Business

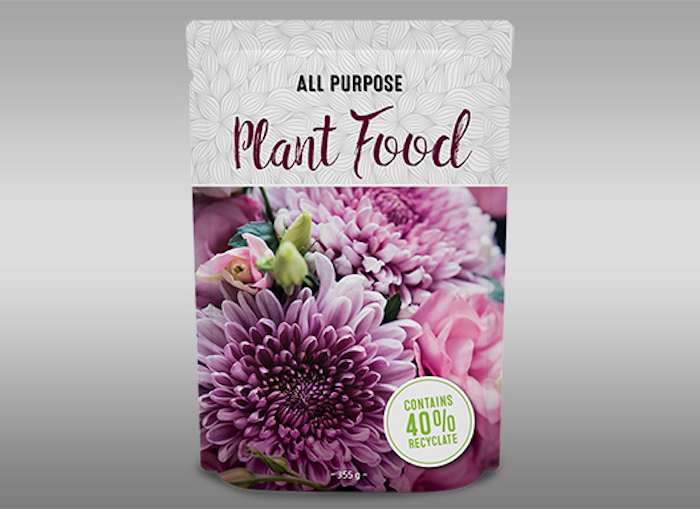

Nova Chemicals releases “Syndigo” line of lower-emission, recycled products

Flexible packaging, heavy duty sacks (salt, mulch bags) and blow molded bottles for home and personal care

News release from NOVA Chemicals

NOVA Chemicals Launches New Circular Solutions Business to Meet Growing Demand for Recycled Plastics

CALGARY — NOVA Chemicals Corporation (“NOVA Chemicals”) today announced the establishment of NOVA Circular Solutions, a new line of business focusing on lower-emission, recycled solutions that will help reshape a better, more sustainable world. NOVA Circular Solutions will be home to the SYNDIGOTM brand, the company’s newest portfolio of recycled polyethylene (rPE).

NOVA Circular Solutions is led by a team of experts in plastics development, recycling technology, additive science, packaging design, and regulatory compliance. It is headed by Alan Schrob, recycling director, who has nearly 30 years of experience in plastics, manufacturing, health, safety, and the environment.

“Plastic products play a critical role in our daily lives, and industry and consumers are placing higher value on products that contribute to the circular economy. They want products that can be recycled, reused, and reimagined,” said John Thayer, NOVA Chemicals senior vice president of sales and marketing. “Today’s announcement underscores NOVA’s commitment to be a leader in sustainable polyethylene production. We are investing time, resources, and world-class technical knowledge into this new line of business and the SYNDIGO brand.”

SYNDIGO rPE is designed to support recycled content and decarbonization goals of converters and brands while setting new industry standards for driving the transition towards a circular economy for plastics. There is a growing demand for recycled products and the SYNDIGO resins are poised to meet those needs in North America.

Commercially available products under the SYNDIGO brand include:

- EX-PCR-WR3 resin, mechanically recycled, sourced from polyethylene (PE) agricultural film, and ideal for e-commerce mailers, can liners, carry-out bags, protective packaging, and shrink.

- EX-PCR-NC4 resin, mechanically recycled, sourced from back-of-store distribution center PE stretch film and front-of-store consumer drop off, and ideal for heavy-duty sacks, e-commerce mailers, stretch wrap, collation shrink, protective packaging, and industrial films.

- EX-PCR-HD5 resin, mechanically recycled, sourced from HDPE milk jugs, and ideal for flexible packaging, heavy-duty sacks and small-part blow molding.

“Converters and brand owners are incorporating more recycled materials into their packaging and products to meet their sustainability goals and the demands of consumers. These important steps support our customers and drive towards a plastic circular economy, helping to protect the planet for future generations,” said Greg DeKunder, NOVA Chemicals vice president of polyethylene marketing & circular polymers. “At NOVA Chemicals, we are excited to leverage our technical knowledge, unmatched customer experience, and relationships throughout the value chain to drive recycled content adoption and demonstrate that plastics circularity is truly achievable.”

For more information on SYNDIGO, click here.

About NOVA Chemicals Corporation

NOVA Chemicals aspires to be the leading sustainable polyethylene producer in North America. Our driving purpose is to reshape plastics for a better, more sustainable world by delivering innovative solutions that advance a circular economy. Through these efforts, we strive to make everyday life healthier and safer while acting as a catalyst for a low-carbon, zero-plastic-waste future. NOVA Chemicals sets itself apart by offering superior product quality, proprietary high-performance resins, recycled and recyclable polyethylene, value chain collaboration, and exceptional customer experience. These benefits enable customers to use our resins to create flexible and rigid products that serve a variety of end-use applications. Our employees work to ensure health, safety, security, and environmental stewardship through our commitment to Sustainability and Responsible Care®.

