Alberta

Moustaches for Men’s Health – The Meaning of Movember

It’s that time of year again! Whether it’s your least favorite month, or this is your time to shine – Movember is back!

While the fun is certainly in the facial hair … Movember is more than just the opportunity to fill in those mutton chops or grow a socially acceptable handlebar moustache. The meaning of this month goes further than flexing the best (or worst) facial hair fashion, it’s the chance to take part in a global movement to support and promote men’s health.

While the fun is certainly in the facial hair … Movember is more than just the opportunity to fill in those mutton chops or grow a socially acceptable handlebar moustache. The meaning of this month goes further than flexing the best (or worst) facial hair fashion, it’s the chance to take part in a global movement to support and promote men’s health.

“The moustache is something of a Trojan Horse that encourages men to engage with their health and talk about the things they often don’t, but should,” says Mitch Hermansen, Western Canada Lead for Movember, “There’s no such thing as a bad moustache. They can all start conversations and save lives.”

Founded in 2003 among four friends, Movember is now the world’s leading men’s health charity, with more than 6 million global supporters all committed to changing the narrative surrounding male health and helping men live “happier, healthier, longer lives”.

The average life expectancy of a man is 6 years shorter than that of the average woman. Movember is working to minimize this gap by focusing on the three factors that pose the greatest risk to mens health worldwide: prostate cancer, testicular cancer and suicide.

Globally, there are 9.9 million men living with or experiencing the effects of prostate cancer. According to the American Cancer Society, prostate cancer is the second leading cause of cancer death in American men, with 1 in 9 men being diagnosed with prostate cancer in their lifetime, and approximately 1 in 41 men dying as a result.

Testicular cancer is the world’s most common cancer among men ages 15-39, and the American Cancer Society estimates 1 in every 250 males will develop testicular cancer during their lifetime. Education, early detection and effective treatments have put the survival rate for this diagnosis at greater than 95%, however the long-term side effects and impacts can have lasting negative implications on quality of life for survivors.

The Movember foundation works to minimize the global impact of these dominant male cancers by funding initiatives and collaborating with innovative global organizations that promote education, early detection and personalized and affordable treatment.

As a holistic men’s health organization, the Movember approach prioritizes mental health as much as physical. Globally, the male suicide rate is shockingly high, with one man dying by suicide every minute of every day, and 6 out of 10 suicides being committed by men (1).

As a holistic men’s health organization, the Movember approach prioritizes mental health as much as physical. Globally, the male suicide rate is shockingly high, with one man dying by suicide every minute of every day, and 6 out of 10 suicides being committed by men (1).

Movember examines and addresses the complex structural factors that contribute to the male suicide rate and keep men from speaking out and seeking help. “We provide men with the tools, avenues and resources to support and engage with their own mental health,” says Hermansen, “as well as ways to support one another.” By facilitating a global conversation surrounding male health and focusing on the three top health risks men currently face worldwide, Movember aims to reduce the number of men dying prematurely by 25% by the year 2030.

This November, there are 4 opportunities to get involved with Movember and contribute to men’s health.

1. Grow your own Mo and raise funds with your face

2. Run or walk 60 km as a part of Move for Movember in recognition of the 60 men lost to suicide each hour, every hour

3. Gather a group and Host a virtual Mo-Ment, and have a good time for a good cause

4. Design your own fundraising challenge and Mo Your Own Way.

Visit movember.com to learn more about men’s health and how to get involved, or to create a profile and start fundraising.

For more stories, visit Todayville Calgary.

