National

Governor General gets $11,200 raise in 2024, third pay bump in three years

News release from the Canadian Taxpayers Federation

Author: Franco Terrazzano

The Governor General’s salary has increased by $60,000, or 20 per cent, since 2019.

Governor General Mary Simon received a $11,200 raise in 2024, her third pay bump since being appointed to the role in 2021, driving her salary for this year up to $362,800.

“Canadians are struggling to afford a jug of milk or a package of ground beef, so the government shouldn’t be rubberstamping another raise for the governor general,” said Franco Terrazzano, CTF Federal Director. “Can the government show Canadians how they’re getting more value, because the governor general’s paycheque just went up a thousand dollars a month.”

The Canadian Taxpayers Federation confirmed Simon’s salary and latest raise with the Privy Council Office.

“For 2024, the Governor General’s salary, which is determined in accordance with the provisions of the Governor General’s Act … is $362,800,” a PCO spokesman told the CTF.

The Governor General’s salary has increased by $60,000, or 20 per cent, since 2019. Meanwhile, the average annual salary among full-time workers is less than $70,000, according to Statistics Canada data.

Table: Annual Governor General salary, per PCO data

|

Year |

GG salary |

|

2024 |

$362,800 |

|

2023 |

$351,600 |

|

2022 |

$342,100 |

|

2021 |

$328,700 |

|

2020 |

$310,100 |

|

2019 |

$302,800 |

On top of the $362,800 annual salary, the governor general receives a range of lavish perks, including a taxpayer-funded mansion, a platinum pension, a generous retirement allowance, a clothing budget, paid dry cleaning services and travel expenses.

Former governors general are also eligible for a full pension, of about $150,000 a year, regardless of how long they serve in office.

Even though Simon’s predecessor, Julie Payette, served in the role for a little more than three years, she will receive an estimated $4.8 million if she collects her pension till the age of 90.

The CTF estimates that Canada’s five living former governors general will receive more than $18 million if they continue to collect their pensions till the age of 90.

Former governors general can also expense taxpayers up to $206,000 annually for the rest of their lives, continuing up to six months after their deaths.

In May 2023, the National Post reported the governor general can expense up to $130,000 in clothing during their five-year mandates, with a $60,000 cap during the first year.

Simon and Payette combined to expense $88,000 in clothing to taxpayers since 2017, including a velvet dress with silk lining, designer gloves, suits, shoes and scarves, among other items.

Rideau Hall expensed $117,000 in dry-cleaning services since 2018, despite having in-house staff responsible for laundry. That’s an average dry cleaning tab of more than $1,800 per month.

It’s also enough money to dry clean 13,831 blouses, 6,204 dresses or 3,918 duvets, according to the prices at Majestic Cleaners in Ottawa.

In 2022, Simon’s first full year on the job, she spent $2.7 million on travel, according to government records obtained by the CTF.

Simon’s travel has sparked multiple controversies, including her nearly six-figure in-flight catering tab during a weeklong trip to the Middle East, and her $71,000 bill at IceLimo Luxury Travel during a four-day trip to Iceland.

In the aftermath of the scandals, a parliamentary committee recommended a range of reforms to the governor general’s travel budget, including a regular review of the cost-effectiveness of trips, a reduction in the size of delegations and less spending on snacks and drinks.

“The platinum pay and perks for the governor general should have been reined in years ago,” Terrazzano said. “A serious government would mandate the governor general’s office be subject to access-to-information requests, cut all international travel except for meetings with the monarchy, end the expense account for former governors general, reform the pension and scrap the clothing allowance.”

Health

Tens of thousands are dying on waiting lists following decades of media reluctance to debate healthcare

Better thousands of us die prematurely, apparently, than risk a grownup conversation

About the same time as William Watson’s outstanding book Globalization and the Meaning of Canadian Life was being published in the late 1990s, the newspaper I worked for was sending a journalist to Europe to research a series of articles on how health care systems work in some of those countries.