NOVA Chemicals, headquartered in Calgary, Alberta, Canada, has nearly 2,500 employees worldwide and is wholly owned by Mubadala Investment Company of the Emirate of Abu Dhabi, United Arab Emirates. Learn more at www.novachem.com or follow us on LinkedIn.

Business

Elon Musk says X targeted by “massive cyberattack” originating in Ukraine

MxM News

MxM News

Quick Hit:

Elon Musk revealed Monday that X was the target of a “massive cyberattack,” with IP addresses linked to the Ukraine region. Musk noted the attack was highly coordinated and suggested it could involve a large group or a nation-state.

Key Details:

-

Speaking to Fox Business’ Larry Kudlow, Musk said, “We’re not exactly sure what happened, but there was a massive cyberattack to try to bring down the ecosystem with IP addresses originating in the Ukraine area.”

-

Earlier Monday, Musk posted about the attack on X, stating, “There was (still is) a massive cyberattack against X,” adding that the platform faces daily attacks but this one was particularly well-resourced.

-

Musk, who acquired X (formerly Twitter) for $44 billion in October 2022, has faced increasing pressure as his companies, including Tesla and SpaceX, deal with coordinated protests that he alleges are backed by left-wing billionaires like George Soros and Reid Hoffman.

Diving Deeper:

X suffered a significant cyberattack Monday, according to its owner Elon Musk. During an interview with Fox Business’ Larry Kudlow, Musk said that while the full details were unclear, the attack sought to “bring down the ecosystem” and had origins tied to the Ukraine region. He suggested the attack was well-funded and likely involved either a large, coordinated group or a nation-state.

Musk had earlier addressed the incident on X, stating that while the platform regularly faces cyber threats, this particular attack was on a different scale. “We get attacked every day, but this was done with a lot of resources,” he wrote, adding that efforts were underway to trace those responsible.

The timing of the cyberattack raises questions, as it comes amid widespread protests against Musk’s other ventures, particularly Tesla. Musk has accused high-profile Democrat donors, including George Soros and LinkedIn co-founder Reid Hoffman, of financing the demonstrations. He has not provided direct evidence to support the claim, but the protests have coincided with an intensifying political battle over Musk’s influence in both the private sector and government.

Musk’s role in the Trump administration as the head of the Department of Government Efficiency has drawn praise from the president. Trump has credited Musk with spearheading efforts to reduce government waste and save taxpayers billions. Meanwhile, Musk’s companies, including SpaceX, hold lucrative contracts with the Department of Defense, making them frequent targets of scrutiny and opposition from political adversaries.

As X continues to investigate the cyberattack, the broader implications remain unclear. Whether a nation-state or an organized cybercriminal group was behind the attack could have significant ramifications, particularly given the geopolitical tensions surrounding Ukraine.

Business

Mark Carney’s Misleading Actions and Non-Disclosure Should Disqualify Him as Canada’s Next Truly “Elected” Prime Minister – Jim Warren

From EnergyNow.Ca

By Jim Warren

If Mark Carney simply told the truth, he wouldn’t have to remember if what he says in Quebec matches what he says in Western Canada.

When speaking in Kelowna on February 12, Mark Carney left the impression he’d been converted from environmental zealot to missionary for an Energy East pipeline.

Carney said he would “use all of the powers of the federal government, including the emergency powers of the federal government, to accelerate the major projects that we need in order to build this economy and take on the Americans.”

Five days later Carney told CBC those emergency powers wouldn’t apply to Quebec. The government of Quebec would have veto power over any pipeline to the east coast. To clear up any possible confusion he repeated his pipeline veto pledge to Quebec at the French debate for the Liberal Leadership.

Apparently tough measures like the “peace, order and good government” clause in the Constitution and the Emergencies Act can be used by Liberals to arrest and seize the bank accounts of truckers who honk horns and cause traffic jams in Ottawa. But they can’t be used to build pipelines across Quebec even if it will reduce the impact of US tariffs on Canada’s economy. Like any good Liberal, Carney knows the interests of Maritimers and the West are of little consequence when his party needs to boost its support in Quebec.

