Business

Judge allows Elon Musk’s ‘thermonuclear’ lawsuit against Media Matters to proceed

From LifeSiteNews

Elon Musk accuses Media Matters of manufacturing images to falsely accuse his social media platform X of putting advertisers next to Nazi content.

A federal judge has ruled that anti-woke, pro-free-speech tech mogul Elon Musk’s lawsuit against far-left Media Matters for America (MMFA) can proceed, keeping alive a “thermonuclear” challenge to the notorious organization’s practices that could set a major precedent.

Last November, Musk, the Tesla owner whose purchase of Twitter and transformation of it into X has upended left-wing activists’ monopoly on social media speech, filed a lawsuit against MMFA over an article it published accusing accusing Musk of having descended “into white nationalist and antisemitic conspiracy theories,” and “placing ads for major brands like Apple, Bravo (NBCUniversal), IBM, Oracle, and Xfinity (Comcast) next to content that touts Adolf Hitler and his Nazi Party.”

Musk responded that the article’s images were “manufactured” to create a false impression and “destroy” X. He vowed to launch a “thermonuclear lawsuit against Media Matters and ALL those who colluded in this fraudulent attack on our company,” promising to hold accountable the group’s’ “board, their donors, their network of dark money, all of them.”

On August 29, Bush-appointed U.S. District Court for the Northern District of Texas Judge Reed O’Connor rejected MMFA’s bid to have the suit dismissed.

“Plaintiff has provided sufficient allegations to survive dismissal,” he wrote. “Plaintiff has factually alleged: the existence of contracts subject to interference; intentional acts of interference; and proximate causation […] Plaintiff plausibly alleges that Defendants proximately caused their harm. Proximate cause requires proof of both cause-in-fact and foreseeability. Defendants present a compelling alternative version of events to Plaintiff’s. However, the Court will not ‘choose among competing inferences’ at this stage […] Accordingly, Plaintiff’s Amended Complaint alleges sufficient facts to state a claim of tortious interference with contract.”

Commenting on the ruling, George Washington University law professor Jonathan Turley wrote that “Musk’s lawsuit may be the most defining for our age of advocacy journalism” because it “directly challenges the ability of media outlets to create false narratives to advance a political agenda.”

“The complaint accuses Media Matters of running its manipulation to produce extremely unlikely pairings, such that one toxic match appeared for ‘only one viewer (out of more than 500 million) on all of X: Media Matters,’” Turley explained. “In other words, the organization wanted to write a hit piece connecting X to pro-Nazi material and proceeded to artificially create pairings between that material and corporate advertisements. It then ran the story as news.”

“Indeed, two defendant employees of Media Matters did not deny that they were aware of the alleged manipulation and that they were seeking to poison the well for advertisers in order to drain advertising revenues for X,” he added.

Media Matters describes its mission as “comprehensively monitoring, analyzing, and correcting conservative misinformation in the U.S. media,” but conservatives say its true mission is to demonize conservative voices and promote leftist narratives and misinformation. Leftist billionaire George Soros has supported the organization with millions in donations since its birth in 2004, though he did not go public with his support until 2010.

Media Matters founder David Brock has described the organization’s mission as “guerrilla warfare and sabotage” against Fox News but has long since branched out to other major outlets deemed out of step with the Left. It has also advocated censoring conservatives on social networks such as Facebook, to which Musk’s purchase and transformation of Twitter stands in opposition.

In 2021, Media Matters was one of multiple left-wing groups that took credit for pressuring Facebook to ban LifeSiteNews, based on false claims of “COVID-19 and vaccine disinformation.”

Business

Canada is failing dismally at our climate goals. We’re also ruining our economy.

From the Fraser Institute

By Annika Segelhorst and Elmira Aliakbari

Short-term climate pledges simply chase deadlines, not results

The annual meeting of the United Nations Conference of the Parties, or COP, which is dedicated to implementing international action on climate change, is now underway in Brazil. Like other signatories to the Paris Agreement, Canada is required to provide a progress update on our pledge to reduce greenhouse gas (GHG) emissions by 40 to 45 per cent below 2005 levels by 2030. After decades of massive government spending and heavy-handed regulations aimed at decarbonizing our economy, we’re far from achieving that goal. It’s time for Canada to move past arbitrary short-term goals and deadlines, and instead focus on more effective ways to support climate objectives.

