Fraser Institute

Federal government should reject Bloc plan—and raise OAS age of eligibility

From the Fraser Institute

By Ben Eisen

Recently, the House of Commons passed a private member’s bill by the Bloc Quebecois to increase Old Age Security (OAS) payments for younger seniors (aged 65-74) by 10 per cent. OAS provides cash benefits for most seniors in Canada, except seniors with very high incomes.

The bill, however, requires the support of Trudeau’s cabinet, which has so far refused to grant a “royal recommendation” that would allow the bill to become law. And that’s the right call. In fact, the government should go further and raise the age of eligibility for OAS.

Here’s why.

Governments should always be cautious with taxpayer money and strive to direct financial assistance to those actually in need. It’s hard to think of a worse strategy to achieve this goal than increasing OAS benefits for seniors who are a relatively high-income demographic. In fact, the share of seniors living in “low-income” is only about half of that for the working-age population. It may be a good idea to increase targeted assistance for the small number of seniors that struggle financially, but spraying almost the entire demographic with a firehose of scarce taxpayer funds is difficult to justify on equity grounds.

The idea also flies in the face of the Trudeau government’s promise in its last budget to work for “generational fairness” and help make the economy work better for younger Canadians who face a housing crisis and low youth employment rates among other economic challenges.

Why? Because any increase to OAS benefits would be deficit-financed (that is, the government would need to borrow the money) and the cost would fall on the shoulders of working-age Canadians who must pay the interest on the resulting debt. In other words, boosting the OAS would be a massive income transfer from younger Canadians to older Canadians.

Again, instead of boosting benefits for younger seniors—like the Bloc has proposed, with support from Conservatives and the NDP—the federal government should go in exactly the opposite direction and increase the age of eligibility for OAS.

Simply put, people are living longer than when the program was first designed. And not just here at home but around the world, which is why there’s a clear international trend in increasing the age of eligibility for old-age benefit programs. According to our analysis in 2022, among 22 high-income OECD countries, 16 had either already increased the age of eligibility for public retirement programs above the age of 65 or were in the process of doing so. Several countries have also indexed the age of eligibility to life expectancy, to help prevent costs from spiralling out of control.

Canada was once on track to participate in this sensible international trend when the Harper government announced a plan to raise the OAS eligibility age from 65 to 67 (while giving ample lead time before the change to not disrupt the financial planning of Canadians nearing retirement). The Trudeau government reversed this decision (at great financial cost) in 2016 almost immediately after taking office. But now, the government would be well-advised to revisit the plan and raise the age of eligibility to 67, for the same reasons it’s reluctant to approve the Bloc’s motion and increase payments to younger seniors.

Ensuring income security for older Canadians is an important policy goal. But it’s equally important to achieving this goal in a way that does not unfairly burden working-age Canadians and directs money where it’s needed most.

Author:

Business

Virtue-signalling devotion to reconciliation will not end well

From the Fraser Institute

By Bruce Pardy

In September, the British Columbia Supreme Court threw private property into turmoil. Aboriginal title in Richmond, a suburb of Vancouver, is “prior and senior” to fee simple interests, the court said. That means it trumps the property you have in your house, farm or factory. If the decision holds up on appeal, it would mean private property is not secure anywhere a claim for Aboriginal title is made out.

If you thought things couldn’t get worse, you thought wrong. On Dec. 5, the B.C. Court of Appeal delivered a different kind of upheaval. Gitxaala and Ehattesaht First Nations claimed that B.C.’s mining regime was unlawful because it allowed miners to register claims on Crown land without consulting with them. In a 2-to-1 split decision, the court agreed. The mining permitting regime is inconsistent with the United Nations Declaration on the Rights of Indigenous People (UNDRIP). And B.C. legislation, the court said, has made UNDRIP the law of B.C.

UNDRIP is a declaration of the United Nations General Assembly. It consists of pages and pages of Indigenous rights and entitlements. If UNDRIP is the law in B.C., then Indigenous peoples are entitled to everything—and to have other people pay for it. If you suspect that is an exaggeration, take a spin through UNDRIP for yourself.

Indigenous peoples, it says, “have the right to the lands, territories and resources which they have traditionally owned, occupied or otherwise used or acquired… to own, use, develop and control, as well as the right to “redress” for these lands, through either “restitution” or “just, fair and equitable compensation.” It says that states “shall consult and cooperate in good faith” in order to “obtain free and informed consent prior to the approval of any project affecting their lands or territories and other resources,” and that they have the right to “autonomy or self-government in matters relating to their internal and local affairs, as well as ways and means for financing their autonomous functions.”

The General Assembly adopted UNDRIP in 2007. At the time, Canada sensibly voted “no,” along with New Zealand, the United States and Australia. Eleven countries abstained. But in 2016, the newly elected Trudeau government reversed Canada’s objection.

