Economy

Federal budget’s scale of spending and debt reveal a government lacking self-control

From the Fraser Institute

By Jake Fuss and Grady Munro

Had the government simply limited the growth in annual program spending to 0.3 per cent for two years, it could have balanced the budget by 2026/27 and avoided significant debt accumulation.

Instead, the government chose to increase annual program spending by an average of 4.4 per cent over the next two years and kick the debt problem down the road for another government to solve.

Time and time again, Prime Minister Justin Trudeau and Finance Minister Chrystia Freeland have emphasized the importance of being fiscally responsible with federal finances. Unfortunately, this year’s federal budget ensures once again their rhetoric rings hollow due to their ongoing mismanagement of federal finances.

This mismanagement is rooted in the government’s insatiable appetite for new and expanded programs or services, which has endured for nine years and will continue for the foreseeable future. The budget introduces billions of dollars in additional spending for a national school food program, housing initiatives and artificial intelligence. As such, program spending (total spending minus debt interest costs) is now expected to be $77.2 billion higher over the next four years than the government forecasted last spring.

In 2024/25 alone, federal program spending will reach a projected $483.6 billion—an increase of $16.1 billion compared to the previous budget’s estimates. On a per-person inflation-adjusted basis, federal program spending is forecasted to reach $11,901, which is approximately 28.0 per cent higher than during the final full year of Stephen Harper’s tenure as prime minister (2014/15). The Trudeau government has already recorded the five (2018 to 2022) highest levels of federal program spending per person in Canadian history (inflation-adjusted), and budget projections suggest it’s now on track to possess the eight highest levels of per-person spending by the end of its term next autumn.

This is despite recent polling data that shows the majority of Canadians (59 per cent) think the Trudeau government is spending too much. Nearly two-thirds (64 per cent) of Canadians are also concerned about the size of the federal deficit.

As it has done nine times before, the Trudeau government will borrow to fund some of its spending spree, resulting in a projected budget deficit of $39.8 billion this year, which is $4.8 billion higher than previously forecasted. And it doesn’t intend to stop borrowing, with annual deficits exceeding $20 billion planned for the subsequent four years. This represents a notable increase in deficits compared to what was expected in the last year’s budget. Simply put, there’s no plan for a return to balanced budgets any time soon. As a result, federal debt (net debt minus non-financial assets) is expected to climb $156.2 billion from now until April 2029.

To make matters worse, the government is also increasing the capital gains inclusion tax rate from 50.0 per cent to 66.6 per cent for capital gains realized above $250,000. This will act as a huge disincentive for individuals and businesses to invest in Canada at a time when the country already struggles to attract the very investment we need to improve productivity, economic growth and living standards. Businesses and individuals will now simply invest their capital elsewhere.

There’s a large body of research that finds low or no capital gains taxes increase the supply and lower the cost of capital for new and growing firms, leading to higher levels of entrepreneurship, economic growth and job creation—precisely what Canada needs more of today and in the future.

While the government did boast about its ability to hold the 2023/24 deficit at $40.0 billion, this had little to do with responsible fiscal management. Instead, the government enjoyed higher-than-anticipated revenues of $8.3 billion, but repeated its all too frequent and ill-advised approach of spending that money and wiping out any chance to reduce the deficit.

Growing federal debt leads to higher debt interest costs, all else equal, which eat up taxpayer dollars that could otherwise have provided services or tax relief for Canadians. For context, the government now spends more ($54.1 billion) on debt interest as on health-care transfers to the provinces ($52.1 billion). Accumulating debt today also increases the tax burden on future generations of Canadians who are ultimately responsible for paying off this debt. Research suggests this effect could be disproportionate, with future generations needing to pay back a dollar borrowed today with more than one dollar in future taxes.

But again, it didn’t have to be this way. As we pointed out before the budget, had the government simply limited the growth in annual program spending to 0.3 per cent for two years, it could have balanced the budget by 2026/27 and avoided significant debt accumulation.

Instead, the government chose to increase annual program spending by an average of 4.4 per cent over the next two years and kick the debt problem down the road for another government to solve. Simply put, the government’s fiscal strategy is not all that different from an overzealous child that eats all their Halloween candy in one night even though they fully understand it won’t end well.

Yet for all this spending and debt, living standards have not improved for Canadians. In fact, inflation-adjusted GDP per person was actually lower at the end of 2023 than it was nine years prior in 2014. And going forward, the OECD predicts Canada will record the lowest growth rates in per-person GDP up to 2060 of any industrialized country—meaning countries such as New Zealand, Italy, Korea, Turkey and Estonia would all surpass Canada with higher living standards.

The combination of tax hikes and scale of spending and debt in this year’s federal budget demonstrate the Trudeau government has no interest in being fiscally responsible or improving living standards for Canadians. Instead of showing restraint, the government chose to repeat its mistakes and lead federal finances down an increasingly perilous path.

