Business

North Carolina-headquartered Barings named in Climate Action 100+ probe

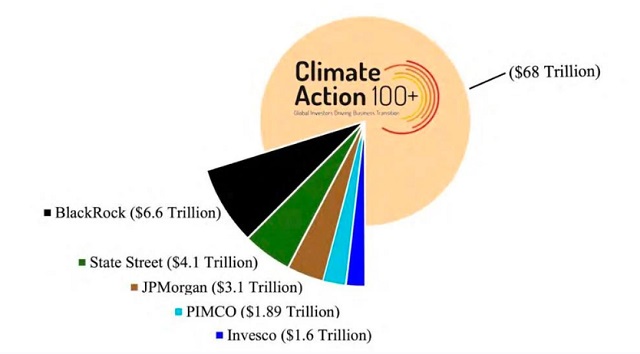

The Judiciary Committee of the U.S. House of Representatives, in a report, says its probe has led to a loss of $17 trillion worth of assets under management by the Climate Action 100+. That includes $6.6 trillion from BlackRock, $4.1 trillion by State Street, $3.1 trillion by JPMorgan, $1.89 trillion by PIMCO, and $1.6 trillion by Invesco.

From The Center Square

By Alan Wooten

An interim report by the Judiciary – Climate Control: Exposing the Decarbonization Collusion in Environmental, Social and Governance (ESG) Investing – labels the initiative a “climate cartel,” one which is involved in collusion and has not been investigated by the Biden administration.

One North Carolina company is among more than 130 in the United States being asked by a congressional committee about involvement with environmental, social and governance initiative Climate Action 100+.

U.S. Reps. Deborah Ross and Dan Bishop, a Democrat and Republican respectively from North Carolina, are among the 42 members of the Judiciary Committee in the House of Representatives seeking answers. In addition to the letter sent to Charlotte-headquartered Barings, the probe also seeks answers on involvement by retirement systems and government pension programs.

The probe and letters dated last Tuesday to Climate Action 100+ is trying to find answers to how the companies are operating with tactics, requests and actions; and garner documentations. A noon Aug. 13 deadline is set for responses.

Antitrust law, and the possible breach of it, is cited in each letter. Antitrust laws, the Department of Justice says, “prohibit anticompetitive conduct and mergers that deprive American consumers, taxpayers, and workers of the benefits of competition.”

An interim report by the Judiciary – Climate Control: Exposing the Decarbonization Collusion in Environmental, Social and Governance (ESG) Investing – labels the initiative a “climate cartel,” one which is involved in collusion and has not been investigated by the Biden administration.

“The climate cartel has declared war on our way of life, escalating its attacks on free markets and demanding that companies slash output of the critical products and services that allow Americans to drive, fly, and eat,” the report says. “The Biden administration has failed to act upon the climate cartel’s apparent violations of longstanding U.S. antitrust law. The committee, in contrast, is actively investigating their anticompetitive behavior.”

The report says with launch of the probe came withdrawals from the effort by BlackRock, State Street and JPAM, “three of the world’s largest asset managers.” Asset managers BlackRock, State Street and Vanguard own 21.9% of shares, and vote 24.9% of the shares, within the Standard and Poor’s (S&P) 500.

More than 272,000 documents and 2.5 million pages of nonpublic information were reviewed, the Judiciary says.

Most of the letters went to addresses in New York, Massachusetts and California.

Barings, according to its website, “is a global asset management firm which seeks to deliver excess returns across public and private markets in fixed income, real assets and capital solutions.”

In general, ESG investing – an acronym used in conjunction with environmental, social, and governance policies in investments – measures company policy. These policies typically align with progressive, or left, thoughts when it comes to politics.

Other names of description are sustainability, such as treatment of natural resources, gas emissions and climate regulations. A company’s policies for profits shared in the community, and how health and safety are impacted, relates to the social aspect. Governance usually aligns not only with integrity of accountability toward shareholders, but also diversity in leadership.

Issues in a company’s industry and the principles of ESG often shape policy.

Bishop is a member of the Subcommittee on the Administrative State, Regulatory Reform, and Antitrust within the Judiciary Committee. The 26-member subcommittee is chaired by Rep. Thomas Massie, R-Ky.

Managing Editor

Business

Musk Slashes DOGE Savings Forecast By 85%

From the Daily Caller News Foundation

By Thomas English

Elon Musk announced Thursday that the Department of Government Efficiency (DOGE) is now targeting $150 billion in federal savings for fiscal year 2026 — dramatically scaling back earlier claims of slashing as much as $2 trillion.

Musk initially projected DOGE would deliver $2 trillion in savings by targeting government waste, fraud and abuse. That figure was halved to $1 trillion earlier this year, but Musk walked it back again at Thursday’s Cabinet meeting, saying the revised $150 billion projection will “result in better services for the American people” and ensure federal spending “in a way that is sensible and fair and good.”

“I’m excited to announce we anticipate saving in FY ’26 from a reduction of waste and fraud a reduction of $150 billion dollars,” Musk said. “And some of it is just absurd, like, people getting unemployment insurance who haven’t been born yet. I mean, I think anyone can appreciate — I mean, come on, that’s just crazy.”

The announcement marks the latest in a string of revised projections from Musk, who has become the face of President Donald Trump’s aggressive federal efficiency agenda.

“Your people are fantastic,” the president responded. “In fact, hopefully they’ll stay around for the long haul. We’d like to keep as many as we can. They’re great — smart, sharp, finding things that nobody would have thought of.”

Musk originally floated the $2 trillion figure during campaign appearances last fall.

