Canadian Energy Centre

Indigenous leaders meet G7 diplomats to make case for Canadian LNG

Indigenous leaders meet with U.S. ambassador to Canada David Cohen. Photo courtesy Energy for a Secure Future

From Shawn Logan of the Canadian Energy Centre Ltd.

‘Every official had a real desire to really understand Indigenous sentiment around resource development’

As G7 leaders left Hiroshima, Japan last month, they made a significant admission that liquefied natural gas (LNG) is a critical fuel to help reduce dependence on Russian energy, and that increased natural gas investment is important.

“In this context, we stress the important role that increased deliveries of LNG can play and acknowledge that investment in the sector can be appropriate in response to the current crisis and to address potential gas market shortfalls provoked by the crisis,” wrote the G7 in their final communique last week.

The decision comes just weeks after a small group of Indigenous leaders went to Ottawa to meet face-to-face with diplomats from some of the world’s top economies, convened by Energy for a Secure Future.

Their message to the world was simple: Indigenous communities in Canada can and should be partners at the table when it comes to developing and sharing our country’s vast natural resources. And it may have resonated.

For John Desjarlais, executive director of the Indigenous Resource Network, the vote of confidence for LNG is music to his ears.

“I’d like to think that we were heard – we met with some pretty influential people and heard some of the right things,” he said.

“For them to make that commitment is a big deal, and certainly a difference from some of the early indicators before the G7.”

Tapped earlier this year as the new executive director of the Indigenous Resource Network, Desjarlais found himself in Ottawa with other Indigenous leaders in April, meeting with diplomatic representatives from Canada’s G7 partners – Germany, France, Japan and the United States – as well as delegations from Poland and India.

Desjarlais said he was surprised just how open diplomats were to the notion that Indigenous communities in Canada can be key players in the global energy marketplace.

“What a whirlwind. It was inspiring, especially speaking with the ambassadors,” Desjarlais said of the two-day diplomatic blitz that both challenged perceptions and paved a path for Indigenous voices to play a greater role on the international stage.

“Every official had a real desire to really understand Indigenous sentiment around resource development. There was a sincere desire to learn from our perspective.”

First Nations and Metis have emerged as key partners in Canadian resource projects, particularly the country’s nascent LNG industry.

Global demand for reliable and responsibly produced LNG has continued to grow, with Russia’s invasion of Ukraine last year thrusting it into even greater prominence. The leaders of Canada’s G7 partners Germany and Japan both came to Canada last year to make direct appeals for more Canadian LNG – they left with no firm commitments.

Desjarlais and a group of fellow Indigenous leaders who are on the advisory council for Energy for a Secure Future – a non-partisan coalition of business, labour and Indigenous representatives – outlined their vision for how Canada and First Nations can help be a solution in the drive for increased global energy security, while also helping lower emissions by providing a cleaner alternative to coal.

Crystal Smith, chief councillor of the Haisla Nation on B.C.’s coast, said the first step is dispelling the notion that Indigenous people oppose resource development in Canada.

“When Europeans, Asians and Americans think of Canada’s Indigenous peoples, they often think we oppose all energy development,” she said during a press conference to mark April’s diplomatic meetings.

“We aren’t victims of development. Increasingly we are partners and even owners in major projects.”

The Haisla Nation has a 50 per cent ownership stake in the proposed $3-billion Cedar LNG project, which was granted regulatory approval earlier this year, and is expected to begin operations in 2027.

It marks the largest Indigenous-owned infrastructure project in Canadian history, as well as the first Indigenous-owned LNG terminal in the world.

Karen Ogen, CEO of the First Nations LNG Alliance, said it’s projects like Cedar LNG and others currently under development that will not only help Indigenous communities achieve prosperity, but help the global community in the quest for vital energy security.

“LNG development has provided immediate- and medium-termed opportunities to lift thousands of Indigenous people and our communities out of inter-generational poverty,” she said.

“We are determined to develop our resources in a socially and environmentally responsible way. We want to work with Canada and our allies in the G7 to bring urgency to the development and export of Canadian LNG.”

Beyond Cedar LNG, dozens of First Nations and Métis communities have entered into equity ownership agreements in pipelines, LNG facilities and carbon capture and storage projects, among others.

The Ksi Lisims LNG project, a joint venture with the Nisga’a Nation in northern B.C., has been granted a 40-year export licence from the Canada Energy Regulator, while in Atlantic Canada the Miawpukek First Nation is a part-owner of the proposed export project LNG Newfoundland and Labrador.

