Economy

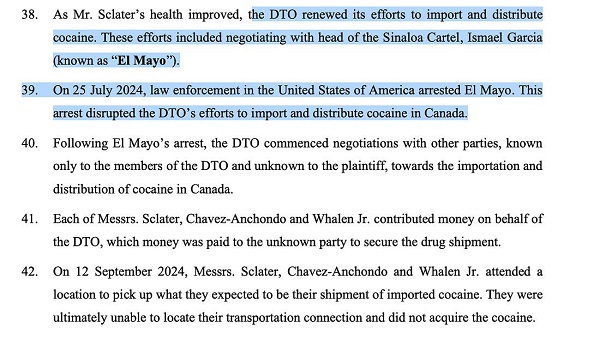

Federal government could balance budget and reduce tax rates with 2.3% spending reduction over two years

From the Fraser Institute

By Jake Fuss and Grady Munro

If the federal government reduced program spending by only 2.3 per cent over two years and eliminated a host of tax expenditures, it could balance the budget and reduce personal income tax rates affecting most Canadians, finds a new

study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“With modest spending reductions and tax reform, the federal government can create the fiscal room to provide tax rate reductions that would benefit most Canadians,” said Jake Fuss, director of fiscal studies at the Fraser Institute and co-author of A New Federal Fiscal Framework for Canada.

Specifically, if the government implemented this spending reduction—and eliminated 49 federal personal income tax expenditures (tax credits, tax exemptions, etc.), which do little to improve economic growth yet reduce government revenue—it could eliminate the three middle federal personal income tax rates (20.5 per cent, 26.0 per cent, 29.0 per cent) and reduce the top rate from 33.0 per cent to its previous level of 29.0 per cent.

As a result, with only two remaining rates, nearly all Canadians would pay a marginal personal income tax rate of 15 per cent. And the federal government could balance the budget by 2026/27.

“In light of Canada’s dim economic prospects and lack of tax competitiveness, the federal government should move away from the status quo and pursue a pro-growth fiscal strategy,” Fuss said.

“At a time when affordability is top of mind, it’s time for Ottawa to reduce tax rates and restore discipline to federal finances.”

- Poor government policy has led to a significant deterioration in Canada’s federal finances over the last decade. The introduction of new and expanded government programs has caused federal spending to increase substantially, resulting in persistent deficits and rising debt.

- Canada also maintains markedly uncompetitive personal income taxes relative to many other advanced economy jurisdictions. This hinders Canada’s ability to attract and retain highly skilled workers, entrepreneurs, and business owners.

- Canada must make meaningful policy reforms by pursuing reductions in both federal spending and tax rates to address the current fiscal and economic challenges.

- The federal government should eliminate 49 federal PIT tax expenditures and remove the three middle income tax rates of 20.5, 26.0, and 29.0 percent while reducing the top marginal PIT rate from 33.0 to 29.0 percent.

- The federal government can introduce a comprehensive tax reform package and achieve a balanced budget by 2026/27 through reducing nominal annual program spending by 2.3 percent over a two-year period.

- Returning to balanced budgets should be viewed as a starting point rather than the end goal.

- Imposing a Tax and Expenditure Limitation (TEL) rule that caps growth in program spending at the rate of inflation plus population growth would be the next step for federal finances over the long-term.

- This would allow for budget surpluses in subsequent years after achieving the initial balanced budget and ensure discipline in government spending for the foreseeable future.

Authors:

Carbon Tax

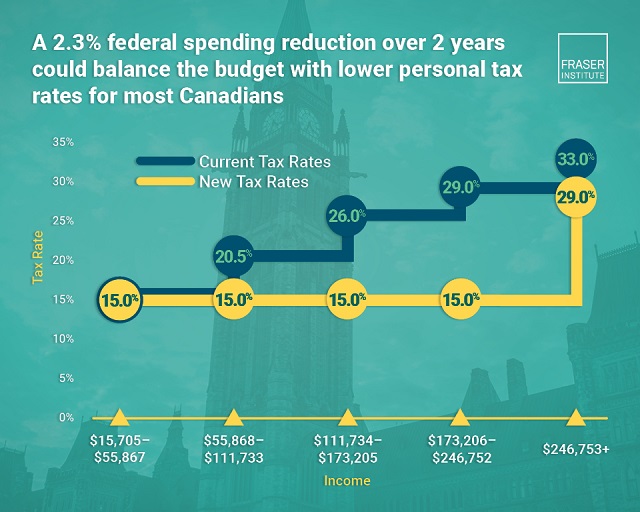

Prime Minister Mark Carney reduces carbon tax to zero

From LifeSiteNews

Conservative Party leader Pierre Poilievre warned, ‘Carbon Tax Carney is pausing the carbon tax until after the election when he no longer needs your vote but still needs your money.’