The Rewrite is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

I mention Bill’s book, which was runner-up for a public policy Donner Prize, because it exquisitely details many of the things Canadians believe about themselves that simply aren’t true. Which was the same reason why the Calgary Herald sent its health reporter (yes, there used to be such a thing), Robert Walker, to Europe – to expose its readers to the fact that there are more than two health care systems: our “defining” one and America’s, both of which are extremes. To the best of my knowledge, that remains the only time a Canadian news organization has taken on that task.

In every country examined in Walker’s reports, as is the case with almost every country in the world, public and private health care and insurance systems maintained a peaceful coexistence and the public’s needs were being met. Almost 30 years later, that remains the case. Also almost 30 years later, neither Bill’s book nor the Herald’s reporting has had the slightest impact on the prevailing media narrative in Canada. It remains determined to perpetuate the fear that any move to increase the role of private health providers or even allow doctors to work in both systems (as was proposed this week by Alberta Premier Danielle Smith) is the first step on the slippery slope to “American-style” health care. This line has been successfully used for decades – often hyperbolically and occasionally hysterically – by public monopoly advocates for Canada’s increasingly expensive and difficult to access systems. We have known for 40 years that once Baby Boomers like your faithful servant turned bald and grey that the system would be unsustainable. But that single, terrifying “American-style” slur has halted reform at every turn.

The Tyee responded with a “Danielle Smith’s secret plan to Destroy Public Health Care” column while the Globe and Mail’s Gary Mason, a Boomer, challenged my thesis here by suggesting it was time for open minds because “the reality is, the health care system in Canada is a mess.”

It is. And at least some of the blame – a lot, in my view – belongs at the door of Canadian news organizations that for decades have failed to fully inform readers by making them aware that there are a great many alternatives to just “ours” and “US-style.”

I was reminded of this in a recent Postmedia story concerning the perils of private health care provision. Referencing a study on MRIs, the story, right on cue, quotes the part of a study that states “It’s a quiet but rapid march toward U.S.-style health care.”

One would not want to suggest that those clinging to that parochial view should be denied a platform. But at the same time, readers have every right to demand that journalists push back and ask advocates for state monopolies simple questions such as “Why do you say that? Could it not be the first step towards UK-, German-, Dutch-, French-, Portugese- or Swedish-style health care?” and open the debate.

But, as it was 30 years ago and likely ever shall be, there is nothing to suggest that approach even crossed the reporter’s mind. Canadians deserve to be fully informed on major public policy matters and the record shows that when it comes to health care, media have largely failed to do so. Stuck in the fetid trench of an us and them narrative that compares two systems at extreme ends of the spectrum, the public is largely unaware that moderate alternatives exist, ensuring that no meaningful reforms will ever take place and tens of thousands of Canadians will continue to die on waiting lists – a story that continues to be of little interest within the mainstream. Better thousands of us die prematurely, apparently, than risk a grownup conversation that could challenge our national mythology and lead us down the path to “European-style” healthcare.

The Rewrite is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Postmedia’s Brian Lilley has written a defence of the use by journalists of anonymous sources. Lilley’s introduction describes him as coming down on both sides of the issue and that “Using anonymous sources is completely justified, if done right.” Well of course it is, but in my view it’s frequently and increasingly not being done right and its abuse is being exploited by government comms people to control the narrative.

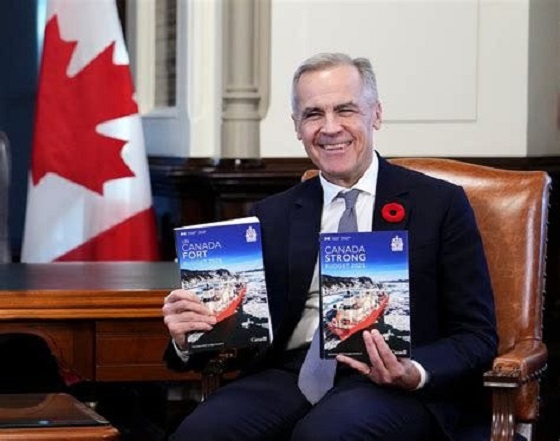

An example of that occurred last week when the Globe and Mail, in a story concerning Prime Minister Mark Carney’s sojourn to the United Arab Emirates, declined to reveal the identity of a source offering very standard information. To wit:

“The (senior government) official, whom The Globe and Mail is not identifying because they were not authorized to speak publicly, said this visit matters because the UAE economy is very much driven by personal relationships – the kind that benefit from face-to-face meetings.”

