Business

Investing In Stocks Isn’t Impossible Or Crazy If You Don’t Swing For The Fences

Investing in stocks has an allure like no other. Each day there are winners and losers, and one can easily see where they could have made a fortune if only they’d acted yesterday. Sitting down and staring at a screen full of stock prices, you can be sure of one thing: If you pick the right combination and dump all your money in, you will be rich within months. On top of that, the ease of entry and exit is remarkably simple. There are none of the challenges of starting your own business, building sales, hiring heroes and weirdos, dealing with the latter, and skating through the other million challenges only small business owners experience. It’s all a lot of work. But stocks…a few clicks and your fortune is made! Maybe!

No wonder we’re drawn to the game like moths to a flame, and the analogy is more startlingly apt than we realize. After you’ve signed your wings, or even worse piloted straight into the flame, you will nod to yourself, yup, that’s how it goes. Which is a shame.

What makes investing so challenging? Many things, but first it is imperative to understand the pricing of securities. The price will go up or down depending on the perceived fortunes of the company, and many investors sadly believe that by reading a headline or making a guess about some market development like a new demand for graphite, they can go grab a stock and ride it to the moon. And they might, but first it’s critical to understand that the pros, the people that live and breathe markets, are light years ahead of you, and have moved their money accordingly. When you get a hot stock tip from your beard-trimmer, the early/smart money has come and gone, and if not gone, is waiting for you to throw yours in before scampering.

If you don’t believe me, consider this quote from a remarkably well-placed US market commentator that goes by the mysterious name of The Heisenberg (heisenbergreport.com). The guy (I think) lives and breathes markets, and reading his output makes one realize that the market is moving in ways that retail investors can’t keep up with unless they are diligent to the point of obsession and have about 22 hours a day to devote to the topic. Here’s a quote from one of his posts at Seeking Alpha: “if, for whatever reason, the long-end of the US curve were to suddenly sell-off, the attendant bear steepener would mechanically force an unwind in all manner of equities expressions tied to the “duration infatuation,” including, but not limited to, min. vol. vehicles, momentum products, secular growth, defensives and, obviously, traditional bond proxies.”

Obviously? Huh? I’ve been around markets for decades, watching all sorts of developments, and people like this lose me by the third line. There is a whole layer of expertise in financial engineering that most people don’t even know exists. I’m pretty sure that if you don’t study market manipulations with the devotion of a dog to its feeding dish that you won’t be able to keep up with that narrative.

The coronavirus pandemonium has made things even worse. Blue-chip stocks that once seemed invincible have seen share prices collapse, because the future is unknown. If all the pros are fleeing, why would an average investor even consider entering the game?

You will at some point have to, one way or another, if you’re involved at all in being responsible for your retirement funding. You can farm it all out and pay through the nose, or learn a bit about what you’re actually investing in and if you’re getting your hard-earned money’s worth. Maybe you decide individual stocks aren’t for you, in which case ETFs (Exchange Traded Funds, which are pools of money that buy stocks that mirror stock or bond sectors, or certain sub-indices) are the next best thing (per a guy who should know – Warren Buffett). If you do buy stocks, preferably ones that grow dividends steadily, the stress of watching your portfolio pogo up and down is relieved because you can focus on the dividend cash flow instead. Then you can relax and go back to quality internet programming like funny cat videos or Russian traffic fails. Or is that just me…

For more stories, visit Todayville Calgary

2025 Federal Election

Alcohol tax and MP pay hike tomorrow (April 1)

The Canadian Taxpayers Federation is calling on all party leaders to stop a pair of bad policies that are scheduled to happen automatically on April 1: pay raises for members Parliament and another alcohol tax increase.

“Party leaders owe taxpayers answers to these two questions: Why do you think you deserve a pay raise and why should Canadians pay higher taxes on beer and wine?” said Franco Terrazzano, CTF Federal Director. “Politicians don’t deserve a raise while millions of Canadians are struggling.

“And the last thing Canadians need is another tax hike when they pour a cold one or uncork a bottle with that special someone.”

MPs give themselves pay raises each year on April 1, based on the average annual increase in union contracts with corporations with 500 or more employees.

The CTF estimates tomorrow’s pay raise will amount to an extra $6,200 for backbench MPs, $9,200 for ministers and $12,400 for the prime minister, based on contract data published by the federal government.

After tomorrow’s pay raise, backbench MPs will receive a $209,300 annual salary, according to CTF estimates. A minister will collect $309,100 and the prime minister will take home $418,600.

Meanwhile, the alcohol escalator automatically increases excise taxes on beer, wine and spirits every year on April 1, without a vote in Parliament. Alcohol taxes will increase by two per cent tomorrow, costing taxpayers about $40 million this year, according to Beer Canada estimates.

The alcohol escalator tax has cost taxpayers more than $900 million since it was imposed in 2017, according to Beer Canada estimates.

“Politicians are padding their pockets on the same day they’re raising beer taxes and that’s wrong,” Terrazzano said. “If party leaders want to prove they care about taxpayers, they should stop the MP pay raises.

“And if party leaders care about giving Canadian brewers, distillers and wineries a fighting chance against tariffs, it’s time to stop hitting them with alcohol tax hikes year after year.”

The CTF released Leger polling showing 79 per cent of Canadians oppose tomorrow’s MP pay raise.

2025 Federal Election

Poilievre To Create ‘Canada First’ National Energy Corridor

From Conservative Party Communications

Poilievre will create the ‘Canada First’ National Energy Corridor to rapidly approve & build the infrastructure we need to end our energy dependence on America so we can stand up to Trump from a position of strength.

