Business

More government interventions hamper capitalism

From the Fraser Institute

By Philip Cross

In his fourth book, What Went Wrong With Capitalism, investor and author Ruchir Sharma eloquently details how advanced market economies for decades have increasingly strayed from the basic principles of market-based competition and pricing, resulting in persistently slow growth which causes many to question whether capitalism works anymore. However, what is often attributed to market failure is often a failure of government.

Collectivists have successfully installed the narrative that the Reagan and Thatcher era in the 1980s ushered in an era of neoliberalism and government austerity. Nothing could be further from the truth. Keynesian counter-cyclical government spending was supposed to support the economy during a recession; instead, it is used to support the economy at every point of the business cycle. At most, the Reagan and Thatcher regimes only slowed the rate of increase of government spending. Combined with a growing public resistance to paying higher taxes, this created permanent budget deficits. Policymakers remain stuck on the stimulus treadmill: former European Central Bank head Mario Draghi recently recommended the EU spend an inconceivable US$900 billion a year to revive its flagging economy.

Moreover, the slowdown in the growth of government spending did little to stop a tidal wave of government rules and regulations, many of which favour entrenched interests and firms. Sharma’s observation that being “pro-business is not the same as pro-capitalism, and the distinction continues to elude us” is especially true for Canada. He documents the increasing use of government subsidies and bail-outs, which helps fuel the growth of so-called zombie firms—unprofitable companies that stay in business thanks to support from governments or lending institutions (who know problems caused by bad loans will be bailed out by government), which prevent labour and capital from moving to areas with better long-term growth potential. Most recently, we have seen governments embrace higher tariffs and industrial policy, notably for green energy projects in Canada and the United States.

Increased government meddling in the marketplace reduces competition and slows the process of creative destruction that is the lifeblood of capitalism by allowing “new firms to rise up and destroy the complacent ones, making the economy ever more productive over time,” according to Sharma. This was most evident during the pandemic, when business failures declined as government hand-outs outweighed the impact of unprecedented shutdown of large parts of the economy. But the decline in business startups and failures has persisted for decades.

Steadily rising government intervention in the economy results in lower productivity and slower growth. This pushes policymakers to resort to higher fiscal deficits and easy money policies in a forlorn attempt to boost long-term potential growth.

It is often said that the recent slowdown of productivity reflects a lack of business investment. That is certainly part of the problem outside of the U.S., especially for Canada over the past decade. However, Sharma notes it is the efficiency and not just the level of investment that is the problem. Pervasive government interventions in the economy distort prices and the allocation of capital, resulting in what the libertarian economist Friedrich Hayek called “malinvestments.” This is especially true for Canada, which for over a decade has shunned clearly profitable investment opportunities in the resource sector while pouring tens of billions into expensive public transit systems, which nevertheless failed to persuade commuters to leave their vehicles at home.

One theme Sharma does not develop is that this growing inability of governments to efficiently deliver results is not due to a lack of resources. Governments have expanded their workforce, their spending, and their regulatory power. Nevertheless, government programs falter because of bad management, chronic political meddling for short-term electoral gains, and a workforce which increasingly serves its own interests and not public’s.

Sharma concludes on both an optimistic and pessimistic note. He examines the ability of capitalism to thrive in countries such as Switzerland and Taiwan by balancing “a business-friendly environment alongside social equality.” Nevertheless, he’s concerned with the “supreme irony: modern voters, particularly the young, now demand that leaders show respect for the fragility of natural ecosystems… [but] at the same time, leaders are riding a popular wave when they propose to intervene in the economy—the global ecosystem in which 8 billion people do business.”

As disillusionment with capitalism spreads due to slow growth, the temptation is to increase government interventions, which only worse the economic outcome.

Author:

2025 Federal Election

As PM Poilievre would cancel summer holidays for MP’s so Ottawa can finally get back to work

From Conservative Party Communications

In the first 100 days, a new Conservative government will pass 3 laws:

1. Affordability For a Change Act—cutting spending, income tax, sales tax off homes

2. Safety For a Change Act to lock up criminals

3. Bring Home Jobs Act—that repeals C-69, sets up 6 month permit turnarounds for new projects

No summer holiday til they pass!

