Business

Feds dish out $406 million in bonuses in 2023

From the Canadian Taxpayers Federation

Author: Ryan Thorpe

About 90 per cent of federal government executives take a bonus each year, according to records obtained by the CTF.

“Less than 50 per cent of [performance] targets are consistently met within the same year”

The Trudeau government rubberstamped more than $406 million in bonuses to federal departments and Crown corporations during the last fiscal year, according to government records obtained by the Canadian Taxpayers Federation.

“Bonuses are for when you do a good job, they shouldn’t be handed out like participation ribbons,” said Franco Terrazzano, CTF Federal Director. “Taxpayers can’t afford to bankroll big bonus cheques each and every year for highly-paid government executives.”

Bureaucrats working in federal departments and agencies took home $210,784,269 in taxpayer-funded bonuses in 2023-24. Meanwhile, bureaucrats working in federal Crown corporations took $195,637,952 in bonuses.

All told, the federal government dished out $406,422,221 in bonuses last year.

This pushes total bonuses for bureaucrats working in federal departments to more than $1.5 billion since 2015.

About 90 per cent of federal government executives take a bonus each year, according to records obtained by the CTF.

“Less than 50 per cent of [performance] targets are consistently met within the same year,” according to the Parliamentary Budget Officer, the government’s independent, non-partisan budget watchdog.

“In the real world, when you fail to do your job you might get a pink slip, not a big bonus cheque,” Terrazzano said. “The government needs to stop handing out these taxpayer-funded bonuses to failing government executives.”

The records detailing bonuses for 2023-24 were released in response to order paper questions submitted by Conservative member of Parliament Andrew Scheer (Regina-Qu’Appelle). The records break down both executive and non-executive bonuses.

The Business Development Bank of Canada issued more bonuses than any other Crown corporation, with its bureaucrats taking home more than $59 million.

The Department of Justice issued the most bonuses among federal departments and agencies, with its bureaucrats taking home more than $18 million.

|

Top-5 Crown corporations |

Total bonuses |

Executives who got a bonus |

|

Business Development Bank of Canada |

$59,105,600 |

100% |

|

Export Development Canada |

$35,632,112 |

95% |

|

Canada Mortgage and Housing Corp. |

$27,328,821 |

100% |

|

Canadian Broadcasting Corporation |

$14,902,755 |

100% |

|

VIA Rail |

$11,391,998 |

73% |

|

Top-5 federal departments |

Total bonuses |

Executives who got a bonus |

|

Department of Justice |

$18,969,929 |

97% |

|

Canada Revenue Agency |

$18,076,704 |

97% |

|

Employment & Social Development Canada |

$12,936,480 |

98% |

|

Global Affairs Canada |

$12,593,425 |

94% |

|

Superintendent of Financial Institutions |

$12,465,982 |

90% |

Business

CDC stops $11 billion in COVID ’emergency’ funding to health departments, NGOs

Fr0m LifeSiteNews

The U.S. Department of Health and Human Services has been providing massive funds in the name of COVID despite the fact that Joe Biden admitted the ‘pandemic’ was over by 2022.

The U.S. Centers for Disease Control and Prevention is withdrawing $11.4 billion in COVID funding to state and local health departments, non-government groups, and international recipients about two years after the U.S. government declared the COVID-19 “national emergency” over.

“The COVID-19 pandemic is over, and HHS will no longer waste billions of taxpayer dollars responding to a non-existent pandemic that Americans moved on from years ago,” HHS director of communications Andrew Nixon said in a statement, NBC News reported.

“HHS is prioritizing funding projects that will deliver on President Trump’s mandate to address our chronic disease epidemic and Make America Healthy Again.“

Despite the fact that former President Joe Biden admitted in 2022 that the COVID “pandemic” was over, Health and Human Services (HHS) has been continuing to allocate funds for COVID testing, “vaccines,” and “global COVID projects,” according to CDC talking points.

The funding cut comes as millions of dollars for other initiatives, including vaccine hesitancy research and HIV prevention, are slashed under new HHS Secretary Robert F. Kennedy Jr.

HHS has made the greatest funding cutbacks government-wide, according to the Department of Government Efficiency’s website.

Dr. Robert Malone argued in 2023 that the only reason the Biden administration decided to end the national COVID “emergency” when it did is because of the congressional legislation seeking that end.

“The bottom line is that the imperial U.S. administrative state will never give up these unconstitutional powers until forced to do so,” Malone wrote.

Business

Publicity Kills DEI: A Free Speech Solution to Woke Companies

For years, major corporations bragged about their wonderful Diversity, Equity, and Inclusion (DEI) programs. They’re good for business and morally correct, they said. So why are they now cutting those programs?

Robby Starbuck says these programs once got a lot of buy-in, because people wanted to be nice! But DEI came to mean much more than just being nice.

Starbuck says what it looked like in practice was “crazy trainings” and “overtly racist hiring practices.” Now lots of people agree with him.

Companies actually take notice when Starbuck tells his many followers about their DEI programs. Often the programs get dropped.

That’s the power of free speech.

After 40+ years of reporting, I now understand the importance of limited government and personal freedom.

——————————————

Libertarian journalist John Stossel created Stossel TV to explain liberty and free markets to young people.

Prior to Stossel TV he hosted a show on Fox Business and co-anchored ABC’s primetime newsmagazine show, 20/20. Stossel’s economic programs have been adapted into teaching kits by a non-profit organization, “Stossel in the Classroom.” High school teachers in American public schools now use the videos to help educate their students on economics and economic freedom. They are seen by more than 12 million students every year.

Stossel has received 19 Emmy Awards and has been honored five times for excellence in consumer reporting by the National Press Club. Other honors include the George Polk Award for Outstanding Local Reporting and the George Foster Peabody Award.

_ _ _ _ _ _ _ _

To get our new weekly video from Stossel TV, sign up here: https://www.johnstossel.com/#subscribe

_ _ _ _ _ _ _ _

-

Alberta2 days ago

Alberta2 days agoFederal emissions plan will cost Albertans dearly

-

International1 day ago

International1 day agoEurope Can’t Survive Without America

-

Business2 days ago

Business2 days agoPossible Criminal Charges for US Institute for Peace Officials who barricade office in effort to thwart DOGE

-

Business24 hours ago

Business24 hours agoWhy a domestic economy upgrade trumps diversification

-

Health2 days ago

Health2 days agoDr. Pierre Kory Exposes the Truth About the Texas ‘Measles Death’ Hoax

-

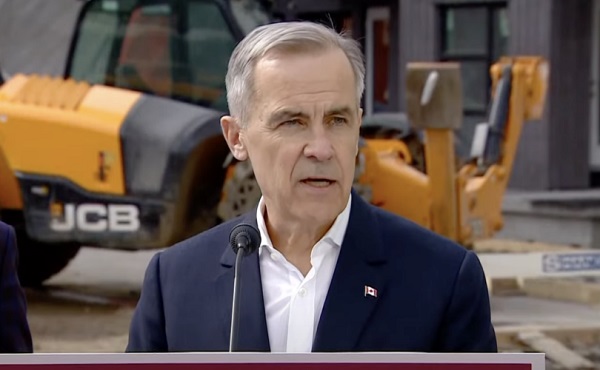

2025 Federal Election2 days ago

2025 Federal Election2 days agoCanadian construction worker goes viral for saying he refused to shake Mark Carney’s hand

-

Business17 hours ago

Business17 hours agoDOGE discovered $330M in Small Business loans awarded to children under 11

-

Business2 days ago

Business2 days ago28 energy leaders call for eliminating ALL energy subsidies—even ones they benefit from