Energy

New Report Reveals Just How Energy Rich America Really Is

From the Daily Caller News Foundation

From the Daily Caller News Foundation

A new report by the Institute for Energy Research (IER), a nonprofit dedicated to the study of the impact of government regulation on global energy resources, finds that U.S. inventories of oil and natural gas have experienced stunning growth since 2011.

The same report, the North American Energy Inventory 2024, finds the United States also leading the world in coal resources, with total proven resources that are more than 53% bigger than China’s.

Despite years of record production levels and almost a decade of curtailed investment in the finding and development of new reserves forced by government regulation and discrimination by ESG-focused investment houses, America’s technically recoverable resource in oil grew by 15% from 2011 to 2024. Now standing at 1.66 trillion barrels, the U.S. resource is 5.6 times the proved reserves held by Saudi Arabia.

The story for natural gas is even more amazing: IER finds the technically recoverable resource for gas expanded by 47% in just 13 years, to a total of 4.03 quadrillion cubic feet. At current US consumption rates, that’s enough gas to supply the country’s needs for 130 years.

“The 2024 North American Energy Inventory makes it clear that we have ample reserves of oil, natural gas, and coal that will sustain us for generations,” Tom Pyle, President at IER, said in a release. “Technological advancements in the production process, along with our unique system of private ownership, have propelled the U.S. to global leadership in oil and natural gas production, fostering economic benefits like lower energy prices, job growth, enhanced national security, and an improved environment.”

It is key to understand here that the “technically recoverable” resource measure used in financial reporting is designed solely to create a point-in-time estimate of the amount of oil and gas in place underground that can be produced with current technology. Because technology advances in the oil and gas business every day, just as it does in society at large, this measure almost always is a vast understatement of the amount of resource that will ultimately be produced.

The Permian Basin has provided a great example of this phenomenon. Just over the past decade, the deployment of steadily advancing drilling and hydraulic fracturing technologies has enabled producers in that vast resource play to more than double expected recoveries from each new well drilled. Similar advances have been experienced in the other major shale plays throughout North America. As a result, the U.S. industry has been able to consistently raise record overall production levels of both oil and gas despite an active rig count that has fallen by over 30% since January 2023.

In its report, IER notes this aspect of the industry by pointing out that, while the technically recoverable resource for U.S. natural gas sits at an impressive 4.03 quads, the total gas resource in place underground is currently estimated at an overwhelming 65 quads. If just half of that resource in place eventually becomes recoverable thanks to advancing technology over the coming decades, that would mean the United States will enjoy more than 1,000 years of gas supply at current consumption levels. That is not a typo.

Where coal is concerned, IER finds the US is home to a world-leading 470 billion short tons of the most energy-dense fossil fuel in place. That equates to 912 years of supply at current consumption rates.

No other country on Earth can come close to rivaling the U.S. for this level of wealth in energy mineral resources, and few countries’ governments would dream of squandering them in pursuit of a political agenda driven by climate fearmongering. “And yet, many politicians, government agents, and activists seek to constrain North America’s energy potential,” Pyle says, adding, “We must resist these efforts and commit ourselves to unlocking these resources so that American families can continue to enjoy the real and meaningful benefits our energy production offers.”

With President Joe Biden and former President Donald Trump staking out polar opposite positions on this crucial question, America’s energy future is truly on the ballot this November.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

Energy

China undermining American energy independence, report says

From The Center Square

By

The Chinese Communist Party is exploiting the left’s green energy movement to hurt American energy independence, according to a new report from State Armor.

Michael Lucci, founder and CEO of State Armor, says the report shows how Energy Foundation China funds green energy initiatives that make America more reliant on China, especially on technology with known vulnerabilities.

