Hill

According to a recent analysis by the Conference Board of Canada think-tank, the cap could reduce Canada’s GDP by up to $1 trillion between 2030 and 2040, eliminate up to 151,000 jobs by 2030, reduce federal government revenue by up to $151 billion between 2030 and 2040, and reduce Alberta government revenue by up to $127 billion over the same period.

According to an announcements last week by Premier Danielle Smith, the Alberta government will use the Alberta Sovereignty within a United Canada Act to challenge Ottawa’s proposal to cap greenhouse gas emissions from the oil and gas sector at 35 per cent below 2019 levels by 2030.

Premier Smith, who said the cap will harm the economy and represents an overstep of federal authority, also plans to prevent emissions data from individual oil and gas companies from being shared with Ottawa. While the federal government said the cap is necessary to fight climate change, several studies suggest the cap will impose significant costs on Canadians without yielding detectable environmental benefits.

According to a recent report by Deloitte, a leading audit and consulting firm, the cap will force Canadian firms to curtail oil production by 626,000 barrels per day by 2030 or by approximately 10.0 per cent of the expected production—and curtail gas production by approximately 12.0 per cent.

Deloitte estimates that Alberta will be hit hardest, with 3.6 per cent less investment, almost 70,000 fewer jobs, and a 4.5 per cent decrease in the province’s economic output (i.e. GDP) by 2040. Ontario will lose 15,000 jobs and $2.3 billion from its economy by 2040. And Quebec will lose more than 3,000 jobs and $0.4 billion from its economy during the same period.

Overall, the country will experience an economic loss equivalent to 1.0 per cent of the value of the entire economy (GDP), translating into lower wages, the loss of nearly 113,000 jobs and a 1.3 per cent reduction in government tax revenues. Canada’s inflation-adjusted GDP growth in 2023 was a paltry 1.3 per cent, so a 1 per cent reduction would be a significant economic loss.

Deloitte’s findings echo previous studies. According to a recent analysis by the Conference Board of Canada think-tank, the cap could reduce Canada’s GDP by up to $1 trillion between 2030 and 2040, eliminate up to 151,000 jobs by 2030, reduce federal government revenue by up to $151 billion between 2030 and 2040, and reduce Alberta government revenue by up to $127 billion over the same period.

Similarly, another recent study published by the Fraser Institute found that the cap would reduce production and exports, leading to at least $45 billion in lost economic activity in 2030 alone, accompanied by a substantial drop in government revenue.

Crucially, these huge economic costs to Canadians will come without any discernable environmental benefits. Even if Canada entirely shut down its oil and gas industry by 2030, eliminating all GHG emissions from the sector, the resulting reduction in global GHG emissions would amount to a mere four-tenths of one per cent with virtually no impact on the climate or any detectable environmental, health or safety benefits.

Given the demand for fossil fuels, constraining oil and gas production and exports in Canada would likely merely shift production to other countries with lower environmental and human rights standards such as Iran, Russia and Venezuela. Consequently, global GHG emissions would increase, not decrease. No other major oil and gas-producing country has imposed a similar cap on its leading export sector.

The Trudeau government’s proposed cap, which still must pass the House and Senate, would further strain an already struggling Canadian economy, and to make matters worse, do virtually nothing to improve the environment. The government should cancel the cap plan given the economic costs and nonexistent environmental benefits.

Julio Mejía

Policy Analyst

Elmira Aliakbari

Director, Natural Resource Studies, Fraser Institute

Tegan Hill

Director, Alberta Policy, Fraser Institute

Energy

Canada’s future prosperity runs through the northwest coast

From Resource Works

A strategic gateway to the world

Tucked into the north coast of B.C. is the deepest natural harbour in North America and the port with the shortest travel times to Asia.

With growing capacity for exports including agricultural products, lumber, plastic pellets, propane and butane, it’s no wonder the Port of Prince Rupert often comes up as a potential new global gateway for oil from Alberta, said CEO Shaun Stevenson.

