Business

From X to SpaceX: EU Regulators Could Fine Musk Companies For Free Speech Push

From Reclaim The Net

|

The EU and Brazil are sharpening their regulatory knives, and who better to test their shiny new powers on than Elon Musk, the guy who seems to have made annoying pro-censorship bureaucrats his full-time hobby? Musk’s social media platform, X has become the latest target for both the European Union and Brazil — but they’re not just going after X anymore. The powers-that-be have decided that since X isn’t worth much these days, maybe they should slap fines on Musk’s other companies—SpaceX, Neuralink, xAI, and even the Boring Company—just because they can.

It’s the ultimate power move by regulators who seem to be more interested in flexing their muscles than addressing real issues. Why settle for a measly 6% fine on a struggling social media platform when you can drag in rockets, to pad the bill? The EU’s Latest Power Trip: Digital Services Act as a Blank Check Enter the Digital Services Act (DSA), the EU’s newest favorite tool for cracking down on “disinformation” and “hate speech” on major digital platforms. It’s got all the right buzzwords—”transparency,” “safety,” and “accountability”—but underneath the noble-sounding veneer, it’s starting to look more like a blank check for the EU to assert control over Big Tech. The law allows for fines of up to 6% of annual revenue for platforms that don’t comply. But when it comes to X, with its plummeting value—now at a measly $9.4 billion, according to Fidelity—the EU seems to be thinking, “Why stop at X when we can go after Musk’s entire empire?” Think about it: SpaceX, Neuralink, the Boring Company—what do they have to do with social media disinformation? Nothing, really. But the EU’s got a grudge, and they’re not about to let a little thing like fairness or logic get in their way. Musk’s decision to pull X out of the EU’s voluntary Code of Practice against disinformation in 2023 certainly didn’t help matters. Sure, he had initially played nice back in 2022, but when Musk realized that the EU’s idea of “voluntary” meant “you’ll comply, or else,” he bailed. Now, Brussels is retaliating by threatening to fine Musk’s companies that have nothing to do with social media, all while pretending this is about “protecting democracy.” If it sounds more like a personal vendetta than a reasoned policy decision, that’s because it probably is. Brazil Freezes Musk’s Assets: Free Speech or Free for All? Not to be outdone by their European counterparts, Brazil has decided to take its regulatory saber-rattling to new heights. The country’s highest court recently froze the assets of Starlink, Musk’s satellite internet venture, in an effort to squeeze a $3 million fine out of X for failing to censor content. That’s right—Brazil couldn’t get X to bend to their will, so they decided to take Musk’s satellites hostage. All in the name of combating “misinformation,” of course. What’s particularly galling about Brazil’s move is how blatantly it ignores the principles of free speech and open communication. The accusation that X “facilitated the spread of misinformation and hate speech” sounds noble on paper, but the way Brazil went about enforcing their demands—by freezing assets of an entirely separate company—looks more like strong-arm tactics than legitimate regulation. At this point, it’s hard to escape the conclusion that these governments are less concerned with disinformation and more interested in exerting control over tech companies that refuse to play by their increasingly arbitrary rules. Musk, who’s spent years promoting free speech as one of X’s core principles, is now facing a global game of whack-a-mole, with each country seemingly more eager than the last to punish him for refusing to fall in line. Personal Accountability or Public Power Play? One of the more interesting twists in the EU’s regulatory circus is the suggestion that they might hold Musk personally accountable under the DSA. Why? Because, according to the EU’s interpretation, “the entity exercising decisive influence” over a platform—whether that’s a company or an individual—can be on the hook for any wrongdoing. In other words, if Musk’s platform doesn’t comply, they’re coming for him directly. This is about using Musk as a punching bag to show the world that the EU is still in charge. Thomas Regnier, a spokesperson for the European Commission, helpfully clarified to Bloomberg, that the DSA’s rules apply “irrespective of whether the entity… is a natural or legal person,” which is bureaucrat-speak for, “We’re gunning for Elon.” |

|

|

|

Since you’re reading this, we hope you find Reclaim The Net useful. Today, we could use your help. We depend on supporters (averaging $15), but fewer than 0.2% of readers choose to give. If you donate just $5, (or the equivalent in your currency) you would help keep Reclaim The Net thriving for years. You don’t have to become a regular supporter; you can make a one-time donation. Please take a minute to keep Reclaim The Net going.

Thank you.

|

Business

Is Government Inflation Reporting Accurate?

David Clinton

David Clinton

Who ya gonna believe: official CPI figures or your lyin’ eyes?

Great news! We’ve brought inflation back under control and stuff is now only costing you 2.4 percent more than it did last year!

That’s more or less the message we’ve been hearing from governments over the past couple of years. And in fact, the official Statistics Canada consumer price index (CPI) numbers do show us that the “all-items” index in 2024 was only 2.4 percent higher than in 2023. Fantastic.

So why doesn’t it feel fantastic?

