Alberta

Japan PM sees LNG Canada as a ‘flagship’ facility to help improve world energy security while lowering emissions

Prime Minister of Japan Fumio Kishida speaks during the G7 summit at Schloss Elmau, Germany on June 26, 2022 as (L-R) Canadian Prime Minister Justin Trudeau and German Chancellor Olaf Schulz look on. Getty Images photo

From the Canadian Energy Centre Ltd.

Kishida is expected to ask for Canadian LNG as the country looks to replace Russian gas supplies

Japanese Prime Minister Fumio Kishida sees the LNG Canada terminal under construction at Kitimat, B.C. as a “flagship” facility, he said in remarks Jan. 12 during a visit to Ottawa to meet with Prime Minster Justin Trudeau.

“LNG will indeed play a crucial role in striking a balance between energy security and decarbonization,” he said.

“LNG Canada is a flagship project making maximum use of the latest technologies of Japanese companies.”

Resource-poor Japan is the world’s largest LNG consumer, using the fuel to generate electricity, power industry, and heat homes and businesses. Qatar is one of Japan’s largest LNG suppliers.

Kishida is expected to ask for Canadian LNG as the country looks to replace Russian gas supplies. Japan, a relatively short distance from the LNG Canada project compared to terminals on the U.S. Gulf Coast, imported nearly 75 million tonnes of LNG in 2020 – worth over $30 billion.

Kishida’s visit comes just months after German Chancellor Olaf Scholz visited Ottawa also seeking Canadian LNG. Prime Minister Trudeau questioned the business case for shipping Canadian LNG to Europe.

Germany, moving swiftly to reduce reliance on natural gas flows from Russia, built an LNG import facility in just 194 days and recently received its first shipment from the U.S. It also signed an agreement with Qatar to receive 2 million tonnes of LNG per year for 15 years starting in 2026. Germany will open a second LNG import terminal in January.

While Canadian LNG can help alleviate the challenge in Europe, the larger long-term opportunity is in Asia, according to energy consultancy Wood Mackenzie.

Module delivery, LNG Canada site, Kitimat, B.C., July 2022. Photo courtesy LNG Canada

“For Asian buyers, Canadian LNG is quite cost competitive due to its relatively low shipping and liquefaction costs compared to other global exporters,” says Dulles Wang, Wood Mackenzie’s director of Americas gas and LNG research.

As of July 2022, Japan had 92 operating coal plants, 6 under construction and 1 in pre-construction, says Global Energy Monitor. Construction of new coal-fired power plants is occurring mostly in Asia, with China accounting for 52 per cent of the 176 gigawatts of coal capacity being built in 20 countries in 2021, says a New Scientist report.

“If Canada increases its LNG export capacity to Asia, net emissions could decline by 188 million tonnes of CO2 equivalent per year through 2050 – or the impact every year of taking 41 million cars off the road,” according to Wood Mackenzie analysis.

Asia drives 67 per cent of global LNG demand today, and that share is expected to grow to 73 per cent by 2050 as world consumption doubles to 700 million tonnes per year.

“Starting in 2027, we see there’s going to be a global supply/demand gap that is probably going to grow to 120 million tonnes per annum and about 150 million tonnes per annum by 2035,” says Matthias Bloennigen, Wood Mackenzie’s director of Americas upstream consulting.

“Developing western Canadian LNG would be helpful to alleviate the LNG demand that’s going to develop in the world.”

The unaltered reproduction of this content is free of charge with attribution to Canadian Energy Centre Ltd.

Alberta

The Canadian Energy Centre’s biggest stories of 2025

From the Canadian Energy Centre

Canada’s energy landscape changed significantly in 2025, with mounting U.S. economic pressures reinforcing the central role oil and gas can play in safeguarding the country’s independence.

Here are the Canadian Energy Centre’s top five most-viewed stories of the year.

5. Alberta’s massive oil and gas reserves keep growing – here’s why

The Northern Lights, aurora borealis, make an appearance over pumpjacks near Cremona, Alta., Thursday, Oct. 10, 2024. CP Images photo

Analysis commissioned this spring by the Alberta Energy Regulator increased the province’s natural gas reserves by more than 400 per cent, bumping Canada into the global top 10.

