Business

Musk Slashes DOGE Savings Forecast By 85%

From the Daily Caller News Foundation

By Thomas English

Elon Musk announced Thursday that the Department of Government Efficiency (DOGE) is now targeting $150 billion in federal savings for fiscal year 2026 — dramatically scaling back earlier claims of slashing as much as $2 trillion.

Musk initially projected DOGE would deliver $2 trillion in savings by targeting government waste, fraud and abuse. That figure was halved to $1 trillion earlier this year, but Musk walked it back again at Thursday’s Cabinet meeting, saying the revised $150 billion projection will “result in better services for the American people” and ensure federal spending “in a way that is sensible and fair and good.”

“I’m excited to announce we anticipate saving in FY ’26 from a reduction of waste and fraud a reduction of $150 billion dollars,” Musk said. “And some of it is just absurd, like, people getting unemployment insurance who haven’t been born yet. I mean, I think anyone can appreciate — I mean, come on, that’s just crazy.”

The announcement marks the latest in a string of revised projections from Musk, who has become the face of President Donald Trump’s aggressive federal efficiency agenda.

“Your people are fantastic,” the president responded. “In fact, hopefully they’ll stay around for the long haul. We’d like to keep as many as we can. They’re great — smart, sharp, finding things that nobody would have thought of.”

Musk originally floated the $2 trillion figure during campaign appearances last fall.

“I think we could do at least $2 trillion,” Musk said at the Madison Square Garden campaign rally in November. “At the end of the day, you’re being taxed — all government spending is taxation … Your money is being wasted, and the Department of Government Efficiency is going to fix that.”

By January, he softened expectations to a “really quite achievable” $1 trillion target before downsizing that figure again this week.

“Our goal is to reduce the deficit by a trillion dollars,” Musk told Fox News’ Bret Baier “Looked at in total federal spending, to drop the federal spending from $7 trillion to $6 trillion by eliminating waste, fraud and abuse … Which seems really quite achievable.”

DOGE’s website, which tracks cost-saving initiatives and contract cancellations, currently calculates total federal savings at $150 billion.

Business

Trumpian chaos—where we are now and what’s coming for Canada

From the Fraser Institute

As we pause to catch our breath amid the ongoing drama of President Donald Trump’s whack-a-mole tariff war, there’s both good and bad news from a Canadian perspective.

On the positive side, Canada (together with Mexico) was not specifically targeted when the president outlined the details of his so-called “reciprocal” tariffs on April 2. These new levies—ranging from 10 per cent to more than 40 per cent, depending on the country—will affect most categories of exports from virtually every U.S. trading partner, but fortunately not America’s two co-signatories to the Canada-U.S.-Mexico Agreement (CUSMA). Instead, apart from a handful of significant economic sectors (discussed below), Canadian exporters, for the moment, will be able to sell tariff-free into the U.S. market, provided they are compliant with the rules and paperwork requirements stipulated in CUSMA. That’s a ray of sunshine in an otherwise dark sky.

On April 9, the president agreed to a 90-day pause on his sweeping reciprocal tariffs, perhaps because of plunging U.S. and global stock markets and mounting fears of economic calamity. At the same time, he announced a jaw-dropping 125 per cent tariff on imports from China, which then immediately retaliated with steep duties of its own on all U.S. goods entering the country.

The risk remains that when the dust settles, the U.S will end up applying much higher tariffs on imports from most of the world. Should President Trump adopt the reciprocal levies announced on April 2 and stick with the 125 per cent tariff on imports from China, Yale University researchers estimate that the average effective U.S. tariff rate will soar to 25.3 per cent—more than 10 times higher than the average over the preceding 25 years. That’s one measure of the disruption that Trump has visited upon the international trading system.

For Canada, the average U.S. tariff would be lower, between 4 and 5 per cent, reflecting the benefits of CUSMA, albeit somewhat offset by the negative impact of the 25 per cent levies the U.S. is imposing on all imports of steel, aluminum, and motor vehicles and parts, along with separate punitive duties on softwood lumber imported from Canada. American tariffs on these Canadian export sectors will undoubtedly exact a toll on our economy. But the damage would be considerably greater if Canada was subject to across-the-board U.S. reciprocal tariffs.

Where does all of this leave Canada’s $3.3 trillion economy as of the second quarter of 2025?

Late last year, most forecasters were expecting a modest pick-up in growth after a notably lacklustre 2024, mainly thanks to lower interest rates and reduced borrowing costs for households and businesses. However, that widely-shared view didn’t account for President Trump’s wholesale assault on the global economic system—“a new economic crisis,” as Bank of Canada Governor Tiff Macklem described the situation in late March.

Back in February, the central bank took a stab at modelling the effects of matching U.S. and Canadian tariffs of 25 per cent, levied on all bilateral goods trade (apart from energy where a lower tariff rate was assumed). Its projections pointed to a permanent loss of Canadian economic output (real GDP) on the order of 2-3 per cent, a double-digit percentage decline in business investment, weaker consumption and a substantial fall in the value of Canadian exports over 2025/26. The Bank’s modelling also foresaw a lower Canadian dollar and a temporary jump in inflation, with the latter due primarily to Canada’s assumed retaliatory tariffs.

