Business

Estonia’s solution to Canada’s stagnating economic growth

From the Fraser Institute

By Callum MacLeod and Jake Fuss

The only taxes corporations face are on profits they distribute to shareholders. This allows the profits of Estonian firms to be reinvested tax-free permitting higher returns for entrepreneurs.

A new study found that the current decline in living standards is one of the worst in Canada’s recent history. While the economy has grown, it hasn’t kept pace with Canada’s surging population, which means gross domestic product (GDP) per person is on a downward trajectory. Carolyn Rogers, senior deputy governor of the Bank of Canada, points to Canada’s productivity crisis as one of the primary reasons for this stagnation.

Productivity is a key economic indicator that measures how much output workers produce per hour of work. Rising productivity is associated with higher wages and greater standards of living, but growth in Canadian productivity has been sluggish: from 2002 to 2022 American productivity grew 160 per cent faster than Canadian productivity.

While Canada’s productivity issues are multifaceted, Rogers pointed to several sources of the problem in a recent speech. Primarily, she highlighted strong business investment as an imperative to productivity growth, and an area in which Canada has continually fallen short. There is no silver bullet to revive faltering investment, but tax reform would be a good start. Taxes can have a significant effect on business incentives and investment, but Canada’s tax system has largely stood in the way of economic progress.

With recent hikes in the capital gains tax rate and sky-high compliance costs, Canada’s taxes continue to hinder its growth. Canada’s primary competitor is the United States, which has considerably lower tax rates. Canada’s rates on personal income and businesses are similarly uncompetitive when compared to other advanced economies around the globe. Uncompetitive taxes in Canada prompt investment, businesses, and workers to relocate to jurisdictions with lower taxes.

The country of Estonia offers one of the best models for tax reform. The small Baltic state has a unique tax system that puts it at the top of the Tax Foundation’s tax competitiveness index. Estonia has lower effective tax rates than Canada—so it doesn’t discourage work the way Canada does—but more interestingly, its business tax model doesn’t punish investment the way Canada’s does.

Their business tax system is a distributed profits tax system, meaning that the only taxes corporations face are on profits they distribute to shareholders. This allows the profits of Estonian firms to be reinvested tax-free permitting higher returns for entrepreneurs.

The demand for investment is especially strong for capital-intensive companies such as information, communications, and technology (ICT) enterprises, which are some of the most productive in today’s economy. A Bank of Canada report highlighted the lack of ICT investment as a major contributor to Canada’s sluggish growth in the 21st century.

While investment is important, another ingredient to economic growth is entrepreneurship. Estonia’s tax system ensures entrepreneurs are rewarded for success and the result is that Estonians start significantly more businesses than Canadians. In 2023, for every 1,000 people, Estonia had 17.8 business startups, while Canada had only 4.9. This trend is even worse for ICT companies, Estonians start 45 times more ICT businesses than Canadians on a per capita basis.

The Global Entrepreneurship Monitor’s (GEM) 2023/24 report on entrepreneurship confirms that a large part of this difference comes from government policy and taxation. Canada ranked below Estonia on all 13 metrics of the Entrepreneurial Framework. Notably, Estonia scored above Canada when taxes, bureaucracy, burdens and regulation were measured.

While there’s no easy solution to Canada’s productivity crisis, a better tax regime wouldn’t penalize investment and entrepreneurship as much as our current system does. This would allow Canadians to be more productive, ultimately improving living standards. Estonia’s business tax system is a good example of how to promote economic growth. Examples of successful tax structures, such as Estonia’s, should prompt a conversation about how Canadian governments could improve economic outcomes for citizens.

Authors:

2025 Federal Election

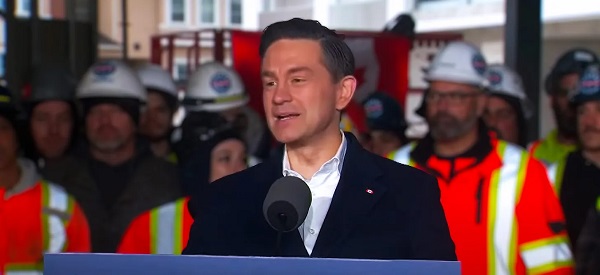

As PM Poilievre would cancel summer holidays for MP’s so Ottawa can finally get back to work

From Conservative Party Communications

In the first 100 days, a new Conservative government will pass 3 laws:

1. Affordability For a Change Act—cutting spending, income tax, sales tax off homes

2. Safety For a Change Act to lock up criminals

3. Bring Home Jobs Act—that repeals C-69, sets up 6 month permit turnarounds for new projects

No summer holiday til they pass!

Conservative Leader Pierre Poilievre announced today that as Prime Minister he will cancel the summer holiday for Ottawa politicians and introduce three pieces of legislation to make life affordable, stop crime, and unleash our economy to bring back powerful paycheques. Because change can’t wait.

A new Conservative government will kickstart the plan to undo the damage of the Lost Liberal Decade and restore the promise of Canada with a comprehensive legislative agenda to reverse the worst Trudeau laws and cut the cost of living, crack down on crime, and unleash the Canadian economy with ‘100 Days of Change.’ Parliament will not rise until all three bills are law and Canadians get the change they voted for.

“After three Liberal terms, Canadians want change now,” said Poilievre. “My plan for ‘100 Days of Change’ will deliver that change. A new Conservative government will immediately get to work, and we will not stop until we have delivered lower costs, safer streets, and bigger paycheques.”