UN General Assembly resolutions are not binding in international law. Nor are they enforceable in Canadian courts. But in 2019, NDP Premier John Horgan and his Attorney General David Eby, now the Premier, introduced Bill 41, the Declaration on the Rights of Indigenous Peoples Act (DRIPA). DRIPA proposed to require the B.C. government to “take all measures necessary to ensure the laws of British Columbia are consistent with the Declaration.” The B.C. Legislature unanimously passed the bill. (The Canadian Parliament passed a similar bill in 2021.)

Two years later, the legislature passed an amendment to the B.C. Interpretation Act. Eby, still B.C.’s Attorney General, sponsored the bill. The amendment read, “Every Act and regulation must be construed as being consistent with the Declaration.”

Eby has expressed dismay about the Court of Appeal decision. It “invites further and endless litigation,” he said. “It looked at the clear statements of intent in the legislature and the law, and yet reached dramatically different conclusions about what legislators did when we voted unanimously across party lines” to pass DRIPA. He has promised to amend the legislation.

These are crocodile tears. The majority judgment from the Court of Appeal is not a rogue decision from activist judges making things up and ignoring the law. Not this time, anyway. The court said that B.C. law must be construed as being consistent with UNDRIP—which is what Eby’s 2021 amendment to the Interpretation Act says.

In fact, Eby’s government has been doing everything in its power to champion Aboriginal interests. DRIPA is its mandate. It’s been making covert agreements with specific Aboriginal groups over specific territories. These agreements promise Aboriginal title and/or grant Aboriginal management rights over land use. In April 2024, an agreement with the Haida Council recognized Haida title and jurisdiction over Haida Gwaii, an archipelago off the B.C. coast formerly known as the Queen Charlotte Islands. Eby has said that the agreement is a template for what’s possible “in other places in British Columbia, and also in Canada.” He is putting title and control of B.C. into Aboriginal hands.

But it’s not just David Eby. The Richmond decision from the B.C. Supreme Court had nothing to do with B.C. legislation. It was a predictable result of years of Supreme Court of Canada (SCC) jurisprudence under Section 35 of the Constitution. That section guarantees “existing” Aboriginal and treaty rights as of 1982. But the SCC has since championed, evolved and enlarged those rights. Legislatures can fix their own statutes, but they cannot amend Section 35 or override judicial interpretation, even using the “notwithstanding clause.”

Meanwhile, on yet another track, Aboriginal rights are expanding under the Charter of Rights and Freedoms. On the same day as the B.C. Court of Appeal decision on UNDRIP, the Federal Court released two judgments. The federal government has an actionable duty to Aboriginal groups to provide housing and drinking water, the court declared. Taxpayer funded, of course.

One week later, at the other end of the country, the New Brunswick Court of Appeal weighed in. In a claim made by Wolastoqey First Nation for the western half of the province, the court said that Aboriginal title should not displace fee simple title of private owners. Yet it confirmed that a successful claim would require compensation in lieu of land. Private property owners or taxpayers, take your pick.

Like the proverb says, make yourself into a doormat and someone will walk all over you. Obsequious devotion to reconciliation has become a pathology of Canadian character. It won’t end well.

Business

The great policy challenge for governments in Canada in 2026

From the Fraser Institute

According to a recent study, living standards in Canada have declined over the past five years. And the country’s economic growth has been “ugly.” Crucially, all 10 provinces are experiencing this economic stagnation—there are no exceptions to Canada’s “ugly” growth record. In 2026, reversing this trend should be the top priority for the Carney government and provincial governments across the country.

Indeed, demographic and economic data across the country tell a remarkably similar story over the past five years. While there has been some overall economic growth in almost every province, in many cases provincial populations, fuelled by record-high levels of immigration, have grown almost as quickly. Although the total amount of economic production and income has increased from coast to coast, there are more people to divide that income between. Therefore, after we account for inflation and population growth, the data show Canadians are not better off than they were before.

Let’s dive into the numbers (adjusted for inflation) for each province. In British Columbia, the economy has grown by 13.7 per cent over the past five years but the population has grown by 11.0 per cent, which means the vast majority of the increase in the size of the economy is likely due to population growth—not improvements in productivity or living standards. In fact, per-person GDP, a key indicator of living standards, averaged only 0.5 per cent per year over the last five years, which is a miserable result by historic standards.

A similar story holds in other provinces. Prince Edward Island, Nova Scotia, Quebec and Saskatchewan all experienced some economic growth over the past five years but their populations grew at almost exactly the same rate. As a result, living standards have barely budged. In the remaining provinces (Newfoundland and Labrador, New Brunswick, Ontario, Manitoba and Alberta), population growth has outstripped economic growth, which means that even though the economy grew, living standards actually declined.

