Business

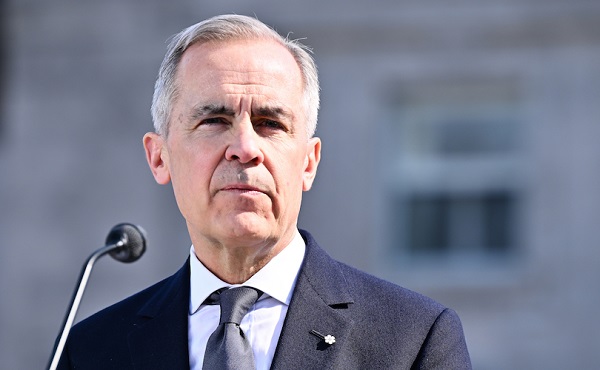

Mark Carney admits he may have to recuse himself on certain matters due to conflicts of interest

From LifeSiteNews

After lashing out at a reporter who pressed him about his investment holdings, Prime Minister Mark Carney has since admitted he will “probably” have to recuse himself on certain governmental matters because of potential conflicts of interest.

Since taking office from Justin Trudeau a week ago, Carney on Tuesday admitted that he will “probably” have to recuse himself from certain governmental matters due to potential conflicts of interest. The prime minister made the concession shortly after lashing out at a reporter when asked whether his large private investment holdings present an ethical issue.

During a Tuesday press conference in Canada’s Arctic, Carney was asked directly if he would have to recuse himself from certain governmental matters in a similar way as to what was required by former Liberal Prime Minister Paul Martin.

“Yes. We are having discussions, and a trust has been created,” he answered, adding that “along with the Ethics Commissioner, probably some screens will be put in place.”

Carney said that his “assets” have been put in a “blind trust well in advance of the requirements.”

“So they’ve been disposed of. But what happens is that there’s a discussion with the Ethics Commissioner for certain screens around certain issues, and that’s a process that is underway,” he added.

“It’s a natural process, and of course, it’s part of the way our system works. And I very much respect the system and those screens become public as they’re developed.”

He was then asked why he did not disclose any potential conflicts of interest in a forthcoming manner. He said this was a question for the “Ethics Commissioner if there is anything that has a major impact, then it’s clear there will be a screen.”

“I can say we are working quickly. I’m working quickly when it comes to those issues.”

Carney’s Tuesday statements came shortly after he lashed out at Canadian Broadcasting Corporation reporter Rosemary Barton when the journalist pressed him on his assets. Barton said she found it “very difficult to believe” there were no possible conflicts of interest now that he is prime minister.

Carney seemed to become visibly annoyed with the line of questioning, telling Barton to “look within herself.”

Before becoming prime minister, Carney worked for Brookfield Asset Management and the United Nations special envoy on climate action.

Recent reports claim that Carney held $6.8 million in Brookfield Asset Management Ltd. stock options before quitting the company.

Conservative leader calls out Carney’s potential conflicts of interest

Responding to the chatter, Conservative Party leader Pierre Poilievre told reporters that the prime minster is “trying to distract from his many scandals and conflicts of interest as well as his disastrous record as Justin Trudeau’s economic advisor by talking about Trump.”

“He’s the guy who sold out to Trump,” said Poilievre, adding that six days after U.S. President Donald Trump “threatened Canada” with tariffs “to steal our jobs,” Carney “announced to Brookfield shareholders that he would move his headquarters from Canada to New York.”

“And when you asked him about it, he lied to your face,” he added.

Poilievre said the Conservatives have this evidence “in writing and we proved it.”

“He sold out Canada. He put his profit ahead of our people and he did exactly what Donald Trump wanted. Never before have we had a prime minister so conflicted and compromised and yet so little scrutinized,” he added.

Carney, an admitted “elitist” and “globalist,” is reportedly due to call a federal election this weekend, just days after being installed as prime minister following the Liberal Party leadership race.

Alberta

Made in Alberta! Province makes it easier to support local products with Buy Local program

Show your Alberta side. Buy Local. |

When the going gets tough, Albertans stick together. That’s why Alberta’s government is launching a new campaign to benefit hard-working Albertans.