“I think we could do at least $2 trillion,” Musk said at the Madison Square Garden campaign rally in November. “At the end of the day, you’re being taxed — all government spending is taxation … Your money is being wasted, and the Department of Government Efficiency is going to fix that.”

By January, he softened expectations to a “really quite achievable” $1 trillion target before downsizing that figure again this week.

“Our goal is to reduce the deficit by a trillion dollars,” Musk told Fox News’ Bret Baier “Looked at in total federal spending, to drop the federal spending from $7 trillion to $6 trillion by eliminating waste, fraud and abuse … Which seems really quite achievable.”

DOGE’s website, which tracks cost-saving initiatives and contract cancellations, currently calculates total federal savings at $150 billion.

2025 Federal Election

Taxpayers urge federal party leaders to drop home sale reporting to CRA

Party leaders must clarify position on home equity tax

The Canadian Taxpayers Federation is calling on all party leaders to prove they’re against home equity taxes by pledging to immediately remove the Canada Revenue Agency reporting requirement on the sale of primary residences.

“Canadians rely on the sale of their homes to pay for their golden years,” said Carson Binda, CTF B.C. Director. “After the government spent hundreds of thousands of dollars flirting with home taxes, taxpayers need party leaders to prove they won’t tax our homes by removing the CRA reporting requirement.”

Right now, the profit you make from selling your home is exempt from the capital gains tax. However, in 2016, the federal government mandated that Canadians report the sale of their homes to the CRA, even though it’s tax exempt.

The Canada Mortgage and Housing Corporation also spent at least $450,000 to study and influence public opinion in favour of home equity taxes. The report recommended a home equity tax targeting the “housing wealth windfalls gained by many homeowners while they sleep and watch TV.”

“A home equity tax would hurt seniors saving for their golden years and make homes more expensive for younger generations,” Binda said. “If the federal government isn’t planning on imposing a home equity tax, then Canadians shouldn’t be forced to report the sale of their home to the CRA.”

-

Business1 day ago

Business1 day agoCanadian Police Raid Sophisticated Vancouver Fentanyl Labs, But Insist Millions of Pills Not Destined for U.S.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoTwo Canadian police unions endorse Pierre Poilievre for PM

-

2025 Federal Election1 day ago

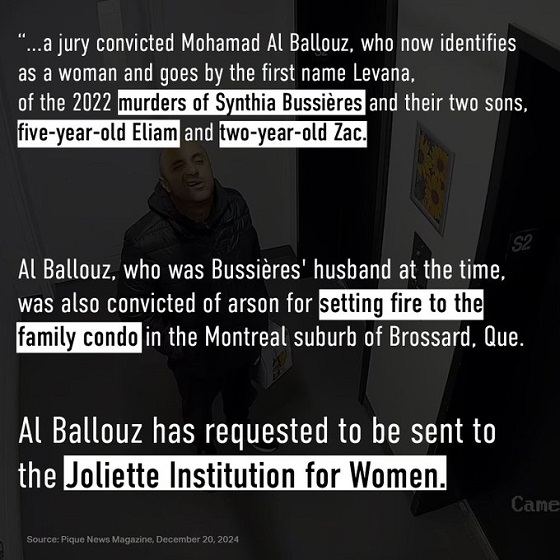

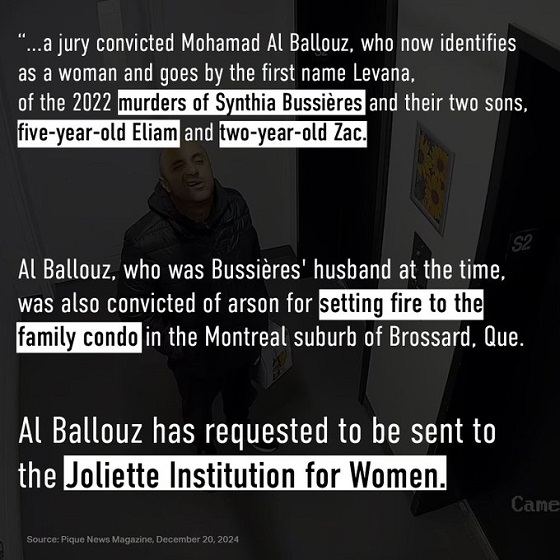

2025 Federal Election1 day ago‘Sadistic’ Canadian murderer claiming to be woman denied transfer to female prison

-

2025 Federal Election22 hours ago

2025 Federal Election22 hours agoTaxpayers urge federal party leaders to drop home sale reporting to CRA

-

2025 Federal Election2 days ago

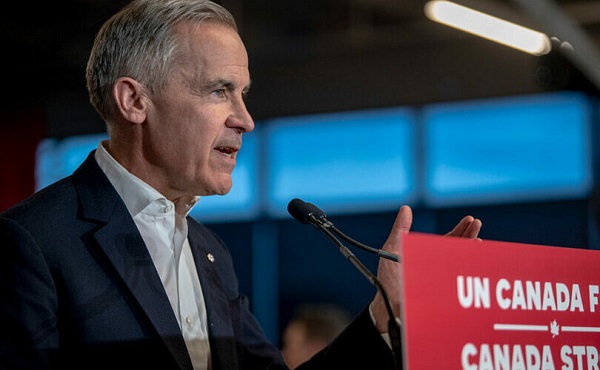

2025 Federal Election2 days agoCarney needs to cancel gun ban and buyback

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoMark Carney vows to provide sterilizing puberty blockers to children ‘without exception’

-

Business21 hours ago

Business21 hours agoMusk Slashes DOGE Savings Forecast By 85%

-

International9 hours ago

International9 hours agoBill Maher Breaks His Silence on His Private Meeting With President Trump