Even with record production, Alberta’s oil reserves – already fourth in the world – also increased by seven billion barrels.

According to McDaniel & Associates, which conducted the report, these reserves are likely to become increasingly important as global demand continues to rise and there is limited production growth from other sources, including the United States.

4. Canada’s pipeline builders ready to get to work

Canada could be on the cusp of a “golden age” for building major energy projects, said Kevin O’Donnell, executive director of the Mississauga, Ont.-based Pipe Line Contractors Association of Canada.

That eagerness is shared by the Edmonton-based Progressive Contractors Association of Canada (PCA), which launched a “Let’s Get Building” advocacy campaign urging all Canadian politicians to focus on getting major projects built.

“The sooner these nation-building projects get underway, the sooner Canadians reap the rewards through new trading partnerships, good jobs and a more stable economy,” said PCA chief executive Paul de Jong.

3. New Canadian oil and gas pipelines a $38 billion missed opportunity, says Montreal Economic Institute

Steel pipe in storage for the Trans Mountain Pipeline expansion in 2022. Photo courtesy Trans Mountain Corporation

In March, a report by the Montreal Economic Institute (MEI) underscored the economic opportunity of Canada building new pipeline export capacity.

MEI found that if the proposed Energy East and Gazoduq/GNL Quebec projects had been built, Canada would have been able to export $38 billion worth of oil and gas to non-U.S. destinations in 2024.

“We would be able to have more prosperity for Canada, more revenue for governments because they collect royalties that go to government programs,” said MEI senior policy analyst Gabriel Giguère.

“I believe everybody’s winning with these kinds of infrastructure projects.”

2. Keyera ‘Canadianizes’ natural gas liquids with $5.15 billion acquisition

Keyera Corp.’s natural gas liquids facilities in Fort Saskatchewan, Alta. Photo courtesy Keyera Corp.

In June, Keyera Corp. announced a $5.15 billion deal to acquire the majority of Plains American Pipelines LLP’s Canadian natural gas liquids (NGL) business, creating a cross-Canada NGL corridor that includes a storage hub in Sarnia, Ontario.

The acquisition will connect NGLs from the growing Montney and Duvernay plays in Alberta and B.C. to markets in central Canada and the eastern U.S. seaboard.

“Having a Canadian source for natural gas would be our preference,” said Sarnia mayor Mike Bradley.

“We see Keyera’s acquisition as strengthening our region as an energy hub.”

1. Explained: Why Canadian oil is so important to the United States

Enbridge’s Cheecham Terminal near Fort McMurray, Alberta is a key oil storage hub that moves light and heavy crude along the Enbridge network. Photo courtesy Enbridge

The United States has become the world’s largest oil producer, but its reliance on oil imports from Canada has never been higher.

Many refineries in the United States are specifically designed to process heavy oil, primarily in the U.S. Midwest and U.S. Gulf Coast.

According to the Alberta Petroleum Marketing Commission, the top five U.S. refineries running the most Alberta crude are:

- Marathon Petroleum, Robinson, Illinois (100% Alberta crude)

- Exxon Mobil, Joliet, Illinois (96% Alberta crude)

- CHS Inc., Laurel, Montana (95% Alberta crude)

- Phillips 66, Billings, Montana (92% Alberta crude)

- Citgo, Lemont, Illinois (78% Alberta crude)

Alberta

Alberta project would be “the biggest carbon capture and storage project in the world”

Pathways Alliance CEO Kendall Dilling is interviewed at the World Petroleum Congress in Calgary, Monday, Sept. 18, 2023.THE CANADIAN PRESS/Jeff McIntosh

From Resource Works

Carbon capture gives biggest bang for carbon tax buck CCS much cheaper than fuel switching: report

Canada’s climate change strategy is now joined at the hip to a pipeline. Two pipelines, actually — one for oil, one for carbon dioxide.

The MOU signed between Ottawa and Alberta two weeks ago ties a new oil pipeline to the Pathways Alliance, which includes what has been billed as the largest carbon capture proposal in the world.

One cannot proceed without the other. It’s quite possible neither will proceed.

The timing for multi-billion dollar carbon capture projects in general may be off, given the retreat we are now seeing from industry and government on decarbonization, especially in the U.S., our biggest energy customer and competitor.