Global uncertainty is threatening the livelihoods of hard-working Alberta farmers, ranchers, processors and their families. The ‘Buy Local’ campaign, recently launched by Alberta’s government, encourages consumers to eat, drink and buy local to show our unified support for the province’s agriculture and food industry.

The government’s ‘Buy Local’ campaign encourages consumers to buy products from Alberta’s hard-working farmers, ranchers and food processors that produce safe, nutritious food for Albertans, Canadians and the world.

“It’s time to let these hard-working Albertans know we have their back. Now, more than ever, we need to shop local and buy made-in-Alberta products. The next time you are grocery shopping or go out for dinner or a drink with your friends or family, support local to demonstrate your Alberta pride. We are pleased tariffs don’t impact the ag industry right now and will keep advocating for our ag industry.”

Alberta’s government supports consumer choice. We are providing tools to help folks easily identify Alberta- and Canadian-made foods and products. Choosing local products keeps Albertans’ hard-earned dollars in our province. Whether it is farm-fresh vegetables, potatoes, honey, craft beer, frozen food or our world-renowned beef, Alberta has an abundance of fresh foods produced right on our doorstep.

Quick facts

- This summer, Albertans can support local at more than 150 farmers’ markets across the province and meet the folks who make, bake and grow our food.

- In March 2023, the Alberta government launched the ‘Made in Alberta’ voluntary food and beverage labelling program to support local agriculture and food sectors.

- Through direct connections with processors, the program has created the momentum to continue expanding consumer awareness about the ‘Made in Alberta’ label to help shoppers quickly identify foods and beverages produced in our province.

- Made in Alberta product catalogue website

Related information

2025 Federal Election

ASK YOURSELF! – Can Canada Endure, or Afford the Economic Stagnation of Carney’s Costly Climate Vision?

From Energy Now

By Tammy Nemeth and Ron Wallace

Carney’s Costly Climate Vision Risks Another “Lost Liberal Decade”

A carbon border tax isn’t the simple offset it’s made out to be—it’s a complex regulatory quagmire poised to reshape Canada’s economy and trade. In its final days, the Trudeau government made commitments to mandate climate disclosures, preserve carbon taxes (both consumer and industrial) and advance a Carbon Border Adjustment Mechanism (CBAM). Newly minted Prime Minister Mark Carney, the godfather of climate finance, has embraced and pledged to accelerate these commitments, particularly the CBAM. Marketed as a strategic shift to bolster trade with the European Union (EU) and reduce reliance on the U.S., a CBAM appears straightforward: pay a domestic carbon price, or face an EU import fee. But the reality is far more extensive and invasive. Beyond the carbon tariffs, it demands rigorous emissions accounting, third-party verification and a crushing compliance burden.

Although it has been little debated, Carney’s proposed climate plan would transform and further undermine Canadian businesses and the economy. Contrary to Carney’s remarks in mid-March, the only jurisdiction that has implemented a CBAM is the EU, with implementation not set until 2026. Meanwhile, the UK plans to implement a CBAM for 1 January 2027. In spite of Carney’s assertion that such a mechanism will be needed for trade with emerging Asian markets, the only Asian country that has released a possible plan for a CBAM is Taiwan. Thus, a Canadian CBAM would only align Canada with the EU and possibly the UK – assuming that those policies are implemented in face of the Trump Administrations’ turbulent tariff policies.

With the first phase of the EU’s CBAM, exporters of cement, iron and steel, aluminum, fertiliser, electricity and hydrogen must have paid a domestic carbon tax or the EU will charge more for those imports. But it’s much more than that. Even if exporting companies have a domestic carbon tax, they will still have to monitor, account for, and verify their CO2 emissions to certify the price they have paid domestically in order to trade with the EU. The purported goal is to reduce so-called “carbon leakage” which makes imports from emission-intensive sectors more costly in favour of products with fewer emissions. Hence, the EU’s CBAM is effectively a CO2 emissions importation tariff equivalent to what would be paid by companies if the products were produced under the EU’s carbon pricing rules under their Emissions Trading System (ETS).

