Economy

If Canadian families spent and borrowed like the federal government, they would be $427,759 in debt

From the Fraser Institute

By Grady Munro and Jake Fuss

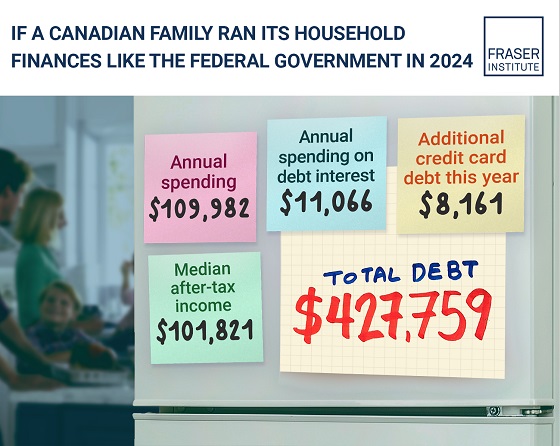

If the median Canadian family spent and borrowed like the federal government, they would already be $427,759 in debt and continuing to borrow, finds a new study published today by the Fraser Institute.

“If the median family in Canada spent and borrowed like the federal government, they would be in serious financial trouble,” said Grady Munro, a Fraser Institute policy analyst and co-author of Understanding the Scale of Canada’s Federal Deficit.

The $39.8 billion deficit expected by Ottawa in 2024/25 represents the 17th consecutive annual federal deficit, with continued deficits expected into the foreseeable future, eventually resulting in higher taxes for Canadians.

Continuous annual borrowing by Ottawa to finance increased spending has driven federal total debt from 53.0 per cent of the economy ($1.1 trillion) in 2014/15 up to an expected 69.8 per cent ($2.1 trillion) in 2024/25.

To put this into perspective, the study’s analysis offers an example of what a median family’s household finances would look like if they were to spend and borrow like the federal government in 2024.

The study found that the median Canadian family in 2024 would spend $109,982 while only earning $101,821, meaning that it would borrow $8,161 just to pay for its normal spending. This $8,000-plus in additional debt is on top of the $427,759 in existing debt the family would already hold based on previous borrowing.

Illustrative of the burden of debt, $11,066 of the family’s income, representing almost 11 per cent, would be spent on just the interest costs of existing debt.

“Unlike most households, where debt is often offset by assets such as a home or investments, the federal government has little in the way of assets to offset its enormous debt,” said Jake Fuss, director of fiscal policy at the Fraser Institute and coauthor. “And it’s important to note that this government debt burden on Canadian families does not include the burden of provincial and municipal government debt, which depending on one’s location, can be significant.”

- For many years the federal government’s approach to government finances has relied on spending-driven deficits and a growing debt burden, causing a deterioration in the state of federal finances.

- While deficits can sometimes be justified in certain circumstances, perpetual spending-driven deficits have become the norm rather than a temporary exception for the federal government. The $39.8 billion deficit expected in 2024/25 is the 17th consecutive annual deficit, and deficits are expected to continue into the foreseeable future.

- Deficits have helped drive federal gross debt from 53.0% of the economy ($1.1 trillion) in 2014/15 up to an expected 69.8% ($2.1 trillion) in 2024/25.

- This increase in the level of federal debt comes with costs and will result in higher taxes on Canadians.

- It may be hard to comprehend the scale of the deficits and debt, so to contextualize the current state of federal finances this bulletin provides an example of what a median family’s household budget would look like in 2024 if it managed its finances the way the federal government does.

- The median family earning $101,821 in 2024 would be spending $109,982 if it spent the way the federal government does. To cover the difference, it would put $8,161 on a credit card, despite already being $427,759 in debt.

- Of the total amount spent, $11,066 would go towards interest on the debt his year. Simply put, a Canadian family that chose to spend like the federal government would be in financial trouble.

Authors:

Automotive

Federal government should swiftly axe foolish EV mandate

From the Fraser Institute

Two recent events exemplify the fundamental irrationality that is Canada’s electric vehicle (EV) policy.

First, the Carney government re-committed to Justin Trudeau’s EV transition mandate that by 2035 all (that’s 100 per cent) of new car sales in Canada consist of “zero emission vehicles” including battery EVs, plug-in hybrid EVs and fuel-cell powered vehicles (which are virtually non-existent in today’s market). This policy has been a foolish idea since inception. The mass of car-buyers in Canada showed little desire to buy them in 2022, when the government announced the plan, and they still don’t want them.

Second, President Trump’s “Big Beautiful” budget bill has slashed taxpayer subsidies for buying new and used EVs, ended federal support for EV charging stations, and limited the ability of states to use fuel standards to force EVs onto the sales lot. Of course, Canada should not craft policy to simply match U.S. policy, but in light of policy changes south of the border Canadian policymakers would be wise to give their own EV policies a rethink.

And in this case, a rethink—that is, scrapping Ottawa’s mandate—would only benefit most Canadians. Indeed, most Canadians disapprove of the mandate; most do not want to buy EVs; most can’t afford to buy EVs (which are more expensive than traditional internal combustion vehicles and more expensive to insure and repair); and if they do manage to swing the cost of an EV, most will likely find it difficult to find public charging stations.

Also, consider this. Globally, the mining sector likely lacks the ability to keep up with the supply of metals needed to produce EVs and satisfy government mandates like we have in Canada, potentially further driving up production costs and ultimately sticker prices.