Authors:

Business

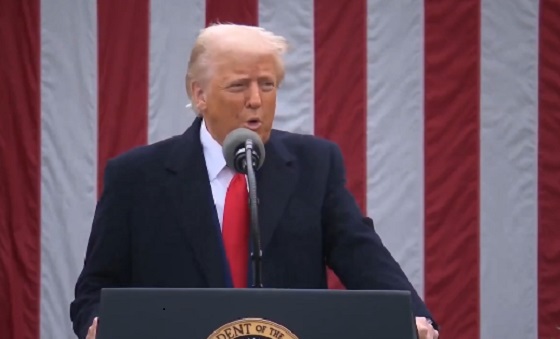

Canada may escape the worst as Trump declares America’s economic independence with Liberation Day tariffs

MxM News

MxM News

Quick Hit:

On Wednesday, President Trump declared a national emergency to implement a sweeping 10% baseline tariff on all imported goods, calling it a “Declaration of Economic Independence.” Trump said the tariffs would revitalize the domestic economy, declaring that, “April 2, 2025, will forever be remembered as the day American industry was reborn.”

Key Details:

-

The baseline 10% tariff will take effect Saturday, while targeted “reciprocal” tariffs—20% on the EU, 24% on Japan, and 17% on Israel—begin April 9th. Trump also imposed 25% tariffs on most Canadian and Mexican goods, as well as on all foreign-made cars and auto parts, effective early Thursday.

-

Trump justified the policy by citing foreign trade restrictions and long-standing deficits. He pointed to policies in Australia, the EU, Japan, and South Korea as examples of protectionist barriers that unfairly harm American workers and industries.

-

The White House estimates the 10% tariff could generate $200 billion in revenue over the next decade. Officials say the added funds would help reduce the federal deficit while giving the U.S. stronger leverage in negotiations with countries running large trade surpluses.

Diving Deeper:

President Trump on Wednesday unveiled a broad new tariff policy affecting every imported product into the United States, marking what he described as the beginning of a new economic era. Declaring a national emergency from the White House Rose Garden, the president announced a new 10% baseline tariff on all imports, alongside steeper country-specific tariffs targeting longstanding trade imbalances.

“This is our Declaration of Economic Independence,” Trump said. “Factories will come roaring back into our country — and you see it happening already.”

The tariffs, which take effect Saturday, represent a substantial increase from the pre-Trump average U.S. tariff rate and are part of what the administration is calling “Liberation Day” for American industry. Reciprocal tariffs kick in April 9th, with the administration detailing specific rates—20% for the European Union, 24% for Japan, and 17% for Israel—based on calculations tied to bilateral trade deficits.

“From 1789 to 1913, we were a tariff-backed nation,” Trump said. “The United States was proportionately the wealthiest it has ever been.” He criticized the establishment of the income tax in 1913 and blamed the 1929 economic collapse on a departure from tariff-based policies.

To underscore the move’s long-anticipated nature, Trump noted he had been warning about unfair trade for decades. “If you look at my old speeches, where I was young and very handsome… I’d be talking about how we were being ripped off by these countries,” he quipped.

The president also used the moment to renew his push for broader economic reforms, urging Congress to eliminate federal taxes on tips, overtime pay, and Social Security benefits. He also proposed allowing Americans to write off interest on domestic auto loans.

Critics of the plan warned it could raise prices for consumers, noting inflation has already risen 22% under the Biden administration. However, Trump pointed to low inflation during his first term—when he imposed more targeted tariffs—as proof his strategy can work without sparking runaway costs.

White House officials reportedly described the new baseline rate as a guardrail against countries attempting to game the system. One official explained the methodology behind the reciprocal tariffs: “The trade deficit that we have with any given country is the sum of all trade practices, the sum of all cheating,” adding that the tariffs are “half of what they could be” because “the president is lenient and he wants to be kind to the world.”

In addition to Wednesday’s sweeping changes, Trump’s administration recently imposed a 25% tariff on Chinese goods tied to fentanyl smuggling and another 25% on steel and aluminum imports—revoking previous carve-outs for countries like Brazil and South Korea. Future tariffs on semiconductors, pharmaceuticals, and raw materials such as copper and lumber are reportedly under consideration.

Trump closed his remarks with a message to foreign leaders: “To all of the foreign presidents, prime ministers, kings, queens, ambassadors… I say, ‘Terminate your own tariffs, drop your barriers.’” He declared April 2nd “the day America’s destiny was reclaimed” and promised, “This will indeed be the golden age of America.”

