National

‘Insider’ connected to ArriveCAN app to testify before House of Commons committee

From LifeSiteNews

The once-mandatory ArriveCAN app cost taxpayers over $50 million, $8.9 million of which was given to an obscure company called GC Strategies which was operated by a two-man team out of an Ontario home.

Canadian MPs investigating the federal government’s $54 million controversial COVID-era ArriveCAN travel app are today questioning an “insider” connected to the app who was claimed to have boasted he “rubbed shoulders” with every assistant “deputy minister in town.”

According to Blacklock’s Reporter, the “insider” to testify before the House of Commons Standing Committee on Government Operations and Estimates (OGGO) as to his involvement with the travel app is consultant Vaughn Brennan, who was reluctantly named as a witness.

According to subcontractors involved in the ArriveCAN app, Brennan had been named as a “self-styled political insider.”

According to witnesses, Brennan said he had “rubbed shoulders with every assistant deputy minister in town” and thought that the $23 million being spent on a sole-sourced contract was “a drop in the bucket.”

To date, Brennan has never spoken publicly about his involvement with the ArriveCAN app, however, it has been confirmed he did work with ArriveCAN consultant GC Strategies Incorporated.

The once-mandatory ArriveCAN app cost taxpayers over $50 million, $8.9 million of which was given to an obscure company called GC Strategies which was operated by a two-man team out of an Ontario home.

The OGGO is investigating how various companies such as Dalian, Coaradix, and GC Strategies received millions in taxpayer dollars to develop the contentious quarantine-tracking ArriveCAN app.

LifeSiteNews last year reported how two tech entrepreneurs testified before the committee that during the development of the ArriveCAN travel app they saw firsthand how federal managers engaged in “extortion,” “corruption,” and “ghost contracting,” all at the expense of taxpayers.

Canada’s Auditor General Karen Hogan announced an investigation of the ArriveCAN app in November of 2022, after the House of Commons voted 173-149 for a full audit of the controversial app.

The OGGO has not yet determined who gave the final approval over the ArriveCAN travel app’s contracts, which paid out millions to consultants.

‘Systemic corruption’ within Trudeau federal government ‘evident to everyone,’ says Conservative MP

Conservative Party of Canada (CPC) MP Stephanie Kusie noted to the committee on October 26, 2023, that it should be “evident to everyone in this room as well as Canadians,” that there is “systemic corruption within this government,” when speaking about ArriveCAN. She added that government corruption “should be absolutely evident.”

According to CPC MP Kelly McCauley, who is chair of the committee, Brennan had declined to testify before it, adding that “GC Strategies is playing hard to get.”

“That would be a polite way of saying it,” said McCauley.

“We have not been able to get a commitment from them despite our clerk going above and beyond in trying to accommodate them. We’re having difficulties with them.”

MPs on the OGGO, without any explanation, were told that a GC Strategies executive “routinely boasted he and his friends, senior government officials with contracting authority, have ‘dirt on each other.’”

Since 2022, GC Strategies has received some $44 million in federal contracts.

Last year LifeSiteNews reported on how during a parliamentary investigation into the misuse of funds used to create the ArriveCAN travel app, Canada’s chief federal technology officer was threatened with contempt of Parliament charges for refusing to give clear answers to questions from MPs regarding his involvement with the much-maligned app.

ArriveCAN was introduced in April 2020 by the Liberal government of Prime Minister Justin Trudeau and made mandatory in November 2020. The app was used by the federal government to track the COVID jab status of those entering the country and enforce quarantines when deemed necessary.

When the app was mandated, all travelers entering Canada had to use it to submit their travel and contact information as well as any COVID vaccination details before crossing the border or boarding a flight.

In October 2021, Trudeau announced unprecedented COVID-19 jab mandates for all federal workers and those in the transportation sector and said the unjabbed will no longer be able to travel by air, boat, or train, both domestically and internationally.

This policy resulted in thousands losing their jobs or being placed on leave for non-compliance.

Trudeau “suspended” the COVID travel vaccine mandates on June 20, 2022. Last October, the Canadian federal government ended all remaining COVID mandates in Canada regarding travel, including masking on planes and trains, COVID testing, and allowing vaccine-free Canadians to no longer be subject to mandatory quarantine.

Over 700 vaccine-free Canadians negatively affected by federal COVID jab dictates have banded together to file a multimillion-dollar class-action lawsuit against the federal government of Prime Minister Justin Trudeau.