Since signing the Paris Agreement in 2015, the federal government has introduced dozens of measures intended to reduce Canada’s carbon emissions, including more than $150 billion in “green economy” spending, the national carbon tax, the arbitrary cap on emissions imposed exclusively on the oil and gas sector, stronger energy efficiency requirements for buildings and automobiles, electric vehicle mandates, and stricter methane regulations for the oil and gas industry.

Recent estimates show that achieving the federal government’s target will impose significant costs on Canadians, including 164,000 job losses and a reduction in economic output of 6.2 per cent by 2030 (compared to a scenario where we don’t have these measures in place). For Canadian workers, this means losing $6,700 (each, on average) annually by 2030.

Yet even with all these costly measures, Canada will only achieve 57 per cent of its goal for emissions reductions. Several studies have already confirmed that Canada, despite massive green spending and heavy-handed regulations to decarbonize the economy over the past decade, remains off track to meet its 2030 emission reduction target.

And even if Canada somehow met its costly and stringent emission reduction target, the impact on the Earth’s climate would be minimal. Canada accounts for less than 2 per cent of global emissions, and that share is projected to fall as developing countries consume increasing quantities of energy to support rising living standards. In 2025, according to the International Energy Agency (IEA), emerging and developing economies are driving 80 per cent of the growth in global energy demand. Further, IEA projects that fossil fuels will remain foundational to the global energy mix for decades, especially in developing economies. This means that even if Canada were to aggressively pursue short-term emission reductions and all the economic costs it would imposes on Canadians, the overall climate results would be negligible.

Rather than focusing on arbitrary deadline-contingent pledges to reduce Canadian emissions, we should shift our focus to think about how we can lower global GHG emissions. A recent study showed that doubling Canada’s production of liquefied natural gas and exporting to Asia to displace an equivalent amount of coal could lower global GHG emissions by about 1.7 per cent or about 630 million tonnes of GHG emissions. For reference, that’s the equivalent to nearly 90 per cent of Canada’s annual GHG emissions. This type of approach reflects Canada’s existing strength as an energy producer and would address the fastest-growing sources of emissions, namely developing countries.

As the 2030 deadline grows closer, even top climate advocates are starting to emphasize a more pragmatic approach to climate action. In a recent memo, Bill Gates warned that unfounded climate pessimism “is causing much of the climate community to focus too much on near-term emissions goals, and it’s diverting resources from the most effective things we should be doing to improve life in a warming world.” Even within the federal ministry of Environment and Climate Change, the tone is shifting. Despite the 2030 emissions goal having been a hallmark of Canadian climate policy in recent years, in a recent interview, Minister Julie Dabrusin declined to affirm that the 2030 targets remain feasible.

Instead of scrambling to satisfy short-term national emissions limits, governments in Canada should prioritize strategies that will reduce global emissions where they’re growing the fastest.

Elmira Aliakbari

Artificial Intelligence

Lawsuit Claims Google Secretly Used Gemini AI to Scan Private Gmail and Chat Data

Whether the claims are true or not, privacy in Google’s universe has long been less a right than a nostalgic illusion.

|

When Google flipped a digital switch in October 2025, few users noticed anything unusual.

Gmail loaded as usual, Chat messages zipped across screens, and Meet calls continued without interruption.

Yet, according to a new class action lawsuit, something significant had changed beneath the surface.

We obtained a copy of the lawsuit for you here.

Plaintiffs claim that Google silently activated its artificial intelligence system, Gemini, across its communication platforms, turning private conversations into raw material for machine analysis.

The lawsuit, filed by Thomas Thele and Melo Porter, describes a scenario that reads like a breach of trust.

It accuses Google of enabling Gemini to “access and exploit the entire recorded history of its users’ private communications, including literally every email and attachment sent and received.”

The filing argues that the company’s conduct “violates its users’ reasonable expectations of privacy.”

Until early October, Gemini’s data processing was supposedly available only to those who opted in.

Then, the plaintiffs claim, Google “turned it on for everyone by default,” allowing the system to mine the contents of emails, attachments, and conversations across Gmail, Chat, and Meet.

The complaint points to a particular line in Google’s settings, “When you turn this setting on, you agree,” as misleading, since the feature “had already been switched on.”

This, according to the filing, represents a deliberate misdirection designed to create the illusion of consent where none existed.