Large consortiums representing Indigenous communities have also acquired or are looking to acquire stakes in major pipeline projects including Coastal GasLink, Trans Mountain, and several oil sands pipelines.

According to Desjarlais, the Ottawa summit proved to be a fruitful meeting of the minds. He said it could signal a more important role for Indigenous communities both as more equal resource partners in Canada, but on the world stage as well. The group has been asked to meet again in June with U.S. ambassador David Cohen.

“I never thought it would accelerate to this point – it’s accelerating so fast,” he said.

“Ownership is reconciliation. There’s a whole cascade of benefits that come from these projects everywhere.”

Alberta

Why U.S. tariffs on Canadian energy would cause damage on both sides of the border

Marathon Petroleum’s Detroit refinery in the U.S. Midwest, the largest processing area for Canadian crude imports. Photo courtesy Marathon Petroleum

From the Canadian Energy Centre

More than 450,000 kilometres of pipelines link Canada and the U.S. – enough to circle the Earth 11 times

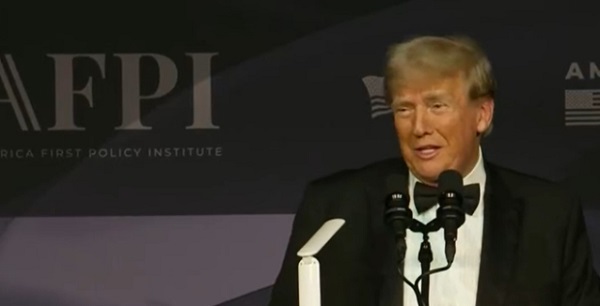

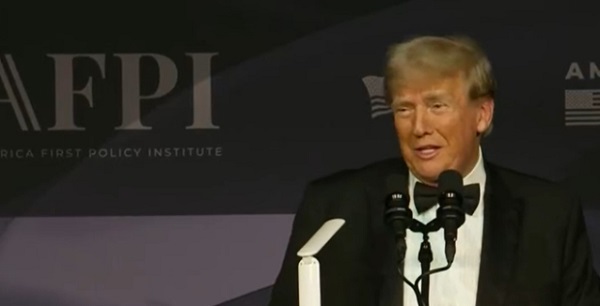

As U.S. imports of Canadian oil barrel through another new all-time high, leaders on both sides of the border are warning of the threat to energy security should the incoming Trump administration apply tariffs on Canadian oil and gas.

“We would hope any future tariffs would exclude these critical feedstocks and refined products,” Chet Thompson, CEO of the American Fuel & Petrochemical Manufacturers (AFPM), told Politico’s E&E News.

AFPM’s members manufacture everything from gasoline to plastic, dominating a sector with nearly 500 operating refineries and petrochemical plants across the United States.

“American refiners depend on crude oil from Canada and Mexico to produce the affordable, reliable fuels consumers count on every day,” Thompson said.

The United States is now the world’s largest oil producer, but continues to require substantial imports – to the tune of more than six million barrels per day this January, according to the U.S. Energy Information Administration (EIA).

Nearly 70 per cent of that oil came from Canada.

Many U.S. refineries are set up to process “heavy” crude like what comes from Canada and not “light” crude like what basins in the United States produce.

“New tariffs on [Canadian] crude oil, natural gas, refined products, or critical input materials that cannot be sourced domestically…would directly undermine energy affordability and availability for consumers,” the American Petroleum Institute, the industry’s largest trade association, wrote in a recent letter to the United States Trade Representative.

More than 450,000 kilometres of oil and gas pipelines link Canada and the United States – enough to circle the Earth 11 times.

The scale of this vast, interconnected energy system does not exist anywhere else. It’s “a powerful card to play” in increasingly unstable times, researchers with S&P Global said last year.

Twenty-five years from now, the United States will import virtually exactly the same amount of oil as it does today (7.0 million barrels per day in 2050 compared to 6.98 million barrels per day in 2023), according to the EIA’s latest outlook.

“We are interdependent on energy. Americans cutting off Canadian energy would be like cutting off their own arm,” said Heather Exner-Pirot, a special advisor to the Business Council of Canada.