This story had three bylines – from a senior parliamentary reporter, an institutional investing reporter and an economics reporter. It is inconceivable to me that, between them, they couldn’t find an on the record source who could explain how important it is, culturally, to have face to face meetings, particularly in that part of the world. Doing so would have added some needed thump to a “sources say” story and helped mute criticisms by others in the industry such as John Robson and Holly Doan, the latter stating in a Tweet that “Anon sources are gov’t propagandists.” Others have privately expressed their dismay.

Meanwhile, I expect Lilley’s piece is worth a read and it’s important to hear all sides but as it is behind a paywall I haven’t got to it myself. It’s also worth pointing out that a recent Reuters Institute survey put Lilley in Canada’s top 10 social media influencers and creators.

Sadly, we have more this week on unnecessary online smartassery by journalists.

First up is Global News’s Sean O’Shea who managed to allow himself to look like a member of Carney’s comms team when he Tweeted his disapproval of some fans’ behaviour at the Grey Cup.

Then came The Hill Times’s Stu Benson, who blasted his alarm from a loudspeaker before deleting.

Honestly, folks, to paraphrase grandpa’s advice and as I have to remind myself from time to time, just because something pops into your head doesn’t mean it has to pop onto your social media feed.

Last week’s column for The Hub on how Diversity, Equity and Inclusion initiatives remain alive and enforced in the nation’s newsrooms is available here. And don’t forget to watch out for the Full Press podcast with myself, Harrison Lowman and Tara Henley on Thursday.

(Peter Menzies is a commentator and consultant on media, Macdonald-Laurier Institute Senior Fellow, a past publisher of the Calgary Herald, a former vice chair of the CRTC and a National Newspaper Award winner.)

The Rewrite is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Business

Budget 2025: Ottawa Fakes a Pivot and Still Spends Like Trudeau

It finally happened. Canada received a federal budget earlier this month, after more than a year without one. It’s far from a budget that’s great. It’s far from what many expected and distant from what the country needs. But it still passed.

With the budget vote drama now behind us, there may be space for some general observations beyond the details of the concerning deficits and debt. What kind of budget did Canada get?

Haultain’s Substack is a reader-supported publication.

To receive new posts and support our work, please consider becoming a free or paid subscriber.

Try it out.

For a government that built its political identity on social-program expansion and moralized spending, Budget 2025 arrives wearing borrowed clothing. It speaks in the language of productivity, infrastructure, and capital formation, the diction of grown-up economics, yet keeps the full spending reflex of the Trudeau era. The result feels like a cabinet trying to change its fiscal costume without changing the character inside it. Time will tell, to be fair, but it feels like more rhetoric, and we have seen this same rhetoric before lead to nothing. So, I remain skeptical of what they say and how they say it.

The government insists it has found a new path, one where public investment leads private growth. That sounds bold. However, it is more a rebranding than a reform. It is a shift in vocabulary, not in discipline.

A comparison with past eras makes this clear.

Jean Chrétien and Paul Martin did not flirt with restraint; they executed it. Their budgets were cut deeply, restored credibility, and revived Canada’s fiscal health when it was most needed. The Chrétien years were unsentimental. Political capital was spent so financial capital could return. Ottawa shrank so the country could grow. Budget 2025 tries to invoke their spirit but not their actions. Nothing in this plan resembles the structural surgery of the mid 1990s.

Stephen Harper, by contrast, treated balanced budgets as policy and principle. Even during the global financial crisis, his government used stimulus as a bridge, not a way of life. It cut taxes widely and consistently, limited public service growth, and placed the long-term burden on restraint rather than rhetoric. Budget 2025 nods toward Harper’s focus on productivity and capital assets, yet it rejects the tax relief and spending controls that made his budgets coherent.