Conservative Leader Pierre Poilievre announced today he will create a ‘Canada First’ National Energy Corridor to fast-track approvals for transmission lines, railways, pipelines, and other critical infrastructure across Canada in a pre-approved transport corridor entirely within Canada, transporting our resources within Canada and to the world while bypassing the United States. It will bring billions of dollars of new investment into Canada’s economy, create powerful paycheques for Canadian workers, and restore our economic independence.

“After the Lost Liberal decade, Canada is poorer, weaker, and more dependent on the United States than ever before,” said Poilievre. “My ‘Canada First National Energy Corridor’ will enable us to quickly build the infrastructure we need to strengthen our country so we can stand on our own two feet and stand up to the Americans.”

In the corridor, all levels of government will provide legally binding commitments to approve projects. This means investors will no longer face the endless regulatory limbo that has made Canadians poorer. First Nations will be involved from the outset, ensuring that economic benefits flow directly to them and that their approval is secured before any money is spent.

Between 2015 and 2020, Canada cancelled 16 major energy projects, resulting in a $176 billion hit to our economy. The Liberals killed the Energy East pipeline and passed Bill C-69, the “No-New-Pipelines” law, which makes it all but impossible to build the pipelines and energy infrastructure we need to strengthen the Canadian economy. And now, the PBO projects that the ‘Carney cap’ on Canadian energy will reduce oil and gas production by nearly 5%, slash GDP by $20.5 billion annually, and eliminate 54,400 full-time jobs by 2032. An average mine opening lead time is now nearly 18 years—23% longer than Australia and 38% longer than the US. As a result of the Lost Liberal Decade, Canada now ranks 23rd in the World Bank’s Ease of Doing Business Index for 2024, a seven-place drop since 2015.

“In 2024, Canada exported 98% of its crude oil to the United States. This leaves us too dependent on the Americans,” said Poilievre. “Our Canada First National Energy Corridor will get us out from under America’s thumb and enable us to build the infrastructure we need to sell our natural resources to new markets, bring home jobs and dollars, and make us sovereign and self-reliant to stand up to Trump from a position of strength.”

Mark Carney’s economic advice to Justin Trudeau made Canada weaker while he and his rich friends made out like bandits. While he advised Trudeau to cancel Canadian energy projects, his own company spent billions on pipelines in South America and the Middle East. And unlike our competitors Australia and America, which work with builders to get projects approved, Mark Carney and Steven Guilbeault’s radical “keep-it-in-the-ground” ideology has blocked development, killed jobs, and left Canada dependent on foreign imports.

“The choice is clear: a fourth Liberal term that will keep our resources in the ground and keep us weak and vulnerable to Trump’s threats, or a strong new Conservative government that will approve projects, build an economic fortress, bring jobs and dollars home, and put Canada First—For a Change.”

-

Uncategorized1 day ago

Uncategorized1 day agoPoilievre on 2025 Election Interference – Carney sill hasn’t fired Liberal MP in Chinese election interference scandal

-

Business1 day ago

Business1 day agoCuba has lost 24% of it’s population to emigration in the last 4 years

-

2025 Federal Election1 day ago

2025 Federal Election1 day ago2025 Election Interference – CCP Bounty on Conservative Candidate – Carney Says Nothing

-

2025 Federal Election11 hours ago

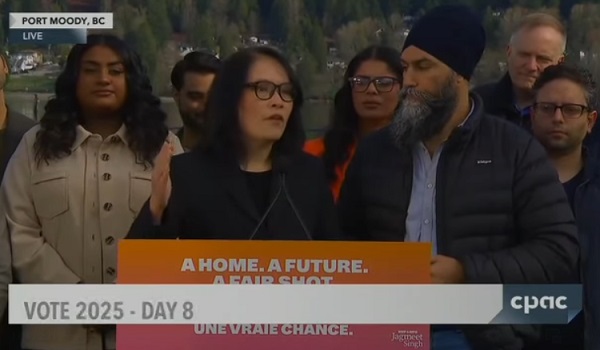

2025 Federal Election11 hours agoChinese Election Interference – NDP reaction to bounty on Conservative candidate

-

Business2 days ago

Business2 days agoTariff-driven increase of U.S. manufacturing investment would face dearth of workers

-

Aristotle Foundation1 day ago

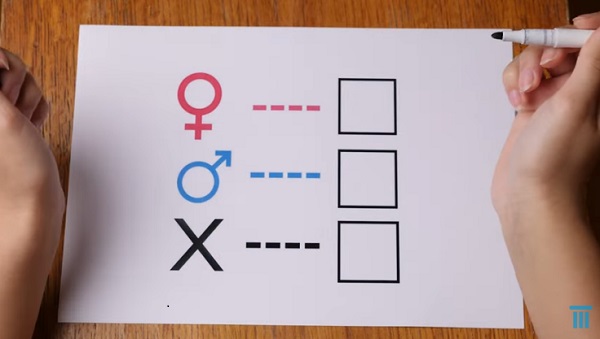

Aristotle Foundation1 day agoCanada has the world’s MOST relaxed gender policy for minors

-

2025 Federal Election1 day ago

2025 Federal Election1 day ago2025 Federal Election Interference from China! Carney Pressed to Remove Liberal MP Over CCP Bounty Remark

-

International1 day ago

International1 day agoTrump signs executive order to make Washington D.C. “safe and beautiful”