While that may sound simple enough, in practice the EU’s CBAM represents a significant expansion of government involvement with a new layer of bureaucracy. The EU system will require corporate emissions accounting of the direct and indirect emissions of production processes to calculate the embedded emissions. This type of emissions accounting is a central component of climate disclosures like those released by the Canadian Sustainability Standards Board.

Hence, the CBAM isn’t just a tariff: It’s a system for continuous emissions monitoring and verification. Unlike traditional tariffs tied to product value, the CBAM requires companies exporting to the EU to track embedded emissions and submit verified data to secure an EU-accredited verification. Piling complexity atop cost, importers must then file a CBAM declaration, reviewed and certified by an EU regulatory body, before obtaining an import certificate.

This system offers little discernible benefit for the environment. The CBAM ignores broader environmental regulatory efforts, fixating solely on taxation of embedded emissions. For Canadian exporters, Carney’s plan would impose an expensive, intricate web of compliance monitoring, verification and fees accompanied by uncertain administrative penalties.

Hence, any serious pivot to the EU to offset trade restrictions in the U.S. will require a transformation of Canada’s economy, one with a questionable return on investment. Carney’s plan to diversify and accelerate trade with the EU, whose economies are increasingly shackled with burdensome climate-related policies, ignores the potential of successful trade negotiations with the U.S., India or emerging Asian countries. The U.S., our largest and most significant trading partner, has abandoned the Paris Climate Agreement, ceased defence of its climate-disclosure rule and will undoubtedly be seeking fewer, not more, climate-related tariffs. Meanwhile, despite rulings from the Supreme Court of Canada, Carney has doubled down on his support for the Trudeau governments’ Impact Assessment Act (Bill C-69) and confirmed intentions to proceed with an emissions cap on oil and gas production. Carney’s continuance of the Trudeau governments’ regulatory agenda combined with new, proposed trade policies will take Canada in directions not conducive to future economic growth or to furthering trade agreements with the U.S.

Canadians need to carefully consider whether or not Canada can endure, or afford, Carney’s costly climate vision that risks another “lost Liberal decade” of economic stagnation?

Tammy Nemeth is a U.K.-based strategic energy analyst.

Ron Wallace is an executive fellow of the Canadian Global Affairs Institute and the Canada West Foundation.

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoMark Carney Vows Internet Speech Crackdown if Elected

-

2025 Federal Election24 hours ago

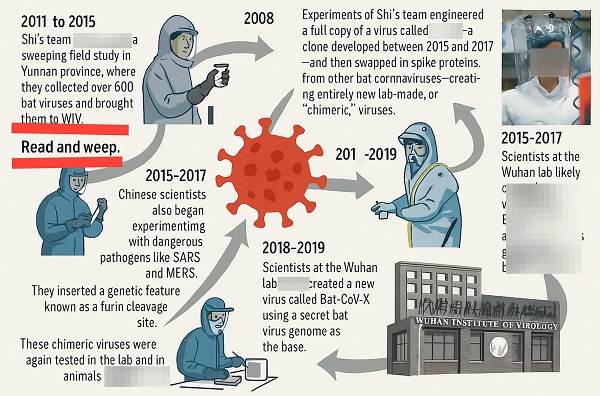

2025 Federal Election24 hours agoPPE Videos, CCP Letters Reveal Pandemic Coordination with Liberal Riding Boss and Former JCCC Leader—While Carney Denies Significant Meeting In Campaign

-

2025 Federal Election14 hours ago

2025 Federal Election14 hours agoASK YOURSELF! – Can Canada Endure, or Afford the Economic Stagnation of Carney’s Costly Climate Vision?

-

Freedom Convoy2 days ago

Freedom Convoy2 days agoA Miscarriage of Justice

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoTrudeau and Carney Have Blown $43B on EVs

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPoilievre will make it harder for politicians to boost their portfolios, close Carney loopholes

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoMark Carney To Ban Free Speech if Elected

-

2025 Federal Election12 hours ago

2025 Federal Election12 hours agoCSIS Warned Beijing Would Brand Conservatives as Trumpian. Now Carney’s Campaign Is Doing It.