The macroeconomic scenario outlined in the Bank of Canada’s January study was dire enough, signalling a Canadian recession stretching over most of 2025 and well into 2026. But seen through today’s lens, the Bank’s earlier analysis looks too optimistic, as it failed to incorporate the worldwide dimensions of President Trump’s tariff barrage, including the scale of the retaliation planned by America’s aggrieved trading partners.

Even if it escapes the worst of Trump’s tariffs, Canada stands to suffer from a gruesome mix of slower global growth, a probable U.S. recession, and falling prices for oil, minerals and other natural resource products, which collectively comprise around half of the country’s international exports. Already there has been a marked erosion of Canadian business confidence, as reported in the Bank of Canada’s spring Business Outlook Survey, with one-third of firms now expecting a recession and hiring intentions sinking to the lowest level in a decade. Most respondents to the Bank’s survey also anticipate rising business input costs and higher Canadian inflation in 2025.

Worryingly, the latest Bank of Canada survey was completed in February; since then, the intensity of the Trumpian chaos has continued to increase. Among other things, the uncertainty that is an inevitable by-product of the president’s shambolic policymaking is having a decisively negative impact on business investment in many industries—in Canada, to be sure, but also in the United States. As two American business analysts recently observed: “With tariff policy shifting not day by day, but hour by hour… business investment is entirely paralyzed—and will continue to be frozen for the foreseeable future. That is exactly the opposite of what Trump intended.”

It doesn’t help that Canada is in the midst of a federal election, and that the government is therefore “otherwise occupied.” Once Canadian voters have spoken, the government elected on April 28 must deal with a deteriorating economy, navigate through the tariff fog and determine how to reset economic and security relations with our principal ally and commercial partner in the turbulent era of Trump 2.0.

2025 Federal Election

Taxpayers urge federal party leaders to drop home sale reporting to CRA

Party leaders must clarify position on home equity tax

The Canadian Taxpayers Federation is calling on all party leaders to prove they’re against home equity taxes by pledging to immediately remove the Canada Revenue Agency reporting requirement on the sale of primary residences.

“Canadians rely on the sale of their homes to pay for their golden years,” said Carson Binda, CTF B.C. Director. “After the government spent hundreds of thousands of dollars flirting with home taxes, taxpayers need party leaders to prove they won’t tax our homes by removing the CRA reporting requirement.”

Right now, the profit you make from selling your home is exempt from the capital gains tax. However, in 2016, the federal government mandated that Canadians report the sale of their homes to the CRA, even though it’s tax exempt.

The Canada Mortgage and Housing Corporation also spent at least $450,000 to study and influence public opinion in favour of home equity taxes. The report recommended a home equity tax targeting the “housing wealth windfalls gained by many homeowners while they sleep and watch TV.”

“A home equity tax would hurt seniors saving for their golden years and make homes more expensive for younger generations,” Binda said. “If the federal government isn’t planning on imposing a home equity tax, then Canadians shouldn’t be forced to report the sale of their home to the CRA.”

-

Business2 days ago

Business2 days agoCanadian Police Raid Sophisticated Vancouver Fentanyl Labs, But Insist Millions of Pills Not Destined for U.S.

-

2025 Federal Election1 day ago

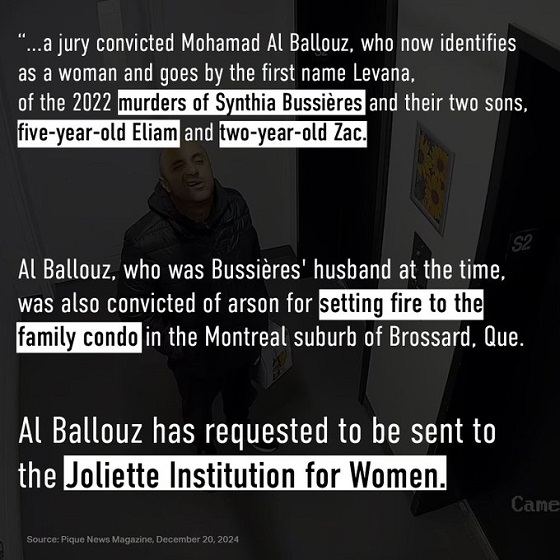

2025 Federal Election1 day ago‘Sadistic’ Canadian murderer claiming to be woman denied transfer to female prison

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoTaxpayers urge federal party leaders to drop home sale reporting to CRA

-

International13 hours ago

International13 hours agoBill Maher Breaks His Silence on His Private Meeting With President Trump

-

Alberta7 hours ago

Alberta7 hours agoProvince introducing “Patient-Focused Funding Model” to fund acute care in Alberta

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoWhat Trump Says About Modern U.S. And What Carney Is Hiding About Canada

-

COVID-192 days ago

COVID-192 days agoCDC Vaccine Safety Director May Have Destroyed Records, Says Sen. Ron Johnson

-

Carbon Tax14 hours ago

Carbon Tax14 hours agoTrump targets Washington’s climate laws in recent executive order