Economy

European Voters Are Taking Sledgehammer To Continent’s Radical Open Borders And Climate Agenda

From the Daily Caller News Foundation

From the Daily Caller News Foundation

By RICHARD HOLT

The results from both the recent European Parliamentary elections and France’s snap legislative elections have surprised our socialist friends across the ocean.

Despite the consistent rejection of climate activism in national elections, the ultra-left European Union Parliament has continued to loom darkly on its subjugated member states with failing “climate” and “open border” policies. The election results are more than just a passing trend: they are a clear repudiation of the left-wing policies on immigration and climate that have dominated the EU’s agenda in recent years.

Voters across Europe have expressed their dissatisfaction with these policies, which they perceive as economically burdensome and socially disruptive. In Germany, for example, center-right Christian Democrats (CDU) secured 30.2% of the vote, while the conservative Alternative for Germany (AfD) surged to 16%, a significant increase from their previous performance. This rise in support for the AfD is a direct response to the German government’s aggressive climate policies and its handling of immigration.

The German government’s climate agenda — particularly the Energiewende, has placed a heavy financial burden on households and businesses. Within the framework is a policy called “Marginal Pricing.” This means that the price of electricity at any given time is set by the most expensive power plant needed to meet demand at that moment. The overall transition to renewable energy has led to some of the highest electricity prices in Europe, with German households paying significantly more than the European average. These high costs have not only strained family budgets but have also impacted the competitiveness of German industries, leading to job losses and economic uncertainty.

Moreover, the decision to phase out coal and nuclear energy without adequate alternatives has left the country reliant on costly and inconsistent renewable sources. This dual energy system has created inefficiencies and further driven up costs. The frustration over these economic pressures has been a significant factor in the rise of conservative parties, who promise to alleviate these burdens by rolling back stringent climate regulations.

Immigration policies have also played a crucial role in the electorate’s shift to the right. Germany, and indeed much of Europe, has experienced a significant influx of asylum seekers over the past decade. The public’s growing concern over immigration, coupled with the perceived inability of left-wing parties to manage this influx effectively, has driven voters toward conservative alternatives. The AfD, for instance, has capitalized on these concerns, positioning itself as the defender of national borders and cultural identity.

This trend is not confined to Germany. In France, the legislative elections held this weekend show a significant shift to the right there as well. Marine Le Pen’s National Rally garnered over 33% of the vote, a dramatic win reflecting public dissatisfaction with Macron’s failed policies. Macron’s policies in regards to taxes, pensions and immigration coupled with long-term protests has eroded support for his centrist alliance, which only received about 21% of the vote. The left-wing New Popular Front, including La France Insoumise and the Socialist Party, trailed with around 28% of the vote. This rightward shift is part of a broader European trend where voters are increasingly turning to conservative parties in response to economic strain and immigration concerns.

The success of these parties underscores a growing demand for policies that prioritize national sovereignty and economic pragmatism over ideological commitments to climate activism and open borders. Voters are increasingly skeptical of policies that they perceive as detached from the realities of everyday life. The economic strain of high energy costs, combined with the social challenges of integrating large numbers of immigrants, has fueled a backlash against the left-wing establishment.

The rightward shift in the elections for the European Parliament is a powerful statement against the dubious feel-good policies from a failed left-wing activism on climate and immigration. It is a demand for a more market-centered approach that considers the economic and social realities faced by regular Europeans. The rise of conservative parties across the continent is not just a political realignment but a profound demand for sanity.

Richard Holt is an ambassador for Project 21, an initiative of The National Center for Public Policy Research to promote the views of African-Americans whose entrepreneurial spirit, dedication to family and commitment to individual responsibility have not traditionally been echoed by the nation’s civil rights establishment. He is also a political consultant at Sirius Campaigns with over two decades of experience working on campaigns for local, state and federal offices across the country.

The views and opinions expressed in this commentary are those of the author and do not reflect the official position of the Daily Caller News Foundation.