Business

Canada has given $109 million to Communist China for ‘sustainable development’ since 2015

From LifeSiteNews

A briefing note showed Canadian aid has gone to ‘key foreign policy priorities in China, including human rights, gender equality, sustainable development, and climate change.’

A federal briefing note disclosed that well over $100 million has been provided to the Communist Chinese government in so-called “foreign aid” to promote “sustainable development” that includes woke ideology such as gender equality.

As reported by Blacklock’s Reporter, a recent briefing note titled Assistance to China from May for the Minister of International Development showed $109 million has gone to “key foreign policy priorities in China, including human rights, gender equality, sustainable development, and climate change” since 2015 and $645 million since 2003.

The briefing note asked directly if funding was “going to the Government of China.”

In reply, the briefing note stated, “Canada has not provided direct bilateral assistance to Chinese state authorities since 2013, though it continues to provide small amounts of funding to international partners and non-state partners on the ground.”

Former Prime Minister Justin Trudeau came to power in 2015 and increased relations with the Communist Chinese regime. This trend under the Liberal Party government has continued with Prime Minister Mark Carney.

During a 2025 federal election campaign debate, Conservative Party leader Pierre Poilievre called out Carney for his ties to Communist China.

Conservative MP Andrew Scheer has consistently called out any money at all going to China, saying, “I don’t believe Canadian taxpayers should be sending any money to China.”

“We’re talking about a Communist dictatorial government that abuses human rights, quashes freedoms, violates rights of its citizens, and has a very aggressive foreign policy throughout the region,” he noted.

Scheer added that he has been calling on the Carney Liberals to “stand up for themselves, stand up for Canadians, stop being bullied and pushed around on the world stage, especially by China.”

Most of the money in foreign aid was spent through globalist-backed agencies such as the World Bank and the United Nations Development Program. Some 39 percent of the money was said to have gone straight to Chinese recipients, but no projects were itemized.

Other countries have received millions of dollars in foreign aid, with $2.1 billion going to Ukraine, $195 million to Ethiopia, $172 million to Haiti, and $151 million to the West Bank and Gaza last year.

Foreign aid to all nations totaled $12.3 billion.

LifeSiteNews recently reported that the Canadian Liberal government gave millions in aid to Chinese universities.

China has been accused of direct election meddling in Canada, as reported by LifeSiteNews.

LifeSiteNews also reported that a new exposé by investigative journalist Sam Cooper has claimed there is compelling evidence that Carney and Trudeau are/were strongly influenced by an “elite network” of foreign actors, including those with ties to China and the World Economic Forum.

MAiD

Study promotes liver transplants from Canadian euthanasia victims

From LifeSiteNews

A new study encourages transplants from euthanasia donors, saying that harvesting the organs of people killed by euthanasia has a ‘real impact’ on organ supply.

A concerning new study shows that liver transplants from euthanasia donors yield similar results as those from other donations, a finding that could increase pressure to euthanize vulnerable Canadians.

On October 26, the Journal of Hepatology published research comparing liver transplants in Canada from donations after circulatory death – a problematic method of organ donation – and from donations of those who were euthanized, in the latest study into increasing organ transplants from euthanasia or so-called “medical assistance in dying” (“MAID”) victims.

“Our study provides the first large-scale Canadian experience, paralleling previous studies from Belgium and the Netherlands, showing that outcomes are positive, while also demonstrating the real impact that MAiD donation can have on the availability of organs,” co-lead investigator A.M. James Shapiro declared.

“While not all individuals pursuing MAiD are suitable for donation for various reasons, we hope that our study will allow a better understanding of the potential role of organ donation following MAiD,” he continued.

Shapiro highlighted, in his view, “how impactful it can be for saving lives of many people in their final act of generosity.”

Canada is one of few countries, alongside Australia, Belgium, Spain, and the Netherlands, that harvests organs from euthanasia victims. Under the Liberal government, Canada has become the world leader in organ donations from people who obtained state-sanctioned euthanasia.

Recently, the interest in the practice has boomed, after the heart of a euthanized Canadian man was successfully harvested and donated to an American man with heart failure.

While many Canadians are left without necessary healthcare and even goaded to end their lives through euthanasia, the Liberal-run health system appears to prioritize the lucrative business of harvesting organs from Canadians killed off by their euthanasia regime.

