Business

Federal tax policy in 2025 will not be kind to Canadians

From the Fraser Institute

By Matthew Lau

Federal tax policy was not kind to Canadians in 2024, and that shouldn’t be a surprise. It wasn’t kind to Canadians in 2023, 2022 or any year since 2016 when the Trudeau government established a new income tax bracket of 33 per cent, pushing the combined federal and provincial top tax rate over 50 per cent in many provinces.

To recap 2024 tax policy changes, the federal government began the year with its sixth consecutive Canada Pension Plan tax hike. In 2018, before the government’s CPP “enhancements” (to use the government’s phrase), for a worker earning $85,000, the combined employer and employee CPP tax was $5,188. In 2024 the same worker’s tax bill was $8,111—or about 56 per cent higher including the government’s new “CPP2” tax.

Unfortunately, things will only get worse for Canadians in 2025. The CPP tax bill for the Canadian earning $85,000 will rise to $8,860 in 2025, bringing the total nominal tax increase to 71 per cent through the government’s seven annual CPP “enhancements.”

In addition to making the CPP tax more expensive yearly, the federal government also has been increasing the carbon tax each year. In April 2024, the Trudeau government increased the carbon tax to $80 per tonne from $65 per tonne, and like the CPP tax, the carbon tax will become more expensive yet again in 2025, rising another $15 per tonne to $95.

Another big tax change in 2024 was the capital gains tax hike announced in June. The Trudeau government claimed it was increasing taxes only on “0.13 per cent of Canadians in any given year”—a statistic that’s both misleading and incomplete. First, 0.13 per cent of Canadians “in any given year” are a different group than the 0.13 per cent of Canadians in the previous or following years, so many more than 0.13 per cent of Canadians will directly pay the tax.

Second, the tax hike also affects corporations, of which millions of Canadians are owners or part-owners (even excluding their ownership of publicly traded companies’ shares). Overall, economist Jack Mintz estimated that through their ownership of private corporations (based on 2021 data) about 4.74 million Canadians would be affected by the higher tax rate, or 15.8 per cent of tax filers. In other words, about 100 times more Canadians than the Trudeau government suggested.

And in reality, just about all Canadians will be made worse off by the tax hike because almost everyone will effectively be subject to the higher capital gains tax rate through their exposure to publicly traded corporations including through public pension plans.

Worse, because capital gains taxes are taxes on investment, the certain effect of the tax hike will be to reduce business investment. Unfortunately as multiple economic analyses have shown, business investment in Canada has already been extremely weak in the past decade, falling further behind the United States and other developed economies, and contributing to Canada’s productivity and economic stagnation crisis. The capital gains tax hike will make this even worse.

Finally, the Trudeau government ended 2024 with a so-called sales tax “holiday” for two months, which imposes severe administrative and logistical nightmares onto business owners (in a survey of small businesses, most opposed the change and 75 per cent said it would be costly and complicated to implement), and will do nothing to increase productivity or improve economic incentives.

Quite the opposite; government deficits fund the tax “holiday,” which will increase the future tax burden—something that will further reduce economic productivity in the future. Federal tax policy clearly was not kind to Canadians in 2024. Unfortunately, 2025 is looking no better.

2025 Federal Election

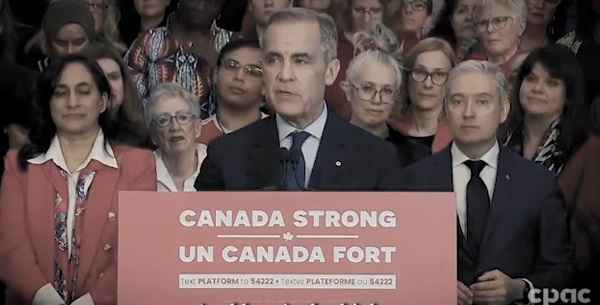

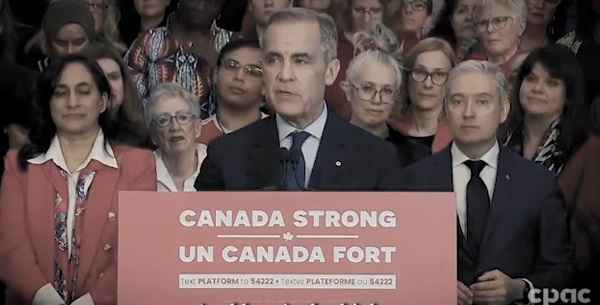

Carney’s budget means more debt than Trudeau’s

The Canadian Taxpayers Federation is criticizing Liberal Party Leader Mark Carney’s budget plan for adding another $225 billion to the debt.

“Carney plans to borrow even more money than the Trudeau government planned to borrow,” said Franco Terrazzano, CTF Federal Director. “Carney claims he’s not like Trudeau and when it comes to the debt, here’s the truth: Carney’s plan is billions of dollars worse than Trudeau’s plan.”

Today, Carney released the Liberal Party’s “fiscal and costing plan.” Carney’s plan projects the debt to increase consistently.

