Economy

Indigenous Loan Program Could Pave the Way for More Natural Resource Economy Ownership

From EnergyNow.ca

“We want to be part of the oil and gas industry”

Ottawa has promised a loan program for Indigenous communities to buy equity stakes in natural resource projects, but many questions are still unanswered.

Ottawa is currently under scrutiny as it prepares to incorporate an Indigenous loan-guarantee program into its 2024-2025 budget, aimed at assisting Indigenous communities in acquiring equity stakes in natural resource projects. This commitment was made in Finance Minister Chrystia Freeland’s fall economic statement on November 21.

The government will advance development of an Indigenous Loan Guarantee Program to help facilitate Indigenous equity ownership in major projects in the natural resource sector. Next steps will be announced in Budget 2024.

The federal budget is typically presented to Parliament in either February or March, with the 2023-2024 budget having been announced on March 28 last year. While Ottawa has engaged in consultations with Indigenous leaders and organizations, there remains a notable lack of specific details, including a critical issue – whether the program will permit investment in oil and gas projects.

The First Nations Major Projects Coalition, boasting over 145 members, strongly advocates for Indigenous peoples to have the autonomy to determine their investment choices without constraints imposed by Ottawa. Although the government did assert its commitment to ensuring Indigenous communities benefit from major projects within their territories on their own terms, First Nations groups worry that the loan-guarantee program might mirror the green restrictions of the current Indigenous loan program provided by the Canada Infrastructure Bank.

This existing program allows equity stakes only in infrastructure projects aligned with the bank’s investments, such as clean power, green infrastructure, broadband technology, and transportation. For some time, the First Nations Major Projects Coalition (FNMPC) and the Indigenous Resource Network have been at the forefront of campaigns urging federal loan guarantees to facilitate Indigenous participation in natural resource projects.

Sharleen Gale, Chair of FNMPC, argues that fossil fuel investments must be a component of any federal loan-guarantee program, as equity in the oil and gas industry can empower First Nations to thrive in alignment with their values.

“We want to be part of the oil and gas industry,” says Gale.

In 2022, the Indigenous Resource Network (IRN) initiated the “Ownership Changes Everything” campaign, advocating for Indigenous ownership in resource projects. This campaign calls upon Ottawa to implement a loan program modeled after similar initiatives in Alberta, Saskatchewan, and Ontario. Robert Merasty, highlights the challenges faced by Indigenous communities due to the Indian Act, which prohibits First Nations from using their land and assets as collateral. Consequently, they lack the necessary at-risk capital to secure favorable interest rates.

“The problems our communities are facing is that there are few mechanisms to access the necessary capital for investing in projects and having equity,” says Merasty.

In 2023, FNMPC penned an open letter to Finance Minister Chrystia Freeland, emphasizing the significance of advancing major resource projects for a successful energy transition and economic growth benefiting all Canadians. They also pointed out that the Indian Act remains a significant hurdle, preventing First Nations from leveraging their assets and land for borrowing.

FNMPC estimates that over the next decade, 470 major projects impacting Indigenous lands will require more than $525 billion in capital investment, with approximately $50 billion needed for Indigenous equity financing. An illustrative case from Alberta involved energy giant Enbridge, which partnered with 23 First Nation and Métis communities to sell an 11.57% interest in seven pipelines in northern Alberta. This partnership was made possible through a loan guarantee from the Alberta Indigenous Opportunities Corp., which provides financing to Indigenous communities seeking commercial collaborations, alongside various other financial supports.

Greg Ebel, CEO of Enbridge, has joined the campaign for a national program.

“Investment in the entire energy sector and many others could be accelerated by the immediate implementation of a federal Indigenous loan-guarantee program to ensure Canada’s Indigenous Peoples have a seat at the table while also having equity that helps them secure a more prosperous future,” says Ebel.

As we await further developments, the question remains: Will a federal loan-guarantee program come to fruition, one that encompasses loan guarantees for investments in natural gas and oil? We are hopeful for a positive outcome.

Business

Saskatchewan becomes first Canadian province to fully eliminate carbon tax

From LifeSiteNews

Saskatchewan has become the first Canadian province to free itself entirely of the carbon tax.

On March 27, Saskatchewan Premier Scott Moe announced the removal of the provincial industrial carbon tax beginning April 1, boosting the province’s industry and making Saskatchewan the first carbon tax free province.

Under Moe’s direction, Saskatchewan has dropped the industrial carbon tax which he says will allow Saskatchewan to thrive under a “tariff environment.”

“I would hope that all of the parties running in the federal election would agree with those objectives and allow the provinces to regulate in this area without imposing the federal backstop,” he continued.

The removal of the tax is estimated to save Saskatchewan residents up to 18 cents a liter in gas prices.

The removal of the tax will take place on April 1, the same day the consumer carbon tax will reduce to 0 percent under Prime Minister Mark Carney’s direction. Notably, Carney did not scrap the carbon tax legislation: he just reduced its current rate to zero. This means it could come back at any time.

Furthermore, while Carney has dropped the consumer carbon tax, he has previously revealed that he wishes to implement a corporation carbon tax, the effects of which many argued would trickle down to all Canadians.

The Saskatchewan Association of Rural Municipalities (SARM) celebrated Moe’s move, noting that the carbon tax was especially difficult on farmers.