Featured image credit: Marine Le Pen (Screen Capture/CSPAN)

Business

The great policy challenge for governments in Canada in 2026

From the Fraser Institute

According to a recent study, living standards in Canada have declined over the past five years. And the country’s economic growth has been “ugly.” Crucially, all 10 provinces are experiencing this economic stagnation—there are no exceptions to Canada’s “ugly” growth record. In 2026, reversing this trend should be the top priority for the Carney government and provincial governments across the country.

Indeed, demographic and economic data across the country tell a remarkably similar story over the past five years. While there has been some overall economic growth in almost every province, in many cases provincial populations, fuelled by record-high levels of immigration, have grown almost as quickly. Although the total amount of economic production and income has increased from coast to coast, there are more people to divide that income between. Therefore, after we account for inflation and population growth, the data show Canadians are not better off than they were before.

Let’s dive into the numbers (adjusted for inflation) for each province. In British Columbia, the economy has grown by 13.7 per cent over the past five years but the population has grown by 11.0 per cent, which means the vast majority of the increase in the size of the economy is likely due to population growth—not improvements in productivity or living standards. In fact, per-person GDP, a key indicator of living standards, averaged only 0.5 per cent per year over the last five years, which is a miserable result by historic standards.

A similar story holds in other provinces. Prince Edward Island, Nova Scotia, Quebec and Saskatchewan all experienced some economic growth over the past five years but their populations grew at almost exactly the same rate. As a result, living standards have barely budged. In the remaining provinces (Newfoundland and Labrador, New Brunswick, Ontario, Manitoba and Alberta), population growth has outstripped economic growth, which means that even though the economy grew, living standards actually declined.

This coast-to-coast stagnation of living standards is unique in Canadian history. Historically, there’s usually variation in economic performance across the country—when one region struggles, better performance elsewhere helps drive national economic growth. For example, in the early 2010s while the Ontario and Quebec economies recovered slowly from the 2008/09 recession, Alberta and other resource-rich provinces experienced much stronger growth. Over the past five years, however, there has not been a “good news” story anywhere in the country when it comes to per-person economic growth and living standards.

In reality, Canada’s recent record-high levels of immigration and population growth have helped mask the country’s economic weakness. With more people to buy and sell goods and services, the overall economy is growing but living standards have barely budged. To craft policies to help raise living standards for Canadian families, policymakers in Ottawa and every provincial capital should remove regulatory barriers, reduce taxes and responsibly manage government finances. This is the great policy challenge for governments across the country in 2026 and beyond.

Business

Dark clouds loom over Canada’s economy in 2026

From the Fraser Institute

The dawn of a new year is an opportune time to ponder the recent performance of Canada’s $3.4 trillion economy. And the overall picture is not exactly cheerful.

Since the start of 2025, our principal trading partner has been ruled by a president who seems determined to unravel the post-war global economic and security order that provided a stable and reassuring backdrop for smaller countries such as Canada. Whether the Canada-U.S.-Mexico trade agreement (that President Trump himself pushed for) will even survive is unclear, underscoring the uncertainty that continues to weigh on business investment in Canada.

At the same time, Europe—representing one-fifth of the global economy—remains sluggish, thanks to Russia’s relentless war of choice against Ukraine, high energy costs across much of the region, and the bloc’s waning competitiveness. The huge Chinese economy has also lost a step. None of this is good for Canada.

Yet despite a difficult external environment, Canada’s economy has been surprisingly resilient. Gross domestic product (GDP) is projected to grow by 1.7 per cent (after inflation) this year. The main reason is continued gains in consumer spending, which accounts for more than three-fifths of all economic activity. After stripping out inflation, money spent by Canadians on goods and services is set to climb by 2.2 per cent in 2025, matching last year’s pace. Solid consumer spending has helped offset the impact of dwindling exports, sluggish business investment and—since 2023—lacklustre housing markets.

Another reason why we have avoided a sharper economic downturn is that the Trump administration has, so far, exempted most of Canada’s southbound exports from the president’s tariff barrage. This has partially cushioned the decline in Canada’s exports—particularly outside of the steel, aluminum, lumber and auto sectors, where steep U.S. tariffs are in effect. While exports will be lower in 2025 than the year before, the fall is less dramatic than analysts expected 6 to 8 months ago.