There is a certain irony woven through the outrage. For all the noise about privacy, most users long ago accepted the quiet trade that powers Google’s empire.

They search, share, and store their digital lives inside Google’s ecosystem, knowing the company thrives on data.

The lawsuit may sound shocking, but for many, it simply exposes what has been implicit all along: if you live in Google’s world, privacy has already been priced into the convenience.

Thele warns that Gemini’s access could expose “financial information and records, employment information and records, religious affiliations and activities, political affiliations and activities, medical care and records, the identities of his family, friends, and other contacts, social habits and activities, eating habits, shopping habits, exercise habits, [and] the extent to which he is involved in the activities of his children.”

In other words, the system’s reach, if the allegations prove true, could extend into nearly every aspect of a user’s personal life.

The plaintiffs argue that Gemini’s analytical capabilities allow Google to “cross-reference and conduct unlimited analysis toward unmerited, improper, and monetizable insights” about users’ private relationships and behaviors.

The complaint brands the company’s actions as “deceptive and unethical,” claiming Google “surreptitiously turned on this AI tracking ‘feature’ without informing or obtaining the consent of Plaintiffs and Class Members.” Such conduct, it says, is “highly offensive” and “defies social norms.”

The case invokes a formidable set of statutes, including the California Invasion of Privacy Act, the California Computer Data Access and Fraud Act, the Stored Communications Act, and California’s constitutional right to privacy.

Google is yet to comment on the filing.

|

|

|

|

Reclaim The Net is reader-supported. Consider becoming a paid subscriber.

|

|

|

|

-

Crime1 day ago

Crime1 day ago‘Modern-Day Escobar’: U.S. Says Former Canadian Olympian Ran Cocaine Pipeline with Cartel Protection and a Corrupt Toronto Lawyer

-

National13 hours ago

National13 hours agoPsyop-Style Campaign That Delivered Mark Carney’s Win May Extend Into Floor-Crossing Gambits and Shape China–Canada–US–Mexico Relations

-

Daily Caller2 days ago

Daily Caller2 days agoDemocrats Explicitly Tell Spy Agencies, Military To Disobey Trump

-

COVID-1910 hours ago

COVID-1910 hours agoCovid Cover-Ups: Excess Deaths, Vaccine Harms, and Coordinated Censorship

-

Alberta24 hours ago

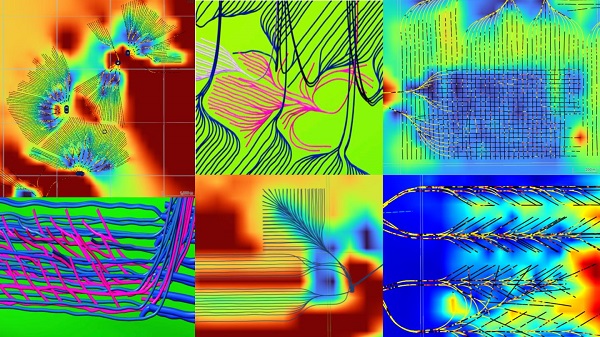

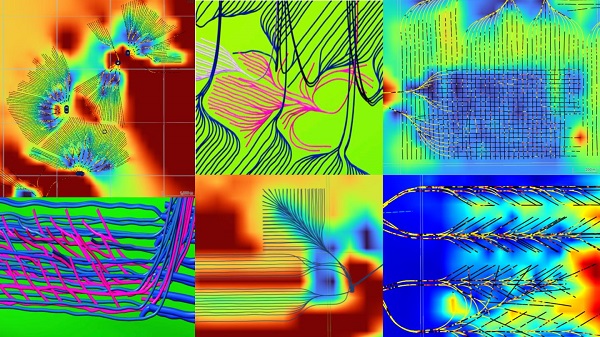

Alberta24 hours ago‘Weird and wonderful’ wells are boosting oil production in Alberta and Saskatchewan

-

Daily Caller2 days ago

Daily Caller2 days agoALAN DERSHOWITZ: Can Trump Legally Send Troops Into Our Cities? The Answer Is ‘Wishy-Washy’

-

Alberta2 days ago

Alberta2 days agoAlberta on right path to better health care

-

Bruce Dowbiggin11 hours ago

Bruce Dowbiggin11 hours agoBurying Poilievre Is Job One In Carney’s Ottawa