Well statistics are funny that way. When you’ve got lots of numbers, there are all kinds of ways to dress ‘em up before presenting them as an index (or chart). And there really is no one combination of adjustments and corrections that’s definitively “right”. So I’m sure Statistics Canada isn’t trying to misrepresent things.

But I’m also curious to test whether the CPI is truly representative of Canadians’ real financial experiences. My first attempt to create my own alternative “consumer price index”, involved Statistics Canada’s “Detailed household final consumption expenditure”. That table contains actual dollar figures for nation-wide spending on a wide range of consumer items. To represent the costs Canadian’s face when shopping for basics, I selected these nine categories:

- Food and non-alcoholic beverages

- Clothing and footwear

- Housing, water, electricity, gas and other fuels

- Major household appliances

- Pharmaceutical products and other medical products (except cannabis)

- Transport

- Communications

- University education

- Property insurance

I then took the fourth quarter (Q4) numbers for each of those categories for all the years between 2013 and 2024 and divided them by the total population of the country for each year. That gave me an accurate picture of per capita spending on core cost-of-living items.

Overall, living and breathing through Q4 2013 would have cost the average Canadian $4,356.38 (or $17,425.52 for a full year). Spending for those same categories in Q4 2024, however, cost us $6,266.48 – a 43.85 percent increase.

By contrast, the official CPI over those years rose only 31.03 percent. That’s quite the difference. Here’s how the year-over-year changes in CPI inflation vs actual spending inflation compare:

As you can see, with the exception of 2020 (when COVID left us with nothing to buy), the official inflation number was consistently and significantly lower than actual spending. And, in the case of 2021, it was more than double.

Since 2023, the items with the largest price growth were university education (57.46 percent), major household appliances (52.67 percent), and housing, water, electricity, gas, and other fuels (50.79).

Having said all that, you could justifiably argue that the true cost of living hasn’t really gone up that much, but that at least part of the increase in spending is due to a growing taste for luxury items and high volume consumption. I can’t put a precise number on that influence, but I suspect it’s not trivial.

Since data on spending doesn’t seem to be the best measure of inflation, perhaps I could build my own basket of costs and compare those numbers to the official CPI. To do that, I collected average monthly costs for gasoline, home rentals, a selection of 14 core grocery items, and taxes paid by the average Canadian homeowner.¹ I calculated the tax burden (federal, provincial, property, and consumption) using the average of the estimates of two AI models.

How did the inflation represented by my custom basket compare with the official CPI? Well between 2017 and 2024, the Statistics Canada’s CPI grew by 23.39 percent. Over that same time, the monthly cost of my basket grew from $4,514.74 to $5,665.18; a difference of 25.48 percent. That’s not nearly as dramatic a difference as we saw when we measured spending, but it’s not negligible either.

The very fact that the government makes all this data freely available to us is evidence that they’re not out to hide the truth. But it can’t hurt to keep an active and independent eye on them, too.

Subscribe to The Audit.

For the full experience, upgrade your subscription.

2025 Federal Election

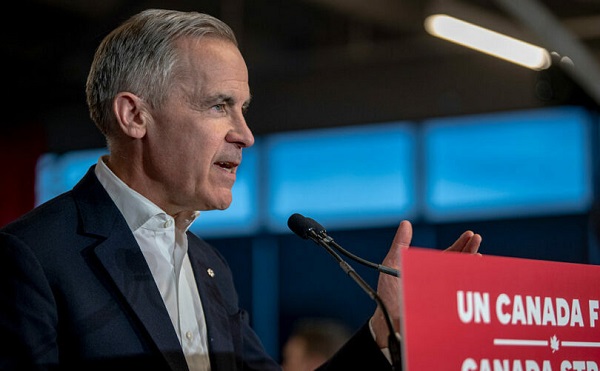

Carney’s Hidden Climate Finance Agenda

From Energy Now

By Tammy Nemeth and Ron Wallace

It is high time that Canadians discuss and understand Mark Carney’s avowed plan to re-align capital with global Net Zero goals.

Mark Carney’s economic vision for Canada, one that spans energy, housing and defence, rests on an unspoken, largely undisclosed, linchpin: Climate Finance – one that promises a Net Zero future for Canada but which masks a radical economic overhaul.

Regrettably, Carney’s potential approach to a Net Zero future remains largely unexamined in this election. As the former chair of the Glasgow Financial Alliance for Net Zero (GFANZ), Carney has proposed new policies, offices, agencies, and bureaus required to achieve these goals.. Pieced together from his presentations, discussions, testimonies and book, Carney’s approach to climate finance appears to have four pillars: mandatory climate disclosures, mandatory transition plans, centralized data sharing via the United Nations’ Net Zero Data Public Utility (NZDPU) and compliance with voluntary carbon markets (VCMs). There are serious issues for Canada’s economy if these principles were to form the core values for policies under a potential Liberal government.

