Business

Federal government clearly misstates its economic record

From the Fraser Institute

“since 2015 Canada has posted some of the weakest economic growth numbers, measured on a per-person basis, in half a century”

“Denominator blindness” refers to situations where people fail to put what seem to be big numbers into proper context. The affliction is especially common among governments seeking to justify their spending and other policy decisions. In Canada, denominator blindness has become a central feature of the narratives peddled by many politicians.

For example, the Trudeau government’s recent economic update, which includes a forward by Finance Minister Chrystia Freeland where she notes that the International Monetary Fund expects Canada to have “the strongest economic growth in the G7 next year.” She also insists her government is fostering economic growth that “creates middle class jobs, raises incomes, and makes middle class communities more prosperous.”

Both claims lack context and misstate the government’s economic record.

Prosperity is measured using both a numerator, typically the amount of output the economy produces in a year, and a denominator, the size of the population. A larger population means the economic pie must be divided into more slices to estimate how much “output” is available to the average resident. With a rapidly expanding population, the economy must generate a lot more output merely to stop the individual pie slices from shrinking.

Minister Freeland is correct that Canada’s economy has been growing, both since the worst of the COVID shock in late-2020/early-2021 and over the period when the Trudeau government has been in power. But she ignores the bigger picture, which shows two important things.

First, since 2015 Canada has posted some of the weakest economic growth numbers, measured on a per-person basis, in half a century. The pattern of feeble economic growth was evident before the onset of COVID.

Second, Canada is among the few advanced economies where output or gross domestic product (GDP) per person in 2023 has still not returned to pre-pandemic levels. In part, this reflects surging population growth, which affects the denominator that helps determine whether economic growth is producing gains in average incomes and living standards. In Canada’s case, modest economic growth combined with a skyrocketing population has resulted in a multi-year decline in per-person income and erosion of overall prosperity. Adjusted for inflation, GDP per person is still 2 per cent lower than in 2019.

Denominator blindness also characterizes recent attempts by the federal, Ontario and Quebec governments to explain why they’re allocating up to $50 billion in subsidies and tax incentives to lure a handful of electric vehicle battery manufacturers to Canada. The politicians making these decisions point to the several thousand jobs the EV manufacturing facilities will support once they are fully operational. But they won’t discuss how this fits within the larger job market.

Total employment in Canada is 20.1 million, with almost 1.8 million jobs in manufacturing. The vast sums being thrown at EV battery manufacturers will have essentially no impact on the aggregate job numbers and barely make a ripple, even in the manufacturing sector. Moreover, not all the promised EV jobs will be “new” positions—many workers attracted to the EV industry will likely be drawn from other businesses, worsening skill shortages that are plaguing Canadian manufacturers.

Perhaps aspiring politicians should be required to study the basic arithmetic of fractions before they run for office.

Author:

Automotive

Electric cars just another poor climate policy

From the Fraser Institute

The electric car is widely seen as a symbol of a simple, clean solution to climate change. In reality, it’s inefficient, reliant on massive subsidies, and leaves behind a trail of pollution and death that is seldom acknowledged.

We are constantly reminded by climate activists and politicians that electric cars are cleaner, cheaper, and better. Canada and many other countries have promised to prohibit the sale of new gas and diesel cars within a decade. But if electric cars are really so good, why would we need to ban the alternatives?

And why has Canada needed to subsidize each electric car with a minimum $5,000 from the federal government and more from provincial governments to get them bought? Many people are not sold on the idea of an electric car because they worry about having to plan out where and when to recharge. They don’t want to wait for an uncomfortable amount of time while recharging; they don’t want to pay significantly more for the electric car and then see its used-car value decline much faster. For people not privileged to own their own house, recharging is a real challenge. Surveys show that only 15 per cent of Canadians and 11 per cent of Americans want to buy an electric car.

The main environmental selling point of an electric car is that it doesn’t pollute. It is true that its engine doesn’t produce any CO₂ while driving, but it still emits carbon in other ways. Manufacturing the car generates emissions—especially producing the battery which requires a large amount of energy, mostly achieved with coal in China. So even when an electric car is being recharged with clean power in BC, over its lifetime it will emit about one-third of an equivalent gasoline car. When recharged in Alberta, it will emit almost three-quarters.