Thanks to its location and natural advantages, the port can efficiently move a wide range of commodities, he said.

That could include oil, if not for the federal tanker ban in northern B.C.’s coastal waters.

“Notwithstanding the moratorium that was put in place, when you look at the attributes of the Port of Prince Rupert, there’s arguably no safer place in Canada to do it,” Stevenson said.

“I think that speaks to the need to build trust and confidence that it can be done safely, with protection of environmental risks. You can’t talk about the economic opportunity before you address safety and environmental protection.”

Safe transit at Prince Rupert

About a 16-hour drive from Vancouver, the Port of Prince Rupert’s terminals are one to two sailing days closer to Asia than other West Coast ports.

The entrance to the inner harbour is wider than the length of three Canadian football fields.

The water is 35 metres deep — about the height of a 10-storey building — compared to 22 metres at Los Angeles and 16 metres at Seattle.

Shipmasters spend two hours navigating into the port with local pilot guides, compared to four hours at Vancouver and eight at Seattle.

“We’ve got wide open, very simple shipping lanes. It’s not moving through complex navigational channels into the site,” Stevenson said.

A port on the rise

The Prince Rupert Port Authority says it has entered a new era of expansion, strengthening Canada’s economic security.

The port estimates it anchors about $60 billion of Canada’s annual global trade today. Even without adding oil exports, Stevenson said that figure could grow to $100 billion.

“We need better access to the huge and growing Asian market,” said Heather Exner-Pirot, director of energy, natural resources and environment at the Macdonald-Laurier Institute.

“Prince Rupert seems purpose-built for that.”

Roughly $3 billion in new infrastructure is already taking shape, including the $750 million rail-to-container CANXPORT transloading complex for bulk commodities like specialty agricultural products, lumber and plastic pellets.

Canadian propane goes global

A centrepiece of new development is the $1.35-billion Ridley Energy Export Facility — the port’s third propane terminal since 2019.

“Prince Rupert is already emerging as a globally significant gateway for propane exports to Asia,” Exner-Pirot said.

Thanks to shipments from Prince Rupert, Canadian propane – primarily from Alberta – has gone global, no longer confined to U.S. markets.

More than 45 per cent of Canada’s propane exports now reach destinations outside the United States, according to the Canada Energy Regulator.

“Twenty-five per cent of Japan’s propane imports come through Prince Rupert, and just shy of 15 per cent of Korea’s imports. It’s created a lift on every barrel produced in Western Canada,” Stevenson said.

“When we look at natural gas liquids, propane and butane, we think there’s an opportunity for Canada via Prince Rupert becoming the trading benchmark for the Asia-Pacific region.”

That would give Canadian production an enduring competitive advantage when serving key markets in Asia, he said.

Deep connection to Alberta

The Port of Prince Rupert has been a key export hub for Alberta commodities for more than four decades.

Through the Alberta Heritage Savings Trust Fund, the province invested $134 million — roughly half the total cost — to build the Prince Rupert Grain Terminal, which opened in 1985.

The largest grain terminal on the West Coast, it primarily handles wheat, barley, and canola from the prairies.

Today, the connection to Alberta remains strong.

In 2022, $3.8 billion worth of Alberta exports — mainly propane, agricultural products and wood pulp — were shipped through the Port of Prince Rupert, according to the province’s Ministry of Transportation and Economic Corridors.

In 2024, Alberta awarded a $250,000 grant to the Prince Rupert Port Authority to lead discussions on expanding transportation links with the province’s Industrial Heartland region near Edmonton.

Handling some of the world’s biggest vessels

The Port of Prince Rupert could safely handle oil tankers, including Very Large Crude Carriers (VLCCs), Stevenson said.

“We would have the capacity both in water depth and access and egress to the port that could handle Aframax, Suezmax and even VLCCs,” he said.

“We don’t have terminal capacity to handle oil at this point, but there’s certainly terminal capacities within the port complex that could be either expanded or diversified in their capability.”