Trump’s threat to apply a 25 per cent tariff on imports from Canada, including energy, would likely “result in lower production in Canada and higher gasoline and energy costs to American consumers while threatening North American energy security,” Canadian Association of Petroleum Producers CEO Lisa Baiton said in a statement.

“We must do everything in our power to protect and preserve this energy partnership.”

Energy products are Canada’s single largest export to the United States, accounting for about a third of total Canadian exports to the U.S., energy analysts Rory Johnston and Joe Calnan noted in a November report for the Canadian Global Affairs Institute.

The impact of applying tariffs to Canadian oil would likely be spread across Canada and the United States, they wrote: higher pump prices for U.S. consumers, weaker business for U.S. refiners and reduced returns for Canadian producers.

“It is vitally important for Canada to underline that it is not just another trade partner, but rather an indispensable part of the economic and security apparatus of the United States,” Johnston and Calnan wrote.

Canadian Energy Centre

Top 10 good news stories about Canadian energy in 2024

From the Canadian Energy Centre

Record oil production, more Indigenous ownership and inching closer to LNG

It’s likely 2024 will go down in history as a turning point for Canadian energy, despite challenging headwinds from federal government policy.

Here’s some of the good news.

10. New carbon capture and storage (CCS) projects to proceed

In June, Shell announced it will proceed with the Polaris and Atlas CCS projects, expanding emissions reduction at the company’s Scotford energy and chemicals park near Edmonton.

Polaris is designed to capture approximately 650,000 tonnes of CO2 per year, or the equivalent annual emissions of about 150,000 gasoline-powered cars. The CO2 will be transported by a 22-kilometre pipeline to the Atlas underground storage hub.

The projects build on Shell’s experience at the Quest CCS project, also located at the Scotford complex. Since 2015, Quest has stored more than eight million tonnes of CO2. Polaris and Atlas are targeted for startup in 2028.

Meanwhile, Entropy Inc. announced in July it will proceed with its Glacier Phase 2 CCS project. Located at the Glacier gas plant near Grande Prairie, the project is expected onstream in mid-2026 and will capture 160,000 tonnes of emissions per year.

Since 2015, CCS operations in Alberta have safely stored roughly 14 million tonnes of CO2, or the equivalent emissions of more than three million cars.

9. Canada’s U.S. oil exports reach new record

Expanded export capacity at the Trans Mountain Westridge Terminal. Photo courtesy Trans Mountain Corporation

Canada’s exports of oil and petroleum products to the United States averaged a record 4.6 million barrels per day in the first nine months of 2024, according to the U.S. Energy Information Administration.

Demand from Midwest states increased, along with the U.S. Gulf Coast, the world’s largest refining hub. Canadian sales to the U.S. West Coast also increased, enabled by the newly completed Trans Mountain Pipeline Expansion.

8. Alberta’s oil production never higher

In early December, ATB Economics analyst Rob Roach reported that Alberta’s oil production has never been higher, averaging 3.9 million barrels per day in the first 10 months of the year.

This is about 190,000 barrels per day higher than during the same period in 2023, enabled by the Trans Mountain expansion, Roach noted.

7. Indigenous energy ownership spreads

Communities of Wapiscanis Waseskwan Nipiy Limited Partnership in December 2023. Photo courtesy Alberta Indigenous Opportunities Corporation

In September, the Bigstone Cree Nation became the latest Indigenous community to acquire an ownership stake in an Alberta energy project.

Bigstone joined 12 other First Nations and Métis settlements in the Wapiscanis Waseskwan Nipiy Holding Limited Partnership, which holds 85 per cent ownership of Tamarack Valley Energy’s Clearwater midstream oil and gas assets.

The Alberta Indigenous Opportunities Corporation (AIOC) is backstopping the agreement with a total $195 million loan guarantee.

In its five years of operations, the AIOC has supported more than 60 Indigenous communities taking ownership of energy projects, with loan guarantees valued at more than $725 million.

6. Oil sands emissions intensity goes down

A November report from S&P Global Commodity said that oil sands production growth is beginning to rise faster than emissions growth.

While oil sands production in 2023 was nine per cent higher than in 2019, total emissions rose by just three per cent.

“This is a notable, significant change in oil sands emissions,” said Kevin Birn, head of S&P Global’s Centre for Emissions Excellence.

Average oil sands emissions per barrel, or so-called “emissions intensity” is now 28 per cent lower than it was in 2009.