This coast-to-coast stagnation of living standards is unique in Canadian history. Historically, there’s usually variation in economic performance across the country—when one region struggles, better performance elsewhere helps drive national economic growth. For example, in the early 2010s while the Ontario and Quebec economies recovered slowly from the 2008/09 recession, Alberta and other resource-rich provinces experienced much stronger growth. Over the past five years, however, there has not been a “good news” story anywhere in the country when it comes to per-person economic growth and living standards.

In reality, Canada’s recent record-high levels of immigration and population growth have helped mask the country’s economic weakness. With more people to buy and sell goods and services, the overall economy is growing but living standards have barely budged. To craft policies to help raise living standards for Canadian families, policymakers in Ottawa and every provincial capital should remove regulatory barriers, reduce taxes and responsibly manage government finances. This is the great policy challenge for governments across the country in 2026 and beyond.

-

Energy2 days ago

Energy2 days agoThe U.S. Just Removed a Dictator and Canada is Collateral Damage

-

Daily Caller1 day ago

Daily Caller1 day agoScathing Indictment Claims Nicolás Maduro Orchestrated Drug-Fueled ‘Culture Of Corruption’ Which Plagued Entire Region

-

International2 days ago

International2 days agoUS Justice Department Accusing Maduro’s Inner Circle of a Narco-State Conspiracy

-

Haultain Research2 days ago

Haultain Research2 days agoTrying to Defend Maduro’s Legitimacy

-

Opinion1 day ago

Opinion1 day agoHell freezes over, CTV’s fabrication of fake news and our 2026 forecast is still searching for sunshine

-

Daily Caller1 day ago

Daily Caller1 day agoTrump Says US Going To Run Venezuela After Nabbing Maduro

-

Business1 day ago

Business1 day agoVirtue-signalling devotion to reconciliation will not end well

-

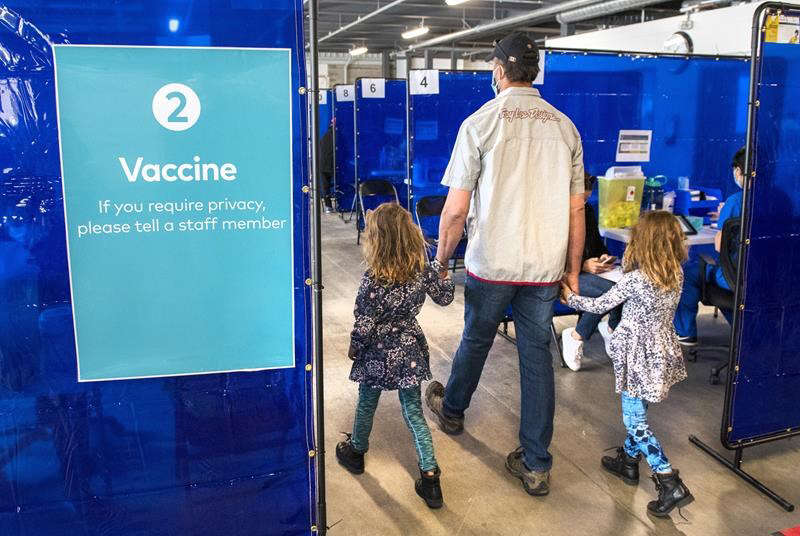

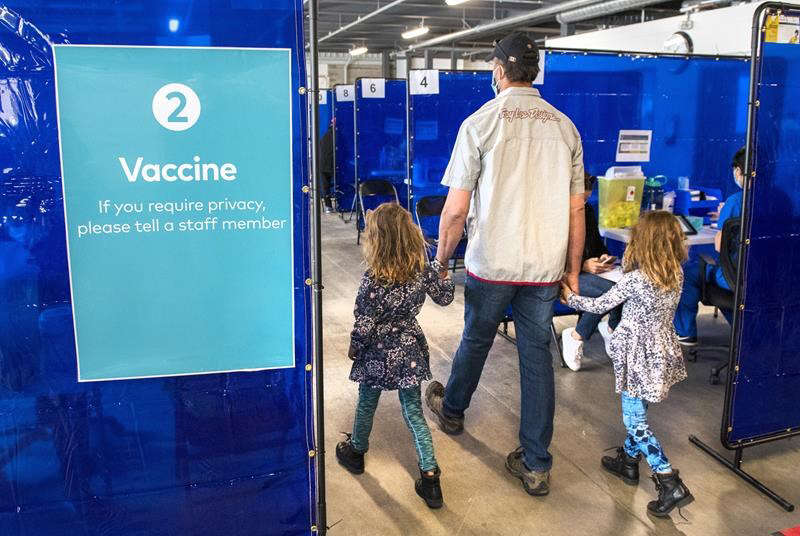

COVID-191 day ago

COVID-191 day agoA new study proves, yet again, that the mRNA Covid jabs should NEVER have been approved for young people.