Finally, if you’re worried about losing the climate and environmental benefits of an EV transition, you should, well, not worry that much. The benefits of vehicle electrification for climate/environmental risk reduction have been oversold. In some circumstances EVs can help reduce GHG emissions—in others, they can make them worse. It depends on the fuel used to generate electricity used to charge them. And EVs have environmental negatives of their own—their fancy tires cause a lot of fine particulate pollution, one of the more harmful types of air pollution that can affect our health. And when they burst into flames (which they do with disturbing regularity) they spew toxic metals and plastics into the air with abandon.

So, to sum up in point form. Prime Minister Carney’s government has re-upped its commitment to the Trudeau-era 2035 EV mandate even while Canadians have shown for years that most don’t want to buy them. EVs don’t provide meaningful environmental benefits. They represent the worst of public policy (picking winning or losing technologies in mass markets). They are unjust (tax-robbing people who can’t afford them to subsidize those who can). And taxpayer-funded “investments” in EVs and EV-battery technology will likely be wasted in light of the diminishing U.S. market for Canadian EV tech.

If ever there was a policy so justifiably axed on its failed merits, it’s Ottawa’s EV mandate. Hopefully, the pragmatists we’ve heard much about since Carney’s election victory will acknowledge EV reality.

Economy

The stars are aligning for a new pipeline to the West Coast

From Resource Works

Mark Carney says another pipeline is “highly likely”, and that welcome news.

While attending this year’s Calgary Stampede, Prime Minister Mark Carney made it official that a new pipeline to Canada’s West Coast is “highly likely.”

While far from a guarantee, it is still great news for Canada and our energy industry. After years of projects being put on hold or cancelled, things are coming together at the perfect time for truly nation-building enterprises.

Carney’s comments at Stampede have been preceded by a number of other promising signs.

At a June meeting between Carney and the premiers in Saskatoon, Alberta Premier Danielle Smith proposed a “grand bargain” that would include a privately funded pipeline capable of moving a million barrels of oil a day, along with significant green investments.

Carney agreed with Smith’s plan, saying that Canada needed to balance economic growth with environmental responsibility.

Business and political leaders have been mostly united in calling for the federal government to speed up the building of pipelines, for economic and strategic reasons. As we know, it is very difficult to find consensus in Canada, with British Columbia Premier David Eby still reluctant to commit to another pipeline on the coast of the province.

Alberta has been actively encouraging support from the private sector to fund a new pipeline that would fulfil the goals of the Northern Gateway project, a pipeline proposed in 2008 but snuffed out by a hail of regulations under former Prime Minister Justin Trudeau.

We are in a new era, however, and we at Resource Works remarked that last month’s G7 meeting in Kananaskis could prove to be a pivotal moment in the history of Canadian energy. An Ipsos poll found that Canada was the most favoured nation for supplying oil in the G7, and our potential as an energy superpower has never been more important for the democratic world, given the instability caused by Russia and other autocratic energy powers.

Because of this shifting, uncertain global climate, Canadian oil and gas are more attractive than ever, and diversifying our exports beyond the United States has become a necessity in the wake of Donald Trump’s regime of tariffs on Canada and other friendly countries.

It has jolted Canadian political leaders into action, and the premiers are all on board with strengthening our economic independence and trade diversification, even if not all agree on what that should look like.

Two premiers who have found common ground are Danielle Smith and Ontario Premier Doug Ford. After meeting at Stampede, the pair signed two memorandums of understanding to collaborate on studying an energy corridor and other infrastructure to boost interprovincial trade. This included the possibility of an eastward-bound pipeline to Ontario ports for shipping abroad.

Ford explicitly said that “the days of relying on the United States 100 percent, those days are over.” That’s in line with Alberta’s push for new pipeline routes, especially to northwestern B.C., which are supported by Smith’s government.

On June 10, Resource Works founder and CEO Stewart Muir wrote that Canadian energy projects are a daunting endeavour, akin to a complicated jigsaw puzzle, but that getting discouraged by the complexity causes us to lose sight of the picture itself. He asserted that Canadians have to accept that messiness, not avoid it.

Prime Minister Carney has suggested he will make adjustments to existing regulations and controversial legislation like Bill C-69 and the emissions cap, all of which have slowed the development of new energy infrastructure.

This moment of alignment between Ottawa, the provinces, and other stakeholders cannot be wasted. The stars are aligning, and it will be a tragedy if we cannot take a great step into the future of our country.

-

MAiD2 days ago

MAiD2 days agoCanada’s euthanasia regime is already killing the disabled. It’s about to get worse

-

Daily Caller16 hours ago

Daily Caller16 hours agoUSAID Quietly Sent Thousands Of Viruses To Chinese Military-Linked Biolab

-

Alberta13 hours ago

Alberta13 hours ago‘Far too serious for such uninformed, careless journalism’: Complaint filed against Globe and Mail article challenging Alberta’s gender surgery law

-

Censorship Industrial Complex23 hours ago

Censorship Industrial Complex23 hours agoCanadian pro-freedom group sounds alarm over Liberal plans to revive internet censorship bill

-

Fraser Institute1 day ago

Fraser Institute1 day agoBefore Trudeau average annual immigration was 617,800. Under Trudeau number skyrocketted to 1.4 million from 2016 to 2024

-

International2 days ago

International2 days agoChicago suburb purchases childhood home of Pope Leo XIV

-

Daily Caller2 days ago

Daily Caller2 days ago‘I Know How These People Operate’: Fmr CIA Officer Calls BS On FBI’s New Epstein Intel

-

Economy1 day ago

Economy1 day agoThe stars are aligning for a new pipeline to the West Coast