5. Oil and gas producers beat methane target, again

Data released by the Alberta Energy Regulator in November 2024 confirmed that methane emissions from conventional oil and gas production in the province continue to go down, exceeding government targets.

In 2022, producers reached the province’s target to reduce methane emissions by 45 per cent compared to 2014 levels by 2025 three years early.

The new data shows that as of 2023, methane emissions have been reduced by 52 per cent.

4. Cedar LNG gets the green light to proceed

Haisla Nation Chief Councillor Crystal Smith and Pembina Pipeline Corporation CEO Scott Burrows announce the Cedar LNG positive final investment decision on June 25, 2024. Photo courtesy Cedar LNG

The world’s first Indigenous majority-owned liquefied natural gas (LNG) project is now under construction on the coast of Kitimat, B.C., following a positive final investment decision in June.

Cedar LNG is a floating natural gas export terminal owned by the Haisla Nation and Pembina Pipeline Corporation. It will have capacity to produce 3.3 million tonnes of LNG per year for export overseas, primarily to meet growing demand in Asia.

The $5.5-billion project will receive natural gas through the Coastal GasLink pipeline. Peak construction is expected in 2026, followed by startup in late 2028.

3. Coastal GasLink Pipeline goes into service

The countdown is on to Canada’s first large-scale LNG exports, with the official startup of the $14.5-billion Coastal GasLink Pipeline in November.

The 670-kilometre pipeline transports natural gas from near Dawson Creek, B.C. to the LNG Canada project at Kitimat, where it will be supercooled and transformed into LNG.

LNG Canada will have capacity to export 14 million tonnes of LNG per year to overseas markets, primarily in Asia, where it is expected to help reduce emissions by displacing coal-fired power.

The terminal’s owners – Shell, Petronas, PetroChina, Mitsubishi and Korea Gas Corporation – are ramping up natural gas production to record rates, according to RBN Energy.

RBN analyst Martin King expects the first shipments to leave LNG Canada by early next year, setting up for commercial operations in mid-2025.

2. Construction starts on $8.9 billion net zero petrochemical plant

In April, construction commenced near Edmonton on the world’s first plant designed to produce polyethylene — a widely used, recyclable plastic — with net zero scope 1 and 2 emissions.

Dow Chemicals’ $8.9 billion Path2Zero project is an expansion of the company’s manufacturing site in Fort Saskatchewan. Using natural gas as a feedstock, it will incorporate CCS to reduce emissions.

According to business development agency Edmonton Global, the project is spurring a boom in the region, with nearly 200 industrial projects worth about $96 billion now underway or nearing construction.

Dow’s plant is scheduled for startup in 2027.

1. Trans Mountain Pipeline Expansion completed

The “Golden Weld” marked mechanical completion of construction for the Trans Mountain Expansion Project on April 11, 2024. Photo courtesy Trans Mountain Corporation

The long-awaited $34-billion Trans Mountain Pipeline Expansion officially went into service in May, in a game-changer for Canadian energy with ripple effects around the world.

The 590,000 barrel-per-day expansion for the first time gives customers outside the United States access to large volumes of Canadian oil, with the benefits flowing to Canada’s economy.

According to the Canada Energy Regulator, exports to non-U.S. locations more than doubled following the expansion startup, averaging 420,000 barrels per day compared to about 130,000 barrels per day in 2023.

The value of Canadian oil exports to Asia has soared from effectively zero to a monthly average of $515 million between June and October, according to ATB Economics.

-

Alberta1 day ago

Alberta1 day agoIs There Any Canadian Province More Proud of their Premier Today…

-

Brownstone Institute2 days ago

Brownstone Institute2 days agoThe Deplorable Ethics of a Preemptive Pardon for Fauci

-

Daily Caller21 hours ago

Daily Caller21 hours agoPastor Lectures Trump and Vance On Trans People, Illegal Immigrants

-

Dan McTeague11 hours ago

Dan McTeague11 hours agoCarney launches his crusade against the oilpatch

-

Business2 days ago

Business2 days agoLiberals to increase CBC funding to nearly $2 billion per year

-

Daily Caller11 hours ago

Daily Caller11 hours agoOpinion: Trump Making ‘Sex’ Great Again On Day One Of Presidency

-

Alberta23 hours ago

Alberta23 hours agoAlberta Premier Danielle Smith Media Roundtable from Washington

-

Alberta2 days ago

Alberta2 days agoTrump delays implementation 25% tariffs: Premier Smith response