Ironically, the second national poll in the past few months shows a majority of Quebecers support the construction of an East/West pipeline through their province. It is the Central Canadian political elite based in the major cities of Ontario and Quebec and excessively zealous environmental activists who oppose pipelines. And the Liberals are, of course, the party which represents that environmentally sanctimonious elite.

You read it here first.

On January 28, EnergyNow ran a column with the headline: Trump’s Wake-up Call to Canada, Politicians & Activists… The column outlined how the “peace, order and good government’” clause in the Constitution and/or the Emergencies Act could be employed to override regulatory barriers and court injunctions to ensure new pipelines to tidewater are built. The column says the first step in that process will be booting the Liberals from office. That condition still applies, given that Carney’s one-time mention of using “emergency powers” in support of a West to East pipeline turned out to be just one more Liberal lie to Western Canada.

Pierre Poilievre has aptly pegged Mark Carney as a hypocrite whose corporate interests and behavior are in substantial conflict with his environmental virtue signaling. At a House of Commons committee hearing in 2021, Poilievre spanked Carney for supporting the cancellation of the Energy East pipeline, while Brookfield Asset Management, the company he chaired, had bought pipelines in Brazil and the United Arab Emirates.

Poilievre admonished Carney, “You make billions of dollars off foreign pipelines and you shut them down here at home, putting our people out of work.”

More recently Carney misled Canadians about the role he played in moving Brookfield’s head office from Canada to the US. Carney claimed he had absolutely nothing to do with the move despite the fact he was company chairman at the time.

No less egregious is the fact Carney has used a loophole in federal legislation to avoid the financial disclosure rules for cabinet ministers including the prime minister. The disclosure rules help Parliament determine when ministers are involved in conflicts of interest. Carney will soon be crowned prime minister by the Liberals and will technically be exempt from the rule.

Carney is technically exempt because he’s never been elected as an MP. He will be able to avoid making his financial disclosure until 60 days after he is appointed prime minster. This means there is a good chance Carney’s financial information won’t be available well into the run up to a possible spring election.

Poilievre rang the alarm regarding the loophole and plans to introduce legislation as soon as Parliament reopens to fix the problem. He pointed out that there was nothing preventing Carney from being transparent and voluntarily providing the necessary information to Canadians prior to the Liberal leadership vote.

Poilevre was being too kind. A lack of integrity is what’s holding Carney back.

Carney is on record as a firm believer in carbon taxes. In the book he published in 2023 he wrote, “Meaningful carbon prices are the cornerstone of any effective [environmental] policy framework.”

Now, in support of his campaign to become prime minister, Carney promises to get rid of Canada’s unpopular carbon tax. The claim is clearly deceptive. He intends to replace the current tax on consumers with an upstream tax on oil producers and industry. Carney must think Canadians are too dumb to realize the increased upstream tax burden will be passed on to consumers in the form of higher prices for virtually everything they purchase.

When Carney is pressed to explain his carbon tax 2.0, he mumbles his way through an incomprehensible word salad worthy of Kamala Harris.

Also like Harris, Carney avoids campaign events where non-supporters might show up or media appearances and interviews where he might be asked a tough question. His appearance on US late night talk shows hosted by uber-liberals like Jon Stewart are unlikely to generate hard ball questions—the hosts are ignorant about Canadian politics and wouldn’t have a clue about what to ask.

I think Carney knows how bad the Kamala campaign tactics look. He was clearly taken aback by an incident at a campaign event in Regina. A member of the Liberal party who was somehow identified as a closet Conservative was accosted by two security agents and police who ejected him from the meeting. The guy had done nothing untoward—he hadn’t so much as raised his voice. It seems Mark Carney is very precious and must be protected from the public– including Liberal party members who are potentially dangerous because they supported another party in the past.

Where Carney really stands on environmental issues

Mark Carney didn’t just drink the climate alarmist Kool-Aid, he helped make it and wants to serve it to you.

“He’s the father of net-zero on a global basis,” according to Catherine Swift, President of the Canadian Coalition of Concerned Manufacturers and Businesses of Canada.

Carney has been a steadfast supporter of the environmental dogma underlying the Liberal assault on the fortunes of the oil and gas industries including the legislation preventing new pipelines. For years now, he’s been working on the inside of international organizations dedicated to climate change mitigation and greenhouse gas (GHG) emissions reduction.

In December 2019, he was appointed as the very first UN Special Envoy for Climate Action and Finance.

Prior to, during and after his time at the UN Carney has found time to hobnob with the billionaires and national leaders who presumably constitute the global elite. He’s been a regular at the annual World Economic Forum conferences in Davos, Switzerland.

