Economy

FLOP28 – Climate proposals would devastate economy

From the Frontier Centre for Public Policy

By Ian Madsen

” Most CO2 comes from natural sources like forest fires, volcanoes and ocean evaporation – not your SUV or natural gas furnace. The human portion of this tiny amount is the equivalent of 6 pennies in a jar of 10,000. “

Politicians, academics, celebrities, self-appointed activists, protesters, and green energy industry lobbyists recently gathered in Dubai at their annual Climate Crisis jamboree (COP28). Their central belief, from their computer models, is that human-generated global warming will lead to a rise in average global temperatures of two degrees Celsius, ‘2 C’ or even more frighteningly, as much as 3 C to 4 C by 2100. They claim that this will cause widespread health, environmental, and economic devastation.

From this hypothesis comes their solution: drastic reductions in so-called greenhouse gas emissions, principally carbon dioxide, ‘CO2’, and rapidly so. To their minds, this would require widespread adoption of their preferred solutions – ending fossil fuels in favour of wind and solar power; pervasive and intensive electrification of the world economy, including the mandated adoption of electric vehicles, ‘EVs’, and batteries, everywhere.

They insist that slashing CO2 levels will not only benefit the world, but also the economy – as these new industries would provide jobs and other benefits.

The hard reality is that CO2, is a life-giving gas that is crucial for photosynthesis and thus the flourishing of all life on Earth. It is a trace gas – making up only .04% of our atmosphere. Most CO2 comes from natural sources like forest fires, volcanoes and ocean evaporation – not your SUV or natural gas furnace. The human portion of this tiny amount is the equivalent of 6 pennies in a jar of 10,000. Very awkwardly, CO2 levels in the atmosphere are uncorrelated with temperatures. It may look so in government computer models, but remember those catastrophically wrong Covid models that gave us devastating lockdowns, failed vaccines and exploding debt and inflation?

Even if we assume that CO2 is “pollution that is warming the planet” their wild proposals’ math doesn’t work out.

Professor Richard Tol of the University of Sussex, United Kingdom, wrote in a special issue of Climate Economics a sobering assessment of the ‘bad deal’ climate crusaders are trying to sell to the world, including Canada. He estimates their proposed climate policies’ costs to be 3.8 to 5.6% of GDP in 2100 compared to benefits of 2.8% to 3.2% of GDP – or excess costs of $900 billion to $1.98 trillion in today’s $90 trillion world economy.

The prohibitively large subsidies required fail the cost benefit test. To summarize: Tol suggests that the whole Green Transition ‘enterprise’ would lose money – in vast amounts. His view is not even the worst assessment of such radical disruptive policies.

Another expert who engages the “CO2 is pollution” bubble and has done the math is Bjorn Lomborg, president of the Copenhagen Consensus think tank and a Hoover Institution Senior Fellow.

He assesses MIT researchers’ studies of the costs of attaining Net Zero (no net GHG emissions) by 2050, in the same journal, Climate Economics, and observes that these Paris policies would cost 8% to 18% of annual GDP by 2050 and 11% to 13% annually by 2100…. Averaged across the century, these promises would create benefits worth $4.5 trillion (in 2023 dollars) annually: “dramatically smaller than the $27 trillion annual cost that Paris promises would incur, as derived from averaging the three cost estimates from the two Climate Change Economics papers through 2100.”

To remove any doubt, these forecast costs would exceed total global annual capital investment of all kinds, and would crowd out everything else, impoverishing all humanity. Expensive, destructive ‘solutions’, for a dubious, unproven catastrophe.

The Dubai COP28 flopped as all others have.

We need to stop the madness.

Ian Madsen is the Senior Policy Analyst at the Frontier Centre for Public Policy

2025 Federal Election

Poilievre, Conservatives receive election endorsement from large Canadian trade union

From LifeSiteNews

The International Brotherhood of Boilermakers said Conservative prime minister candidate Pierre Poilievre ‘understands that the surest and most sustainable route to providing a cleaner environment is through technology, not dismantling our energy sectors, raising taxes, importing energy from other nations, and shipping Canadian jobs abroad.’

Conservative Party of Canada (CPC) leader Pierre Poilievre gained the support of one of Canada’s largest trade unions to become the nation’s next Prime Minister in what is an unprecedented show of favor to the conservatives.

An open letter statement published March 24 by the Arnie Stadnick, the International Brotherhood of Boilermakers’ vice president, stated that it is in its “interest” to announce its “endorsement for Pierre Poilievre and all the conservative candidates across Canada in this federal election.”