In some parts of the world, like India, so much of the power comes from coal that electric cars end up emitting more CO₂ than gasoline cars. Across the world, on average, the International Energy Agency estimates that an electric car using the global average mix of power sources over its lifetime will emit nearly half as much CO₂ as a gasoline-driven car, saving about 22 tonnes of CO₂.

But using an electric car to cut emissions is incredibly ineffective. On America’s longest-established carbon trading system, you could buy 22 tonnes of carbon emission cuts for about $660 (US$460). Yet, Ottawa is subsidizing every electric car to the tune of $5,000 or nearly ten times as much, which increases even more if provincial subsidies are included. And since about half of those electrical vehicles would have been bought anyway, it is likely that Canada has spent nearly twenty-times too much cutting CO₂ with electric cars than it could have. To put it differently, Canada could have cut twenty-times more CO₂ for the same amount of money.

Moreover, all these estimates assume that electric cars are driven as far as gasoline cars. They are not. In the US, nine-in-ten households with an electric car actually have one, two or more non-electric cars, with most including an SUV, truck or minivan. Moreover, the electric car is usually driven less than half as much as the other vehicles, which means the CO₂ emission reduction is much smaller. Subsidized electric cars are typically a ‘second’ car for rich people to show off their environmental credentials.

Electric cars are also 320–440 kilograms heavier than equivalent gasoline cars because of their enormous batteries. This means they will wear down roads faster, and cost societies more. They will also cause more air pollution by shredding more particulates from tire and road wear along with their brakes. Now, gasoline cars also pollute through combustion, but electric cars in total pollute more, both from tire and road wear and from forcing more power stations online, often the most polluting ones. The latest meta-study shows that overall electric cars are worse on particulate air pollution. Another study found that in two-thirds of US states, electric cars cause more of the most dangerous particulate air pollution than gasoline-powered cars.

These heavy electric cars are also more dangerous when involved in accidents, because heavy cars more often kill the other party. A study in Nature shows that in total, heavier electric cars will cause so many more deaths that the toll could outweigh the total climate benefits from reduced CO₂ emissions.

Many pundits suggest electric car sales will dominate gasoline cars within a few decades, but the reality is starkly different. A 2023-estimate from the Biden Administration shows that even in 2050, more than two-thirds of all cars globally will still be powered by gas or diesel.

Source: US Energy Information Administration, reference scenario, October 2023

Fossil fuel cars, vast majority is gasoline, also some diesel, all light duty vehicles, the remaining % is mostly LPG.

Electric vehicles will only take over when innovation has made them better and cheaper for real. For now, electric cars run not mostly on electricity but on bad policy and subsidies, costing hundreds of billions of dollars, blocking consumers from choosing the cars they want, and achieving virtually nothing for climate change.

2025 Federal Election

Fight against carbon taxes not over yet

As the federal government removes the consumer carbon tax, the Canadian Taxpayers Federation is calling on all party leaders to oppose all carbon taxes, including the hidden tax on business.

“Canadians fought hard to force Ottawa to back down on its consumer carbon tax and now the fight moves to stopping the hidden carbon tax on business,” said Franco Terrazzano, CTF Federal Director. “Canadians can’t afford a carbon tax on business that pushes up prices at the gas station and makes it harder for our businesses to compete while they’re already struggling with a trade war.”

Today, the federal government cut the consumer carbon tax rate to $0. This will reduce taxes by about 17 cents per litre of gasoline, 21 cents per litre of diesel and 15 cents per cubic metre of natural gas.

The federal government still imposes an industrial carbon tax on oil and gas, steel and fertilizer businesses, among others.

During the Liberal Party leadership race, Prime Minister Mark Carney said he would “improve and tighten” the industrial carbon tax and “extend the framework to 2035.”

Just 12 per cent of Canadians believe businesses pay most of the cost of the industrial carbon tax, according to a Leger poll commissioned by the CTF. Meanwhile, 70 per cent said businesses would pass most or some carbon tax costs on to consumers.