But if the public, industry and our governments still think getting Canada’s GHG emissions down is a priority, decarbonizing Alberta oil, gas and heavy industry through CCS promises to be the most cost-effective technology approach.

New modelling by Clean Prosperity, a climate policy organization, finds large-scale carbon capture gets the biggest bang for the carbon tax buck.

Which makes sense. If oil and gas production in Alberta is Canada’s single largest emitter of CO2 and methane, it stands to reason that methane abatement and sequestering CO2 from oil and gas production is where the biggest gains are to be had.

A number of CCS projects are already in operation in Alberta, including Shell’s Quest project, which captures about 1 million tonnes of CO2 annually from the Scotford upgrader.

What is CO2 worth?

Clean Prosperity estimates industrial carbon pricing of $130 to $150 per tonne in Alberta and CCS could result in $90 billion in investment and 70 megatons (MT) annually of GHG abatement or sequestration. The lion’s share of that would come from CCS.

To put that in perspective, 70 MT is 10% of Canada’s total GHG emissions (694 MT).

The report cautions that these estimates are “hypothetical” and gives no timelines.

All of the main policy tools recommended by Clean Prosperity to achieve these GHG reductions are contained in the Ottawa-Alberta MOU.

One important policy in the MOU includes enhanced oil recovery (EOR), in which CO2 is injected into older conventional oil wells to increase output. While this increases oil production, it also sequesters large amounts of CO2.

Under Trudeau era policies, EOR was excluded from federal CCS tax credits. The MOU extends credits and other incentives to EOR, which improves the value proposition for carbon capture.

Under the MOU, Alberta agrees to raise its industrial carbon pricing from the current $95 per tonne to a minimum of $130 per tonne under its TIER system (Technology Innovation and Emission Reduction).

The biggest bang for the buck

Using a price of $130 to $150 per tonne, Clean Prosperity looked at two main pathways to GHG reductions: fuel switching in the power sector and CCS.

Fuel switching would involve replacing natural gas power generation with renewables, nuclear power, renewable natural gas or hydrogen.

“We calculated that fuel switching is more expensive,” Brendan Frank, director of policy and strategy for Clean Prosperity, told me.

Achieving the same GHG reductions through fuel switching would require industrial carbon prices of $300 to $1,000 per tonne, Frank said.

Clean Prosperity looked at five big sectoral emitters: oil and gas extraction, chemical manufacturing, pipeline transportation, petroleum refining, and cement manufacturing.

“We find that CCUS represents the largest opportunity for meaningful, cost-effective emissions reductions across five sectors,” the report states.

Fuel switching requires higher carbon prices than CCUS.

Measures like energy efficiency and methane abatement are included in Clean Prosperity’s calculations, but again CCS takes the biggest bite out of Alberta’s GHGs.

“Efficiency and (methane) abatement are a portion of it, but it’s a fairly small slice,” Frank said. “The overwhelming majority of it is in carbon capture.”

From left, Alberta Minister of Energy Marg McCuaig-Boyd, Shell Canada President Lorraine Mitchelmore, CEO of Royal Dutch Shell Ben van Beurden, Marathon Oil Executive Brian Maynard, Shell ER Manager, Stephen Velthuizen, and British High Commissioner to Canada Howard Drake open the valve to the Quest carbon capture and storage facility in Fort Saskatchewan Alta, on Friday November 6, 2015. Quest is designed to capture and safely store more than one million tonnes of CO2 each year an equivalent to the emissions from about 250,000 cars. THE CANADIAN PRESS/Jason Franson

Credit where credit is due

Setting an industrial carbon price is one thing. Putting it into effect through a workable carbon credit market is another.

“A high headline price is meaningless without higher credit prices,” the report states.

“TIER credit prices have declined steadily since 2023 and traded below $20 per tonne as of November 2025. With credit prices this low, the $95 per tonne headline price has a negligible effect on investment decisions and carbon markets will not drive CCUS deployment or fuel switching.”

Clean Prosperity recommends a kind of government-backstopped insurance mechanism guaranteeing carbon credit prices, which could otherwise be vulnerable to political and market vagaries.

Specifically, it recommends carbon contracts for difference (CCfD).

“A straight-forward way to think about it is insurance,” Frank explains.

