Business

Federal government should tackle Canada’s productivity crisis in upcoming budget

From the Fraser Institute

In late-2014, per-person gross domestic product (GDP), a common indicator of living standards, stood at $58,162 (adjusted for inflation). By the end of 2023 it was actually slightly lower. This means Canadian living standards haven’t increased in a decade.

In a recent speech, the Bank of Canada’s senior deputy governor highlighted the risk posed by chronically sluggish productivity growth to the country’s living standards. She also noted that stalled productivity makes it harder to reduce inflation and keep it at (or close to) the Bank’s 2 per cent target.

Productivity is conventionally defined as the value of economic output per hour of work. Over time, it’s the most important determinant of overall economic growth. In a mainly market-based economy such as Canada’s, particular attention should be paid to the productivity performance of the business sector.

Unfortunately, here the news isn’t good.

Business sector productivity has flatlined in Canada, with the level of output per hour worked essentially unchanged from seven years ago. This pattern of productivity stagnation, in turn, is the principal reason why the value of economic output per person has stalled in Canada. In late-2014, per-person gross domestic product (GDP), a common indicator of living standards, stood at $58,162 (adjusted for inflation). By the end of 2023 it was actually slightly lower. This means Canadian living standards haven’t increased in a decade. That’s not a picture any Canadian citizen or policymaker should be happy about.

For many people, GDP is an abstract concept that doesn’t easily map to their lived experience. But the level and rate of growth of GDP clearly matter to the wellbeing of citizens. Academic studies confirm that worker wages are based in part on the productivity level of their employers. Put simply, the most productive businesses generally pay higher wages, salaries and benefits.

Moreover, over time individual and household incomes can only grow if the economy itself generates more output per hour of work and per person. When per-person GDP increases by 2 per cent a year (after inflation), average income doubles within 35 years. With 1 per cent annual growth in per-person GDP, it takes 70 years. At 0.5 per cent growth in per-person GDP, 139 years must pass before the average income will double. In Canada, per-person GDP has been declining outright, an alarming and unusual trend.

Addressing Canada’s productivity crisis should be job one for the federal government’s 2024 budget, which the Trudeau government will table on April 16. In the early 1980s, Canada was roughly 88 per cent as productive as the United States, measured by the value of output per hour of work across the economy. By 2022, that figure had dropped to 71 per cent, and it’s continued to decline since then.

What can be done? So far, the Trudeau government has relied on population growth fuelled by high levels of immigration to drive economic growth. That strategy has manifestly failed, as the government itself recently (if sheepishly) acknowledged by dialing back the numbers of non-permanent immigrants who will be admitted to the country.

A smarter approach is to boost investment in the things that make businesses and workers more productive—machinery, equipment, digital tools and technologies, intellectual property, up-to-date transportation and communications infrastructure, and research and development focused on bringing innovative products and ideas to market, rather than keeping them in the lab or in academic institutions. Canada’s record is poor in most of these areas, as evidenced by the fact we trail far behind the U.S. and many European countries in the level of business investment per employee.

That will need to change if we hope to up our game on productivity and lay the foundations for a more prosperous Canada.

Author:

Business

Trump considers $5K bonus for moms to increase birthrate

MxM News

MxM News

Quick Hit:

President Trump voiced support Tuesday for a $5,000 cash bonus for new mothers, as his administration weighs policies to counter the country’s declining birthrate. The idea is part of a broader push to promote family growth and revive the American family structure.

Key Details:

- Trump said a reported “baby bonus” plan “sounds like a good idea to me” during an Oval Office interview.

- Proposals under consideration include a $5,000 birth bonus, prioritizing Fulbright scholarships for parents, and fertility education programs.

- U.S. birthrates hit a 44-year low in 2023, with fewer than 3.6 million babies born.

Diving Deeper:

President Donald Trump signaled his support Tuesday for offering financial incentives to new mothers, including a potential $5,000 cash bonus for each child born, as part of an effort to reverse America’s falling birthrate. “Sounds like a good idea to me,” Trump told The New York Post in response to reports his administration is exploring such measures.

The discussions highlight growing concern among Trump administration officials and allies about the long-term implications of declining fertility and family formation in the United States. According to the report, administration aides have been consulting with pro-family advocates and policy experts to brainstorm solutions aimed at encouraging larger families.

Among the proposals: a $5,000 direct payment to new mothers, allocating 30% of all Fulbright scholarships to married applicants or those with children, and launching federally supported fertility education programs for women. One such program would educate women on their ovulation cycles to help them better understand their reproductive health and increase their chances of conceiving.

The concern stems from sharp demographic shifts. The number of babies born in the U.S. fell to just under 3.6 million in 2023—down 76,000 from 2022 and the lowest figure since 1979. The average American family now has fewer than two children, a dramatic drop from the once-common “2.5 children” norm.