Although Canada’s economy grew in 2025, the job market lost steam. Employment growth has softened and the unemployment rate has ticked higher—it’s on track to average almost 7 per cent this year, up from 5.4 per cent two years ago. Unemployment among young people has skyrocketed. With the economy showing little momentum, employment growth will remain muted next year.

Unfortunately, there’s nothing positive to report on the investment front. Adjusted for inflation, private-sector capital spending has been on a downward trajectory for the last decade—a long-term trend that can’t be explained by Trump’s tariffs. Canada has underperformed both the United States and several other advanced economies in the amount of investment per employee. The investment gap with the U.S. has widened steadily since 2014. This means Canadian workers have fewer and less up-to-date tools, equipment and technology to help them produce goods and services compared to their counterparts in the U.S. (and many other countries). As a result, productivity growth in Canada has been lackluster, narrowing the scope for wage increases.

Preliminary data indicate that both overall non-residential investment and business capital spending on machinery, equipment and advanced technology products will be down again in 2025. Getting clarity on the future of the Canada-U.S. trade relationship will be key to improving the business environment for private-sector investment. Tax and regulatory policy changes that make Canada a more attractive choice for companies looking to invest and grow are also necessary. This is where government policymakers should direct their attention in 2026.

-

Energy2 days ago

Energy2 days agoThe U.S. Just Removed a Dictator and Canada is Collateral Damage

-

Daily Caller1 day ago

Daily Caller1 day agoScathing Indictment Claims Nicolás Maduro Orchestrated Drug-Fueled ‘Culture Of Corruption’ Which Plagued Entire Region

-

International2 days ago

International2 days agoUS Justice Department Accusing Maduro’s Inner Circle of a Narco-State Conspiracy

-

Haultain Research2 days ago

Haultain Research2 days agoTrying to Defend Maduro’s Legitimacy

-

Opinion1 day ago

Opinion1 day agoHell freezes over, CTV’s fabrication of fake news and our 2026 forecast is still searching for sunshine

-

Daily Caller1 day ago

Daily Caller1 day agoTrump Says US Going To Run Venezuela After Nabbing Maduro

-

Business1 day ago

Business1 day agoVirtue-signalling devotion to reconciliation will not end well

-

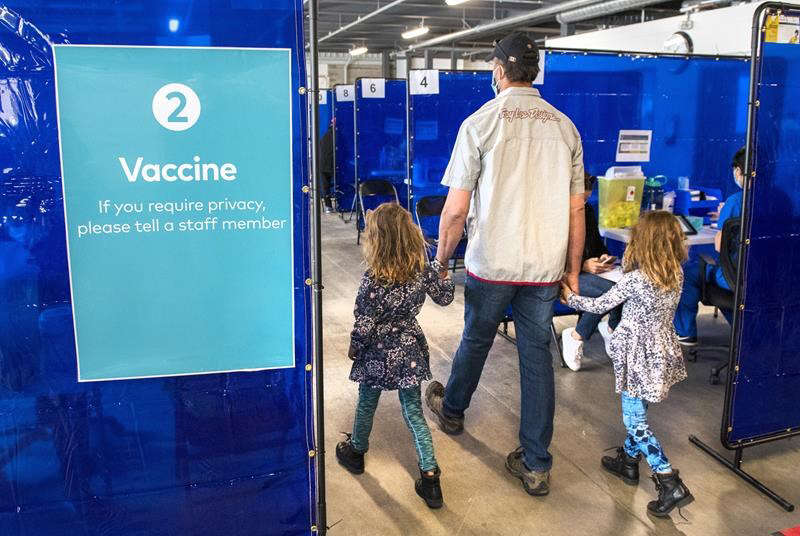

COVID-191 day ago

COVID-191 day agoA new study proves, yet again, that the mRNA Covid jabs should NEVER have been approved for young people.