As a member of the forum’s Foundation Board he is a duly qualified member of the modern day Illuminati. He associates with the international bankers who presume to know what’s best for the little people. His promotion of the radical green agenda dovetails nicely with the environmental virtue signaling of the world’s rich and powerful at Davos. They are dedicated to conquering global warming no matter what it costs the rest of us.

At the COP26 conference in 2021 Carney proudly proclaimed he was part of the same social movement as Greta Thunberg. Carney praised Thunberg as the “catalyst” who inspired the youth wing of the environmental movement. I haven’t heard if he’s gone off Greta and her wing of the movement now that she has announced her support for Hamas.

Don Braid recently wrote an insightful column in the Calgary Herald where he proposes that Carney is too deeply embedded in environmental activism and too publicly committed to climate change mitigation and the anti-oil agenda to run away from it when he becomes prime minister. Braid reports what Carney had to say about the environment and the need to abandon natural gas and petroleum in the 600 page door-stopper book he published in 2021, Value(s): Building a Better World for All.

In 2021, Carney was deluded enough to imagine the world’s virtuous emissions cutters would prevent the planet’s average temperature in 2050 from being any higher than 1.5O above what it was in the middle of the 19th century.

Not even serious climate change alarmists like Gwynne Dyer believe that’s remotely possible. The goals of climate zealots like Carney include fanciful, overly ambitious emissions reduction targets. They want change to happen too fast to be affordable for virtually everyone except the sorts of people who hang out at Davos.

In his book, Carney identifies what he believes should happen to the fossil fuel industries. His goals don’t bode well for the future of Canada’s petroleum and gas sectors and can’t help but harm the country’s economy.

Carney writes, “To meet the 1.5o C target, more than 80 per cent of current fossil fuel reserves (including three-quarters of coal, half of gas, one-third of oil)” will need to “stay in the ground, stranding these assets.”

Steven Guilbeault, Canada’s most infamous and politically dangerous environmental extremist backed Carney in the Liberal leadership contest. Guilbeault’s support is in recognition of Carney’s radical record on environmental issues including climate change mitigation.

Nothing to say about Liberal corruption

One of the most disturbing omissions from Carney’s political platform and media coverage of his campaign is any mention of plans for dealing with runaway Liberal cronyism and corruption.

He hasn’t promised to open the books and jail the crooks. He hasn’t promised to release the unredacted evidence of Green Slush Fund corruption. He hasn’t promised to release that evidence and turn it over to Parliament and the RCMP. He hasn’t announced plans for a thorough forensic accounting of Liberal backroom deals. And he hasn’t promised investigations into sweetheart contracts and looting in cases like the ArriveCAN scam.

He can’t do any of the above because it would implicate a number of Liberal insiders and he needed them to support him in the leadership contest. And how will he be able to work with the government caucus if he suggests he wants to get tough with the hogs at the trough? Given that he won’t release his financial information, it could be he doesn’t want to limit his own access to the gravy train.

In the final analysis, you’d have to say Mark Carney is a committed environmental zealot except when it interferes with his business interests or political ambitions.

He appears comfortable giving preference to the environmental extremism of the Davos set over the harm overly zealous climate change policies do to the livelihoods of ordinary Canadians and the country’s economy.

He appears comfortable with hypocrisy and misleading Canadians which clearly qualifies him to lead the Liberal party, but makes for a bad prime minister.

-

International1 day ago

International1 day agoIs Russia at War With Ukraine, or With the West?

-

Business20 hours ago

Business20 hours agoCarney must scrap carbon tax immediately

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoHow America is interfering in Brazil and why that matters everywhere. An information drop about USAID

-

Fraser Institute21 hours ago

Fraser Institute21 hours agoNew Prime Minister Carney’s Fiscal Math Doesn’t Add Up

-

Economy13 hours ago

Economy13 hours agoCANADA MUST REVIVE A “PIPELINE WEST” – Indigenous Ownership and Investment in Energy Projects are Critical to Canada’s Oil Customer Diversification

-

Daily Caller19 hours ago

Daily Caller19 hours agoEnergy Sec Slams Biden Admin Climate Obsession, Lays Out Trump Admin’s Pivot In Keynote Houston Speech

-

Business1 day ago

Business1 day agoReport: $128 million in federal grants spent on gender ideology

-

Business21 hours ago

Business21 hours agoTime to unplug Ottawa’s EV sales mandates