Here is the breakdown of Carney’s annual budget deficits:

- 2025-26: $62 billion

- 2026-27: $60 billion

- 2027-28: $55 billion

- 2028-29: $48 billion

Over the next four years, Carney plans to add an extra $225 billion to the debt. For comparison, the Trudeau government planned on increasing the debt by $131 billion over those years, according to the most recent Fall Economic Statement.

Carney’s additional debt means he will waste an extra $5.6 billion on debt interest charges over the next four years. Debt interest charges already cost taxpayers $54 billion every year – more than $1 billion every week.

“Carney’s debt binge means he will waste $1 billion more every year on debt interest charges,” Terrazzano said. “Carney’s plan isn’t credible and it’s even more irresponsible than the Trudeau plan.

“After years of runaway spending Canadians need a government that will cut spending and stop wasting so much money on debt interest charges.”

Business

Canada Urgently Needs A Watchdog For Government Waste

From the Frontier Centre for Public Policy

By Ian Madsen

From overstaffed departments to subsidy giveaways, Canadians are paying a high price for government excess

Not all the Trump administration’s policies are dubious. One is very good, in theory at least: the Department of Government Efficiency. While that term could be an oxymoron, like ‘political wisdom,’ if DOGE is useful, so may be a Canadian version.

DOGE aims to identify wasteful, duplicative, unnecessary or destructive government programs and replace outdated data systems. It also seeks to lower overall costs and ensure mechanisms are in place to evaluate proposed programs for effectiveness and value for money. This can, and usually does, involve eliminating some departments and, eventually, thousands of jobs. Some new roles within DOGE may need to become permanent.

The goal in the U.S. is to lower annual operating costs and ensure that the growth in government spending is lower than in revenues. Washington’s spending has exploded in recent years. The U.S. federal deficit exceeds six per cent of gross domestic product. According to the U.S. Treasury Department, annual debt service cost is escalating unsustainably.

Canada’s latest budget deficit of $61.9 billion in fiscal 2023–24 is about two per cent of GDP, which seems minor compared to our neighbour. However, it adds to the federal debt of $1.236 trillion, about 41 per cent of our approximate $3 trillion GDP. Ottawa’s public accounts show that expenses are 17.8 per cent of GDP, up from about 14 per cent just eight years ago. Interest on the escalating debt were 10.2 per cent of revenues in the most recent fiscal year, up from just five per cent a mere two years ago.

The Canadian Taxpayers Federation (CTF) continually identifies dubious or frivolous spending and outright waste or extravagance: “$30 billion in subsidies to multinational corporations like Honda, Volkswagen, Stellantis and Northvolt. Federal corporate subsidies totalled $11.2 billion in 2022 alone. Shutting down the federal government’s seven regional development agencies would save taxpayers an estimated $1.5 billion annually.”

The CTF also noted that Ottawa hired 108,000 more staff in the past eight years at an average annual cost of over $125,000. Hiring in line with population growth would have added only 35,500, saving about $9 billion annually. The scale of waste is staggering. Canada Post, the CBC and Via Rail lose, in total, over $5 billion a year. For reference, $1 billion would buy Toyota RAV4s for over 25,600 families.

Ottawa also duplicates provincial government functions, intruding on their constitutional authority. Shifting those programs to the provinces, in health, education, environment and welfare, could save many more billions of dollars per year. Bad infrastructure decisions lead to failures such as the $33.4 billion squandered on what should have been a relatively inexpensive expansion of the Trans Mountain pipeline—a case where hiring better staff could have saved money. Terrible federal IT systems, exemplified by the $4 billion Phoenix payroll horror, are another failure. The Green Slush Fund misallocated nearly $900 million.

Ominously, the fast-growing Old Age Supplement and Guaranteed Income Security programs are unfunded, unlike the Canada Pension Plan. Their costs are already roughly equal to the deficit and could become unsustainable.

Canada is sleepwalking toward financial perdition. A Canadian version of DOGE—Canada Accountability, Efficiency and Transparency Team, or CAETT—is vital. The Auditor General Office admirably identifies waste and bad performance, but is not proactive, nor does it have enforcement powers. There is currently no mechanism to evaluate or end unnecessary programs to ensure Canadians will have a prosperous and secure future. CAETT could fill that role.

Ian Madsen is the Senior Policy Analyst at the Frontier Centre for Public Policy.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCarney’s Fiscal Fantasy: When the Economist Becomes More Dangerous Than the Drama Teacher

-

International11 hours ago

International11 hours agoPope Francis has died aged 88

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoA Perfect Storm of Corruption, Foreign Interference, and National Security Failures

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCampaign 2025 : The Liberal Costed Platform – Taxpayer Funded Fiction

-

Business11 hours ago

Business11 hours agoCanada Urgently Needs A Watchdog For Government Waste

-

Energy10 hours ago

Energy10 hours agoIndigenous-led Projects Hold Key To Canada’s Energy Future

-

2025 Federal Election10 hours ago

2025 Federal Election10 hours agoCarney’s budget means more debt than Trudeau’s

-

International7 hours ago

International7 hours agoPope Francis Dies on Day after Easter