About the first pillar Carney has been unequivocal: “Achieving net zero requires a whole economy transition.” This would require a restructuring energy and financial systems to shift away from fossil fuels to renewable energy with Carney insisting repeatedly in his book that “every financial [and business] decision takes climate change into account.” Climate finance, unlike broader sustainable finance with its Environmental, Social, and Governance (ESG) focus would channel capital into sectors aligned with a 2050 Net Zero trajectory. Carney states: “Companies, and those who invest in them…who are part of the solution, will be rewarded. Those lagging behind…will be punished.” In other words, capital would flow to compliant firms but be withheld from so-called “high emitters”.

How will investors, banks and insurers distinguish solution from problem? Mandatory climate disclosures, aligned with the International Sustainability Standards Board (ISSB), would compel firms to report emissions and outline their Net Zero strategies. Canada’s Sustainability Standards Board has adopted these methodologies, despite concerns they would disadvantage Canadian businesses. Here, Carney repeatedly emphasizes disclosures as the cornerstone to track emissions data required to shift capital away from “high emitters”. Without this, he claims, large institutional investors lack the data on supply chains to make informed decisions to shift capital to businesses that are Net Zero compliant.

The second pillar, Mandatory Transition Plans would require companies to map a 2050 Net Zero trajectory for emission reduction targets. Failure to meet those targets would invite pressure from investors, banks, or activists, who may pursue litigation for non-compliance. The UK’s Transition Plan Task Force, now part of ISSB, provides this standardized framework. Carney, while at GFANZ, advocated using transition plans for a “managed phase-out” of high-emitting assets like coal, oil and gas, not just through divestment but by financing emissions reductions. “As part of their transition planning, [GFANZ] members should establish and apply financing policies to phase out and align carbon-intensive sectors and activities, such as thermal coal, oil and gas and deforestation, not only through asset divestment but also through transition finance that reduces real world emissions. To assist with these efforts GFANZ will continue to develop and implement a framework for the Managed Phase-out of high-emitting assets.” Clearly, the purpose of this is to ensure companies either decarbonize or face capital withdrawal.

The third pillar is the United Nations’ Net Zero Data Public Utility (NZDPU), a centralized platform for emissions and transition data. Carney insists these data be freely accessible, enabling investors, banks and insurers to judge companies’ progress to Net Zero. As Carney noted in 2021: “Private finance is judging…banks, pension funds and asset managers have to show where they are in the transition to Net Zero.” Hence, compliant firms would receive investment; laggards would face divestment.

Finally, voluntary carbon markets (VCMs) allow companies to offset emissions by purchasing credits from projects like reforestation. Carney, who launched the Taskforce on Scaling VCMs in 2020, has insisted on monitoring, verification and lifecycle tracking. At a 2024 Beijing conference, he suggested major jurisdictions could establish VCMs by COP 30 (planned for 2025 in Brazil) to create a global market. If Canada mandates VCMs, businesses especially small and medium enterprises (SMEs) would face much higher compliance costs with credits available only to those that demonstrate progress with transition plans.

These potential mandatory disclosures and transition plans would burden Canadian businesses with material costs and legal risks that constitute an economic gamble which few may recognize but all should weigh. Do Canadians truly want a government that has an undisclosed climate finance agenda that would be subservient to an opaque globalized Net Zero agenda?

Tammy Nemeth is a U.K.-based strategic energy analyst. Ron Wallace is an executive fellow of the Canadian Global Affairs Institute and the Canada West Foundation.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoMark Carney Wants You to Forget He Clearly Opposes the Development and Export of Canada’s Natural Resources

-

International2 days ago

International2 days agoPope Francis’ body on display at the Vatican until Friday

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCanada’s pipeline builders ready to get to work

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoFormer WEF insider accuses Mark Carney of using fear tactics to usher globalism into Canada

-

2025 Federal Election14 hours ago

2025 Federal Election14 hours agoCarney’s Hidden Climate Finance Agenda

-

COVID-191 day ago

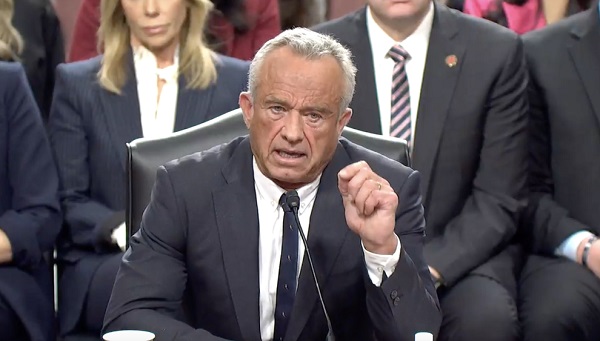

COVID-191 day agoRFK Jr. Launches Long-Awaited Offensive Against COVID-19 mRNA Shots

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCanada’s press tries to turn the gender debate into a non-issue, pretend it’s not happening

-

2025 Federal Election23 hours ago

2025 Federal Election23 hours agoConservatives promise to ban firing of Canadian federal workers based on COVID jab status