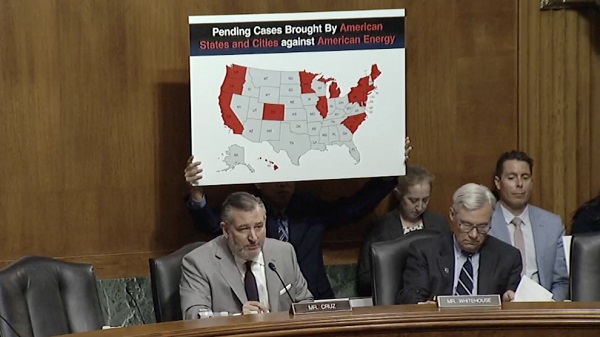

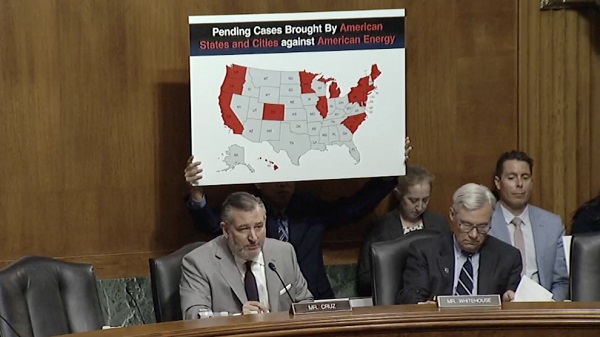

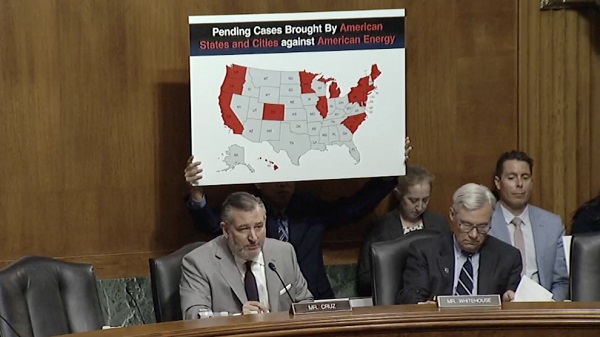

“Our report exposes how Energy Foundation China functions not as an independent nonprofit, but as a vehicle advancing the strategic interests of the Chinese Communist Party by funding U.S. green energy initiatives to shift American supply chains toward Beijing and undermine our energy security,” Lucci said in a statement before the Senate Judiciary Subcommittee’s hearing on Wednesday titled “Enter the Dragon – China and the Left’s Lawfare Against American Energy Dominance.”

Lucci said the group’s operations represent a textbook example of Chinese influence in America.

“This is a very good example of how the Chinese Communist Party operates influence operations within the United States. I would actually describe it as a perfect case study from their perspective,” he told The Center Square in a phone interview. “They’re using American money to leverage American policy changes that make the American energy grid dependent upon China.”

Lucci said one of the most concerning findings is that China-backed technology entering the U.S. power grid includes components with “undisclosed back doors” – posing a direct threat to the power grid.

“These are not actually green tech technologies. They’re red technologies,” he said. “We are finding – and this is open-source news reporting – they have undisclosed back doors in them. They’re described in a Reuters article as rogue communication devices… another way to describe that is kill switches.”

Lucci said China exploits American political divisions on energy policy to insert these technologies under the guise of environmental progress.

“Yes, and it’s very crafty,” he said. “We are not addressing the fact that these green technologies are red. Technologies controlled by the Communist Party of China should be out of the question.”

Although Lucci sees a future for carbon-free energy sources in the United States – particularly nuclear and solar energy – he doesn’t think the country should use technology from a foreign adversary to do it.

“It cannot be Chinese solar inverters that are reported in Reuters six weeks ago as having undisclosed back doors,” he said. “It cannot be Chinese batteries going into the grid … that allow them to sabotage our grid.”

Lucci said energy is a national security issue, and the United States is in a far better position to achieve energy independence than China.

“We are luckily endowed with energy independence if we choose to have it. China is not endowed with that luxury,” he said. “They’re poor in natural resources. We’re very well endowed – one of the best – with natural resources for energy production.”

He said that’s why China continues to build coal plants – and some of that coal comes from Australia – while pushing the United States to use solar energy.

“It’s very foolish of us to just make ourselves dependent on their technologies that we don’t need, and which are coming with embedded back doors that give them actual control over our energy grid,” he said.

Lucci says lawmakers at both the state and federal levels need to respond to this threat quickly.

“The executive branch should look at whether Energy Foundation China is operating as an unregistered foreign agent,” he said. “State attorneys general should be looking at these back doors that are going into our power grid – undisclosed back doors. That’s consumer fraud. That’s a deceptive trade practice.”