“Pierre gets it. He knows and understands that the surest and most sustainable route to providing a cleaner environment is through technology, not dismantling our energy sectors, raising taxes, importing energy from other nations, and shipping Canadian jobs abroad,” Stadnick wrote.

The Boilermakers, who represent about 12,000 skilled trades workers in many industries such as shipbuilding, manufacturing, and energy, said it supports Poilievre’s “Boots not Suits” policy that looks to expand training for tradespeople in the nation and increase grants.

“This plan is designed to strengthen the workforce and reduce reliance on foreign labour, adding 350,000 Canadian workers to job sites over five years,” the Boilermakers’ union noted.

“We believe that Pierre Poilievre is the man best equipped to support all of us in the work that we do.”

The Coalition of Concerned Manufacturers and Businesses of Canada also endorsed the Conservative leader with a statement last week, saying it “strongly supports the election of Pierre Poilievre as the next Prime Minister of Canada.”

Canada will hold its next federal election on April 28 after Prime Minister Mark Carney, who took over from Justin Trudeau a few weeks ago, triggered it a week ago.

Poilievre has blasted Carney as an “establishment” Liberal politician who was “installed” by “Justin Trudeau’s insiders.”

Carney thus far appears to not have gained the favor of Canada’s trade workers, as could be seen from a recent incident involving a Canadian construction worker. A video of this worker went viral online after the worker “vowed” not to “shake the hand” of Carney at a recent press conference in Alberta.

2025 Federal Election

Fixing Canada’s immigration system should be next government’s top priority

From the Fraser Institute

Whichever party forms government after the April 28 election must put Canada’s broken immigration system at the top of the to-do list.

This country has one of the world’s lowest fertility rates. Were it not for immigration, our population would soon start to decline, just as it’s declining in dozens of other low-fertility countries around the world.

To avoid the social and economic tensions of an aging and declining population, the federal government should re-establish an immigration system that combines a high intake with strictly enforced regulations. Once Canadians see that program in place and working, public support for immigration should return.

Canada’s total fertility rate (the number of children, on average, a woman will have in her lifetime) has been declining, with the odd blip here and there, since the 1960s. In 1972, it fell below the replacement rate of 2.1.

According to Statistics Canada, the country’s fertility rate fell to a record low of 1.26 in 2023. That puts us in the company of other lowest-low fertility countries such as Italy (1.21), Japan (1.26) and South Korea (0.82).

Those three countries are all losing population. But Canada’s population continues to grow, with immigrants replacing the babies who aren’t born. The problem is that, in the years that followed the COVID-19 lockdowns, the population grew too much.

The Liberal government was unhappy that the pandemic had forced Canada to restrict immigration and concerned about post-pandemic labour shortages. To compensate, Ottawa set a target of 500,000 new permanent residents for 2025, double the already-high intake of about 250,000 a year that had served as a benchmark for the Conservative government of Stephen Harper and the Liberal governments of Paul Martin and Jean Chrétien.

Ottawa also loosened restrictions on temporary foreign worker permits and the admission of foreign students to colleges and universities. Both populations quickly exploded.

Employers preferred hiring workers from overseas rather than paying higher wages for native-born workers. Community colleges swelled their ranks with international students who were also issued work permits. Private colleges—Immigration Minister Marc Miller called them “puppy mills”—sprang up that offered no real education at all.

At the same time, the number of asylum claimants in Canada skyrocketed due to troubles overseas and relaxed entry procedures, reaching a total of 457,285 in 2024.

On January 1 of this year, Statistics Canada estimated that there were more than three million temporary residents in the country, pushing Canada’s population up above 41.5 million.

Their presence worsened housing shortages, suppressed wages and increased unemployment among younger workers. The public became alarmed at the huge influx of foreign residents.

For the first time in a quarter century, according to an Environics poll, a majority of Canadians believed there were too many immigrants coming into Canada.

Some may argue that the solution to Canada’s demographic challenges lie in adopting family-friendly policies that encourage couples to have children. But while governments improve parental supports and filter policies through a family-friendly lens—for example, houses with backyards are more family-friendly than high-rise towers—no government has been able to reverse declining fertility back up to the replacement rate of 2.1.

The steps to repairing Canada’s immigration mess lie in returning to first principles.

According to Statistics Canada, there were about 300,000 international students at postsecondary institutions when the Liberals came to power in 2015. Let’s return to those levels.

The temporary foreign worker program should be toughened up. The government recently implemented stricter Labour Market Impact Assessments, but even stricter rules may be needed to ensure that foreign workers are only brought in when local labour markets cannot meet employer needs, while paying workers a living wage.