Conservative Leader Pierre Poilievre announced today that as Prime Minister he will cancel the summer holiday for Ottawa politicians and introduce three pieces of legislation to make life affordable, stop crime, and unleash our economy to bring back powerful paycheques. Because change can’t wait.

A new Conservative government will kickstart the plan to undo the damage of the Lost Liberal Decade and restore the promise of Canada with a comprehensive legislative agenda to reverse the worst Trudeau laws and cut the cost of living, crack down on crime, and unleash the Canadian economy with ‘100 Days of Change.’ Parliament will not rise until all three bills are law and Canadians get the change they voted for.

“After three Liberal terms, Canadians want change now,” said Poilievre. “My plan for ‘100 Days of Change’ will deliver that change. A new Conservative government will immediately get to work, and we will not stop until we have delivered lower costs, safer streets, and bigger paycheques.”

The ’100 Days of Change’ will include three pieces of legislation:

The Affordability–For a Change Act

Will lower food prices, build more homes, and bring back affordability for Canadians by:

- Cutting income taxes by 15%. The average worker will keep an extra $900 each year, while dual-income families will keep $1,800 more annually.

- Axing the federal sales tax on new homes up to $1.3 million. Combined with a plan to incentivize cities to lower development charges, this will save homebuyers $100,000 on new homes.

- Axing the federal sales tax on new Canadian cars to protect auto workers’ jobs and save Canadians money, and challenge provinces to do the same.

- Axing the carbon tax in full. Repeal the entire carbon tax law, including the federal industrial carbon tax backstop, to restore our industrial base and take back control of our economy from the Americans.

- Scrapping Liberal fuel regulations and electricity taxes to lower the cost of heating, gas, and fuel.

- Letting working seniors earn up to $34,000 tax-free.

- Axing the escalator tax on alcohol and reset the excise duty rates to those in effect before the escalator was passed.

- Scrapping the plastics ban and ending the planned food packaging tax on fresh produce that will drive up grocery costs by up to 30%.

We will also:

- Identify 15% of federal buildings and lands to sell for housing in Canadian cities.

The Safe Streets–For a Change Act

Will end the Liberal violent crime wave by:

- Repealing all the Liberal laws that caused the violent crime wave, including catch-and-release Bill C-75, which lets rampant criminals go free within hours of their arrest.

- Introducing a “three strikes, you’re out” rule. After three serious offences, offenders will face mandatory minimum 10-year prison sentences with no bail, parole, house arrest, or probation.

- Imposing life sentences for fentanyl trafficking, illegal gun trafficking, and human trafficking. For too long, radical Liberals have let crime spiral out of control—Canada will no longer be a haven for criminals.

- Stopping auto theft, extortion, fraud, and arson with new minimum penalties, no house arrest, and a new more serious offence for organized theft.

- Give police the power to end tent cities.

- Bringing in tougher penalties and a new law to crack down on Intimate Partner Violence.

- Restoring consecutive sentences for multiple murderers, so the worst mass murderers are never let back on our streets.

The Bring Home Jobs–For a Change Act

This Act will be rocket fuel for our economy. We will unleash Canada’s vast resource wealth, bring back investment, and create powerful paycheques for workers so we can stand on our own feet and stand up to Trump from a position of strength, by:

- Repealing the Liberal ‘No Development Law’, C-69 and Bill C-48, lifting the cap on Canadian energy to get major projects built, unlock our resources, and start selling Canadian energy to the world again.

- Bringing in the Canada First Reinvestment Tax Cut to reward Canadians who reinvest their earnings back into our country, unlocking billions for home building, manufacturing, and tools, training and technology to boost productivity for Canadian workers.

- Creating a One-Stop-Shop to safely and rapidly approve resource projects, with one simple application and one environmental review within one year.

Poilievre will also:

- Call President Trump to end the damaging and unjustified tariffs and accelerate negotiations to replace CUSMA with a new deal on trade and security. We need certainty—not chaos, but Conservatives will never compromise on our sovereignty and security.