Mark Carney, as his first move as Prime Minister of Canada, has dropped the infamous carbon tax.

Moments after his March 14 swearing in, Prime Minister Carney signed legislation to reduce the consumer carbon tax rate on Canadians to zero, essentially removing it from April 1.

“This will make a difference to hard-pressed Canadians, but it is part of a much bigger set of measures that this government is taking to ensure that we fight against climate change, that our companies are competitive, and the country moves forward,” Carney told media in the cabinet meeting room.

“Based on the discussion we’ve had and consistent with a promise that I made, and others supported, during the [Liberal Party] leadership campaign, we will be eliminating the Canada fuel charge, the consumer fuel charge, immediately,” he continued.

However, it is important to note that Carney did not scrap the carbon tax legislation: he just reduced it to zero. This means it could come back at any time.

Furthermore, while Carney has dropped the consumer carbon tax, he has previously revealed that he wishes to implement a corporation carbon tax, the effects of which many argued would trickle down to all Canadians.

First implemented in 2019, the carbon tax was advertised as a way to reduce emissions. However, Liberals have since admitted that the carbon tax has reduced greenhouse gas emissions by only one percent.

The tax is wildly unpopular and blamed for the rising cost of living throughout Canada. Currently, Canadians living in provinces under the federal carbon pricing scheme pay $80 per tonne.

Notably, Carney’s decision to drop the unpopular carbon tax comes just weeks before he is expected to call a federal election.

Conservative Party leader Pierre Poilievre responded to Carney’s move by saying, “Carbon Tax Carney is pausing the carbon tax until after the election when he no longer needs your vote but still needs your money.”

“He’s flip-flopping on his beliefs to trick Canadians into a 4th Liberal government,” he stated on an X post. “If Carney wins, Canada loses.”

Indeed, Carney’s decision also appears to be contrary to his own ideology, as he recently argued that the carbon tax was too low. He also rebuked Trudeau for exempting home heating oil from the carbon tax in 2023.

Furthermore, although Carney has assured Canadians that while he is no longer on the board of the World Economic Forum, he has been a longtime supporter of the globalist agenda, including the United Nations’ energy regulations. In January 2023, he attended the World Economic Forum’s meeting in Davos, Switzerland.

Carney uses his social media to advocate for achieving net-zero energy goals.

“The net-zero revolution is becoming a driver of country competitiveness, job creation & growth,” he posted on X earlier in November. “In the future, great powers will be green powers — and Canada can be a great power.”

Banks

Bank of Canada Slashes Interest Rates as Trade War Wreaks Havoc

With businesses cutting jobs, inflation rising, and consumer confidence collapsing, the BoC scrambles to contain the damage

The Bank of Canada just cut interest rates again, this time by 25 basis points, bringing the rate down to 2.75%. On the surface, that might sound like good news—lower rates usually mean cheaper borrowing, easier access to credit, and in theory, more money flowing into the economy. But let’s be clear about what’s actually happening here. The Canadian economy isn’t growing because of strong fundamentals or responsible fiscal policy. The Bank of Canada is slashing rates because the Trudeau—sorry, Carney—government has utterly mismanaged this country’s economic future. And now, with the U.S. slapping tariffs on Canadian goods and our government responding with knee-jerk retaliatory tariffs, the central bank is in full-blown damage control.

Governor Tiff Macklem didn’t mince words at his press conference. “The Canadian economy ended 2024 in good shape,” he insisted, before immediately admitting that “pervasive uncertainty created by continuously changing U.S. tariff threats have shaken business and consumer confidence.” In other words, the economy was doing fine—until reality set in. And that reality is simple: a trade war with our largest trading partner is economic suicide, yet the Canadian government has charged headlong into one.

Macklem tried to explain the Bank’s thinking. He pointed out that while inflation has remained close to the BoC’s 2% target, it’s expected to rise to 2.5% in March thanks to the expiry of a temporary GST holiday. That’s right—Canadians are about to get slammed with higher prices on top of already sky-high costs for groceries, gas, and basic necessities. But that’s not even the worst part. Macklem admitted that while inflation will go up, consumer spending and business investment are both set to drop as a result of this economic uncertainty. Businesses are pulling back on hiring. They’re delaying investment. They’re scared. And rightly so.