Conservative Party Leader Pierre Poilievre said he will “repeal the entire carbon tax law, including the tax on Canadian businesses and industries.”

“Carbon taxes on refineries make gas more expensive, carbon taxes on utilities make home heating more expensive and carbon taxes on fertilizer plants increase costs for farmers and that makes groceries more expensive,” Terrazzano said. “Canadians know Poilievre will end all carbon taxes and Canadians know Carney’s carbon tax costs won’t be zero.

“Carney owes Canadians a clear answer: How much will your carbon tax cost?”

-

2025 Federal Election2 days ago

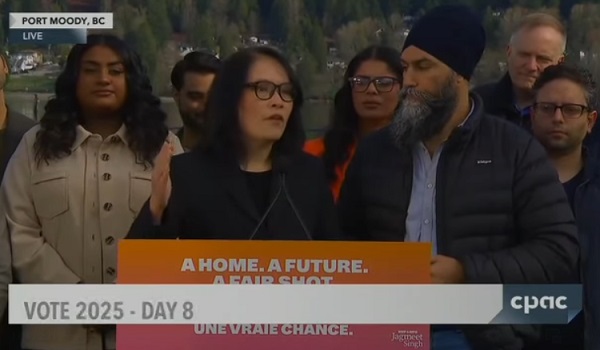

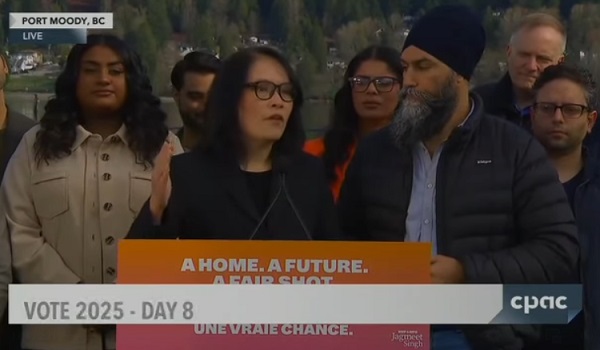

2025 Federal Election2 days agoChinese Election Interference – NDP reaction to bounty on Conservative candidate

-

2025 Federal Election1 day ago

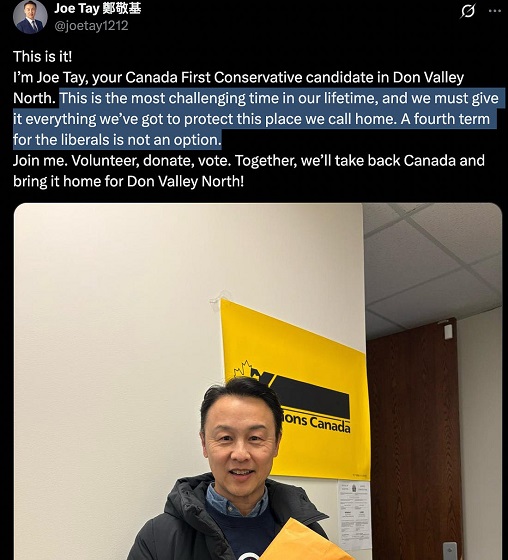

2025 Federal Election1 day agoChina Election Interference – Parties Received Security Briefing Days Ago as SITE Monitors Threats to Conservative Candidate Joe Tay

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoFixing Canada’s immigration system should be next government’s top priority

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoLondon-Based Human Rights Group Urges RCMP to Investigate Liberal MP for Possible Counselling of Kidnapping

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoJoe Tay Says He Contacted RCMP for Protection, Demands Carney Fire MP Over “Bounty” Remark

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoHong Kong-Canadian Groups Demand PM Carney Drop Liberal Candidate Over “Bounty” Remark Supporting CCP Repression

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoBeijing’s Echo Chamber in Parliament: Part 2 – Still No Action from Carney

-

2025 Federal Election18 hours ago

2025 Federal Election18 hours agoRCMP Confirms It Is ‘Looking Into’ Alleged Foreign Threat Following Liberal Candidate Paul Chiang Comments