Business

Federal government should stay in its lane

From the Fraser Institute

By Jason Clemens and Jake Fuss

There’s been more talk this year than normal about the need for governments, particularly Ottawa, to “stay in their own lane.” But what does this actually mean when it comes to the practical taxing, spending and regulating done by provincial and federal governments?

The rules of the road, so to speak, are laid out in sections 91 and 92 of the Canadian Constitution. As noted economist Jack Mintz recently explained, the federal government was allocated responsibility for areas of national priority such as defence and foreign relations, criminal law, and national industries such as transportation, communication and financial institutions. The provinces, on the other hand, were allotted responsibilities deemed to be closer to the people such as health care, education, social services and municipalities.

Simply put, the principle of staying in one’s lane means the federal and provincial governments respect one another’s areas of responsibility and work collaboratively when there are joint interests and/or overlapping responsibilities such as environmental issues.

The experience of the mid-1990s through to roughly 2015 shows the tangible benefits of having each level of government focus on their areas of responsibility. Recall that the Liberal Chrétien government fundamentally removed itself from several areas of provincial jurisdiction, particularly welfare and social services, in its historic 1995 budget.

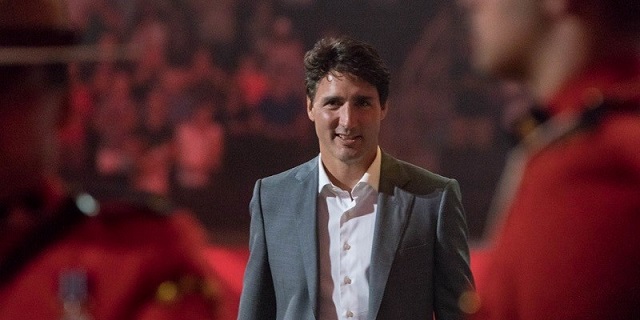

But the election of the Trudeau government in 2015 represented a marked change in approach. The tax and spending policies of the Trudeau government, which broke a 20-year consensus, favoured ever-increasing spending, higher taxes and much higher levels of borrowing. Federal spending (excluding interest payments on debt) has increased from $273.6 billion in 2015-16 when Trudeau first took office to an expected $483.6 billion this year, an increase of 76.7 per cent.

Federal taxes on most Canadians, including the middle class, have also increased despite the Trudeau government promising lower taxes. And despite the tax increases, borrowing has also increased. Consequently, the national debt has ballooned from $1.1 trillion when Trudeau took office to an estimated $2.1 trillion this year.

Despite these massive spending increases, there are serious questions about core areas of federal responsibility. Consider, for example, the major problems with Canada’s defence spending.

Canada has been called out by both NATO officials and our counterparts within NATO for failing to meet our commitments. As a NATO country, Canada is committed to spend 2 per cent of the value of our economy (GDP) annually on defence. The latest estimate is that Canada will spend 1.4 per cent of GDP on defence and we’re the only country without a plan to reach the target by 2030. The Parliamentary Budget Officer recently estimated that to reach our NATO commitment, defence spending would have to increase by $21.3 billion in 2029-30, which given the state of federal finances would entail much higher borrowing and/or higher taxes.

So, while the Trudeau government has increased federal spending markedly, it has not spent those funds on core areas of federal responsibility. Instead, Trudeau’s Ottawa has increasingly involved itself in provincial areas of responsibility. Consider three new national initiatives that are all squarely provincial areas of responsibility: pharmacare, $10-a-day daycare and dental care.

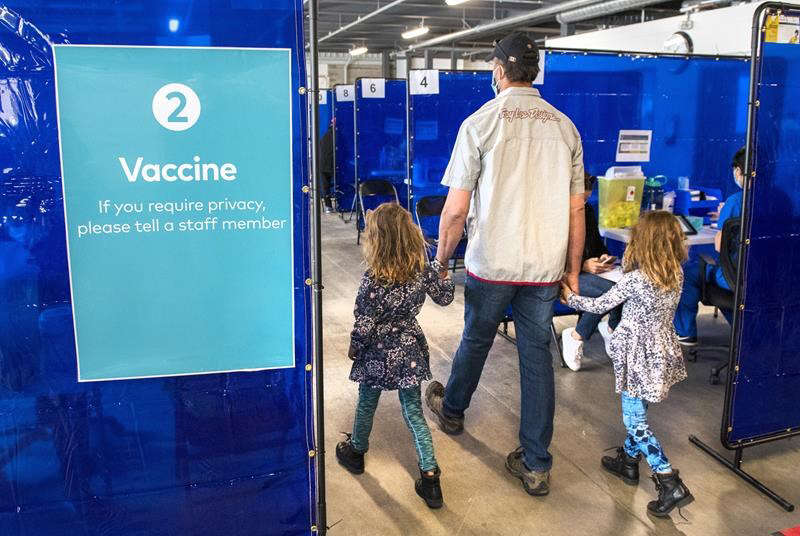

And the amounts involved in these programs are not incidental. In Budget 2021, the Trudeau government announced $27.2 billion over five years for the new $10-a-day daycare initiative, Budget 2023 committed $13.0 billion for the dental benefit over five years, and Budget 2024 included a first step towards national pharmacare with spending of $1.5 billion over five years to cover most contraceptives and some diabetes medications.