The ’100 Days of Change’ will include three pieces of legislation:

The Affordability–For a Change Act

Will lower food prices, build more homes, and bring back affordability for Canadians by:

- Cutting income taxes by 15%. The average worker will keep an extra $900 each year, while dual-income families will keep $1,800 more annually.

- Axing the federal sales tax on new homes up to $1.3 million. Combined with a plan to incentivize cities to lower development charges, this will save homebuyers $100,000 on new homes.

- Axing the federal sales tax on new Canadian cars to protect auto workers’ jobs and save Canadians money, and challenge provinces to do the same.

- Axing the carbon tax in full. Repeal the entire carbon tax law, including the federal industrial carbon tax backstop, to restore our industrial base and take back control of our economy from the Americans.

- Scrapping Liberal fuel regulations and electricity taxes to lower the cost of heating, gas, and fuel.

- Letting working seniors earn up to $34,000 tax-free.

- Axing the escalator tax on alcohol and reset the excise duty rates to those in effect before the escalator was passed.

- Scrapping the plastics ban and ending the planned food packaging tax on fresh produce that will drive up grocery costs by up to 30%.

We will also:

- Identify 15% of federal buildings and lands to sell for housing in Canadian cities.

The Safe Streets–For a Change Act

Will end the Liberal violent crime wave by:

- Repealing all the Liberal laws that caused the violent crime wave, including catch-and-release Bill C-75, which lets rampant criminals go free within hours of their arrest.

- Introducing a “three strikes, you’re out” rule. After three serious offences, offenders will face mandatory minimum 10-year prison sentences with no bail, parole, house arrest, or probation.

- Imposing life sentences for fentanyl trafficking, illegal gun trafficking, and human trafficking. For too long, radical Liberals have let crime spiral out of control—Canada will no longer be a haven for criminals.

- Stopping auto theft, extortion, fraud, and arson with new minimum penalties, no house arrest, and a new more serious offence for organized theft.

- Give police the power to end tent cities.

- Bringing in tougher penalties and a new law to crack down on Intimate Partner Violence.

- Restoring consecutive sentences for multiple murderers, so the worst mass murderers are never let back on our streets.

The Bring Home Jobs–For a Change Act

This Act will be rocket fuel for our economy. We will unleash Canada’s vast resource wealth, bring back investment, and create powerful paycheques for workers so we can stand on our own feet and stand up to Trump from a position of strength, by:

- Repealing the Liberal ‘No Development Law’, C-69 and Bill C-48, lifting the cap on Canadian energy to get major projects built, unlock our resources, and start selling Canadian energy to the world again.

- Bringing in the Canada First Reinvestment Tax Cut to reward Canadians who reinvest their earnings back into our country, unlocking billions for home building, manufacturing, and tools, training and technology to boost productivity for Canadian workers.

- Creating a One-Stop-Shop to safely and rapidly approve resource projects, with one simple application and one environmental review within one year.

Poilievre will also:

- Call President Trump to end the damaging and unjustified tariffs and accelerate negotiations to replace CUSMA with a new deal on trade and security. We need certainty—not chaos, but Conservatives will never compromise on our sovereignty and security.

- Get Phase 2 of LNG Canada built to double the project’s natural gas production.

- Accelerate at least nine other projects currently snarled in Liberal red tape to get workers working and Canada building again.

“After the Lost Liberal Decade of rising costs and crime and a falling economy under America’s thumb, we cannot afford a fourth Liberal term,” said Poilievre. “We need real change, and that is what Conservatives will bring in the first 100 days of a new government. A new Conservative government will get to work on Day 1 and we won’t stop until we have delivered the change we promised, the change Canadians deserve, the change Canadians voted for.”

Automotive

Canadians’ Interest in Buying an EV Falls for Third Year in a Row

From Energy Now

Electric vehicle prices fell 7.8 per cent in the last quarter of 2024 year-over-year, according to the AutoTader price index

Fewer Canadians are considering buying an electric vehicle, marking the third year in a row interest has dropped despite lower EV prices, a survey from AutoTrader shows.

Forty-two per cent of survey respondents say they’re considering an EV as their next vehicle, down from 46 per cent last year. In 2022, 68 per cent said they would consider buying an EV.

Meanwhile, 29 per cent of respondents say they would exclusively consider buying an EV — a significant drop from 40 per cent last year.

The report, which surveyed 1,801 people on the AutoTrader website, shows drivers are concerned about reduced government incentives, a lack of infrastructure and long-term costs despite falling prices.

Electric vehicle prices fell 7.8 per cent in the last quarter of 2024 year-over-year, according to the AutoTader price index.

The survey, conducted between Feb. 13 and March 12, shows 68 per cent of non-EV owners say government incentives could influence their decision, while a little over half say incentives increase their confidence in buying an EV.

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCarney’s Hidden Climate Finance Agenda

-

2025 Federal Election19 hours ago

2025 Federal Election19 hours agoTrump Has Driven Canadians Crazy. This Is How Crazy.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoFormer WEF insider accuses Mark Carney of using fear tactics to usher globalism into Canada

-

2025 Federal Election21 hours ago

2025 Federal Election21 hours agoThe Anhui Convergence: Chinese United Front Network Surfaces in Australian and Canadian Elections

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoStudy links B.C.’s drug policies to more overdoses, but researchers urge caution

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoConservatives promise to ban firing of Canadian federal workers based on COVID jab status

-

Automotive6 hours ago

Automotive6 hours agoHyundai moves SUV production to U.S.

-

International2 days ago

International2 days agoPope Francis Got Canadian History Wrong