- Get Phase 2 of LNG Canada built to double the project’s natural gas production.

- Accelerate at least nine other projects currently snarled in Liberal red tape to get workers working and Canada building again.

“After the Lost Liberal Decade of rising costs and crime and a falling economy under America’s thumb, we cannot afford a fourth Liberal term,” said Poilievre. “We need real change, and that is what Conservatives will bring in the first 100 days of a new government. A new Conservative government will get to work on Day 1 and we won’t stop until we have delivered the change we promised, the change Canadians deserve, the change Canadians voted for.”

Automotive

Canadians’ Interest in Buying an EV Falls for Third Year in a Row

From Energy Now

Electric vehicle prices fell 7.8 per cent in the last quarter of 2024 year-over-year, according to the AutoTader price index

Fewer Canadians are considering buying an electric vehicle, marking the third year in a row interest has dropped despite lower EV prices, a survey from AutoTrader shows.

Forty-two per cent of survey respondents say they’re considering an EV as their next vehicle, down from 46 per cent last year. In 2022, 68 per cent said they would consider buying an EV.

Meanwhile, 29 per cent of respondents say they would exclusively consider buying an EV — a significant drop from 40 per cent last year.

The report, which surveyed 1,801 people on the AutoTrader website, shows drivers are concerned about reduced government incentives, a lack of infrastructure and long-term costs despite falling prices.

Electric vehicle prices fell 7.8 per cent in the last quarter of 2024 year-over-year, according to the AutoTader price index.

The survey, conducted between Feb. 13 and March 12, shows 68 per cent of non-EV owners say government incentives could influence their decision, while a little over half say incentives increase their confidence in buying an EV.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoTrump Has Driven Canadians Crazy. This Is How Crazy.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCarney’s Hidden Climate Finance Agenda

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoThe Anhui Convergence: Chinese United Front Network Surfaces in Australian and Canadian Elections

-

2025 Federal Election2 days ago

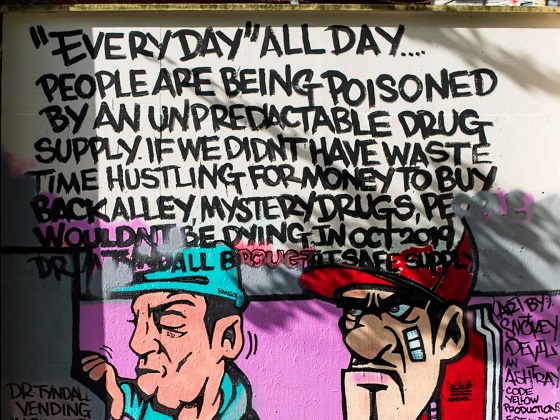

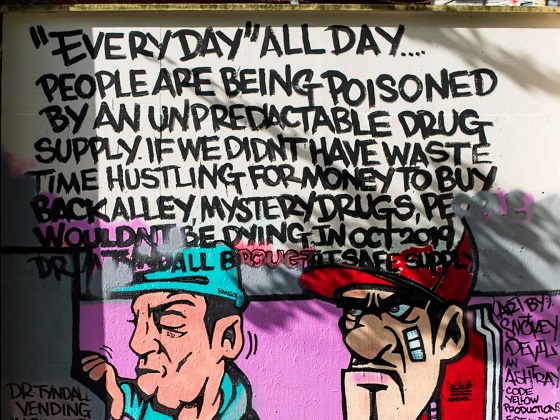

2025 Federal Election2 days agoStudy links B.C.’s drug policies to more overdoses, but researchers urge caution

-

Automotive1 day ago

Automotive1 day agoHyundai moves SUV production to U.S.

-

Entertainment1 day ago

Entertainment1 day agoPedro Pascal launches attack on J.K. Rowling over biological sex views

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoWhen it comes to pipelines, Carney’s words flow both ways

-

2025 Federal Election20 hours ago

2025 Federal Election20 hours agoAs PM Poilievre would cancel summer holidays for MP’s so Ottawa can finally get back to work