So, while the Trudeau government has deprioritized core areas of federal responsibility such as defence, it has increasingly intruded on areas of provincial responsibility.

Canada works best when provincial and federal governments recognize and adhere to their roles within Confederation as was more the norm for more than two decades. The Trudeau government’s intrusion into provincial jurisdiction has increased tensions with the provinces, likely created unsustainable new programs that will ultimately put enormous financial pressure on the provinces, and led to a less well-functioning federal government. Staying in one’s lane makes sense for both driving and political governance.

Authors:

Business

Policy uncertainty continues to damage Canada’s mining potential

From the Fraser Institute

By Julio Mejía and Elmira Aliakbari

According to a new survey of mining investors, despite the rich mineral potential of many Canadian jurisdictions, government policies are deterring investment

Canada is renowned for its abundant minerals and network of engineering firms with mining experience. These advantages, coupled with the rising global demand for copper, lithium, nickel, cobalt and rare-earth elements, should spur growing interest in our mining sector among investors. Yet, mining investment in Canada is on the wane.

In nominal terms, exploration investment alone fell from $4.4 billion in 2022 to $4.2 billion in 2023, with preliminary numbers for 2024 suggesting a further 2 per cent drop. And several leading exploration companies including Solaris Resources Inc., Falcon Energy Materials and Barrick Mining Corporation (the world’s second-largest mining company) have either moved their headquarters out of Canada or are considering doing so.

This downward trend extends beyond just exploration investment. In 2023 (the latest year of available data) investment in Canada’s mining sector totalled $15.2 billion, 26 per cent below the record-high $20.5 billion in 2012 (inflation-adjusted).

So, why is one of the most mineral-rich countries on Earth losing investor interest?

According to a new survey of mining investors, despite the rich mineral potential of many Canadian jurisdictions, government policies are deterring investment.

Take British Columbia, Yukon and Manitoba, for example. Although all three rank among the world’s top 10 most attractive jurisdictions for their mineral endowment, all three fall far behind in policy perception, ranking 32nd, 40th and 43rd out of 82 jurisdictions, respectively. The Northwest Territories (56th), Nunavut (59th) and Nova Scotia (76th) also rank low in terms of policy, while Saskatchewan (3rd), Newfoundland and Labrador (6th) and Alberta (9th) are the only Canadian jurisdictions that perform well.

Indeed, in multiple editions of the mining survey over many years, investors have cited policy uncertainty as a key deterrent to investment in many Canadian jurisdictions. In particular, uncertainty around disputed land claims, protected areas and environmental regulations.

Of course, Canadian jurisdictions compete with jurisdictions around the world including in the United States. And the differences in investor perception are striking. While a strong majority of survey respondents for B.C. (76 per cent), Manitoba (75 per cent) and the Yukon (69 per cent) say uncertainty around disputed land claims deters investment, the percentages are much smaller for Nevada (13 per cent) and Arizona (16 per cent). Similarly, the percentage of respondents who say uncertainty around protected areas deters investment for B.C. (76 per cent), the Yukon (76 per cent) and Manitoba (63 per cent) was much larger than for Wyoming (11 per cent) and Nevada (27 per cent).

To build new mining projects, develop technologies that improve productivity, create jobs and help spread prosperity, Canadian jurisdictions must attract investment. In 2023, mining was Canada’s second-leading export, trailing only energy, and contributed $117 billion to Canada’s total economic output. More importantly, that same year the industry provided a livelihood for 711,000 Canadians while paying wages that nearly double the average of other industries. And according to a 2021 census, the sector provided jobs to more than 17,300 First Nations people, making it one of the largest employers of Indigenous workers in the country.

Bad policies create uncertainty and deter investment. If policymakers are serious about unleashing Canada’s mining potential, they must eliminate regulatory uncertainty and establish a predictable policy framework. Otherwise, the country will keep declining in the eyes of investors.

Elmira Aliakbari

Business

Virtue-signalling devotion to reconciliation will not end well

From the Fraser Institute

By Bruce Pardy

In September, the British Columbia Supreme Court threw private property into turmoil. Aboriginal title in Richmond, a suburb of Vancouver, is “prior and senior” to fee simple interests, the court said. That means it trumps the property you have in your house, farm or factory. If the decision holds up on appeal, it would mean private property is not secure anywhere a claim for Aboriginal title is made out.

If you thought things couldn’t get worse, you thought wrong. On Dec. 5, the B.C. Court of Appeal delivered a different kind of upheaval. Gitxaala and Ehattesaht First Nations claimed that B.C.’s mining regime was unlawful because it allowed miners to register claims on Crown land without consulting with them. In a 2-to-1 split decision, the court agreed. The mining permitting regime is inconsistent with the United Nations Declaration on the Rights of Indigenous People (UNDRIP). And B.C. legislation, the court said, has made UNDRIP the law of B.C.