According to some estimates, a heart is “worth around $1 million in the U.S. Livers come in second, about $557,000, and kidneys cost about $262,000 each. Not to speak about human skin ($10/inch), stomach ($500), and eyeballs ($1,500 each).”

Additionally, as LifeSiteNews has extensively covered, health officials have sounded the alarm over organs being harvested from still living patients in order to obtain fresh organs for transplants.

Similarly, conservative Irish think tank academic Dr. Angelo Bottone has warned against a push to harvest organs from euthanasia victims before they are killed.

“While donation after euthanasia is already happening in those countries, doctors are now discussing harvesting organs before euthanasia patients are declared dead, in order to preserve organ viability,” Bottone wrote.

“They propose that organs be removed under general anaesthesia before the patient is declared dead, thereby maintaining continuous blood circulation and oxygenation to the organs until the moment of retrieval,” the scholar continued. “This method could significantly improve the quality and quantity of organs available for transplantation.”

The most recent reports show that euthanasia is the sixth highest cause of death in Canada. However, it was not listed as such in Statistics Canada’s top 10 leading causes of death from 2019 to 2022.

Asked why euthanasia was left off the list, the agency said that it records the illnesses that led Canadians to choose to end their lives via euthanasia, not the actual cause of death, as the primary cause of death.

According to Health Canada, in 2022, 13,241 Canadians died by lethal euthanasia injections. This accounts for 4.1 percent of all deaths in the country for that year, a 31.2 percent increase from 2021.

-

Alberta2 days ago

Alberta2 days agoPremier Smith sending teachers back to school and setting up classroom complexity task force

-

International1 day ago

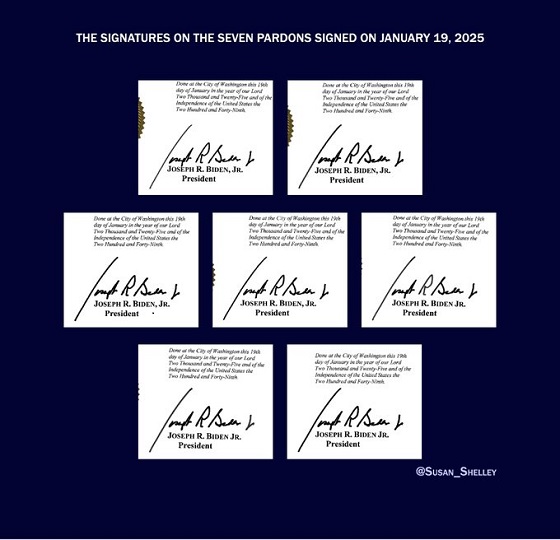

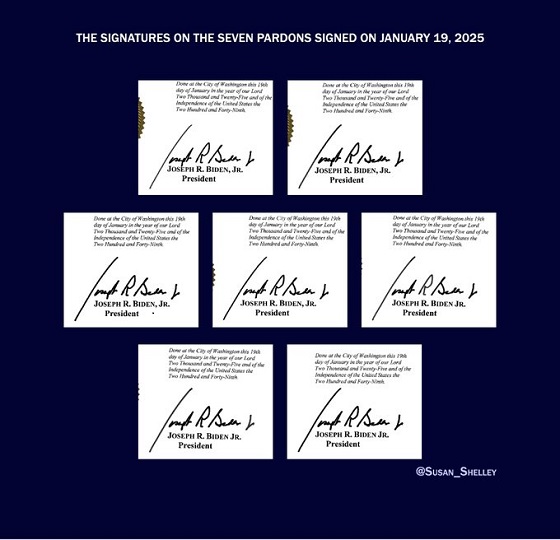

International1 day agoBiden’s Autopen Orders declared “null and void”

-

Business1 day ago

Business1 day agoTrans Mountain executive says it’s time to fix the system, expand access, and think like a nation builder

-

Alberta2 days ago

Alberta2 days agoThousands of Albertans march to demand independence from Canada

-

Canada Free Press1 day ago

Canada Free Press1 day agoThe real genocide is not taking place in Gaza, but in Nigeria

-

Business15 hours ago

Business15 hours agoCanada has given $109 million to Communist China for ‘sustainable development’ since 2015

-

Crime2 days ago

Crime2 days agoSuspect caught trying to flee France after $100 million Louvre jewel robbery

-

Business1 day ago

Business1 day agoCanada’s combative trade tactics are backfiring