Market access lessons from TMX

Like propane, Canada’s oil exports have gained traction in Asia, thanks to the expanded Trans Mountain pipeline and the Westridge Marine Terminal near Vancouver — about 1,600 kilometres south of Prince Rupert, where there is no oil tanker ban.

The Trans Mountain expansion project included the largest expansion of ocean oil spill response in Canadian history, doubling capacity of the West Coast Marine Response Corporation.

The Canada Energy Regulator (CER) reports that Canadian oil exports to Asia more than tripled after the expanded pipeline and terminal went into service in May 2024.

As a result, the price for Canadian oil has gone up.

The gap between Western Canadian Select (WCS) and West Texas Intermediate (WTI) has narrowed to about $12 per barrel this year, compared to $19 per barrel in 2023, according to GLJ Petroleum Consultants.

Each additional dollar earned per barrel adds about $280 million in annual government royalties and tax revenues, according to economist Peter Tertzakian.

The road ahead

There are likely several potential sites for a new West Coast oil terminal, Stevenson said.

“A pipeline is going to find its way to tidewater based upon the safest and most efficient route,” he said.

“The terminal part is relatively straightforward, whether it’s in Prince Rupert or somewhere else.”

Under Canada’s Marine Act, the Port of Prince Rupert’s mandate is to enable trade, Stevenson said.

“If Canada’s trade objectives include moving oil off the West Coast, we’re here to enable it, presuming that the project has a mandate,” he said.

“If we see the basis of a project like this, we would ensure that it’s done to the best possible standard.”

This article originally appeared in Canadian Energy Centre

Resource Works News

Business

The world is no longer buying a transition to “something else” without defining what that is

From Resource Works

Even Bill Gates has shifted his stance, acknowledging that renewables alone can’t sustain a modern energy system — a reality still driving decisions in Canada.

You know the world has shifted when the New York Times, long a pulpit for hydrocarbon shame, starts publishing passages like this:

“Changes in policy matter, but the shift is also guided by the practical lessons that companies, governments and societies have learned about the difficulties in shifting from a world that runs on fossil fuels to something else.”

For years, the Times and much of the English-language press clung to a comfortable catechism: 100 per cent renewables were just around the corner, the end of hydrocarbons was preordained, and anyone who pointed to physics or economics was treated as some combination of backward, compromised or dangerous. But now the evidence has grown too big to ignore.

Across Europe, the retreat to energy realism is unmistakable. TotalEnergies is spending €5.1 billion on gas-fired plants in Britain, Italy, France, Ireland and the Netherlands because wind and solar can’t meet demand on their own. Shell is walking away from marquee offshore wind projects because the economics do not work. Italy and Greece are fast-tracking new gas development after years of prohibitions. Europe is rediscovering what modern economies require: firm, dispatchable power and secure domestic supply.

Meanwhile, Canada continues to tell itself a different story — and British Columbia most of all.

A new Fraser Institute study from Jock Finlayson and Karen Graham uses Statistics Canada’s own environmental goods and services and clean-tech accounts to quantify what Canada’s “clean economy” actually is, not what political speeches claim it could be.

The numbers are clear:

- The clean economy is 3.0–3.6 per cent of GDP.

- It accounts for about 2 per cent of employment.

- It has grown, but not faster than the economy overall.

- And its two largest components are hydroelectricity and waste management — mature legacy sectors, not shiny new clean-tech champions.

Despite $158 billion in federal “green” spending since 2014, Canada’s clean economy has not become the unstoppable engine of prosperity that policymakers have promised. Finlayson and Graham’s analysis casts serious doubt on the explosive-growth scenarios embraced by many politicians and commentators.

What’s striking is how mainstream this realism has become. Even Bill Gates, whose philanthropic footprint helped popularize much of the early clean-tech optimism, now says bluntly that the world had “no chance” of hitting its climate targets on the backs of renewables alone. His message is simple: the system is too big, the physics too hard, and the intermittency problem too unforgiving. Wind and solar will grow, but without firm power — nuclear, natural gas with carbon management, next-generation grid technologies — the transition collapses under its own weight. When the world’s most influential climate philanthropist says the story we’ve been sold isn’t technically possible, it should give policymakers pause.