UNDRIP is a declaration of the United Nations General Assembly. It consists of pages and pages of Indigenous rights and entitlements. If UNDRIP is the law in B.C., then Indigenous peoples are entitled to everything—and to have other people pay for it. If you suspect that is an exaggeration, take a spin through UNDRIP for yourself.

Indigenous peoples, it says, “have the right to the lands, territories and resources which they have traditionally owned, occupied or otherwise used or acquired… to own, use, develop and control, as well as the right to “redress” for these lands, through either “restitution” or “just, fair and equitable compensation.” It says that states “shall consult and cooperate in good faith” in order to “obtain free and informed consent prior to the approval of any project affecting their lands or territories and other resources,” and that they have the right to “autonomy or self-government in matters relating to their internal and local affairs, as well as ways and means for financing their autonomous functions.”

The General Assembly adopted UNDRIP in 2007. At the time, Canada sensibly voted “no,” along with New Zealand, the United States and Australia. Eleven countries abstained. But in 2016, the newly elected Trudeau government reversed Canada’s objection.

UN General Assembly resolutions are not binding in international law. Nor are they enforceable in Canadian courts. But in 2019, NDP Premier John Horgan and his Attorney General David Eby, now the Premier, introduced Bill 41, the Declaration on the Rights of Indigenous Peoples Act (DRIPA). DRIPA proposed to require the B.C. government to “take all measures necessary to ensure the laws of British Columbia are consistent with the Declaration.” The B.C. Legislature unanimously passed the bill. (The Canadian Parliament passed a similar bill in 2021.)

Two years later, the legislature passed an amendment to the B.C. Interpretation Act. Eby, still B.C.’s Attorney General, sponsored the bill. The amendment read, “Every Act and regulation must be construed as being consistent with the Declaration.”

Eby has expressed dismay about the Court of Appeal decision. It “invites further and endless litigation,” he said. “It looked at the clear statements of intent in the legislature and the law, and yet reached dramatically different conclusions about what legislators did when we voted unanimously across party lines” to pass DRIPA. He has promised to amend the legislation.

These are crocodile tears. The majority judgment from the Court of Appeal is not a rogue decision from activist judges making things up and ignoring the law. Not this time, anyway. The court said that B.C. law must be construed as being consistent with UNDRIP—which is what Eby’s 2021 amendment to the Interpretation Act says.

In fact, Eby’s government has been doing everything in its power to champion Aboriginal interests. DRIPA is its mandate. It’s been making covert agreements with specific Aboriginal groups over specific territories. These agreements promise Aboriginal title and/or grant Aboriginal management rights over land use. In April 2024, an agreement with the Haida Council recognized Haida title and jurisdiction over Haida Gwaii, an archipelago off the B.C. coast formerly known as the Queen Charlotte Islands. Eby has said that the agreement is a template for what’s possible “in other places in British Columbia, and also in Canada.” He is putting title and control of B.C. into Aboriginal hands.

But it’s not just David Eby. The Richmond decision from the B.C. Supreme Court had nothing to do with B.C. legislation. It was a predictable result of years of Supreme Court of Canada (SCC) jurisprudence under Section 35 of the Constitution. That section guarantees “existing” Aboriginal and treaty rights as of 1982. But the SCC has since championed, evolved and enlarged those rights. Legislatures can fix their own statutes, but they cannot amend Section 35 or override judicial interpretation, even using the “notwithstanding clause.”

Meanwhile, on yet another track, Aboriginal rights are expanding under the Charter of Rights and Freedoms. On the same day as the B.C. Court of Appeal decision on UNDRIP, the Federal Court released two judgments. The federal government has an actionable duty to Aboriginal groups to provide housing and drinking water, the court declared. Taxpayer funded, of course.

One week later, at the other end of the country, the New Brunswick Court of Appeal weighed in. In a claim made by Wolastoqey First Nation for the western half of the province, the court said that Aboriginal title should not displace fee simple title of private owners. Yet it confirmed that a successful claim would require compensation in lieu of land. Private property owners or taxpayers, take your pick.

Like the proverb says, make yourself into a doormat and someone will walk all over you. Obsequious devotion to reconciliation has become a pathology of Canadian character. It won’t end well.

-

Energy2 days ago

Energy2 days agoThe U.S. Just Removed a Dictator and Canada is Collateral Damage

-

Daily Caller1 day ago

Daily Caller1 day agoScathing Indictment Claims Nicolás Maduro Orchestrated Drug-Fueled ‘Culture Of Corruption’ Which Plagued Entire Region

-

International2 days ago

International2 days agoUS Justice Department Accusing Maduro’s Inner Circle of a Narco-State Conspiracy

-

Haultain Research2 days ago

Haultain Research2 days agoTrying to Defend Maduro’s Legitimacy

-

Opinion1 day ago

Opinion1 day agoHell freezes over, CTV’s fabrication of fake news and our 2026 forecast is still searching for sunshine

-

Daily Caller1 day ago

Daily Caller1 day agoTrump Says US Going To Run Venezuela After Nabbing Maduro

-

Business1 day ago

Business1 day agoVirtue-signalling devotion to reconciliation will not end well

-

COVID-191 day ago

COVID-191 day agoA new study proves, yet again, that the mRNA Covid jabs should NEVER have been approved for young people.