Though the birthrate briefly rose from 2021 to 2022, that bump appears to have been temporary. Additionally, the age of motherhood is trending older, with fewer teens and young women having children, while more women in their 30s and 40s are giving birth.

White House Press Secretary Karoline Leavitt underscored the administration’s commitment to families, saying, “The President wants America to be a country where all children can safely grow up and achieve the American dream.” Leavitt, herself a mother, added, “I am proud to work for a president who is taking significant action to leave a better country for the next generation.”

Business

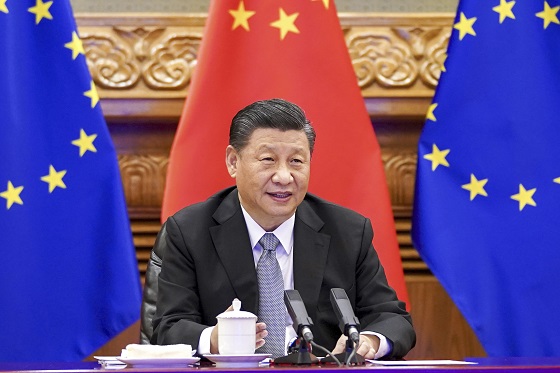

Trump: China’s tariffs to “come down substantially” after negotiations with Xi

MxM News

MxM News

Quick Hit:

President Trump said the 145% tariff rate on Chinese imports will drop significantly once a deal is struck with Chinese President Xi Jinping, expressing confidence that a new agreement is on the horizon.

Key Details:

- Trump said the current 145% tariff rate on China “won’t be anywhere near that high” after negotiations.

- He pointed to his relationship with Xi Jinping as a reason for optimism.

- The White House said it is preparing the groundwork for a deal, and Treasury officials expect a “de-escalation” of the trade war.

Diving Deeper:

President Donald Trump on Tuesday told reporters that the steep tariff rate currently imposed on Chinese imports will come down substantially after his administration finalizes a new trade deal with Chinese President Xi Jinping. While the current level stands at 145%, Trump made clear that number was temporary and would be adjusted following talks with Beijing.

“145 percent is very high. It won’t be that high, it’s not going to be that high … it won’t be anywhere near that high,” Trump said from the Oval Office, signaling a shift once a bilateral agreement is reached. “It will come down substantially, but it won’t be zero.”

The tariff, which Trump previously described as “reciprocal,” was maintained on China even after he delayed similar penalties on other trading partners. Those were cut to 10% and paused for 90 days to allow room for further negotiation.

“We’re going to be very nice. They’re going to be very nice, and we’ll see what happens. But ultimately, they have to make a deal because otherwise they’re not going to be able to deal in the United States,” Trump said, reinforcing his view that the U.S. holds the leverage.

Trump’s remarks come as markets remain wary of ongoing trade tensions, though the White House signaled progress, saying it is “setting the stage for a deal with China.” The president cited his personal rapport with Xi Jinping as a key factor in his confidence that an agreement can be reached.

“China was taking us for a ride, and it’s not going to happen,” Trump said. “They would make billions a year off us and build up their military with our money. That’s over. But we’ll still be good to China, and I think we’ll work together.”

Treasury Secretary Scott Bessent also said Tuesday that he expects a cooling of trade hostilities between the two nations, according to several reports from a private meeting with investors.

As the 90-day pause on other reciprocal tariffs nears its end, Trump emphasized that his team is prepared to finalize deals quickly. “We’ve been in talks with many, many world leaders,” he said, expressing confidence that talks will “go pretty quickly.”

White House Press Secretary Karoline Leavitt added that the administration has received 18 formal proposals from other countries engaged in trade negotiations, another sign that momentum is building behind Trump’s broader push to restructure global trade in favor of American workers and businesses.

(Li Xueren/Xinhua via AP)

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoBREAKING: THE FEDERAL BRIEF THAT SHOULD SINK CARNEY

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCHINESE ELECTION THREAT WARNING: Conservative Candidate Joe Tay Paused Public Campaign

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoOttawa Confirms China interfering with 2025 federal election: Beijing Seeks to Block Joe Tay’s Election

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoReal Homes vs. Modular Shoeboxes: The Housing Battle Between Poilievre and Carney

-

2025 Federal Election13 hours ago

2025 Federal Election13 hours agoMark Carney Wants You to Forget He Clearly Opposes the Development and Export of Canada’s Natural Resources

-

2025 Federal Election13 hours ago

2025 Federal Election13 hours agoCanada’s pipeline builders ready to get to work

-

Business16 hours ago

Business16 hours agoHudson’s Bay Bid Raises Red Flags Over Foreign Influence

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoHow Canada’s Mainstream Media Lost the Public Trust