“I think the carbon tax has been in place for approximately six years now coming up in April and the cost keeps going up every year,” SARM president Bill Huber said.

“It puts our farming community and our business people in rural municipalities at a competitive disadvantage, having to pay this and compete on the world stage,” he continued.

“We’ve got a carbon tax on power — and that’s going to be gone now — and propane and natural gas and we use them more and more every year, with grain drying and different things in our farming operations,” he explained.

“I know most producers that have grain drying systems have three-phase power. If they haven’t got natural gas, they have propane to fire those dryers. And that cost goes on and on at a high level, and it’s made us more noncompetitive on a world stage,” Huber decalred.

The carbon tax is wildly unpopular and blamed for the rising cost of living throughout Canada. Currently, Canadians living in provinces under the federal carbon pricing scheme pay $80 per tonne.

2025 Federal Election

Fight against carbon taxes not over yet

As the federal government removes the consumer carbon tax, the Canadian Taxpayers Federation is calling on all party leaders to oppose all carbon taxes, including the hidden tax on business.

“Canadians fought hard to force Ottawa to back down on its consumer carbon tax and now the fight moves to stopping the hidden carbon tax on business,” said Franco Terrazzano, CTF Federal Director. “Canadians can’t afford a carbon tax on business that pushes up prices at the gas station and makes it harder for our businesses to compete while they’re already struggling with a trade war.”

Today, the federal government cut the consumer carbon tax rate to $0. This will reduce taxes by about 17 cents per litre of gasoline, 21 cents per litre of diesel and 15 cents per cubic metre of natural gas.

The federal government still imposes an industrial carbon tax on oil and gas, steel and fertilizer businesses, among others.

During the Liberal Party leadership race, Prime Minister Mark Carney said he would “improve and tighten” the industrial carbon tax and “extend the framework to 2035.”

Just 12 per cent of Canadians believe businesses pay most of the cost of the industrial carbon tax, according to a Leger poll commissioned by the CTF. Meanwhile, 70 per cent said businesses would pass most or some carbon tax costs on to consumers.

Conservative Party Leader Pierre Poilievre said he will “repeal the entire carbon tax law, including the tax on Canadian businesses and industries.”

“Carbon taxes on refineries make gas more expensive, carbon taxes on utilities make home heating more expensive and carbon taxes on fertilizer plants increase costs for farmers and that makes groceries more expensive,” Terrazzano said. “Canadians know Poilievre will end all carbon taxes and Canadians know Carney’s carbon tax costs won’t be zero.

“Carney owes Canadians a clear answer: How much will your carbon tax cost?”

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoFixing Canada’s immigration system should be next government’s top priority

-

2025 Federal Election2 days ago

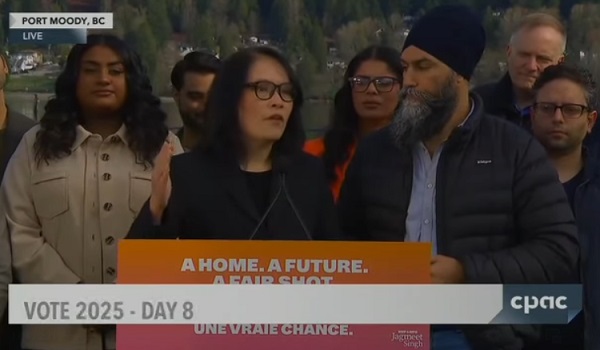

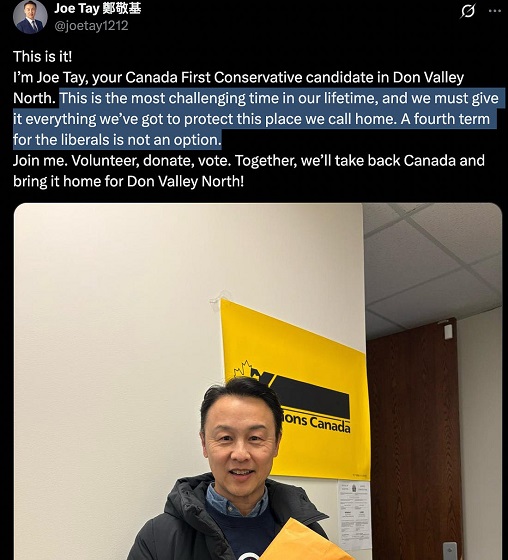

2025 Federal Election2 days agoChina Election Interference – Parties Received Security Briefing Days Ago as SITE Monitors Threats to Conservative Candidate Joe Tay

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoLondon-Based Human Rights Group Urges RCMP to Investigate Liberal MP for Possible Counselling of Kidnapping

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoJoe Tay Says He Contacted RCMP for Protection, Demands Carney Fire MP Over “Bounty” Remark

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoHong Kong-Canadian Groups Demand PM Carney Drop Liberal Candidate Over “Bounty” Remark Supporting CCP Repression

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoBeijing’s Echo Chamber in Parliament: Part 2 – Still No Action from Carney

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoRCMP Confirms It Is ‘Looking Into’ Alleged Foreign Threat Following Liberal Candidate Paul Chiang Comments

-

International10 hours ago

International10 hours agoTrump’s ‘Golden Dome’ defense shield must be built now, Lt. Gen. warns