Energy

Carney’s Bill C-5 will likely make things worse—not better

From the Fraser Institute

By Niels Veldhuis and Jason Clemens

The Carney government’s signature legislation in its first post-election session of Parliament—Bill C-5, known as the Building Canada Act—recently passed the Senate for final approval, and is now law. It gives the government unprecedented powers and will likely make Canada even less attractive to investment than it is now, making a bad situation even worse.

Over the past 10 years, Canada has increasingly become known as a country that is un-investable, where it’s nearly impossible to get large and important projects, from pipelines to mines, approved. Even simple single-site redevelopment projects can take a decade to receive rezoning approval. It’s one of the primary reasons why Canada has experienced a mass exodus of investment capital, some $387 billion from 2015 to 2023. And from 2014 to 2023, the latest year of comparable data, investment per worker (excluding residential construction and adjusted for inflation) dropped by 19.3 per cent, from $20,310 to $16,386 (in 2017 dollars).

In theory, Bill C-5 will help speed up the approval process for projects deemed to be in the “national interest.” But the cabinet (and in practical terms, the prime minister) will determine the “national interest,” not the private sector. The bill also allows the cabinet to override existing laws, regulations and guidelines to facilitate investment and the building of projects such as pipelines, mines and power transmission lines. At a time when Canada is known for not being able to get large projects done, many are applauding this new approach, and indeed the bill passed with the support of the Opposition Conservatives.

But basically, it will allow the cabinet to go around nearly every existing hurdle impeding or preventing large project developments, and the list of hurdles is extensive: Bill C-69 (which governs the approval process for large infrastructure projects including pipelines), Bill C-48 (which effectively bans oil tankers off the west coast), the federal cap on greenhouse gas emissions for only the oil and gas sector (which effectively means a cap or even reductions in production), a quasi carbon tax on fuel (called the Clean Fuels Standard), and so on.

Bill C-5 will not change any of these problematic laws and regulations. It simply will allow the cabinet to choose when and where they’re applied. This is cronyism at its worst and opens up the Carney government to significant risks of favouritism and even corruption.

Consider firms interested in pursuing large projects. If the bill becomes the law of the land, there won’t be a new, better and more transparent process to follow that improves the general economic environment for all entrepreneurs and businesses. Instead, there will be a cabinet (i.e. politicians) with new extraordinary powers that firms can lobby to convince that their project is in the “national interest.”

Indeed, according to some reports, some senators are referring to Bill C-5 as the “trust me” law, meaning that because there aren’t enough details and guardrails within the legislation, senators who vote in favour are effectively “trusting” Prime Minister Carney and his cabinet to do the right thing, effectively and consistently over time.

Consider the ambiguity in the legislation and how it empowers discretionary decisions by the cabinet. According to the legislation, cabinet “may consider any factor” it “considers relevant, including the extent to which the project can… strengthen Canada’s autonomy, resilience and security” or “provide economic benefits to Canada” or “advance the interests of Indigenous peoples” or “contribute to clean growth and to meeting Canada’s objectives with respect to climate change.”

With this type of “criteria,” nearly anything cabinet or the prime minister can dream up could be deemed in the “national interest” and therefore provide the prime minister with unprecedented and near unilateral powers.

In the preamble to the legislation, the government said it wants an accelerated approval process, which “enhances regulatory certainty and investor confidence.” In all likelihood, Bill C-5 will do the opposite. It will put more power in the hands of a very few in government, lead to cronyism, risks outright corruption, and make Canada even less attractive to investment.

-

Automotive1 day ago

Automotive1 day agoElectric vehicle sales are falling hard in BC, and it is time to recognize reality.

-

Alberta5 hours ago

Alberta5 hours agoAlberta Independence Seekers Take First Step: Citizen Initiative Application Approved, Notice of Initiative Petition Issued

-

Automotive1 day ago

Automotive1 day agoPower Struggle: Electric vehicles and reality

-

Business1 day ago

Business1 day agoTrump on Canada tariff deadline: ‘We can do whatever we want’

-

Business7 hours ago

Business7 hours agoCanada Caves: Carney ditches digital services tax after criticism from Trump

-

Brownstone Institute2 days ago

Brownstone Institute2 days agoFDA Exposed: Hundreds of Drugs Approved without Proof They Work

-

Crime7 hours ago

Crime7 hours agoSuspected ambush leaves two firefighters dead in Idaho

-

Energy1 day ago

Energy1 day agoChina undermining American energy independence, report says