2025 Federal Election

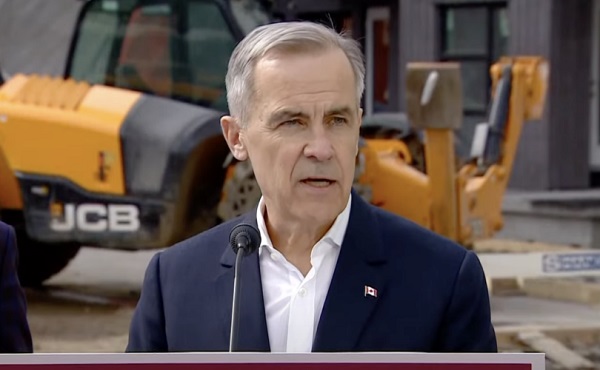

Next federal government should recognize Alberta’s important role in the federation

From the Fraser Institute

By Tegan Hill

With the tariff war continuing and the federal election underway, Canadians should understand what the last federal government seemingly did not—a strong Alberta makes for a stronger Canada.

And yet, current federal policies disproportionately and negatively impact the province. The list includes Bill C-69 (which imposes complex, uncertain and onerous review requirements on major energy projects), Bill C-48 (which bans large oil tankers off British Columbia’s northern coast and limits access to Asian markets), an arbitrary cap on oil and gas emissions, numerous other “net-zero” targets, and so on.

Meanwhile, Albertans contribute significantly more to federal revenues and national programs than they receive back in spending on transfers and programs including the Canada Pension Plan (CPP) because Alberta has relatively high rates of employment, higher average incomes and a younger population.

For instance, since 1976 Alberta’s employment rate (the number of employed people as a share of the population 15 years of age and over) has averaged 67.4 per cent compared to 59.7 per cent in the rest of Canada, and annual market income (including employment and investment income) has exceeded that in the other provinces by $10,918 (on average).

As a result, Alberta’s total net contribution to federal finances (total federal taxes and payments paid by Albertans minus federal money spent or transferred to Albertans) was $244.6 billion from 2007 to 2022—more than five times as much as the net contribution from British Columbians or Ontarians. That’s a massive outsized contribution given Alberta’s population, which is smaller than B.C. and much smaller than Ontario.

Albertans’ net contribution to the CPP is particularly significant. From 1981 to 2022, Alberta workers contributed 14.4 per cent (on average) of total CPP payments paid to retirees in Canada while retirees in the province received only 10.0 per cent of the payments. Albertans made a cumulative net contribution to the CPP (the difference between total CPP contributions made by Albertans and CPP benefits paid to retirees in Alberta) of $53.6 billion over the period—approximately six times greater than the net contribution of B.C., the only other net contributing province to the CPP. Indeed, only two of the nine provinces that participate in the CPP contribute more in payroll taxes to the program than their residents receive back in benefits.

So what would happen if Alberta withdrew from the CPP?

For starters, the basic CPP contribution rate of 9.9 per cent (typically deducted from our paycheques) for Canadians outside Alberta (excluding Quebec) would have to increase for the program to remain sustainable. For a new standalone plan in Alberta, the rate would likely be lower, with estimates ranging from 5.85 per cent to 8.2 per cent. In other words, based on these estimates, if Alberta withdrew from the CPP, Alberta workers could receive the same retirement benefits but at a lower cost (i.e. lower payroll tax) than other Canadians while the payroll tax would have to increase for the rest of the country while the benefits remained the same.

Finally, despite any claims to the contrary, according to Statistics Canada, Alberta’s demographic advantage, which fuels its outsized contribution to the CPP, will only widen in the years ahead. Alberta will likely maintain relatively high employment rates and continue to welcome workers from across Canada and around the world. And considering Alberta recorded the highest average inflation-adjusted economic growth in Canada since 1981, with Albertans’ inflation-adjusted market income exceeding the average of the other provinces every year since 1971, Albertans will likely continue to pay an outsized portion for the CPP. Of course, the idea for Alberta to withdraw from the CPP and create its own provincial plan isn’t new. In 2001, several notable public figures, including Stephen Harper, wrote the famous Alberta “firewall” letter suggesting the province should take control of its future after being marginalized by the federal government.

The next federal government—whoever that may be—should understand Alberta’s crucial role in the federation. For a stronger Canada, especially during uncertain times, Ottawa should support a strong Alberta including its energy industry.

Alberta

Province announces plans for nine new ‘urgent care centres’ – redirecting 200,000 hospital visits

Expanding urgent care across Alberta

If passed, Budget 2025 includes $17 million in planning funds to support the development of urgent care facilities across the province.