A BoC survey released alongside the rate decision shows that 40% of businesses plan to cut back on hiring, particularly in manufacturing, mining, and oil and gas—precisely the industries that were already hammered by Ottawa’s obsession with green energy and ESG policies. As Macklem put it, “Canadians are more worried about their job security and financial health as a result of trade tensions, and they intend to spend more cautiously.” In other words, this is self-inflicted. The government could have pursued a different approach. It could have worked with the U.S. to de-escalate trade tensions. Instead, Mark Carney—an unelected, Davos-approved globalist—is running the show, doubling down on tariffs that will raise prices for Canadians while doing absolutely nothing to change U.S. policy.

The worst part is that the Bank of Canada is completely cornered. It can’t provide forward guidance on future rate decisions because, as Macklem admitted, it has no idea what’s going to happen next. “We are focused on assessing the upward pressure on inflation from tariffs and a weaker dollar, and the downward pressure from weaker domestic demand,” he said. That’s central banker-speak for: We’re guessing, and we hope we don’t screw this up. And if inflation does spiral out of control, the BoC could be forced to raise rates instead of cutting them.

At the heart of this mess is a government that has spent years inflating the size of the state while crushing private sector growth. Macklem admitted that consumer and business confidence has been “sharply affected” by recent developments. That’s putting it mildly. The Canadian dollar has dropped nearly 5% since January, making everything imported from the U.S. more expensive. Meanwhile, Ottawa has responded to U.S. tariffs with a tit-for-tat strategy, placing nearly $30 billion in retaliatory tariffs on American goods. The BoC is now forced to clean up the wreckage, but it’s like trying to put out a fire with a garden hose.

And what about unemployment? Macklem dodged giving a direct forecast, but he didn’t exactly sound optimistic. “We expect the first quarter to be weaker,” he said. “If household demand, if business investment remains restrained in the second quarter, and you’ll likely see weakness in exports, you could see an even weaker second quarter.” That’s code for job losses. It’s already happening. The hiring freezes, the canceled investments—those translate into real layoffs, real pay cuts, real suffering for Canadian families.

Meanwhile, inflation expectations are rising. And once those expectations set in, they become nearly impossible to undo. Macklem was careful in his wording, but the meaning was clear: “Some prices are going to go up. We can’t change that. What we particularly don’t want to see is that first round of price increases have knock-on effects, causing other prices to go up… becoming generalized and ongoing inflation.” Translation: We know this is going to hurt Canadians, we just hope it doesn’t spiral out of control.

If this sounds familiar, that’s because it is. The same policymakers who told you that inflation was “transitory” in 2021 and then jacked up rates at record speed are now telling you that trade war-driven inflation will be “temporary.” But remember this: the BoC is only reacting to the mess created by politicians. The real blame lies with the people in charge. And now, that’s Mark Carney.

Macklem refused to comment on Carney’s role as prime minister, insisting that the BoC remains “independent” from politics. That’s cute. But the damage is already done. Ottawa picked a fight with the U.S. and now the BoC is left trying to prevent a full-scale economic downturn. The problem is, monetary policy can’t fix bad leadership. Canadians are the ones who will pay the price.

-

National2 days ago

National2 days agoMark Carney’s new chief of staff was caught lying about Emergencies Act use

-

Business1 day ago

Business1 day agoBrookfield’s Deep Ties to Chinese Land, Loans, and Green Deals—And a Real Estate Tycoon With CCP Links—Raise Questions as Carney Takes Over from Trudeau

-

National2 days ago

National2 days agoTwo Liberal ministers suggest Mark Carney will call election after being sworn in as PM

-

Alberta24 hours ago

Alberta24 hours agoAlberta power outages and higher costs on the way with new federal electricity regulations, AESO says

-

International1 day ago

International1 day agoEU leaders silent as Romania cancels anti-globalist presidential candidate

-

Alberta20 hours ago

Alberta20 hours agoHighway twinning from Sylvan Lake to Rocky Mountain House among dozens of infrastructure projects beginning in Alberta

-

International1 day ago

International1 day agoUnited Nations Judge Convicted For Having A Slave

-

Energy10 hours ago

Energy10 hours agoTrump asserts energy dominance, set to meet oil titans amid trade war