And this is where the British Columbia story becomes astonishing.

It would be one thing if the result was dramatic reductions in emissions. The provincial government remains locked into the CleanBC architecture despite a record of consistently missed targets.

Since the staunchest defenders of CleanBC are not much bothered by the lack of meaningful GHG reductions, a reasonable person is left wondering whether there is some other motivation. Meanwhile, Victoria’s own numbers a couple of years ago projected an annual GDP hit of courtesy CleanBC of roughly $11 billion.

But here is the part that would make any objective analyst blink: when I recently flagged my interest in presenting my research to the CleanBC review panel, I discovered that the “reviewers” were, in fact, two of the key architects of the very program being reviewed. They were effectively asked to judge their own work.

You can imagine what they told us.

What I saw in that room was not an evidence-driven assessment of performance. It was a high-handed, fact-light defence of an ideological commitment. When we presented data showing that doctrinaire renewables-only thinking was failing both the economy and the environment, the reception was dismissive and incurious. It was the opposite of what a serious policy review looks like.

Meanwhile our hydro-based electricity system is facing historic challenges: long term droughts, soaring demand, unanswered questions about how growth will be powered especially in the crucial Northwest BC region, and continuing insistence that providers of reliable and relatively clean natural gas are to be frustrated at every turn.

Elsewhere, the price of change increasingly includes being able to explain how you were going to accomplish the things that you promise.

And yes — in some places it will take time for the tide of energy unreality to recede. But that doesn’t mean we shouldn’t be improving our systems, reducing emissions, and investing in technologies that genuinely work. It simply means we must stop pretending politics can overrule physics.

Europe has learned this lesson the hard way. Global energy companies are reorganizing around a 50-50 world of firm natural gas and renewables — the model many experts have been signalling for years. Even the New York Times now describes this shift with a note of astonishment.

British Columbia, meanwhile, remains committed to its own storyline even as the ground shifts beneath it. This isn’t about who wins the argument — it’s about government staying locked on its most basic duty: safeguarding the incomes and stability of the families who depend on a functioning energy system.

Resource Works News

-

National2 days ago

National2 days agoCanada’s free speech record is cracking under pressure

-

Energy1 day ago

Energy1 day agoTanker ban politics leading to a reckoning for B.C.

-

Energy1 day ago

Energy1 day agoMeet REEF — the massive new export engine Canadians have never heard of

-

Business2 days ago

Business2 days agoTaxpayers Federation calls on politicians to reject funding for new Ottawa Senators arena

-

Fraser Institute1 day ago

Fraser Institute1 day agoClaims about ‘unmarked graves’ don’t withstand scrutiny

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoOttawa’s New Hate Law Goes Too Far

-

Business2 days ago

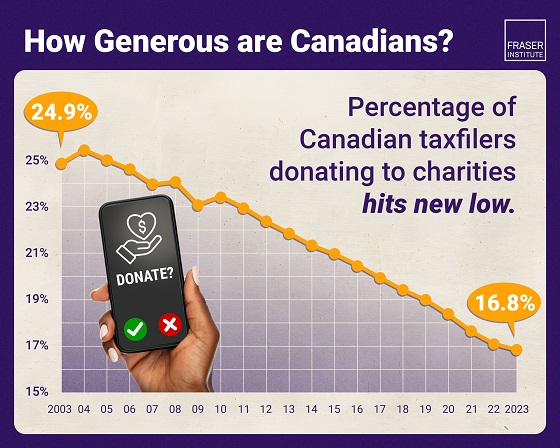

Business2 days agoAlbertans give most on average but Canadian generosity hits lowest point in 20 years

-

Business1 day ago

Business1 day agoToo nice to fight, Canada’s vulnerability in the age of authoritarian coercion