As Alberta’s population grows, so does the demand for health care. In response, the government is making significant investments to ensure every Albertan has access to high-quality care close to home. Currently, more than 35 per cent of emergency department visits are for non-life-threatening conditions that could be treated at urgent care centres. By expanding these centres, Alberta’s government is enhancing the health care system and improving access to timely care.

If passed, Budget 2025 includes $15 million to support plans for eight new urgent care centres and an additional $2 million in planning funds for an integrated primary and urgent care facility in Airdrie. These investments will help redirect up to 200,000 lower-acuity emergency department visits annually, freeing up capacity for life-threatening cases, reducing wait times and improving access to care for Albertans.

“More people are choosing to call Alberta home, which is why we are taking action to build capacity across the health care system. Urgent care centres help bridge the gap between primary care and emergency departments, providing timely care for non-life-threatening conditions.”

“Our team at Infrastructure is fully committed to leading the important task of planning these eight new urgent care facilities across the province. Investments into facilities like these help strengthen our communities by alleviating strains on emergency departments and enhance access to care. I am looking forward to the important work ahead.”

The locations for the eight new urgent care centres were selected based on current and projected increases in demand for lower-acuity care at emergency departments. The new facilities will be in west Edmonton, south Edmonton, Westview (Stony Plain/Spruce Grove), east Calgary, Lethbridge, Medicine Hat, Cold Lake and Fort McMurray.

“Too many Albertans, especially those living in rural communities, are travelling significant distances to receive care. Advancing plans for new urgent care centres will build capacity across the health care system.”

“Additional urgent care centres across Alberta will give Albertans more options for accessing the right level of care when it’s needed. This is a necessary and substantial investment that will eventually ease some of the pressures on our emergency departments.”

The remaining $2 million will support planning for One Health Airdrie’s integrated primary and urgent care facility. The operating model, approved last fall, will see One Health Airdrie as the primary care operator, while urgent care services will be publicly funded and operated by a provider selected through a competitive process.

“Our new Airdrie facility, offering integrated primary and urgent care, will provide same-day access to approximately 30,000 primary care patients and increase urgent care capacity by around 200 per cent, benefiting the entire community and surrounding areas. We are very excited.”

Alberta’s government will continue to make smart, strategic investments in health facilities to support the delivery of publicly funded health programs and services to ensure Albertans have access to the care they need, when and where they need it.

Budget 2025 is meeting the challenge faced by Alberta with continued investments in education and health, lower taxes for families and a focus on the economy.

Quick facts

- The $2 million in planning funds for One Health Airdrie are part of a total $24-million investment to advance planning on several health capital initiatives across the province through Budget 2025.

- Alberta’s population is growing, and visits to emergency departments are projected to increase by 27 per cent by 2038.

- Last year, Alberta’s government provided $8.4 million for renovations to the existing Airdrie Community Health Centre.

Related information

-

Business1 day ago

Business1 day agoFeds Spent Roughly $1 Billion To Conduct Survey That Could’ve Been Done For $10,000, Musk Says

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoChinese Gangs Dominate Canada: Why Will Voters Give Liberals Another Term?

-

Alberta17 hours ago

Alberta17 hours agoPhoto radar to be restricted to School, Playground, and Construction Zones as Alberta ends photo radar era

-

Health20 hours ago

Health20 hours agoRFK Jr. Drops Stunning Vaccine Announcement

-

Alberta11 hours ago

Alberta11 hours agoProvince announces plans for nine new ‘urgent care centres’ – redirecting 200,000 hospital visits

-

Business9 hours ago

Business9 hours agoElon Musk, DOGE officials reveal ‘astonishing’ government waste, fraud in viral interview

-

Energy2 days ago

Energy2 days agoEnergy, climate, and economics — A smarter path for Canada

-

Alberta2 days ago

Alberta2 days agoAlberta Institute urging Premier Smith to follow Saskatchewan and drop Industrial Carbon Tax