New legislation should ensure that only asylum claimants who can demonstrate they are at risk of persecution or other harm in their home country are given refuge in Canada, and that the process for assessing claims is fair, swift and final. If necessary, the government should consider employing the Constitution’s notwithstanding clause to protect such legislation from court challenges.

Finally, the government should admit fewer permanent residents under the family reunification stream and more from the economic stream. And the total admitted should be kept to around 1 per cent of the total population. That would still permit an extremely robust intake of about 450,000 new Canadians each year.

Restoring public confidence in Canada’s immigration system will take much longer than it took to undermine that confidence. But there can be no higher priority for the federal government. The country’s demographic future is at stake.

-

Uncategorized2 days ago

Uncategorized2 days agoPoilievre on 2025 Election Interference – Carney sill hasn’t fired Liberal MP in Chinese election interference scandal

-

2025 Federal Election1 day ago

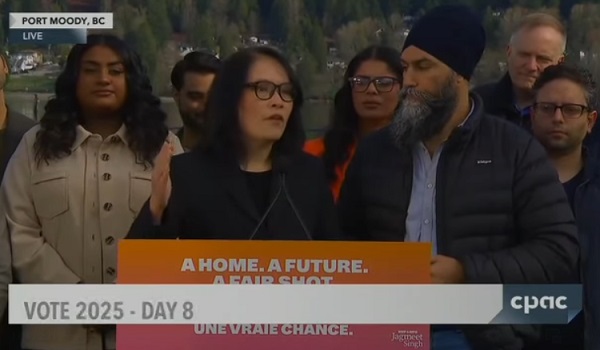

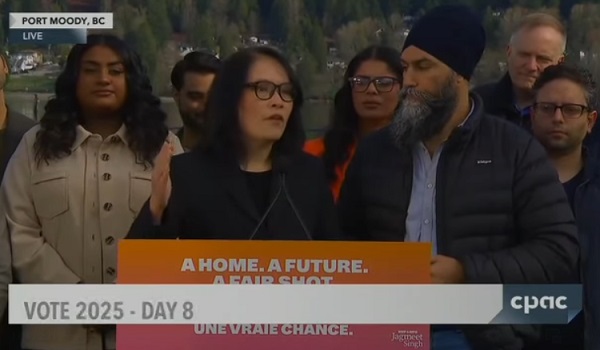

2025 Federal Election1 day agoChinese Election Interference – NDP reaction to bounty on Conservative candidate

-

2025 Federal Election2 days ago

2025 Federal Election2 days ago2025 Election Interference – CCP Bounty on Conservative Candidate – Carney Says Nothing

-

2025 Federal Election19 hours ago

2025 Federal Election19 hours agoChina Election Interference – Parties Received Security Briefing Days Ago as SITE Monitors Threats to Conservative Candidate Joe Tay

-

2025 Federal Election2 days ago

2025 Federal Election2 days ago2025 Federal Election Interference from China! Carney Pressed to Remove Liberal MP Over CCP Bounty Remark

-

2025 Federal Election16 hours ago

2025 Federal Election16 hours agoLondon-Based Human Rights Group Urges RCMP to Investigate Liberal MP for Possible Counselling of Kidnapping

-

2025 Federal Election22 hours ago

2025 Federal Election22 hours agoHong Kong-Canadian Groups Demand PM Carney Drop Liberal Candidate Over “Bounty” Remark Supporting CCP Repression

-

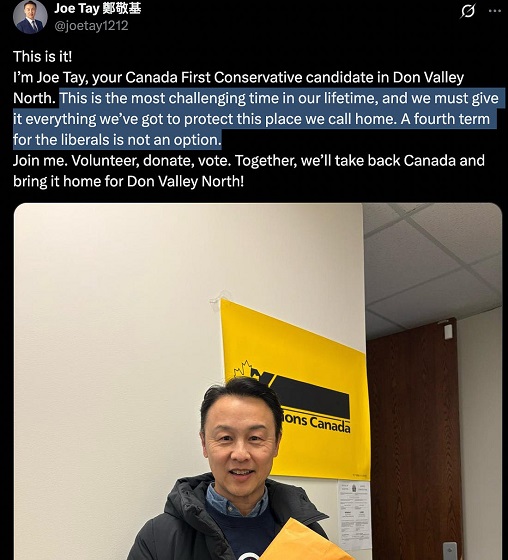

2025 Federal Election21 hours ago

2025 Federal Election21 hours agoJoe Tay Says He Contacted RCMP for Protection, Demands Carney Fire MP Over “Bounty” Remark