Carbon credit prices are vulnerable to risks, including “stroke-of-pen risks,” in which governments change or cancel price schedules. There are also market risks.

CCfDs are contractual agreements between the private sector and government that guarantees a specific credit value over a specified time period.

“The private actor basically has insurance that the credits they’ll generate, as a result of making whatever low-carbon investment they’re after, will get a certain amount of revenue,” Frank said. “That certainty is enough to, in our view, unlock a lot of these projects.”

From the perspective of Canadian CCS equipment manufacturers like Vancouver’s Svante, there is one policy piece still missing from the MOU: eligibility for the Clean Technology Manufacturing (CTM) Investment tax credit.

“Carbon capture was left out of that,” said Svante co-founder Brett Henkel said.

Svante recently built a major manufacturing plant in Burnaby for its carbon capture filters and machines, with many of its prospective customers expected to be in the U.S.

The $20 billion Pathways project could be a huge boon for Canadian companies like Svante and Calgary’s Entropy. But there is fear Canadian CCS equipment manufacturers could be shut out of the project.

“If the oil sands companies put out for a bid all this equipment that’s needed, it is highly likely that a lot of that equipment is sourced outside of Canada, because the support for Canadian manufacturing is not there,” Henkel said.

Henkel hopes to see CCS manufacturing added to the eligibility for the CTM investment tax credit.

“To really build this eco-system in Canada and to support the Pathways Alliance project, we need that amendment to happen.”

Resource Works News

-

Business2 days ago

Business2 days agoMainstream media missing in action as YouTuber blows lid off massive taxpayer fraud

-

International2 days ago

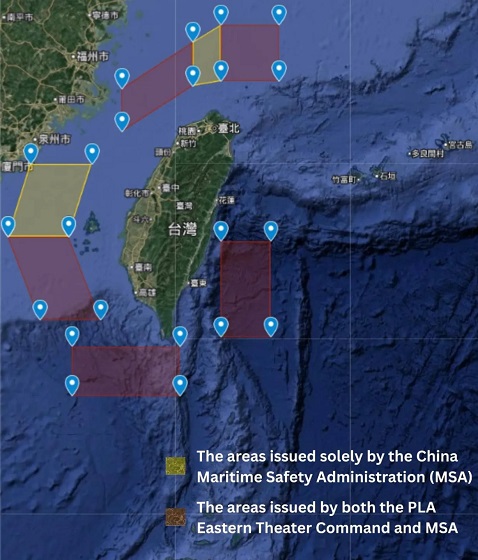

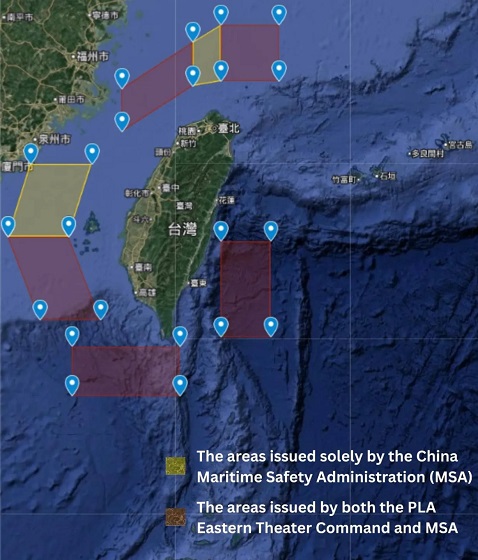

International2 days agoChina Stages Massive Live-Fire Encirclement Drill Around Taiwan as Washington and Japan Fortify

-

Energy2 days ago

Energy2 days agoRulings could affect energy prices everywhere: Climate activists v. the energy industry in 2026

-

Digital ID2 days ago

Digital ID2 days agoThe Global Push for Government Mandated Digital IDs And Why You Should Worry

-

Business10 hours ago

Business10 hours agoDisclosures reveal Minnesota politician’s husband’s companies surged thousands-fold amid Somali fraud crisis

-

Business23 hours ago

Business23 hours agoDOOR TO DOOR: Feds descend on Minneapolis day cares tied to massive fraud

-

Alberta10 hours ago

Alberta10 hours agoThe Canadian Energy Centre’s biggest stories of 2025

-

Business22 hours ago

Business22 hours agoCanada needs serious tax cuts in 2026