Then there is Justin Trudeau, the high tide of redistribution, vacuous identity politics, and deficit-as-virtue posturing. Ottawa expanded into an ideological planner for everything, including housing, climate, childcare, inclusion portfolios, and every new identity category. Much of that ideological scaffolding consisted of mere words, weakening the principle of equality under the law and encouraging the government to referee culture rather than administer policy.

Budget 2025 is the first hint of retreat from that style. The identity program fireworks are dimmer, though they have not disappeared. The social policy boosterism is quieter. Perhaps fiscal gravity has begun to whisper in the prime minister’s ear.

However, one cannot confuse tone for transformation.

Spending is still vast. Deficits grew. The new fiscal anchor, balancing only the operating budget, is weaker than the one it replaced. The budget relies on the hopeful assumption that Ottawa’s capital spending will attract private investment on a scale that economists politely describe as ambitious.

The housing file illustrates the contradiction. The budget announces new funding for the construction of purpose-built rentals and a larger federal role in modular and subsidized housing builds. These are presented as productivity measures, yet they continue the Trudeau-era instinct to centralize housing policy rather than fix the levers that matter. Permitting delays, zoning rigidity, municipal approvals, and labour shortages continue to slow actual construction. Ottawa spends, but the foundations still cure at the same pace.

Defence spending tells the same story. Budget 2025 offers incremental funding and some procurement gestures, but it avoids the core problem: Canada’s procurement system is broken. Delays stretch across decades. Projects become obsolete before contracts are signed. The system cannot buy a ship, an aircraft, or an armoured vehicle without cost overruns and missed timelines. Spending more through this machinery will waste time and money. It adds motion, not capability.

Most importantly, the structural problems remain untouched: no regulatory reform for major projects, no tax competitiveness agenda, no strategy for shrinking a federal bureaucracy that has grown faster than the economy it governs. Ottawa presides over a low-productivity country but insists that a new accounting framework will solve what decades of overregulation and policy clutter have created. More bluster.

To receive new posts and support our work, please consider becoming a free or paid subscriber.

From an Alberta vantage, the pivot is welcome but inadequate. The economy that pays for Confederation, energy, mining, agriculture, and transportation receives more rhetorical respect in Budget 2025, yet the same regulatory thicket that blocks pipelines and mines remains intact. The government praises capital formation but still undermines the key sectors that generate it.

Budget 2025 tries to walk like Chrétien and talk like Harper while spending like Trudeau. That is not a transformation; it is a costume change. The country needed a budget that prioritized growth rooted in tangible assets and real productivity. What it got instead is a rhetorical turn without the courage to cut, streamline, or reform.

Canada does not require a new budgeting vocabulary. It requires a government willing to govern in the best interest of the country.

Haultain’s Substack is a reader-supported publication.

Help us bring you more quality research and commentary.

-

Daily Caller2 days ago

Daily Caller2 days agoTrump Gives Zelenskyy Until Thanksgiving To Agree On Peace Deal, With U.S. Weapons And Intel On The Line

-

Daily Caller2 days ago

Daily Caller2 days agoBari Weiss Reportedly Planning To Blow Up Legacy Media Giant

-

COVID-192 days ago

COVID-192 days agoFreedom Convoy protestor Evan Blackman convicted at retrial even after original trial judge deemed him a “peacemaker”

-

Business1 day ago

Business1 day agoI Was Hired To Root Out Bias At NIH. The Nation’s Health Research Agency Is Still Sick

-

Carbon Tax15 hours ago

Carbon Tax15 hours agoCarney fails to undo Trudeau’s devastating energy policies

-

Health12 hours ago

Health12 hours agoTens of thousands are dying on waiting lists following decades of media reluctance to debate healthcare

-

Daily Caller2 days ago

Daily Caller2 days agoMTG Says She’s Resigning From Office

-

International21 hours ago

International21 hours agoCanada’s lost decade in foreign policy