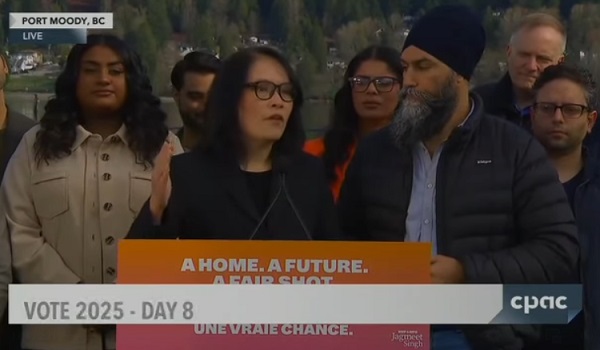

2025 Federal Election

Three cheers for Poilievre’s alcohol tax cut

By Franco Terrazzano

The Canadian Taxpayers Federation applauds Conservative Party Leader Pierre Poilievre’s commitment to end and reverse the alcohol escalator tax.

“Poilievre just promised major alcohol tax cuts and taxpayers will cheers to that,” said Franco Terrazzano, CTF Federal Director. “Poilievre’s tax cut will save Canadians money every time they have a cold one with a buddy or enjoy a glass of Pinot with their better half and it will give Canadians brewers, distillers and wineries a fighting chance against tariffs.”

Today, federal alcohol taxes increased by two per cent, costing taxpayers about $40 million this year, according to Beer Canada.

Poilievre announced a Conservative government “will axe the escalator tax on wine, beer and spirits back to 2017 levels, ending the automatic annual tax increases.”

The alcohol escalator tax has automatically increased excise taxes on beer, wine and spirits every year, without a vote in Parliament, since 2017. The alcohol escalator tax has cost taxpayers more than $900 million since being imposed, according to Beer Canada.

Taxes from multiple levels of government account for about half of the price of alcohol.

Meanwhile, tariffs are hitting the industry hard. Brewers have described the tariffs as “Armageddon for craft brewing.”

“Automatic tax hikes are undemocratic, uncompetitive and unaffordable and they need to stop,” Terrazzano said. “If politicians think Canadians aren’t paying enough tax, they should at least have the spine to vote on the tax increase.

“Poilievre is right to end the escalator tax and all party leaders should commit to making life more affordable for Canadian consumers and businesses by ending the undemocratic alcohol tax hikes.”

-

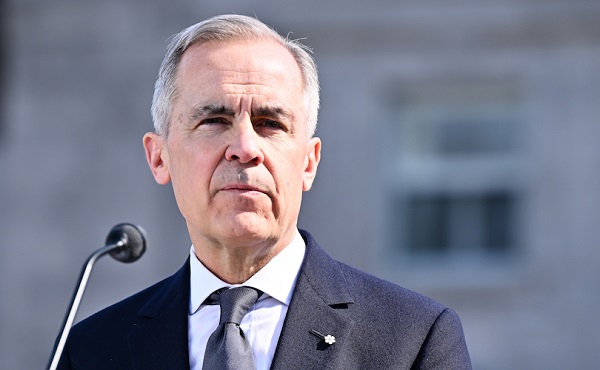

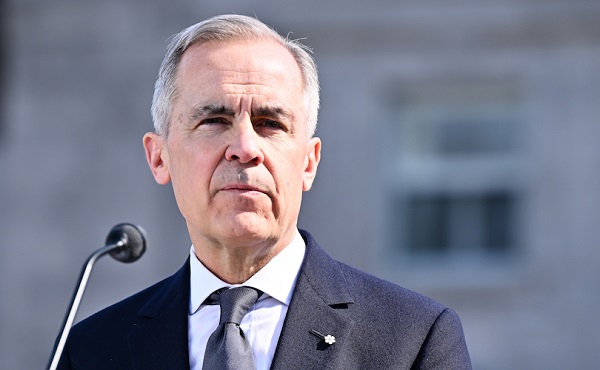

2025 Federal Election1 day ago

2025 Federal Election1 day agoPM Carney’s Candidate Paul Chiang Steps Down After RCMP Confirms Probe Into “Bounty” Comments

-

International23 hours ago

International23 hours agoTrump’s ‘Golden Dome’ defense shield must be built now, Lt. Gen. warns

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoRCMP Confirms It Is ‘Looking Into’ Alleged Foreign Threat Following Liberal Candidate Paul Chiang Comments

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoFight against carbon taxes not over yet

-

2025 Federal Election7 hours ago

2025 Federal Election7 hours agoMORE OF THE SAME: Mark Carney Admits He Will Not Repeal the Liberal’s Bill C-69 – The ‘No Pipelines’ Bill

-

Business1 day ago

Business1 day agoSaskatchewan becomes first Canadian province to fully eliminate carbon tax

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoMark Carney refuses to clarify 2022 remarks accusing the Freedom Convoy of ‘sedition’

-

Automotive1 day ago

Automotive1 day agoElectric cars just another poor climate policy